Operational Technology Market Size, Share, Growth & Industry Analysis, By Component (Hardware (Sensors, Controllers, PLCs), Software (SCADA, DCS, MES), Services (Consulting, Integration, Support)), By Industry (Manufacturing, Energy & Utilities, Oil & Gas, Transportation, Healthcare, Others), By Deployment (On-premise, Cloud), Large Enterprises), and Telecommunications, Manufacturing, Others), and Regional Analysis, 2024-2031

Operational Technology Market: Global Share and Growth Trajectory

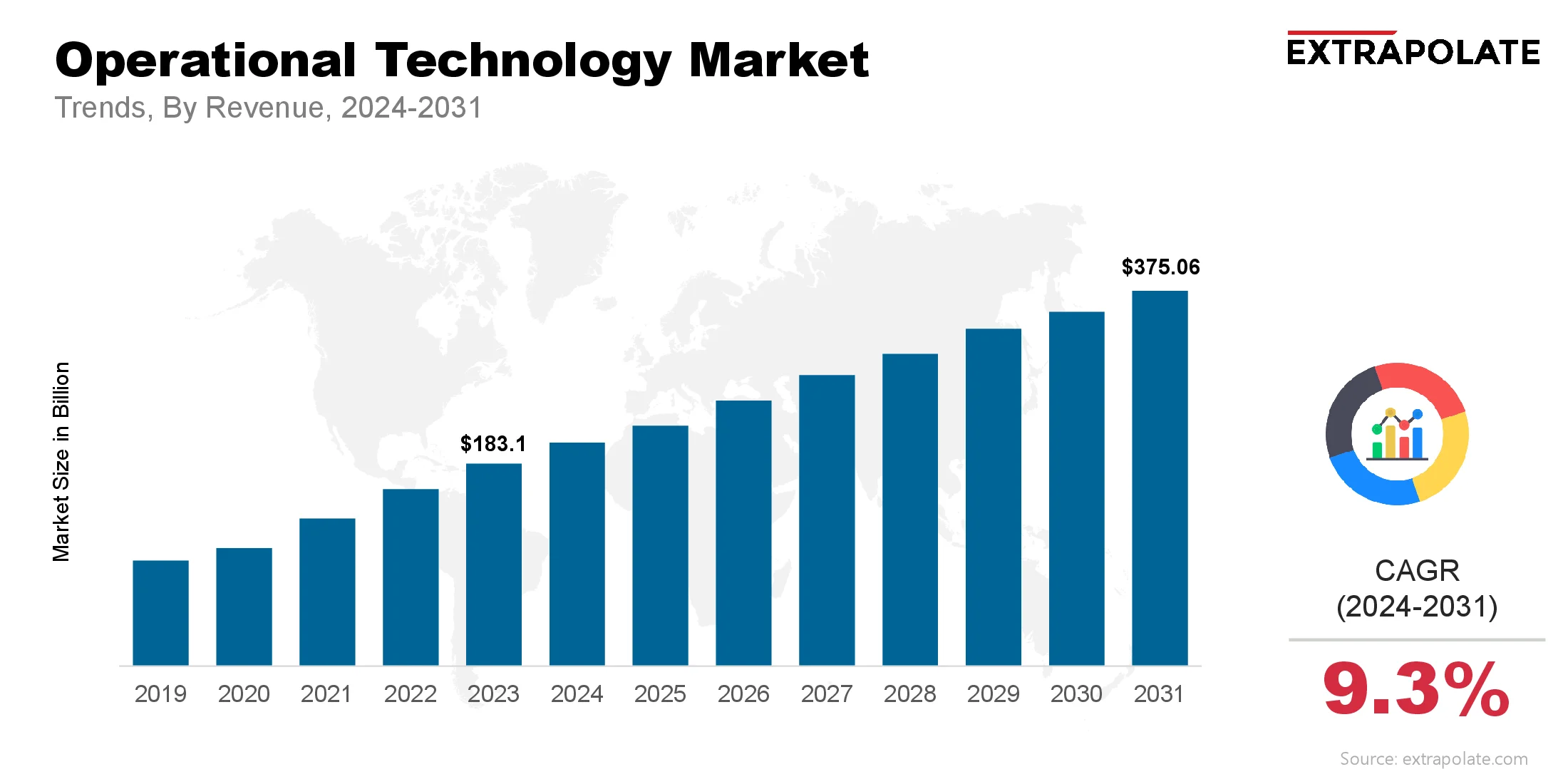

The global Operational Technology Market size was valued at USD 183.1 billion in 2023 and is projected to grow from USD 200.4 billion in 2024 to USD 375.06 billion by 2031, exhibiting a CAGR of 9.3% during the forecast period.

The global operational technology (OT) market is witnessing rapid expansion, fueled by the increasing convergence of information technology (IT) and operational technology (OT), rising demand for industrial automation, and the growing need for enhanced efficiency, productivity, and safety in manufacturing and critical infrastructure sectors. OT encompasses a broad spectrum of hardware and software systems that monitor and control physical devices, processes, and infrastructure.

Industries such as manufacturing, energy and utilities, oil & gas, transportation, and healthcare are rapidly adopting OT solutions to support the shift toward Industry 4.0. The integration of OT with modern IT systems enables real-time data collection, advanced analytics, and remote monitoring, which are crucial for smart decision-making and process optimization. This convergence is driving innovation and creating new growth avenues for vendors and service providers in the market.

The increasing implementation of industrial automation is one of the key drivers propelling the growth of the OT market. Manufacturers are under constant pressure to reduce downtime, lower operational costs, and improve product quality.

As a result, they are deploying advanced OT solutions to automate routine operations, ensure operational consistency, and minimize human error. Furthermore, the rising emphasis on safety and regulatory compliance in hazardous environments is bolstering the demand for robust and secure OT systems.

Another important factor influencing market growth is the proliferation of Industrial Internet of Things (IIoT) technologies. IIoT is enabling OT systems to become smarter and more connected by embedding sensors and communication capabilities into machines and equipment. This results in improved asset utilization, predictive maintenance, and enhanced operational visibility.

The increasing volume of data generated by OT systems is also driving demand for cloud computing, edge computing, and AI-powered analytics platforms that support real-time monitoring and predictive insights.

However, the rapid digitization and interconnectedness of OT environments have also introduced new challenges, particularly in terms of cybersecurity. As legacy OT systems were not originally designed with cybersecurity in mind, integrating them with modern IT systems exposes vulnerabilities that malicious actors can exploit. Consequently, the market is witnessing a surge in demand for OT security solutions and services to protect critical infrastructure and sensitive data.

Geographically, North America is expected to hold a significant share of the operational technology market, owing to the presence of major industry players and early adoption of digital technologies in sectors such as energy, automotive, and manufacturing. Meanwhile, the Asia-Pacific region is anticipated to witness the fastest growth, driven by rapid industrialization, government initiatives to boost smart manufacturing, and increasing investments in infrastructure development.

Key Market Trends Driving Product Adoption

The operational technology market is shaped by innovation. Industry 4.0 and growing cybersecurity needs for critical infrastructure are key drivers. Key trends driving market growth include:

- Integration with IT Networks: Merging operational and information tech is improving data analysis. It also enhances remote monitoring and predictive maintenance.

- Cybersecurity Focus: As OT systems connect more, cybersecurity is a top focus. Protecting industrial assets from threats is crucial.

- Edge Computing: Edge computing enables real-time processing at the source. This cuts latency and boosts operational efficiency.

- Industrial IoT (IIoT): Connected sensors and smart devices are growing in number. They allow smooth communication and smart automation in industries.

AI and Machine Learning: These technologies optimize operations. They help detect issues and improve decision-making in OT settings.

Major Players and their Competitive Positioning

The OT market is led by top automation firms. These include Siemens, ABB, Schneider Electric, Honeywell, and Rockwell. These companies are always evolving their offerings. They innovate and form strategic partnerships. Niche players and startups are entering the market. They offer specialized OT solutions and digital platforms.

Consumer Behavior Analysis

End-users of OT systems, including manufacturers, utilities, and energy providers, are increasingly focused on:

- Operational Efficiency: Automation and real-time data analysis streamline processes. They help minimize downtime.

- Safety and Compliance: Control systems ensure workplace safety. They also help meet regulatory requirements.

- Sustainability Goals: Smart OT solutions cut energy use. They also reduce the carbon footprint.

- Cost Optimization: Predictive maintenance lowers upkeep costs. It also extends the life of assets.

Pricing Trends

Pricing in the OT market is influenced by solution complexity, customization levels, and integration capabilities. High-end systems with AI, IoT, and cybersecurity cost more. Modular solutions are popular with SMEs for being cost-effective and scalable.

Growth Factors

Several factors are fueling the growth of the operational technology market:

- Industrial Automation: The demand for automation is growing in oil & gas, manufacturing, and energy. This is driving OT adoption.

- Digital Transformation: Smart factories and digital twins are pushing investment. This is boosting the growth of modern OT platforms.

- Workforce Challenges: Skilled labor shortages are increasing reliance on intelligent OT systems to maintain productivity.

- Remote Operations: Post-pandemic remote management needs are leading to increased deployment of remote OT solutions.

Regulatory Landscape

The regulatory framework for OT solutions includes safety, environmental, and cybersecurity standards. Compliance with IEC 62443 for cybersecurity and ISO safety standards is crucial. It helps gain market acceptance.

Recent Developments

The operational technology market is evolving rapidly, with notable developments including:

- AI-Driven Control Systems: Smart OT platforms use AI for process optimization. They also help detect faults.

- Cloud-Based SCADA: Cloud technologies enable scalable OT management. They also offer flexibility and centralization.

- Enhanced Cybersecurity Solutions: Advanced threat detection systems are tailored for industries. They also focus on incident response.

- 5G Integration: 5G networks enable faster communication between OT devices. They also improve reliability.

Current and Potential Growth Implications

- Demand Supply Analysis

OT solutions are in higher demand. This is especially true in energy, utilities, and manufacturing sectors. However, global supply chain disruptions and semiconductor shortages may delay hardware availability. - Gap Analysis

Despite significant advancements, challenges persist:

- Legacy Systems: Many industries still use old OT systems. These limit scalability.

- Interoperability Issues: The absence of standardized protocols slows integration. It affects compatibility across platforms.

- Cybersecurity Gaps: OT environments are at risk. This is due to limited security measures.

- Talent Shortage: Advanced OT systems need skilled workers. They handle setup, use, and upkeep.

Top Companies in the Operational Technology Market

- Siemens AG

- Honeywell International Inc.

- Schneider Electric SE

- Rockwell Automation, Inc.

- ABB Ltd.

- Mitsubishi Electric Corporation

- Yokogawa Electric Corporation

- Emerson Electric Co.

- GE Digital

- Fortinet, Inc.

Operational Technology Market: Report Snapshot

Segmentation | Details |

By Component | Hardware (Sensors, Controllers, PLCs), Software (SCADA, DCS, MES), Services (Consulting, Integration, Support) |

By Industry | Manufacturing, Energy & Utilities, Oil & Gas, Transportation, Healthcare, Others |

By Deployment | On-premise, Cloud |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

High Growth Segments

The following market segments are expected to experience significant growth:

- Industrial Control Systems (ICS): Core systems for controlling and monitoring industrial processes.

- Cloud-Based OT Solutions: Growing demand for remote access and scalability.

- Cybersecurity Solutions for OT: Increasing need for protecting critical infrastructure.

Major Innovations

Innovation is a driving force in the OT market. Noteworthy trends include:

- Digital Twins: Virtual replicas of physical systems for real-time monitoring and optimization.

- AI-Powered Predictive Maintenance: Reducing downtime and operational costs.

- Edge Computing Platforms: Real-time decision-making at the edge of the network.

- Industrial Blockchain: Enhancing data integrity and transparency in industrial processes.

Potential Growth Opportunities

Companies operating in the OT market face several challenges and opportunities:

- Legacy System Upgrades: Modernizing outdated infrastructure offers major opportunities.

- Cybersecurity Integration: Demand for integrated security features is surging.

- IT-OT Convergence: Seamless integration is a competitive advantage.

- Scalability Challenges: Need for flexible and scalable systems across industries.

- Regulatory Compliance: Adhering to industry-specific safety and data standards.

Extrapolate Research says:

The global operational technology market is positioned for robust growth over the next decade, driven by automation trends, digital transformation, and rising industrial connectivity. Organizations that innovate, address cybersecurity, and ensure interoperability will gain a significant edge in this evolving market landscape.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Operational Technology Market Size

- May-2025

- 148

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021