Wire Connectors Market Size, Share, Growth & Industry Analysis, By Product Type (Twist-on Connectors, Crimp Connectors, Push-in Connectors, Spring Connectors, IDC (Insulation Displacement) Connectors, Others), By Application (Residential, Commercial, Industrial, Automotive, Energy & Utilities, Consumer Electronics, Telecom), By End-User (Electricians, OEMs, System Integrators, Utility Providers, Contractors), and Regional Analysis, 2026-2033

Wire Connectors Market: Global Share and Growth Trajectory

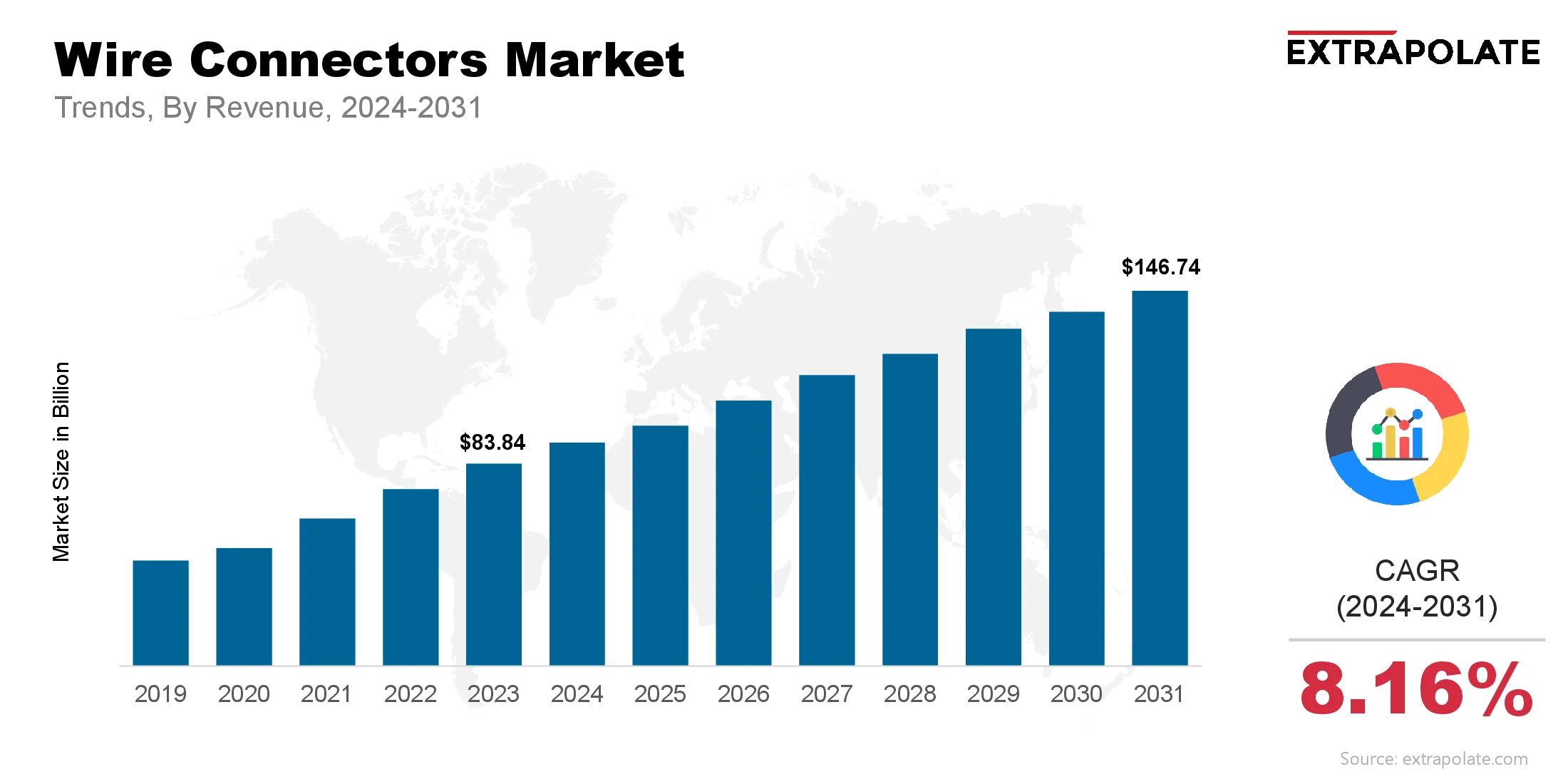

The global Wire Connectors Market size was valued at USD 83.84 billion in 2023 and is projected to grow from USD 84.71 billion in 2026 to USD 146.74 billion by 2033, exhibiting a CAGR of 8.16% during the forecast period.

The wire connectors market is booming as industrialization speeds up, electrical infrastructure gets rolled out and renewable energy systems grow. Wire connectors (also known as terminal blocks or electrical connectors) are the key to secure and stable connections in low and high voltage systems. They are used across various industries such as automotive, industrial automation, telecommunications, residential and commercial construction and consumer electronics.

The demand for efficient energy distribution, modernization of power grids and smart home technologies are driving the wire connectors market. Plus the increasing regulatory focus on electrical safety, energy efficiency and fire prevention is encouraging the adoption of advanced connector solutions that offer better performance and compliance to safety standards. As manufacturing and energy infrastructure evolves the wire connectors market will continue to grow and innovate.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several macro and micro-level trends are influencing the adoption of wire connectors across industries:

- Shift Toward Electrification and Smart Infrastructure: Urbanization and the transition to electric mobility have significantly increased the demand for efficient electrical distribution systems. Wire connectors are pivotal in electric vehicle (EV) batteries, charging systems, and onboard power electronics. Similarly, the development of smart grids and intelligent building management systems has elevated the need for highly reliable and modular connector solutions.

- Advancements in Connector Technologies: The introduction of push-in, spring-loaded, and insulation displacement connectors has revolutionized installation efficiency, safety, and reliability. These innovations minimize the risk of loose connections and enable faster assembly, making them particularly attractive for use in high-volume manufacturing, renewable energy systems, and compact electronic devices.

- Growing Focus on Fire Safety and Compliance: Strict global regulations regarding fire and electrical safety are prompting the use of flame-retardant, halogen-free, and RoHS-compliant connector materials. Connector designs are also evolving to meet IP (Ingress Protection) and UL (Underwriters Laboratories) ratings, ensuring resistance to dust, moisture, and heat in critical applications.

- Increased Automation and Robotics: As factories embrace Industry 4.0 principles, wire connectors are becoming essential in connecting sensors, actuators, and control systems. The emphasis on modular design and quick-change capability is enhancing productivity and maintenance efficiency across automated industrial settings.

Major Players and their Competitive Positioning

The wire connectors market is highly competitive, characterized by a mix of global conglomerates and regional players. Major companies are focusing on product innovation, strategic acquisitions, and expansion into emerging markets to maintain a competitive edge.

Leading manufacturers included are TE Connectivity Ltd., 3M Company, Amphenol Corporation, Molex LLC (Koch Industries), ABB Ltd., WAGO Kontakttechnik GmbH & Co. KG, Phoenix Contact GmbH & Co. KG, Hirose Electric Co., Ltd., Panduit Corp., Weidmüller Interface GmbH & Co. KG and others.

These companies are investing heavily in research and development to create connectors that support higher data transfer rates, improved electrical performance, and compliance with international safety standards. Their portfolios cater to a wide range of sectors, including automotive, power distribution, data centers, and telecommunication networks.

Consumer Behavior Analysis

Consumer behavior in the wire connectors market is largely influenced by the drive for operational efficiency, cost savings, and safety assurance. The key behavioral drivers include:

- Emphasis on Durability and Performance: End-users increasingly prefer connectors that offer long-term performance with minimal maintenance. The growing use of advanced polymers, corrosion-resistant metals, and modular housing designs aligns with this demand, particularly in harsh or outdoor environments.

- Preference for Plug-and-Play Solutions: Installers and technicians seek wire connectors that simplify wiring tasks and reduce downtime. Pre-insulated and tool-less connectors have gained popularity among electricians and engineers working on residential wiring, industrial machinery, and automotive systems.

- Cost Sensitivity Balanced with Quality: While cost remains an important consideration, consumers are willing to invest in connectors that minimize installation time and ensure long-lasting performance. The total cost of ownership, including labor and maintenance, often justifies the use of premium products.

- Rising Demand for Miniaturized Components: In sectors like consumer electronics, telecommunications, and automotive, there is a growing need for compact, lightweight, and high-density connectors. Consumer preferences are shifting toward products that support these form factors without compromising connectivity or safety.

Pricing Trends

The pricing of wire connectors is influenced by various factors, including raw material costs, technological complexity, certification requirements, and end-user industry demands. The market offers a broad pricing spectrum, ranging from low-cost basic connectors used in DIY electrical work to high-end precision connectors used in aerospace and medical devices.

- Raw Material Volatility: Prices for key materials such as copper, aluminum, nickel, and high-performance plastics significantly impact production costs. As global supply chains adapt to market fluctuations and geopolitical dynamics, raw material costs continue to be a crucial pricing determinant.

- Customization and Compliance: Connectors that meet stringent regulatory standards (UL, CE, RoHS, REACH) or are designed for specific applications (e.g., high-frequency or high-voltage environments) often command premium prices. The need for customized solutions also drives higher pricing due to tooling and design complexities.

- Global Supply Chain and Logistics Costs: Shipping, warehousing, and labor costs have seen a significant rise in recent years, affecting the final price of connectors, particularly for cross-border transactions. Regional manufacturing hubs and nearshoring strategies are being explored to optimize supply chain efficiency.

- Despite these factors, manufacturers are establishing competitive pricing strategies, which include tiered product lines, volume discounts, and bundled accessories to retain and attract clients.

Growth Factors

Several strong forces are driving market growth. These keep pushing the wire connectors market forward:

- Booming Renewable Energy Sector: Solar panels, wind power, and storage units are being added widely. They rely on tough connectors to transfer energy without loss or damage. Government support for clean energy is growing fast. This is driving strong demand for connectors built for solar, wind, and storage systems.

- Electrification in Automotive Industry: Electric and hybrid cars use special wire connectors. These power big batteries and smart car parts. Automotive OEMs team up with connector firms. The goal is to make light and strong parts that meet new needs.

- Infrastructure Modernization Projects: Improving aging electrical grids, installing smart metering systems, and increasing broadband networks contribute to the increasing demand for wire connectors. These initiatives are strong in regions like North America, Western Europe, and East Asia, where governments are investing heavily in infrastructure improvement.

- Smart Home and IoT Devices: The large-scale adoption of smart appliances, home automation systems, and security devices is growing the need for compact and high-reliability wire connectors in housing environments. These connectors ensure smooth power supply and communication between multiple smart devices.

Regulatory Landscape

The wire connectors market works with firm rules. These cover safety, the planet, and product use:

- UL and CE Certification: In North America and Europe, wire connectors need to be UL (Underwriters Laboratories) or CE certified to verify compliance to safety, fire resistance, and performance standards. These certifications are necessary for product acceptance across consumer and industrial applications.

- RoHS and REACH Compliance: Environmental laws such as RoHS and REACH regulate chemical use in manufacturing. Wire connector materials must meet these standards to stay compliant. Manufacturers are shifting to safer materials to follow global environmental standards.. Halogen-free and lead-free materials are now widely adopted for compliance.

- ISO 9001 and ISO 14001 Standards: To maintain uniform production, companies must follow international quality and environmental systems. ISO certification strengthens brand reputation and supports entry into global markets.

- National Electrical Code (NEC): The National Electrical Code (NEC) provides safety guidelines for wiring in the U.S. Connectors in residential, commercial, and industrial setups must comply with NEC standards.

Recent Developments

New technologies and smart business moves are changing the wire connectors market. These shifts are reshaping how companies compete and grow:

- Product Innovation: To meet rising tech demands, TE Connectivity and Molex introduced new data-power connectors. These products target the growing EV and industrial robotics markets.

- In January 2025, TE Connectivity’s redesigned MULTIGIG HD connector was selected by the VITA Standards Organization as the next-generation VPX module interface. The connector offers higher data rates and increased pin density, with deployment expected in mid-2025.

- Strategic Acquisitions: Amphenol Corporation acquired MTS Systems Corporation to grow its test and measurement portfolio. The deal also boosts Amphenol’s strength in advanced connector solutions.

- Sustainable Product Lines: To support cleaner technologies, Phoenix Contact and WAGO now offer connectors using recycled and bio-based materials. They are designed for use in solar setups and environmentally friendly buildings.

- Regional Expansion: To serve expanding markets, ABB and Weidmüller have boosted production in Asia. Their new facilities in India and Southeast Asia support strong regional growth.

The wire connectors market is growing quickly with new ideas and tech. These trends also point to greater global reach and faster development.

Current and Potential Growth Implications

a. Demand-Supply Analysis: The rise of high-tech industries is increasing pressure on connector production. This is leading to global supply chain expansion and greater manufacturing agility. Even with growing demand, access to chips and raw inputs remains limited. These constraints are slowing production and delivery in many sectors.

b. Gap Analysis: While standard connectors are common, few offer smart features. Demand is growing for smart connectors with built-in monitoring features. Users want real-time updates on system status and performance. Sensor-enabled connectors offer advanced functions like monitoring and control. This helps manufacturers stand out and lead in the smart connectivity space. It allows companies to deliver better, more adaptive connector systems. That gives them a strong position in industries moving toward smart connectivity.

Top Companies in the Wire Connectors Market

- TE Connectivity Ltd.

- Amphenol Corporation

- Molex LLC (Koch Industries)

- 3M Company

- ABB Ltd.

- Phoenix Contact GmbH & Co. KG

- WAGO Kontakttechnik GmbH & Co. KG

- Panduit Corp.

- Weidmüller Interface GmbH & Co. KG

- Hirose Electric Co., Ltd.

Wire Connectors Market: Report Snapshot

Segmentation | Details |

By Product Type | Twist-on Connectors, Crimp Connectors, Push-in Connectors, Spring Connectors, IDC (Insulation Displacement) Connectors, Others |

By Application | Residential, Commercial, Industrial, Automotive, Energy & Utilities, Consumer Electronics, Telecom |

By End-User | Electricians, OEMs, System Integrators, Utility Providers, Contractors |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Automotive Connectors: More people are switching to electric vehicles across the world. This is raising the need for connectors that can handle high power and heat.

- Push-In and IDC Connectors: Quick and simple installation is driving widespread use of these components. Their seamless integration with automated systems boosts efficiency on the factory floor.

- Renewable Energy Installations: Renewable energy systems often face extreme conditions in outdoor locations. Corrosion-resistant connectors help them stay safe and efficient over time.

Major Innovations

- Tool-less Installation Connectors: User-friendly designs help speed up the building process in manufacturing. They also lower labor needs and raise production levels.

- High-Density Modular Connectors: Devices and vehicles are getting smaller and more advanced with each new model. Compact connectors make this possible by fitting powerful functions into tight spaces.

- Smart Connectors with Embedded Sensors: Real-time tracking shows how machines are working every second. It also helps fix issues before they cause a breakdown.

Potential Growth Opportunities

- Expansion in Emerging Markets: Infrastructure work is speeding up across emerging regions like India and Africa. Global businesses can now tap into new demand for energy, transport, and tech solutions.

- Integration with IoT and Smart Systems: The growth of smart tech is pushing the need for advanced, self-monitoring connectors. These tools can run checks and control device functions in real time.

Extrapolate Research says:

Demand for wire connectors is rising across several fast-moving sectors. Industries like auto, energy, and manufacturing are boosting this market’s growth. Advances in design now allow faster, safer, and smarter connector use. This helps them work well in both simple and complex setups. As more systems go electric and connected, the need for strong wiring is growing fast. Wire connectors are becoming key parts of today’s buildings, grids, and tech setups. More industries are linking systems to build safer and smarter technology. Companies that focus on new ideas, green goals, and strong rules will lead the change.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Wire Connectors Market Size

- July-2025

- 140

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020