Rockets and Missiles Market Size, Share, Growth & Industry Analysis, By Product (Rockets, Missiles), By Speed (Surface-to-Surface, Surface-to-Air, Air-to-Air, Air-to-Surface, Subsea-to-Surface), By Propulsion Type (Solid, Liquid, Hybrid, Ramjet, Turbojet, Scramjet), By End-User (Defence, Homeland Security), and Regional Analysis, 2024-2031

Rockets and Missiles Market: Global Share and Growth Trajectory

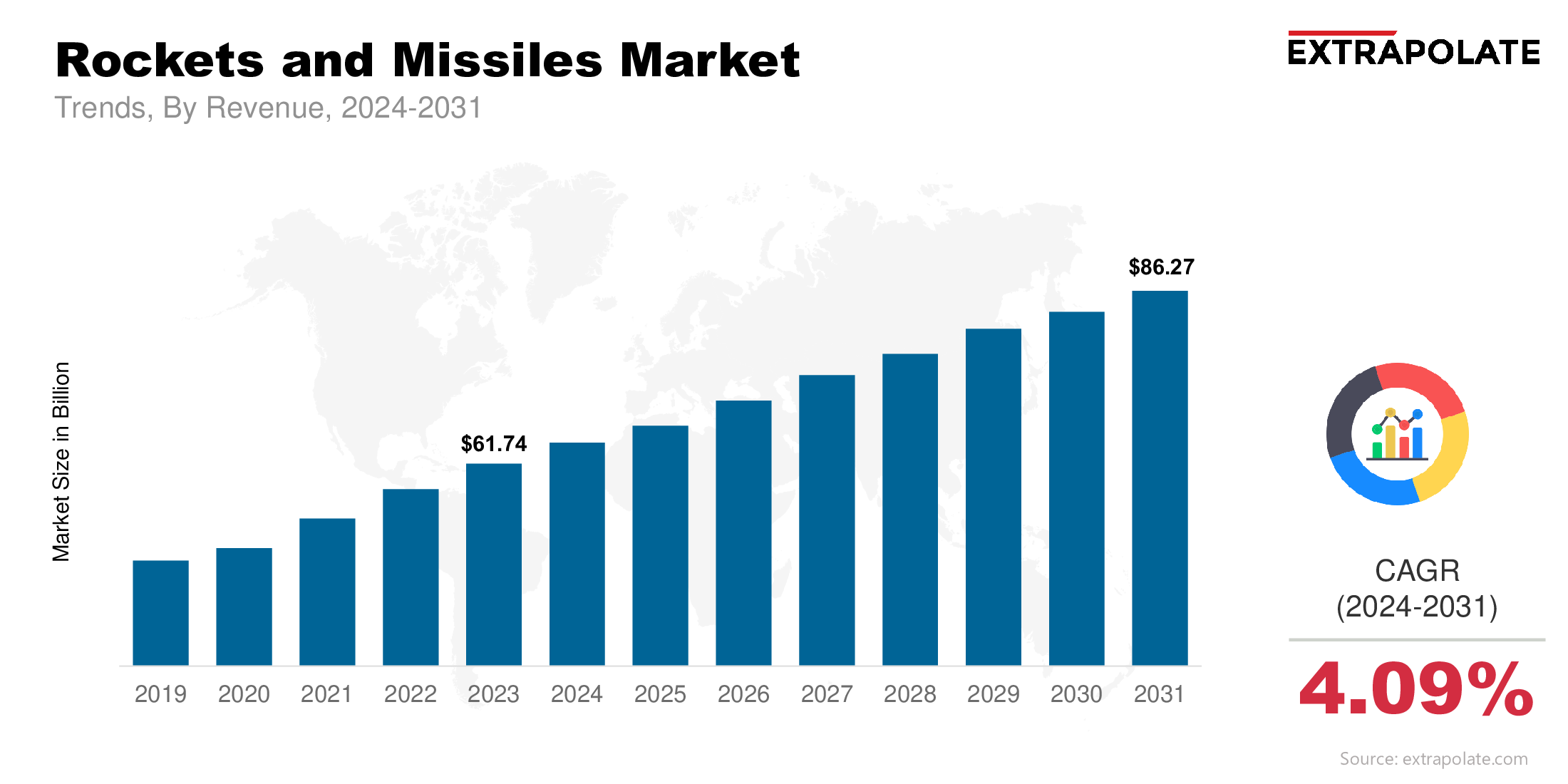

The global Rockets and Missiles Market size was valued at USD 61.74 billion in 2023 and is projected to grow from USD 65.12 billion in 2024 to USD 86.27 billion by 2031, exhibiting a CAGR of 4.09 % during the forecast period.

The global market is on a growth path, driven by increasing defense spending, evolving warfare doctrine and the need for long range strike capabilities. Across the globe, countries are investing heavily in their missile and rocket arsenal to strengthen their strategic deterrence and defense preparedness. These advanced weapons systems are the backbone of modern military operations – from tactical combat to strategic nuclear deterrence and space based missions.

With rising border tensions, asymmetric warfare threats and the deployment of next generation technologies like hypersonic propulsion, artificial intelligence and satellite navigation, the market is poised for growth. Countries are not only acquiring powerful weapons but also precision, survivability and responsiveness – giving rise to smart missile systems and reusable rocket technologies.

North America dominates the global market due to its massive defense budget, technological superiority and presence of key industry players. However, Asia Pacific is emerging as the fastest growing region driven by regional rivalries, strategic military modernization and growing indigenous production capabilities.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

- Hypersonic and Advanced Propulsion Technologies

One of the key trends driving adoption in the rockets and missiles sector is the shift towards hypersonic systems. Hypersonic missiles – capable of speeds above Mach 5 – offer superior maneuverability, speed and penetration capabilities and pose a major challenge to conventional missile defense systems. As major powers like US, Russia and China are racing to develop and deploy hypersonic glide vehicles (HGVs) and cruise missiles, demand for such technologies is surging.

- AI and Smart Targeting

Artificial intelligence and machine learning is revolutionizing modern missile systems. Today’s missiles are equipped with advanced sensors, data fusion algorithms and adaptive guidance systems. These features enable real time decision making and target recognition even in contested or cluttered environments. AI enabled missiles can assess threat levels dynamically and improve strike accuracy and mission efficiency.

- Reusable Rocket Systems

The trend towards reusable launch systems – driven primarily by commercial space and defense collaboration – is having a big impact on the rocket segment. Companies like SpaceX have demonstrated the cost savings and performance benefits of reusing first stage boosters. Governments and defense agencies are also exploring reusable ballistic missile systems to optimize costs and enhance flexibility in satellite deployment and long range reconnaissance missions.

- Precision-Guided Munitions (PGMs)

With the focus on minimizing collateral damage in military operations, PGMs are in demand. PGMs – guided rockets and missiles – are designed to hit the target with minimal deviation using GPS, INS and laser guidance. These are critical in counter terrorism, urban warfare and strategic deterrence missions.

Major Players and Their Competitive Positioning

The rockets and missiles industry is highly competitive and technologically intensive. Key players are engaged in strategic collaborations, extensive R&D, and government contracting to gain a competitive edge. Notable companies dominating the global landscape include Lockheed Martin Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, Boeing Defense, Space & Security, BAE Systems plc, Thales Group, MBDA Missile Systems, Rafael Advanced Defense Systems, General Dynamics Corporation, China Aerospace Science and Technology Corporation (CASC) and others.

These firms are continually investing in advanced propulsion, miniaturized warheads, multi-role platforms, and export-ready missile systems. Long-term defense contracts and joint development programs with national governments underpin their market leadership and innovation momentum.

Consumer Behavior Analysis

- Heightened National Security Awareness: Government buyers and defence departments worldwide are prioritising missile and rocket procurement as part of their national security agenda. In response to conventional and non-conventional threats – rogue states, terrorism and cyber warfare – defence ministries are accelerating the acquisition of strategic and tactical missile systems.

- Cost Vs Capability: Cost is a big consideration especially for emerging economies. But nations are willing to invest in high value systems that offer deterrence, survivability and dual use. Many buyers opt for modular missile systems that offer scalability, reusability or compatibility with existing launch platforms.

- Indigenous Capability Development: Many countries are moving towards developing indigenous missile and rocket production capabilities to reduce dependence on foreign suppliers. Domestic manufacturing is not only cheaper but also strategically important in building self reliant defence ecosystems. Examples are India’s DRDO missile programmes and South Korea’s Hyunmoo systems.

- Procurement Driven by Strategic Alliances: Consumer demand is also driven by geopolitical alliances. NATO, Quad and other defence pacts promote joint missile defence strategies and standardised interoperability among member states. This often results in collaborative development programs and technology transfer agreements among allied nations.

Pricing

Pricing of rockets and missiles varies widely based on system complexity, guidance technology, payload capability and intended use – tactical, strategic or space launch. Ballistic missile systems cost more due to their long range and advanced propulsion systems. Short range tactical missiles and unguided rocket artillery are relatively cheaper and often produced in bulk.

Recent innovations like reusable rocket stages and modular missile kits are reducing lifecycle costs. Defence procurement is also moving towards performance based logistics (PBL) and long term sustainment contracts which balances initial acquisition costs with long term support savings.

Growth Factors

- Increasing Defense Budgets: A big increase in global defence spending – especially in the US, China, India and Russia – is creating sustained demand for rocket and missile systems. These investments are often targeted towards modernisation programs, force restructuring and strengthening strategic deterrence.

- Regional Conflicts: Ongoing conflicts and border tensions in Eastern Europe, Middle East and East Asia are driving immediate demand for precision strike weapons. Nations bordering conflict zones are upgrading missile capabilities for quick response and deterrence against adversaries.

- Asymmetric Warfare: Asymmetric tactics by non-state actors – insurgents and terrorist groups – is forcing nations to develop missile systems for quick deployment, accurate strikes and mission specific configurations. Portable rocket systems and air launched missiles are in high demand for counter insurgency operations.

- Commercial Space Launch: Beyond military use, rockets are finding commercial applications for satellite launches, space research and interplanetary missions. Defence companies are partnering with commercial space agencies to build multipurpose launch vehicles, opening up new revenue streams and application domains.

Regulatory Landscape

The rockets and missiles market operates under strict national and international regulations to prevent the spread of weapons of mass destruction and to maintain strategic balance. Key regulations are:

- The Missile Technology Control Regime (MTCR): An informal and voluntary agreement among 35 countries to limit the spread of missile and UAV technology that can carry a 500 kg payload at least 300 km.

- ITAR (International Traffic in Arms Regulations): Regulates the export of US defense related technology including missile components and software.

- UN Security Council Resolutions: These resolutions often restrict missile development in sanctioned countries like North Korea and Iran and affect global trade and partnerships.

Compliance with these regulations is mandatory for manufacturers and suppliers to ensure ethical and legal distribution of high impact technologies.

Recent Developments

- Hypersonic Breakthroughs: US Army and Navy along with DARPA have accelerated the development of hypersonic glide vehicles. Russia’s Avangard and China’s DF-ZF are also making progress, showing global competition in this area.

- Integrated Missile Defense Systems: Countries are developing multi-layered missile defense systems, combining radar, interceptors and space based early warning systems. Israel’s Iron Dome and India’s PAD-AAD system are examples of this.

- Reusable Rocket Innovations: SpaceX’s Falcon 9 and upcoming Starship are redefining the economics of rocket deployment. Their reusability and modularity is influencing government procurement for both defense and research.

- Export and Partnership Deals: India’s BrahMos missile co-developed with Russia is being exported to the Philippines, a strategic move towards defense exports. Such bilateral deals are becoming common in the Asia-Pacific region.

Current and Potential Growth Implications

a. Demand-Supply Analysis

Growing demand for missiles, especially those with precision strike and long-range capabilities, is placing pressure on global supply chains. Raw material shortages, geopolitical trade restrictions, and technology transfer constraints are key challenges in meeting procurement timelines.

b. Gap Analysis

Despite robust development in missile technologies, significant gaps remain in areas such as defense against hypersonic weapons, neutralization of low-flying cruise missiles, and cost-effective reusable rockets. Addressing these requires global R&D collaboration and specialized investments.

Top Companies in the Rockets and Missiles Market

Leading players dominating the global market include:

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- Northrop Grumman Corporation

- Boeing Defense, Space & Security

- BAE Systems plc

- Thales Group

- MBDA Missile Systems

- Rafael Advanced Defense Systems

- General Dynamics Corporation

- China Aerospace Science and Technology Corporation (CASC)

Rockets and Missiles Market: Report Snapshot

Segmentation | Details |

By Product | Rockets, Missiles |

By Speed | Subsonic, Supersonic, Hypersonic |

By Launch Mode | Surface-to-Surface, Surface-to-Air, Air-to-Air, Air-to-Surface, Subsea-to-Surface |

By Propulsion Type | Solid,Liquid, Hybrid, Ramjet, Turbojet, Scramjet |

By End-User | Defense, Homeland Security |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Hypersonic Missiles: Fastest growing due to strike velocity and evasion capabilities. Hypersonic systems are at the heart of every major power’s defense strategy.

- Cruise Missiles: Cruise missiles are core to conventional precision strike capabilities. Versatile platforms and long range accuracy is driving demand especially in regional militaries.

- Space Launch Rockets: Small satellites and commercial payloads are driving demand for cost effective, reusable space launch vehicles, a big growth area in the rocket space.

Major Innovations

- AI-Powered Guidance Systems: Missiles now have AI to navigate changing battlefield dynamics. Smart missiles adjust in flight, detect jamming and execute evasive maneuvers.

- Reusable Propulsion Stages: Reusable launch and propulsion technology reduces costs and environmental impact and increases military and scientific mission efficiency.

- Dual-Use Payload Systems: Missiles and rockets are being designed to be multi-configured, to deploy kinetic warheads or satellite payloads, for strategic flexibility.

Potential Growth Opportunities

- Expansion in Asia-Pacific: With tensions rising in the Indo-Pacific, Japan, South Korea and India are investing heavily in indigenous missile programs. A big opportunity for global companies through joint ventures and technology transfer.

- Commercial-Military Integration: Commercial space technology merging with defense applications is a new growth area. Government space agencies and private launch providers are partnering up fast.

- Next-Gen Missile Defense Systems: Opportunities abound in integrated systems to intercept ballistic, cruise and hypersonic threats. Countries are investing in satellite based surveillance, AI powered interceptors and quantum radar.

Extrapolate Research says:

The rockets and missiles market is set to explode as warfare paradigms change and the geopolitical landscape shifts. With precision, survivability and speed being the watchwords, missiles are no longer standalone assets but critical nodes in a network of smart, responsive defense systems.

As budgets rise and technology advances, global powers are investing big in both offensive and defensive missile capabilities. Hypersonic systems, AI targeting and reusable rockets are setting the stage for a decade of change in this space. Companies that can marry innovation with reliability and cost will be the leaders in the next era of strategic deterrence and space exploration.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Rockets and Missiles Market Size

- June-2025

- 140

- Global

- aerospace-and-defence

Related Research

Aerospace Robotics Market Size, Share, Growth & Industry Analysis, By Robot Type (Articulated Robots

June-2025

AESA Radar Market Size, Share, Growth & Industry Analysis, By Platform (Airborne, Naval, Ground-Base

July-2025

Aviation Refueling Hose Market Size, Share, Growth & Industry Analysis, By Material (Rubber, Thermop

June-2025

Dog Automatic Feeder-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

Drone Market Size, Share, Growth & Industry Analysis, By Type (Consumer Drones, Commercial Drones, M

March-2025

Electric Ships Market Size, Share, Growth & Industry Analysis, By Vessel Type (Passenger Ships, Carg

April-2025

Global Military Radar Market Size, Share, and COVID-19 Impact Analysis, By Component (Digital Signal

July-2022

Rockets and Missiles Market Size, Share, Growth & Industry Analysis, By Product (Rockets, Missiles),

June-2025

Satellite Propulsion Systems Market Size, Share, Growth & Industry Analysis, By Propulsion Type (Che

June-2025

Small Satellite Market Size, Share, Growth & Industry Analysis, By Satellite Type (CubeSat, MiniSat,

April-2025