Online Home Services Market Size, Share, Growth & Industry Analysis, By Service Type (Cleaning, Repair & Maintenance, Landscaping, Pest Control, Beauty & Wellness, Tutoring, Others) By Platform Type (Web-based, Mobile Apps) By End-User (Residential, Commercial), and Regional Analysis, 2024-2031

Online Home Services Market: Global Share and Growth Trajectory

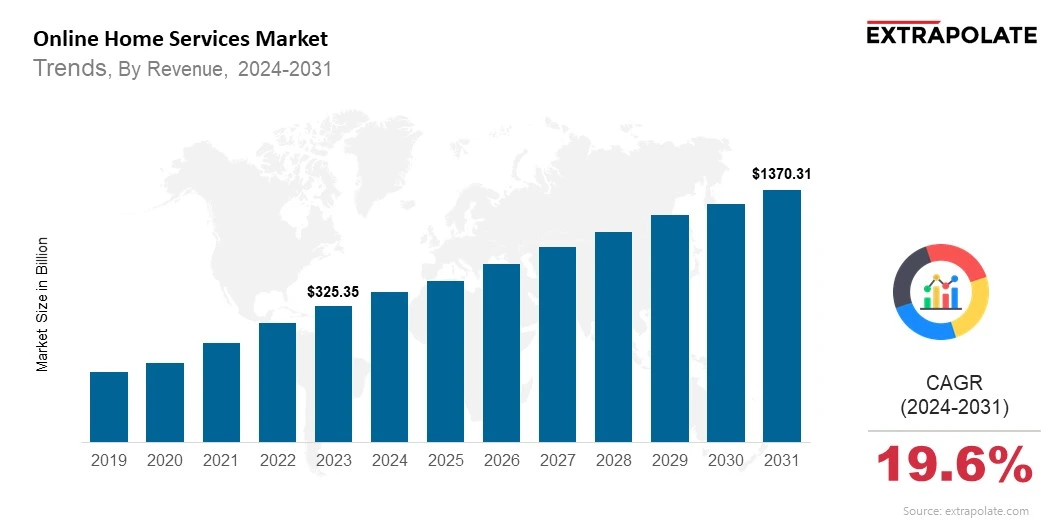

The global Online Home Services Market size was valued at USD 325.35 billion in 2023 and is projected to grow from USD 392.28 billion in 2024 to USD 1370.31 billion by 2031, exhibiting a CAGR of 19.6% during the forecast period.

The global online home services market has witnessed remarkable growth over recent years, driven by the increasing adoption of digital platforms that connect homeowners with a variety of service providers. This market encompasses a wide range of services, including home cleaning, repairs, maintenance, landscaping, pest control, and appliance servicing, all offered through online portals or mobile apps. The convenience and efficiency these platforms provide have transformed the way consumers manage household tasks, leading to a steady rise in demand worldwide.

Technological advancements have played a crucial role in the market’s growth. The integration of mobile technology, artificial intelligence (AI), and data analytics enables platforms to offer personalized service recommendations, optimize scheduling, and improve operational efficiency. AI-powered chatbots provide instant customer support, while geo-location services allow precise matching of providers to client locations. Additionally, secure payment gateways and digital wallets ensure safe and convenient transactions, further boosting consumer confidence in online home services.

Geographically, North America and Europe currently hold significant shares in the online home services market, attributed to high internet penetration, smartphone adoption, and mature e-commerce ecosystems. However, the Asia-Pacific region is emerging as the fastest-growing market due to rapid urbanization, increasing disposable incomes, and a rising middle class eager to embrace digital convenience. Countries such as India, China, and Southeast Asian nations are witnessing a surge in new service providers and platforms catering to diverse home service needs.

Looking ahead, the online home services market is poised for sustained growth. Factors such as increasing smartphone penetration, growing internet access in rural areas, and heightened consumer awareness of digital solutions will propel market expansion. Moreover, the ongoing advancements in technology and the rising trend of smart homes will create new avenues for service innovation and customization, reinforcing the market’s upward trajectory globally.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several notable trends are shaping the online home services market:

- Increasing Preference for On-Demand Services: Consumers are moving away from traditional appointment scheduling toward instant or same-day bookings. This shift favors platforms offering quick turnaround and real-time availability, creating an impetus for innovative scheduling and dispatch technologies.

- Expansion of Service Categories: Initially dominated by cleaning and handyman services, online home services now encompass a diverse range, including plumbing, electrical repairs, pest control, appliance servicing, home tutoring, and even wellness services such as home massages. This expansion attracts a broader user base.

- Use of AI and Machine Learning: Platforms increasingly deploy AI-powered algorithms to match customers with service providers efficiently, predict demand spikes, personalize offers, and improve customer support via chatbots and virtual assistants. This technological edge enhances user experience and operational efficiency.

- Integration of Contactless Payments and Digital Wallets: In response to the growing need for safety and convenience, digital payment options have become integral. Contactless transactions reduce friction and build consumer trust in online platforms.

- Rising Focus on Service Quality and Trust: Customer reviews, ratings, and verified service provider profiles are critical for building trust. Platforms invest heavily in background checks, certifications, and performance monitoring to ensure high-quality service delivery and customer satisfaction.

Major Players and their Competitive Positioning

The online home services market is highly competitive, with global and regional players innovating to expand market share. Leading companies focus on service breadth, geographic reach, and technology integration:

- TaskRabbit (IAC) – A pioneer in connecting freelance labor with home tasks, emphasizing handyman and moving services.

- Handy (ANGI Homeservices) – Specializes in cleaning and repair services, offering subscription-based models for regular customers.

- Urban Company (formerly UrbanClap) – Dominant in India and expanding internationally, offers a broad range of services from beauty to home repairs with vetted professionals.

- Thumbtack – Provides a marketplace model connecting customers with local professionals for a wide range of services.

- Amazon Home Services – Leverages Amazon’s massive customer base to offer appliance installation, home cleaning, and repairs.

- Helpling – Focuses on on-demand cleaning services across European markets.

- Mr. Handyman (neighborly) – A network of franchise-operated handyman services offering standardized service quality.

These players compete by enhancing platform usability, expanding service offerings, ensuring provider reliability, and engaging in strategic partnerships or acquisitions.

Consumer Behavior Analysis

Understanding consumer behavior is pivotal to grasping market dynamics:

- Convenience and Time-Saving: Busy consumers go for platforms that save time and eliminate the hassle of finding trusted service providers. Booking ease, transparent pricing and on-time service drives adoption.

- Reliability and Trust: Consumers rely heavily on user reviews, ratings and verified credentials when choosing services. Trusted providers are preferred even if slightly more expensive.

- Digital Interaction: Younger demographics prefer platforms with mobile apps, real-time updates and digital communication channels over phone calls.

- Cost Conscious: While convenience is important, price is still important especially in price sensitive markets. Consumers compare multiple platforms and providers before deciding.

- Increasing Willingness to Outsource Non-Core Tasks: As remote work and dual income households rise, more consumers outsource cleaning, repairs and maintenance to free up personal time, creating steady demand growth.

Pricing Trends

Pricing models in the online home services market vary widely depending on service complexity, location and provider expertise. Fixed pricing for standard services, hourly rates for repairs or handyman work, dynamic pricing based on demand and service urgency are common. Subscription plans with discounted rates for recurring services are gaining traction with loyal customers. With multiple providers on the platform, prices are moderated for consumers. But premium services with highly skilled professionals command higher rates. Some platforms are also experimenting with surge pricing during peak times or in high demand areas.

Growth Factors

Several factors are propelling the online home services market’s expansion:

- Technological Advancement: Faster mobile internet, more smartphones and better app development means more customers.

- Urbanization and Changing Lifestyles: More people living in cities and busier schedules means more demand for services at your doorstep.

- Increased Internet Penetration in Emerging Markets: Emerging markets are going digital, opening up new markets for online home service platforms.

- Gig Economy: More freelancers and part timers means more supply side and platforms can scale faster.

- COVID-19 Impact: The pandemic accelerated digital adoption and contactless service delivery, more consumers are using online platforms for essential home services.

- Government Initiatives: Supportive regulatory environment for digital services and small businesses means smoother operations and more consumer confidence in online platforms.

Regulatory Landscape

The online home services market navigates various regulatory requirements that vary by country and service type:

- Licensing and Certifications: Many services like electrical work, plumbing and pest control require licensed professionals to comply with safety and quality standards. Platforms verify credentials to comply with local laws.

- Consumer Protection Laws: Regulations require transparency in pricing, service guarantees and dispute resolution mechanisms to protect users from fraud or subpar services.

- Labor Laws and Worker Classification: With the gig economy foundation of many platforms, legal scrutiny around employee classification versus independent contractor status affects operational models. Some regions have stricter rules which affects platform costs and provider engagement.

- Data Privacy and Security: Handling consumer data requires compliance with data protection laws like GDPR in Europe and CCPA in California which impacts platform design and operations.

Recent Developments

Key recent trends and events in the online home services market include:

- AI-Enabled Personalization: Platforms are using AI to analyze user preferences, browsing behavior and feedback to offer personalized service recommendations, increasing engagement and conversion rates.

- Expansion of Contactless and Remote Services: Introduction of virtual consultations and remote diagnostics has improved service delivery especially in maintenance and repairs.

- Strategic Partnerships: Many companies have partnered with payment gateways, insurance providers and local businesses to enrich their service ecosystem.

- Market Consolidation: Leading platforms have acquired smaller players to strengthen their geographic reach and diversify offerings, reflecting industry.

- Sustainability Initiatives: Some players are offering eco-friendly services like green cleaning products or energy efficient home improvements as consumers become more environmentally aware.

Current and Potential Growth Implications

- Demand-Supply Analysis: Consumer preference for convenience and increasing provider registrations is driving growth. But challenges remain in maintaining service quality and provider availability in non-urban areas.

- Gap Analysis: Despite growth, there are still huge gaps in penetration in rural or underserved areas and affordability for lower income demographics. Efforts to bridge these gaps through localized services and flexible pricing are underway.

Top Companies in the Online Home Services Market

- TaskRabbit (IAC)

- Handy (ANGI Homeservices)

- Urban Company

- Thumbtack

- Amazon Home Services

- Helpling

- Mr. Handyman (Neighborly)

Online Home Services Market: Report Snapshot

Segmentation | Details |

By Service Type | Cleaning, Repair & Maintenance, Landscaping, Pest Control, Beauty & Wellness, Tutoring, Others |

By Platform Type | Web-based, Mobile Apps |

By End-User | Residential, Commercial |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Online Home Services Market: High-Growth Segments

- Cleaning Services: Biggest segment driven by recurring demand and standardization. Both residential and commercial cleaning services are growing fast.

- Repair and Maintenance: Includes plumbing, electrical, appliance repairs and handyman services. Consumers prefer reliable, certified providers via trusted platforms.

- Beauty & Wellness at Home: Growing interest in at-home grooming, massage and wellness services, especially in urban areas and among millennials and Gen Z.

Major Innovations

- AI-Powered Service Matching: Algorithms match users with the best-fit providers, increasing satisfaction and reducing wait times..

- End-to-End Digital Ecosystems: Booking, payment, service tracking and feedback all in one platform simplifies the user journey.

- Smart Home Service Integration: IoT-enabled homes are starting to connect with service platforms for proactive maintenance alerts and auto-booking.

Online Home Services Market: Potential Growth Opportunities

- Expansion into Emerging Markets: Rapid urbanization and digital adoption in Asia-Pacific, Latin America and Africa is huge.

- Incorporation of AR/VR Technologies: Augmented reality for remote diagnostics and virtual service previews can increase customer experience and trust.

- Collaboration with Smart Device Manufacturers: Partnerships can enable predictive maintenance and auto-booking based on device performance data.

Kings Research says:

The online home services market will grow strongly over the forecast period. Digital advancements, changing consumer behavior and expanding service categories are driving demand. As platforms become more personalized, efficient and trustworthy, they will be essential for modern homes. With increasing smartphone penetration and internet connectivity, even the most underserved regions are opportunities.

The combination of AI, mobile and gig economy will keep the online home services market on an upward trajectory, changing how consumers access home services globally .

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Online Home Services Market Size

- June-2025

- 148

- Global

- smart-utilities

Related Research

Collaborative Robot Market By Payload (Upto 5 Kg, Upto 5-10 Kg, Upto 10-20 Kg, above 20 Kg), Compone

February-2023

E-Cigarette and Vaping Market By Product (Rechargeable, Disposable, Modular, Modular, and Others), D

January-2023

Global Smart Clothing Market: by Product (Outer Wear, Inner Wear), Fabric Type (Active Smart, Passiv

January-2023

Infuser Water Bottles Market Size, Share, Growth & Industry Analysis, By Product Type (Plastic Infus

June-2025

Modular Kitchen Appliances Market By Product Type (Built-in Ovens, Built-in Microwaves, Built-in Dis

May-2023

Motorcycle Gear Market Size, Share, Growth & Industry Analysis, By Product Type (Helmets, Jackets, G

May-2025

Online Home Services Market Size, Share, Growth & Industry Analysis, By Service Type (Cleaning, Repa

June-2025

Smart Manufacturing Market Size, Share, Growth & Industry Analysis, By Component (Services, Solution

September-2024

Smart Plugs Market By Type (Bluetooth, Zigbee, Wi-Fi, and Others), Application (Household, Commercia

March-2023

Smart Remote Market Size, Share, Growth & Industry Analysis, By Type (Infrared Smart Remote-Control,

September-2024