Data Discovery Market Size, Share, Growth & Industry Analysis, By Component (Software, Services (Managed Services, Professional Services)) By Deployment (Cloud-Based, On-Premise) By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises) By Application (Risk Management, Customer Experience Management, Compliance Management, Sales & Marketing Optimization, Others) By End-User (BFSI, Healthcare, Retail & E-Commerce, IT & Telecom, Government, Manufacturing, Others) and Regional Analysis, 2024-2031

Data Discovery Market: Global Share and Growth Trajectory

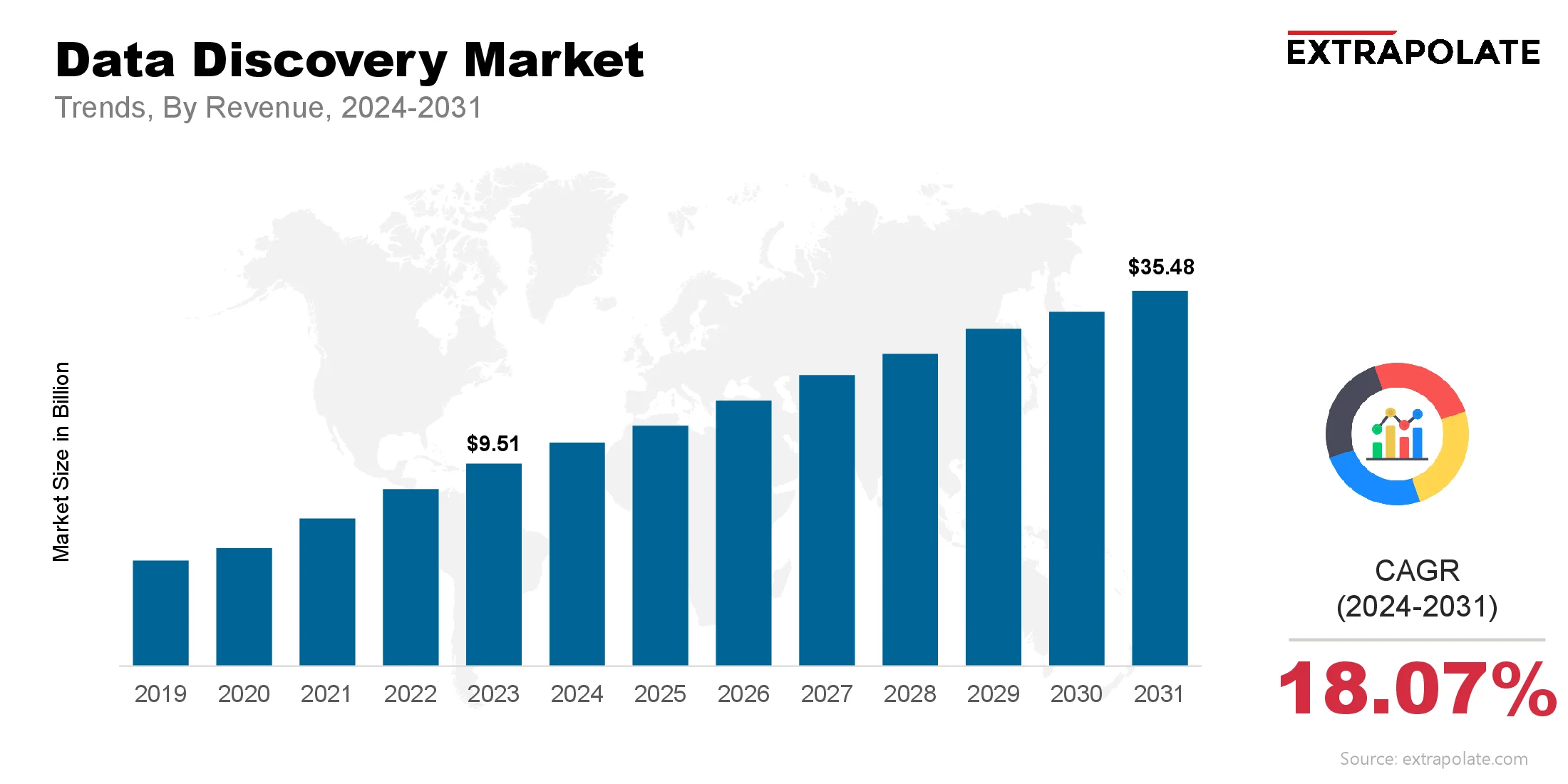

The global Data Discovery Market size was valued at USD 9.51 billion in 2023 and is projected to grow from USD 11.09 billion in 2024 to USD 35.48 billion by 2031, exhibiting a CAGR of 18.07% during the forecast period.

The global data discovery market is advancing at a rapid pace as organizations across all sectors seek enhanced capabilities to explore, visualize, and understand their data. Businesses are adopting data discovery platforms to gain deeper insights, improve decision-making, and maintain a competitive edge. These platforms enable intuitive, user-friendly access to data, promoting a culture of data-driven operations.

Propelled by big data analytics, cloud adoption, and the democratization of data across organizations, data discovery tools are transforming how enterprises analyze and interpret information. The integration of artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) is further enhancing these tools' capabilities. As technology continues to evolve, the data discovery market is expected to experience remarkable and sustained growth.

Data discovery is fundamentally reshaping enterprise intelligence. By enabling users to identify patterns, correlations, and trends across various data sets without requiring technical expertise, these tools are supporting faster, more informed decision-making. As organizations increasingly shift toward self-service business intelligence (BI) and data democratization, the importance of scalable and agile data discovery solutions has never been higher.

Key Market Trends Driving Product Adoption

Several transformative trends are accelerating the adoption of data discovery platforms:

Self-Service Business Intelligence (BI):

Organizations are empowering their employees with self-service BI tools, allowing non-technical users to explore data and generate insights independently. This shift eliminates bottlenecks typically associated with IT departments and promotes agility in decision-making. As a result, data discovery solutions that offer intuitive interfaces and advanced analytics are in high demand.

Integration of AI and ML Capabilities:

Modern data discovery tools are increasingly being integrated with AI and ML to enhance pattern recognition, predictive analytics, and anomaly detection. These technologies assist in uncovering hidden insights, streamlining workflows, and delivering smarter recommendations, which drive greater user adoption.

Cloud-Based Data Discovery Solutions:

Cloud deployment offers scalability, flexibility, and ease of access—key reasons why many enterprises are moving their analytics infrastructure to the cloud. Cloud-based data discovery tools enable seamless collaboration across geographies and departments, making them attractive for global organizations.

Data Governance and Compliance Focus:

With growing regulatory pressures such as GDPR, HIPAA, and CCPA, companies are prioritizing data governance. Data discovery tools now come equipped with features that ensure data lineage, auditability, and policy enforcement. This trend ensures regulatory compliance while enhancing trust in data quality.

Major Players and Their Competitive Positioning

The data discovery market is highly competitive and features several prominent vendors offering innovative solutions. These companies are actively expanding their portfolios through strategic acquisitions, product enhancements, and collaborations. Key players include: Tableau Software (a Salesforce company), Microsoft Corporation (Power BI), Qlik Technologies, SAP SE, IBM Corporation, SAS Institute Inc., TIBCO Software Inc., Oracle Corporation, Sisense Inc., ThoughtSpot Inc.

These companies compete on parameters such as user experience, data integration capabilities, advanced analytics, and deployment flexibility. To remain competitive, they continue to invest in AI-driven analytics, cloud-native architectures, and robust data governance features.

Consumer Behavior Analysis

Consumer behavior in the data discovery market is shaped by a variety of evolving expectations and operational challenges:

- Demand for Real-Time Insights: Businesses are increasingly prioritizing real-time analytics to respond swiftly to market changes. This has led to a surge in demand for data discovery tools that can process and visualize streaming data in real time.

- Preference for Customization: End-users favor platforms that can be tailored to specific roles or departments. Custom dashboards, personalized alerts, and user-specific access levels are features that resonate strongly with consumers in this market.

- Growing Data Literacy: As organizations invest in data literacy programs, users across functions are becoming more confident in handling analytical tools. This cultural shift is driving wider adoption of self-service data discovery solutions.

- Emphasis on Ease of Use: Ease of use remains a crucial determinant of tool adoption. Drag-and-drop interfaces, natural language queries, and rich visualization options enhance user engagement and satisfaction.

Pricing Trends

The pricing of data discovery platforms varies depending on several factors, including deployment model, features, number of users, and data capacity. Subscription-based cloud models (Software-as-a-Service) dominate the landscape due to their scalability and lower upfront costs.

Enterprise-level platforms typically operate under tiered pricing structures, offering different modules based on feature depth and organizational scale. While some tools provide free versions or trial periods to attract small businesses, comprehensive solutions for large enterprises can become costly. However, the ability to generate actionable insights and improve operational efficiency continues to justify the investment for most businesses.

Growth Factors

Numerous factors are driving the growth of the data discovery market:

- Explosion of Data Volumes: Rapid data growth presents new challenges for enterprises. To stay competitive, they must adopt intelligent tools that enable efficient analysis. Data discovery platforms enable users to explore complex datasets. They extract value from both unstructured and semi-structured data sources.

- Rise of Data-Driven Cultures: As markets grow complex, decisions need evidence. Businesses are turning to data for more confident moves. This shift is raising demand for easy-to-use platforms. Users want to explore and analyze data without coding.

- Advancements in Cloud Computing: Fast data needs flexible systems. Cloud platforms offer the power to scale on demand. Collaboration is simpler with the cloud. It keeps data discovery tools available across devices and locations.

- Need for Agile Decision-Making: Modern business needs quick thinking. Agility supports fast, smart decisions. With faster insight, firms gain agility. Data tools let them pivot when new risks or chances arise.

Regulatory Landscape

Governments now prioritize data safety. The rules guiding discovery platforms are becoming more structured. Key regulatory considerations include:

- GDPR (General Data Protection Regulation) in Europe: It sets clear limits on data flow. Businesses must protect how they keep and transfer user data.

- HIPAA (Health Insurance Portability and Accountability Act) in the U.S.: It mandates strong safeguards for health-related data. Providers must follow clear rules to protect privacy.

- CCPA (California Consumer Privacy Act): It gives California consumers more say in their data. They can view, limit, or delete the info companies collect.

Rules like GDPR and HIPAA require added security. Platforms must build in access controls and tracking features. Industries with tough rules prefer secure tools. Vendors offering certified, compliant systems attract more buyers.

Recent Developments

Several noteworthy developments are shaping the data discovery market:

- Embedded Analytics: Vendors are adding data features to popular software. This makes analytics smoother and more relevant to tasks.

- Natural Language Query Interfaces: Natural language features are being added to data tools. This lets users ask questions without using complex query code. This makes the tools easier for everyone to use. As a result, more people across roles can explore data.

- Strategic Partnerships: Major players are aligning to offer full analytics stacks. These alliances connect data sources, boost workflow speed, and improve decision-making.

- AI-Powered Automation: AI-driven platforms speed up the path to insights. They automate prep, visuals, and anomaly checks with ease.

Current and Potential Growth Implications

Demand-Supply Analysis:

Fields like banking, healthcare, and retail now rely on deep insights. This drives need for scalable discovery tools. The need for data skills is high, but supply is low. This shortage limits what vendors and firms can achieve. Automation and easy tools are in focus. Vendors use these to help users do more with less data skill.

Gap Analysis:

Even with strong growth, some issues stay. Data integration, ease of use, and cost slow adoption by smaller firms. Pulling data from many systems remains a key need. Dashboards that bring it all together help users act faster. To grow in new markets, tools must go local. This includes clear language options and rule-based setups.

Top Companies in the Data Discovery Market

- Tableau Software (Salesforce)

- Microsoft Corporation

- Qlik Technologies

- SAP SE

- IBM Corporation

- SAS Institute Inc.

- Oracle Corporation

- TIBCO Software Inc.

- Sisense Inc.

- ThoughtSpot Inc.

Data Discovery Market: Report Snapshot

Segmentation | Details |

By Component | Software, Services (Managed Services, Professional Services) |

By Deployment | Cloud-Based, On-Premise |

By Organization Size | Small & Medium Enterprises (SMEs), Large Enterprises |

By Application | Risk Management, Customer Experience Management, Compliance Management, Sales & Marketing Optimization, Others |

By End-User | BFSI, Healthcare, Retail & E-Commerce, IT & Telecom, Government, Manufacturing, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Data Discovery Market: High Growth Segments

Cloud-Based Deployment:

Cloud-based platforms are in demand. They help users grow fast, cut costs, and stay flexible. Cloud platforms suit remote and blended workforces. Their rise has grown sharply after the pandemic.

In July 2025, SISA unveiled a first-of-its-kind multilingual, AI-powered data discovery platform designed to enhance cybersecurity and data compliance. The platform enables organizations to detect, classify, and protect sensitive data across multiple languages and data environments with greater accuracy and speed.

BFSI Sector:

The BFSI industry is using data tools at scale. They support safer operations and smarter customer decisions. Due to tight rules, firms must use secure data tools. Advanced analytics helps them meet these demands.

SMEs Adoption:

Affordable and simple platforms are now on the rise. This helps small firms explore data without high costs or tech skills. Firms offering pricing tiers and flexible setups are growing fast. These models work well for cost-conscious and growing businesses.

Major Innovations

- Augmented Data Discovery: Data discovery is getting smarter with AI. Tools now show trends fast using auto logic and clean visuals.

- Integration with Collaboration Tools: Leading platforms now sync with chat apps like Slack and Teams. Users can view data and respond without leaving the app.

- Voice-Activated Analytics: Analytics is becoming more voice-driven. Users interact with charts and reports by speaking, which improves ease and reach.

Data Discovery Market: Potential Growth Opportunities

- Expansion into Emerging Markets: Regions like Asia-Pacific, Africa, and Latin America are going digital fast. They now seek smart, user-friendly analytics to keep up. Vendors with local plans and fair prices are well placed. These steps help them tap into fast-growing regions.

- Cross-Industry Adoption: Use of data tools is growing across sectors. Education, energy, and logistics now turn to them for better results and smoother delivery.

- Integration with IoT Analytics: With IoT data becoming more prevalent, the need to analyze sensor-based data is driving interest in real-time data discovery solutions capable of handling high-velocity streams.

Extrapolate says

The data discovery market is shifting fast. New tech, self-use tools, and growing data needs drive this change. As per Extrapolate, the market will expand in the coming years. This rise comes as more firms turn to data for smart, agile moves. More firms use cloud and AI to gain speed and insight. But growing rules on data and safety also shape the market game. The market still faces hurdles in cost and tech fit. But firms pushing smart design, automation, and expansion will lead the way. Using data well is now vital for growth. The report shares how firms can turn insights into a real edge in a crowded market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Data Discovery Market Size

- July-2025

- ���1���4���8

- Global

- Information-Technology-Communication-IoT

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021