Industrial Internet of Things (IIoT) Market Size, Share, Growth & Industry Analysis, By Component (Hardware, Software, Services) By Application (Predictive Maintenance, Asset Monitoring, Remote Monitoring, Process Automation) By Industry (Manufacturing, Energy & Utilities, Transportation & Logistics, Oil & Gas, Healthcare), and Regional Analysis, 2024-2031

Industrial Internet of Things (IIoT) Market: Global Share and Growth Trajectory

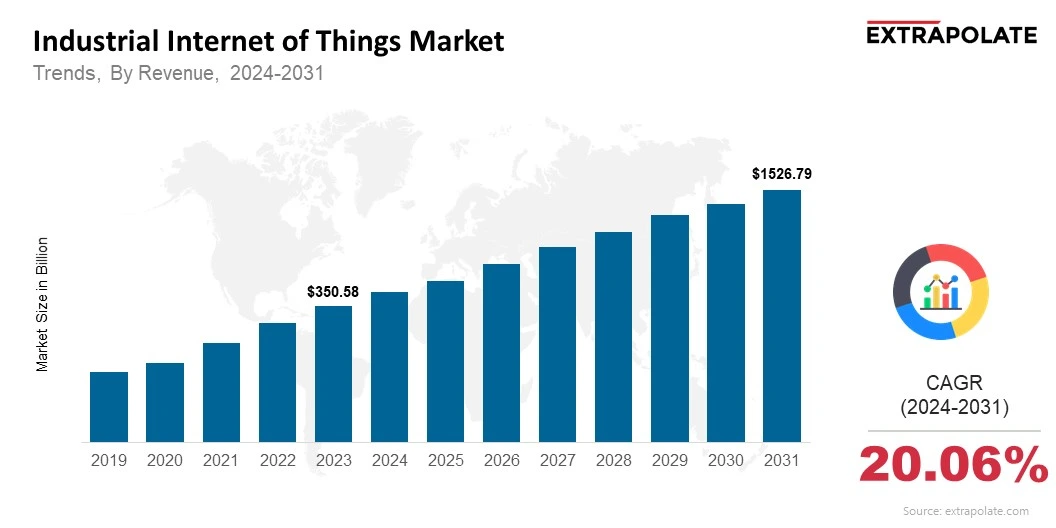

Global Industrial Internet of Things (IIoT) Market size was recorded at USD 350.58 billion in 2023, which is estimated to be valued at USD 424.47 billion in 2024 and reach USD 1526.79 billion by 2031, growing at a CAGR of 20.06% during the forecast period.

The global Industrial Internet of Things (IIoT) market is experiencing a transformative surge. Industrial facilities, from manufacturing and energy to logistics and infrastructure, are increasingly integrating IIoT technologies to enhance operational efficiency, improve safety, and enable real-time decision-making.

Through the deployment of intelligent sensors, advanced analytics, and connected machinery, businesses are entering a new era of automation and intelligence. This rapid expansion is fueled by the convergence of IT and OT (Operational Technology), rising demand for predictive maintenance, and a strategic shift toward data-driven business models.

As enterprises embrace digital transformation, IIoT plays a pivotal role, helping organizations unlock hidden value, optimize processes, and reduce downtime. The market is expected to witness significant momentum as edge computing, 5G, and artificial intelligence (AI) become deeply integrated into industrial systems, positioning IIoT as a foundational technology in the future of global industry.

Key Market Trends Driving Product Adoption

Rise of Predictive Maintenance

Predictive maintenance is a top use case for IIoT. Sensors in machines track performance data in real time. This helps detect issues early and schedule maintenance before failures happen. It reduces costly downtime and extends equipment life. Machine learning tools analyze sensor data to predict problems. Industries like automotive, oil & gas, and aerospace are seeing big gains.

Real-Time Asset Tracking and Remote Monitoring

IIoT makes it easy to track assets in real time. Companies can monitor equipment, inventory, and people remotely. Examples include connected forklifts and geofenced pipelines. This improves efficiency and speeds up response times. In energy, smart grids and meters help deliver stable and optimized power.

Integration with Artificial Intelligence

AI is making IIoT systems smarter. It spots patterns in data that humans may miss. This supports automation in tasks like quality checks and supply chain planning. AI also helps manage resources better. As the technology improves, more industries are adopting AI-powered IIoT. For example, in March 2025, Nokia launched six new Industry 4.0 edge applications for its MX Industrial Edge platform, partnering with Bosch Rexroth, Ipsotek, Nozomi Networks, Prosys, SmartCone, and SwitchON, to enhance automation, AI-powered inspection, connectivity, and industrial cybersecurity.

Growing Importance of Edge Computing

Edge computing processes data near the source. This reduces delays and improves speed. In factories, quick responses can prevent failures. Edge-powered IIoT devices support real-time control and automation. They are key in areas like smart logistics and autonomous manufacturing.

Major Players and their Competitive Positioning

The IIoT market is fiercely competitive, characterized by the participation of global technology leaders and industrial giants who are continuously investing in research, strategic partnerships, and product development. Key players include: Siemens AG, General Electric (GE), Cisco Systems Inc., IBM Corporation, Rockwell Automation, Honeywell International Inc., ABB Ltd, Schneider Electric SE, Intel Corporation, PTC Inc. These companies are focusing on end-to-end IIoT solutions, ranging from hardware and middleware to advanced analytics and cloud integration. Strategic collaborations with cloud providers and AI startups are helping major players expand their ecosystems and meet growing demand from industrial clients.

Consumer Behavior Analysis

Emphasis on Operational Efficiency

Companies are turning to IIoT to cut costs and boost productivity. The technology helps monitor operations in real time, automate routine tasks, and support smarter decision-making. This reduces waste and improves how resources are used. Industries like manufacturing, utilities, and logistics are using IIoT to fine-tune production and reduce downtime.

Rising Awareness of Industrial Cybersecurity

As more industrial systems go online, security has become a top concern. Companies now choose IIoT vendors based on how well they secure data, manage user identities, and detect threats. Cybersecurity is becoming a key part of IIoT strategy. As a result, businesses prefer platforms that offer strong, multi-layered protection.

Demand for Customization and Scalability

Many industrial users need IIoT solutions that fit their specific needs. Some have to connect old machines, while others need systems that work across multiple locations. Businesses are looking for flexible platforms that can adapt and grow. Vendors offering modular and interoperable systems are seeing greater demand.

Digital Skills and Training

Skilled workers play a big role in IIoT adoption. Companies with trained teams are more likely to invest in these technologies. As more training programs become available, and user interfaces become easier to use, even smaller firms are expected to adopt IIoT more quickly.

Pricing Trends

The cost of implementing IIoT can vary a lot. It depends on the size of the deployment, the industry, and the technology being used. Large companies that are going fully digital may spend millions on complete, integrated systems.

However, costs are starting to come down. Sensor prices are dropping steadily. At the same time, affordable connectivity options like LPWAN (Low Power Wide Area Network) are becoming more common.

Subscription-based models, such as IIoT-as-a-Service, are also growing in popularity. These models reduce the need for large upfront investments. Companies only pay for the data and analytics they use.

Bundled solutions that include hardware, software, and managed services are also helping. They make it easier and more affordable for mid-sized manufacturers and utility providers to get started with IIoT.

Growth Factors

Smart Manufacturing

Industry 4.0 is driving the growth of IIoT. Smart factories rely on connected systems for real-time control and flexibility in production. They collect data from every step of the manufacturing process. So companies can respond to demand changes quickly while keeping quality high. Hence IIoT adoption is growing fast.

Government Support and Digital Policies

Governments worldwide are pushing industrial digitalization. Initiatives like Germany’s Industrie 4.0, China’s Made in China 2025 and India’s Digital India are examples. These programs offer funding, policy support and infrastructure development. They also run subsidies and pilot projects to help small and mid-sized businesses adopt IIoT technologies.

Rise in Connected Devices

Number of connected devices is increasing rapidly. By 2030 more than 30 billion devices will be part of industrial IoT landscape. This massive growth is generating more data than ever before. To handle it, industries need powerful analytics and high speed networks. This is driving demand for scalable IIoT platforms.

Growing Need for Energy Efficiency

Energy efficiency is becoming a top priority for industries. IIoT tools help track energy consumption in factories, warehouses and transportation systems. They enable real-time energy adjustment which reduces costs and supports sustainability efforts. For energy intensive industries IIoT is becoming a key part of their decarbonization journey.

Regulatory Landscape

The IIoT market has to follow several rules and standards. These cover important areas like data security, equipment safety, and how well devices work together. Some of the key standards and frameworks include:

- ISO/IEC 30141 – This provides a reference architecture for IIoT systems.

- NIST Cybersecurity Framework – It offers guidance on protecting critical infrastructure and industrial networks.

- GDPR – This regulates how personal and machine data is handled in IIoT setups across the EU.

- FCC and CE Marking – These ensure that wireless devices meet safety and electromagnetic compatibility standards in the US and Europe.

Global organizations are also working on rules for the ethical use of AI. These will affect IIoT systems, especially those that use autonomous decision-making.

Recent Developments

- Launch of Next-Gen IIoT Platforms

Updated IIoT platform versions are being introduced by companies such as Siemens and GE Digital. These new platforms have cloud-native designs, enhanced edge capabilities, and greater AI. - Strategic Acquisitions and Partnerships

Large tech companies are collaborating to increase the scope of their IIoT products. For instance, Honeywell and Microsoft have teamed up to develop cloud-based warehouse management systems. In the meantime, PTC strengthened its IIoT design and collaboration tools by acquiring Onshape. For example, Advantech, a developer of embedded platforms and intelligent systems for the Internet of Things (IoT), announced in April 2025 that it has partnered with Nagarro, a global digital engineering consultancy, on artificial intelligence (AI). The goal of this partnership is to improve Advantech's EdgeSync software-defined architecture while fortifying the integration of Edge AI hardware and software. - 5G Rollouts and Low Latency Applications

Faster and more responsive industrial automation is being fueled by the introduction of 5G networks. Applications like remote-controlled robotics and intelligent transportation systems that demand fast responses would particularly benefit from this. - Rise of Digital Twins

More companies are now building digital versions of physical assets. These digital twins help with real-time monitoring and simulations. They are making processes like product development and predictive maintenance more efficient.

Current and Potential Growth Implications

Demand-Supply Analysis

The demand for IIoT solutions is growing faster than the supply. This is especially true in developing countries. Many of these regions still lack proper infrastructure and a strong vendor network. On the other hand, global suppliers are starting to scale up. They are increasing production and entering new markets. This is happening through distribution deals and setting up local manufacturing units.

Gap Analysis

Even with the market growing, some gaps remain. Many small businesses don’t have the right digital setup or skilled staff to adopt IIoT. There are also issues with connecting old equipment to new platforms. These interoperability problems make full integration difficult. Fixing these gaps is key to realizing the full potential of the IIoT market.

Top Companies in the IIoT Market

- Siemens AG

- General Electric (GE)

- Cisco Systems Inc.

- IBM Corporation

- Rockwell Automation

- Honeywell International Inc.

- ABB Ltd

- Schneider Electric SE

- Intel Corporation

- PTC Inc.

Industrial Internet of Things Market: Report Snapshot

Segmentation | Details |

By Component | Hardware, Software, Services |

By Application | Predictive Maintenance, Asset Monitoring, Remote Monitoring, Process Automation |

By Industry | Manufacturing, Energy & Utilities, Transportation & Logistics, Oil & Gas, Healthcare |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

IIoT Market: High Growth Segments

Software Segment

Software platforms that offer analytics, visualization, and integration capabilities are gaining high traction. Cloud-native solutions and low-code platforms are enabling rapid deployment and easier customization.

Manufacturing Industry

Manufacturing remains the leading sector in IIoT adoption due to its need for automation, quality control, and supply chain visibility. Smart factories are setting the benchmark for IIoT maturity.

Major Innovations

AI-Enabled Predictive Systems

AI is transforming IIoT applications by making predictive maintenance more accurate and production lines more efficient. Algorithms now proactively identify bottlenecks and recommend corrective actions in real time.

Industrial Edge Devices

Smart edge devices capable of local data processing are enabling real-time insights without the need to transmit data to the cloud. This is revolutionizing industries where speed and data privacy are paramount.

IIoT Market: Potential Growth Opportunities

Expansion into Emerging Markets

Emerging economies like India, Brazil, and Southeast Asia are growing quickly. Urbanization and industrialization are happening at a rapid pace. These regions are becoming more digitally prepared. Government initiatives are also supporting technological adoption. As a result, they offer significant potential for IIoT expansion.

Cross-Industry Collaboration

IIoT is increasingly being combined with technologies like blockchain, AI, and AR/VR. This opens up new possibilities in areas such as quality assurance, employee training, and smart contracts. Collaboration across industries is growing quickly. It’s especially visible in sectors like logistics and supply chain management.

Extrapolate says:

The industrial Internet of Things (IIoT) market is likely to grow over the next 10 years. As industries focus on digital transformation, IIoT is the key to efficiency, resilience and sustainability. The convergence of AI, edge computing and 5G is opening up new use cases in manufacturing, energy, logistics and healthcare.

Governments are supporting digital industrialization and enterprises are demanding real-time operational intelligence, the IIoT market is projected to see increased innovation. Leading companies are redefining how assets are monitored, maintained and optimized. The stage is set for IIoT to be the foundation of the next industrial ecosystem.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Industrial Internet of Things

- July-2025

- 140

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021