Aerospace Robotics Market Size, Share, Growth & Industry Analysis, By Robot Type (Articulated Robots, SCARA Robots, Cartesian Robots, Cylindrical Robots, Collaborative Robots), By Application (Drilling, Painting, Welding, Assembly, Inspection, Material Handling), By Payload (Aircraft Manufacturers, Maintenance Repair & Overhaul (MRO), Component Manufacturers), and Regional Analysis, 2024-2031

Aerospace Robotics Market: Global Share and Growth Trajectory

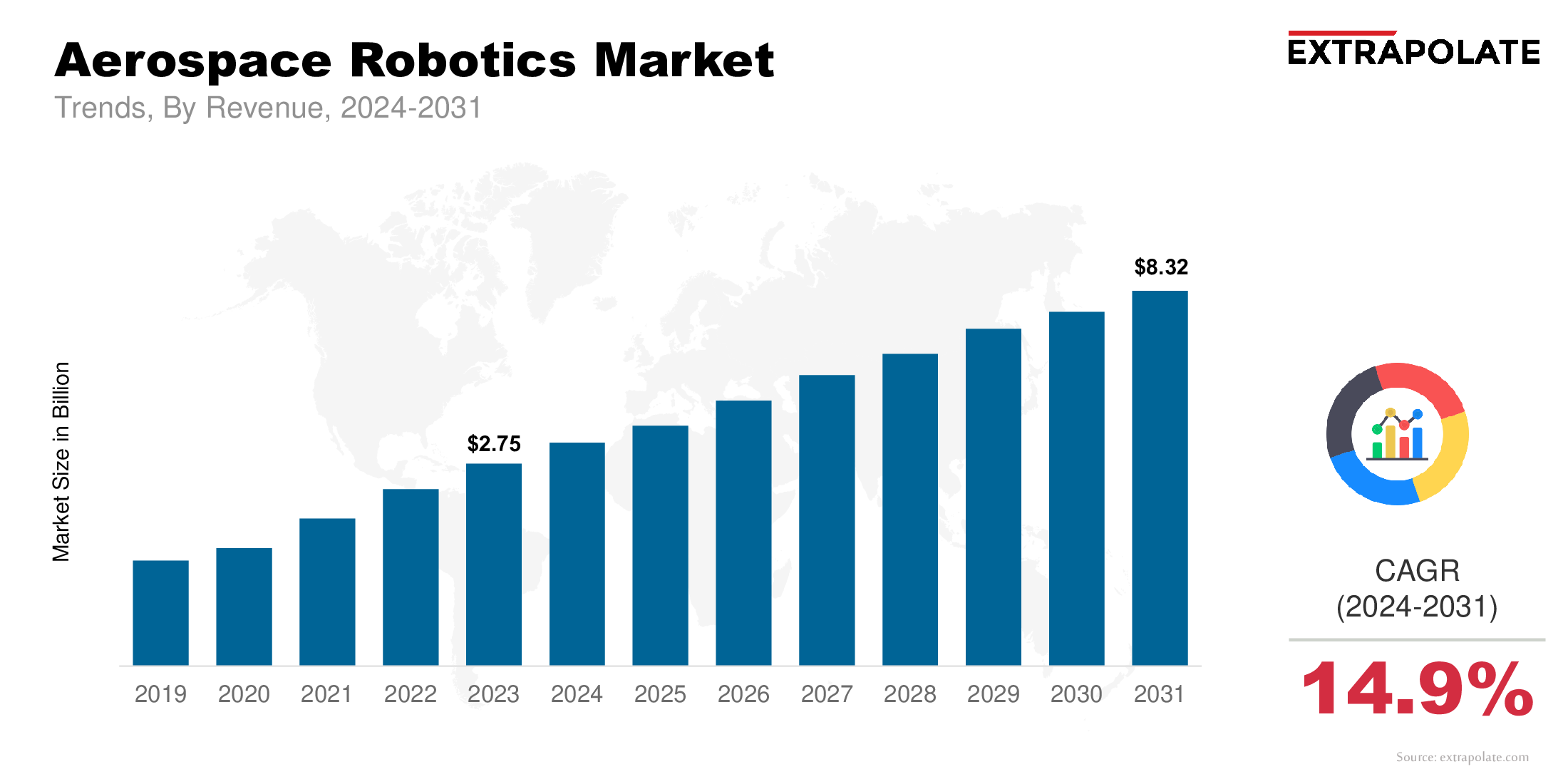

The global aerospace robotics market size was valued at USD 2.75 billion in 2023 and is projected to grow from USD 3.14 billion in 2024 to USD 8.32 billion by 2031, exhibiting a CAGR of 14.9 % during the forecast period.

The market is making rapid headway as automation becomes crucial to modern aircraft manufacturing, maintenance, and quality assurance. With growing global air traffic, rising defense budgets, and the need for accuracy and efficiency in aerospace production, robotic systems are being rapidly adopted by aircraft manufacturers and maintenance providers.

These advanced robotic solutions are used for a vast range of applications like drilling, fastening, welding, painting, and non-destructive testing. The ability of robots to deliver high precision, repeatability, and constant operation with minimal human intervention is fueling their integration into aerospace production lines. This shift is particularly important as the industry faces rising labor costs and a shortage of skilled technicians.

North America currently leads the global market due to the presence of major aircraft OEMs like Boeing and Lockheed Martin, as well as advanced robotics suppliers. However, the Asia-Pacific region is expected to experience the fastest growth, propelled by increasing investments in aerospace infrastructure and expanding commercial aviation fleets in countries like China and India.

As the aerospace industry aims for leaner, more precise, and safer operations, robotics stands at the forefront of this transformation. The market is expected to expand over the next decade, supported by innovations in automation, increasing demand for air travel, and a global shift toward intelligent manufacturing systems.

Key Market Trends Driving Product Adoption

Various transformative trends are driving the adoption of aerospace robotics globally:

- Rising Demand for Aircraft Production Efficiency

With commercial aviation witnessing a resurgence post-pandemic and defense contracts expanding in several countries, aircraft manufacturers face immense pressure to deliver faster and with greater precision. Robotics enables 24/7 production capabilities with minimal downtime, addressing this need. Automated systems conduct tasks such as riveting, sealing, and welding with unmatched speed and accuracy, reducing production delays and enhancing throughput.

- Technological Advancements in Robotics and AI Integration

The aerospace sector is increasingly integrating robotics with artificial intelligence (AI), vision systems, and machine learning algorithms. These advancements allow robotic arms to adapt to complex geometries and perform delicate tasks, like composite material trimming and ultrasonic inspections, with minimal supervision. Smart sensors and AI-backed analytics help monitor component quality in real-time, minimizing rework and ensuring compliance with regulatory standards.

- Labor Shortages and Rising Labor Costs

Aerospace manufacturing requires skilled labor, but labor shortages and rising wages have created operational challenges for manufacturers. Robotics offers a solution by reducing reliance on human labor for repetitive and high-risk tasks. Robots not only fill the labor gap but also work in hazardous environments, enhancing worker safety and operational efficiency.

- Emphasis on Aircraft Safety and Quality

Aerospace is a zero-defect industry where even the slightest error can have catastrophic consequences. Robotics ensures high levels of precision and repeatability in aircraft component manufacturing and inspection. Automated non-destructive testing (NDT) and laser-based inspections are increasingly conducted with the help of robots to detect structural anomalies early in the production process.

Major Players and Their Competitive Positioning

The aerospace robotics industry features leading players focused on continuous innovation, strategic partnerships, and geographic expansion. Leading robotics companies are collaborating with major aircraft manufacturers to deliver customized automation solutions.

Key players in this evolving market include are KUKA AG, FANUC Corporation, ABB Ltd., Kawasaki Heavy Industries Ltd., Yaskawa Electric Corporation, Northrop Grumman Corporation, Electroimpact Inc., Staubli International AG, Universal Robots A/S, Teradyne Inc. and others.

These companies are investing in next-generation robotic solutions designed for aerospace assembly and maintenance tasks. Strategic moves like mergers and collaborations with OEMs are helping them secure long-term contracts and expand their market share worldwide.

Consumer Behavior Analysis

Adoption patterns in the market are influenced by economic and strategic considerations:

- Focus on Consistency and Performance:

Aircraft manufacturers and MRO (maintenance, repair, and overhaul) firms are giving priority to robotics for meeting quality benchmarks. Consistency in riveting, surface finishing, and inspection improves aircraft reliability and reduces warranty costs. Robotics ensures that every part meets specification every time. - Cost Optimization Goals:

While initial capital investment in aerospace robots can be high, decision-makers are focusing on lifecycle cost savings. These include faster production cycles, reduced rework rates, fewer workplace injuries, and lower operational costs. Automation ultimately supports affordable scaling and greater ROI over time. - Rising Preference for Flexible Manufacturing:

Aerospace firms are shifting to modular production lines that can accommodate frequent design changes. Collaborative robots (cobots) and mobile robotic systems offer flexibility and adaptability for such environments, and are thus becoming popular. - Technological Awareness and Training Investments:

As companies become more familiar with robotic technologies, training programs are being established to upskill employees. Manufacturers are investing in simulation software and virtual commissioning to familiarize workers with robotic workflows before real-world deployment.

Pricing

Aerospace robotics pricing varies by function, customization, payload capacity and technology stack. High end robotic arms used in drilling, painting or composite handling can cost between $150,000 to $500,000 per unit. But the total system cost including installation, programming and peripherals can be much higher.

To address budget concerns many vendors are now offering flexible leasing models and Robotics-as-a-Service (RaaS) plans. This allows aerospace companies to access latest automation without heavy upfront costs. Moreover cost reductions in sensors, processors and software are slowly making robotics more affordable for smaller players in the industry.

Growth Factors

Multiple key drivers are driving growth in the aerospace robotics market:

- Lightweight Aircraft Components:

Airlines are demanding fuel efficient aircraft, manufacturers are using lightweight composites and alloys that require precision machining. Robotics ensures high precision in working with fragile materials without breaking them. - Increased Defense Spending:

Governments worldwide are increasing their defense budgets which leads to higher demand for military aircraft and drones. Aerospace manufacturers are ramping up production using robotics to meet contractual timelines and quality expectations. - Advanced Software Platforms:

Software innovations like digital twins, real-time monitoring and cloud based analytics are improving robot performance. Manufacturers can now simulate robotic movements virtually, fine tune operations before deploying physical robots on the factory floor. - Sustainability and Resource Efficiency:

Environmental concerns are driving aerospace companies to upgrade their resource usage. Robotic systems reduce material waste, improve energy efficiency and support sustainable manufacturing by minimizing human error and production scrap.

Regulatory Landscape

The aerospace robotics sector operates under precise regulatory frameworks designed to ensure the safety and reliability of aircraft systems. Compliance with these standards is necessary:

- AS9100 Certification: A global quality standard specific to the aerospace industry, which requires robotic systems and processes to meet strict quality and safety norms.

- NADCAP Accreditation: Robotics used in processes such as welding and NDT may need compliance with NADCAP (National Aerospace and Defense Contractors Accreditation Program) guidelines.

- ISO 10218 & ISO/TS 15066: These international standards govern the design and safety requirements needed for industrial and collaborative robots.

To meet legal standards, robot makers adjust design, limit actions, and add fail-safe systems. Aerospace robotics suppliers must often undergo extensive qualification and validation processes before deployment.

Recent Developments

Several things are happening in the aerospace robotics space:

- Collaborative Robotics in Aerospace: Cobots are showing up on aerospace production floors more and more, helping humans with complex and dynamic tasks. Their small footprint and ease of programming make them perfect for small lot production or custom manufacturing runs.

- AI and Machine Vision: Robotics systems with AI-powered vision are being used for real-time quality checks and alignment during assembly. They can self correct errors and increase productivity and part consistency.

- MRO Automation: Aerospace MRO facilities are automating labor intensive tasks like surface cleaning, coating removal and visual inspections with robotic arms and drones to reduce aircraft turnaround times.

- Strategic Partnerships: KUKA’s partnership with Airbus and FANUC’s work with Boeing on fully automated drilling and fastening lines are examples of how OEMs are co-developing custom robotic solutions for specific aircraft models.

Current and Potential Growth Implications

- Demand-Supply Analysis:

Surging demand for aircraft across commercial and defense sectors is compelling aerospace OEMs to scale up production. Robot providers are scaling both factory work and field support to meet strong demand. Robot makers face major delivery delays due to global shortages in electronic parts such as semiconductors, sensors, and control units. - Gap Analysis:

While the sector advances, small-to-mid aerospace firms face limits like high costs, lack of tech staff, and tight budgets, slowing automation use. The price, lack of trained staff, and hard system setup make it tough for some companies to adopt smart tools. Vendors must now focus on simplified plug-and-play solutions and training support to make robotics accessible to a broader market.

Top Companies in the Aerospace Robotics Market

Leading companies pushing innovation in the aerospace robotics sector include:

- KUKA AG

- ABB Ltd.

- FANUC Corporation

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries Ltd.

- Electroimpact Inc.

- Northrop Grumman Corporation

- Staubli International AG

- Universal Robots A/S

- Teradyne Inc.

These firms offer robotics platforms customized for aerospace tasks and are expanding globally through joint ventures, R&D investments, and digital integration.

Aerospace Robotics Market: Report Snapshot

Segmentation | Details |

By Robot Type | Articulated Robots, SCARA Robots, Cartesian Robots, Cylindrical Robots, Collaborative Robots |

By Application | Drilling, Painting, Welding, Assembly, Inspection, Material Handling |

By Payload | Up to 16 Kg, 16.01–60 Kg, 60.01–225 Kg, More than 225 Kg |

By End-User | Aircraft Manufacturers, Maintenance Repair & Overhaul (MRO), Component Manufacturers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The segments expected to experience the most substantial growth:

- Collaborative Robots (Cobots): Flexibility and safety in shared work areas are making these systems a top choice.

- Inspection and Quality Control Applications: Automation in inspection using machine vision-equipped robots is expanding rapidly.

- MRO End-Users: Adoption in maintenance depots is increasing due to rising global air traffic and aging aircraft fleets.

Major Innovations

Innovation is the lifeblood of the aerospace robotics industry. Key advancements include:

- AI-Powered Robotics Platforms: Capable of autonomous decision-making and continuous learning from operational feedback.

- Mobile Robots with Autonomous Navigation: Used in large aircraft factories for transporting materials and components.

- 3D Laser Scanning Robots: These are speeding up aircraft scans while giving better, more accurate results.

Potential Growth Opportunities

The market is rife with future opportunities, including:

- Expansion in Emerging Markets: By growing aircraft work and modernizing airports, these regions are fueling a rise in smart aerospace tools.

- Integration with Digital Twin Technology: Robots and virtual models help firms see what might break, plan builds, and keep lines running smooth.

- Adoption in Space Exploration Missions: Robotic systems for satellite setup, ship builds, and space tasks are paving the way for new growth in aerospace tech.

Extrapolate Research says:

The aerospace robotics market is poised for remarkable growth as the global aerospace industry evolves to meet higher production demands, quality standards, and safety benchmarks. Robots have become vital in aerospace to meet rising demand, boost build quality, and keep planes safe and well-kept. By using AI, cameras, and live data, robots are helping the aerospace world get sharper, quicker, and more secure.

From smart bots that speed up builds to scan tools that boost safety, aerospace robotics is becoming the base of tomorrow’s flight systems. Faster tech and lower prices are set to drive wide use of robotics, building a future of smart, automated flight.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Aerospace Robotics Market Size

- June-2025

- 148

- Global

- aerospace-and-defence

Related Research

Aerospace Robotics Market Size, Share, Growth & Industry Analysis, By Robot Type (Articulated Robots

June-2025

AESA Radar Market Size, Share, Growth & Industry Analysis, By Platform (Airborne, Naval, Ground-Base

July-2025

Aviation Refueling Hose Market Size, Share, Growth & Industry Analysis, By Material (Rubber, Thermop

June-2025

Dog Automatic Feeder-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

Drone Market Size, Share, Growth & Industry Analysis, By Type (Consumer Drones, Commercial Drones, M

March-2025

Electric Ships Market Size, Share, Growth & Industry Analysis, By Vessel Type (Passenger Ships, Carg

April-2025

Global Military Radar Market Size, Share, and COVID-19 Impact Analysis, By Component (Digital Signal

July-2022

Rockets and Missiles Market Size, Share, Growth & Industry Analysis, By Product (Rockets, Missiles),

June-2025

Satellite Propulsion Systems Market Size, Share, Growth & Industry Analysis, By Propulsion Type (Che

June-2025

Small Satellite Market Size, Share, Growth & Industry Analysis, By Satellite Type (CubeSat, MiniSat,

April-2025