Structured Cabling Market Size, Share, Growth & Industry Analysis, By Product Type (Copper Cables, Fiber Optic Cables, Others), By Application (Data Centers, Commercial Buildings, Residential Buildings, Industrial Infrastructure, Others), By End User (IT and Telecom, Residential, Commercial, Industrial, Healthcare) and Regional Analysis, 2024-2031

Structured Cabling Market: Global Share and Growth Trajectory

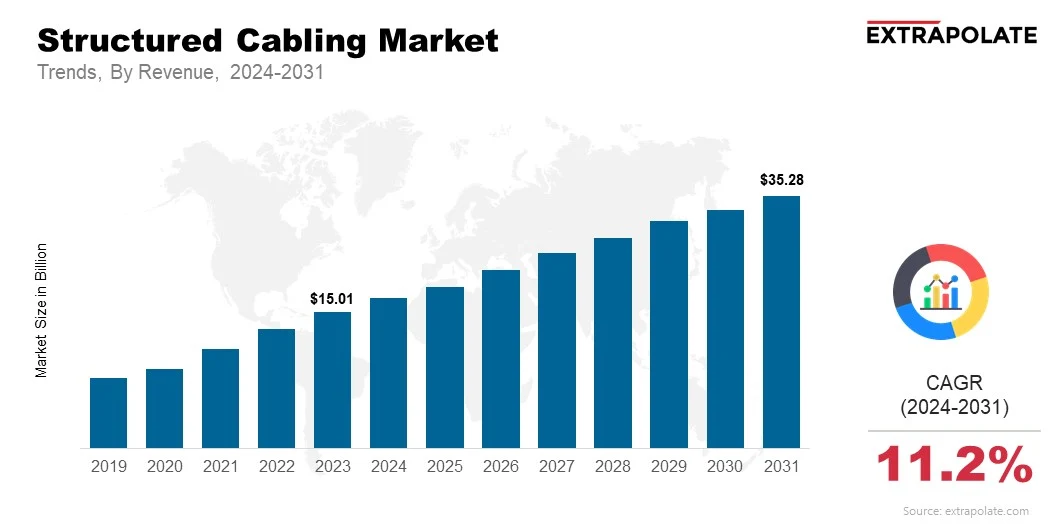

Global Structured Cabling Market size was recorded at USD 15.01 billion in 2023, which is estimated to be valued at USD 16.83 billion in 2024 and reach USD 35.28 billion by 2031, growing at a CAGR of 11.2% during the forecast period.

The global structured cabling market is experiencing significant growth, driven by the increasing demand for high-speed internet, improved communication systems, and the growing complexity of network infrastructures.

Structured cabling systems, which consist of standardized cabling components used for data, voice, and video transmission, play a critical role in ensuring reliable and efficient connectivity across various industries, including telecommunications, IT, commercial, and residential sectors. As businesses and organizations expand their digital footprint, the need for scalable and high-performance cabling solutions has never been more crucial.

The rise of smart buildings, the increasing adoption of cloud-based services, and the expansion of data centers are key factors contributing to the growth of the market. These infrastructures require robust cabling solutions to support data-intensive applications, including cloud computing, video streaming, and enterprise communication.

Moreover, with the introduction of 5G technology and the growing importance of the Internet of Things (IoT), there is an increasing demand for advanced structured cabling systems that can handle high volumes of data transmission and provide seamless connectivity.

Technological advancements in cabling solutions, such as fiber optic cables, are also playing a pivotal role in driving market growth. Fiber optic cables offer faster data transfer speeds and greater bandwidth, making them ideal for high-demand applications.

Furthermore, the shift towards energy-efficient and eco-friendly cabling solutions is gaining momentum, as businesses seek to reduce their environmental impact while maintaining efficient network performance.

As the global reliance on digital connectivity continues to grow, the structured cabling market is poised for sustained growth. The increasing complexity of network infrastructures, combined with the rising demand for higher bandwidth and lower latency, is expected to drive innovation in cabling technologies.

With continued investments in next-generation network solutions, the structured cabling market share is set to play a pivotal role in supporting the future of global communications and data transmission.

Key Market Trends Driving Product Adoption

The structured cabling market is characterized by technological advancements, rising demand for reliable and scalable network infrastructure, and shifting consumer and enterprise needs. Key trends driving market growth include:

- High-Speed Data Transmission: Greater need for quick access to the web besides data exchange motivates the use of fiber optic cables as well as similar, effective wiring options.

- Smart Infrastructure Growth: Smart cities and structures gain prevalence. The requirement for evolved cabling systems, to support interconnected devices and systems, escalates.

- Integration with IoT: The expanded Internet of Things increases the need for solid cabling solutions. These structures handle connected devices and secure effective exchange between them.

- Energy Efficiency: Developments in organized wiring systems tend toward better energy use. This change lowers the ecological effects of substantial construction endeavors.

- Cloud Adoption and Data Centers: Cloud services besides data centers expand regularly and this growth causes a greater need for complex plus adaptable cabling systems.

Competitive Landscape and Key Players

The structured cabling trends are highly competitive, with key players including Belden Inc., Prysmian Group, Legrand, and Nexans. These companies are focusing on innovation, quality improvement, and cost efficiency to retain their market share. Smaller players and regional manufacturers are also emerging with specialized products catering to niche markets, which contribute to the competitive dynamics of the market.

Consumer Behavior Analysis

Organizations are increasingly adopting structured cabling solutions for a variety of reasons:

- Efficient Network Infrastructure: High-performance, reliable cabling is crucial. It supports growing bandwidth and faster network speeds.

- Scalability and Flexibility: Structured cabling systems help businesses scale easily. They ensure network solutions are future-proof.

- Cost-Effectiveness: Structured cabling offers long-term savings. It lowers maintenance costs, reduces downtime, and cuts upgrade needs.

- Simplified Installation: Standardized, pre-configured cabling systems make installation easier. They reduce network setup complexity.

Pricing Trends

Cable type like copper or fiber optic and installation scope or difficulty affect structured cabling costs. Fiber optic cables usually cost more because they perform better plus are more sustainable. With higher demand, costs should lower, particularly in new economies.

Growth Factors

Several factors are driving the growth of the structured cabling market:

- Data Traffic Surge: Rising internet use and big data growth fuel the demand for faster, reliable cabling infrastructure.

- Smart Cities and Buildings: Smart city construction and IoT adoption in buildings drive the need for advanced cabling systems.

- Telecom and IT Infrastructure Development: Telecom network growth and new data centers increase demand for structured cabling systems.

- Globalization and Digital Transformation: Global businesses build stronger, interconnected IT networks. This drives the need for reliable cabling infrastructure.

Regulatory Landscape

Regulations for structured cabling are tightening. Installation, performance, and safety standards are becoming stricter. Data privacy, network security, and cable quality regulations push manufacturers to meet global standards. This ensures reliability and trust.

Recent Developments

Recent advancements in the structured cabling market include:

- Introduction of 5G Infrastructure: 5G rollout increases demand for cabling. It needs to support higher frequencies and faster data speeds.

- Enhanced Fiber Optic Solutions: Fiber optic innovations boost scalability. Higher-density cables and better data transmission enhance network performance.

- Sustainability Initiatives: Manufacturers aim for eco-friendly cabling. They use recyclable materials and reduce carbon footprints.

Current and Potential Growth Implications

Demand-Supply Analysis

Structured cabling demand grows as telecom and IT infrastructure advance quickly. Supply chain disruptions, material shortages, and copper price swings may impact supply.

Gap Analysis

Despite the robust growth, there are areas where the market can improve:

- Installation Challenges: Easing installation and reducing disruptions in large networks drive market growth.

- Standardization: The market pushes for standardization. Yet, cable quality and compatibility issues slow adoption.

- Upgrades and Future-Proofing: Cabling must keep up with fast-changing tech. 5G and IoT demand future-ready systems.

Top Companies in the Structured Cabling Market

- Belden Inc.

- Prysmian Group

- Legrand

- Nexans

- CommScope

- Siemens

- Schneider Electric

- Corning Incorporated

- Panduit Corporation

Structured Cabling Market: Report Snapshot

Segmentation | Details |

By Product Type | Copper Cables, Fiber Optic Cables, Others |

By Application | Data Centers, Commercial Buildings, Residential Buildings, Industrial Infrastructure, Others |

By End User | IT and Telecom, Residential, Commercial, Industrial, Healthcare |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

High Growth Segments

The following market segments are expected to experience significant growth:

- Fiber Optic Cables: They manage vast data loads. High-speed links keep networks fast.

- Data Centers: Cloud growth boosts demand for structured cabling. Data centers need reliable storage solutions.

- Commercial Buildings: Smart buildings need strong cabling. Scalability ensures smooth network performance.

Major Innovations

Innovation is central to remaining competitive in the structured cabling market. Key innovations include:

- High-Density Fiber Optic Solutions: Made for settings that need high data transfers.

- Sustainable Cable Designs: Cables now use sustainable materials. Energy-efficient methods improve production.

- Enhanced Data Transmission Capabilities: Cable materials and designs advance to support 5G. IoT networks benefit from these improvements.

Potential Growth Opportunities

Companies in the structured cabling market face several challenges:

- Intense Competition: The market is fiercely competitive. Established firms and newcomers compete for share.

- Rapid Technological Changes: Companies must innovate constantly to stay ahead in telecom. Advancements in 5G and IoT drive this need.

- Sustainability Challenges: Manufacturers face rising pressure to meet sustainability goals. Waste reduction and eco-friendly practices are key.

Kings Research Says:

The global market for structured cabling faces continued expansion. Increased data transmission requirements, progress in smart infrastructure and a greater need for capable networks contribute to this. But firms which put money into innovation, work to improve sustainability and handle supply chain issues stand to profit significantly from the enlarged market possibilities.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Structured Cabling Market Size

- April-2025

- 140

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020