PCI Express Controllers Market Size, Share, Growth & Industry Analysis, By Type (PCIe 3.0, PCIe 4.0, PCIe 5.0, PCIe 6.0), By Application (Data Centers, Consumer Electronics, Industrial Automation, Automotive, Communication Infrastructure), By Component (Hardware Controllers, IP Cores, SoCs), By End-User (Enterprises, OEMs, Cloud Service Providers, Industrial Facilities), and Regional Analysis, 2024-2031

PCI Express Controllers Market: Global Share and Growth Trajectory

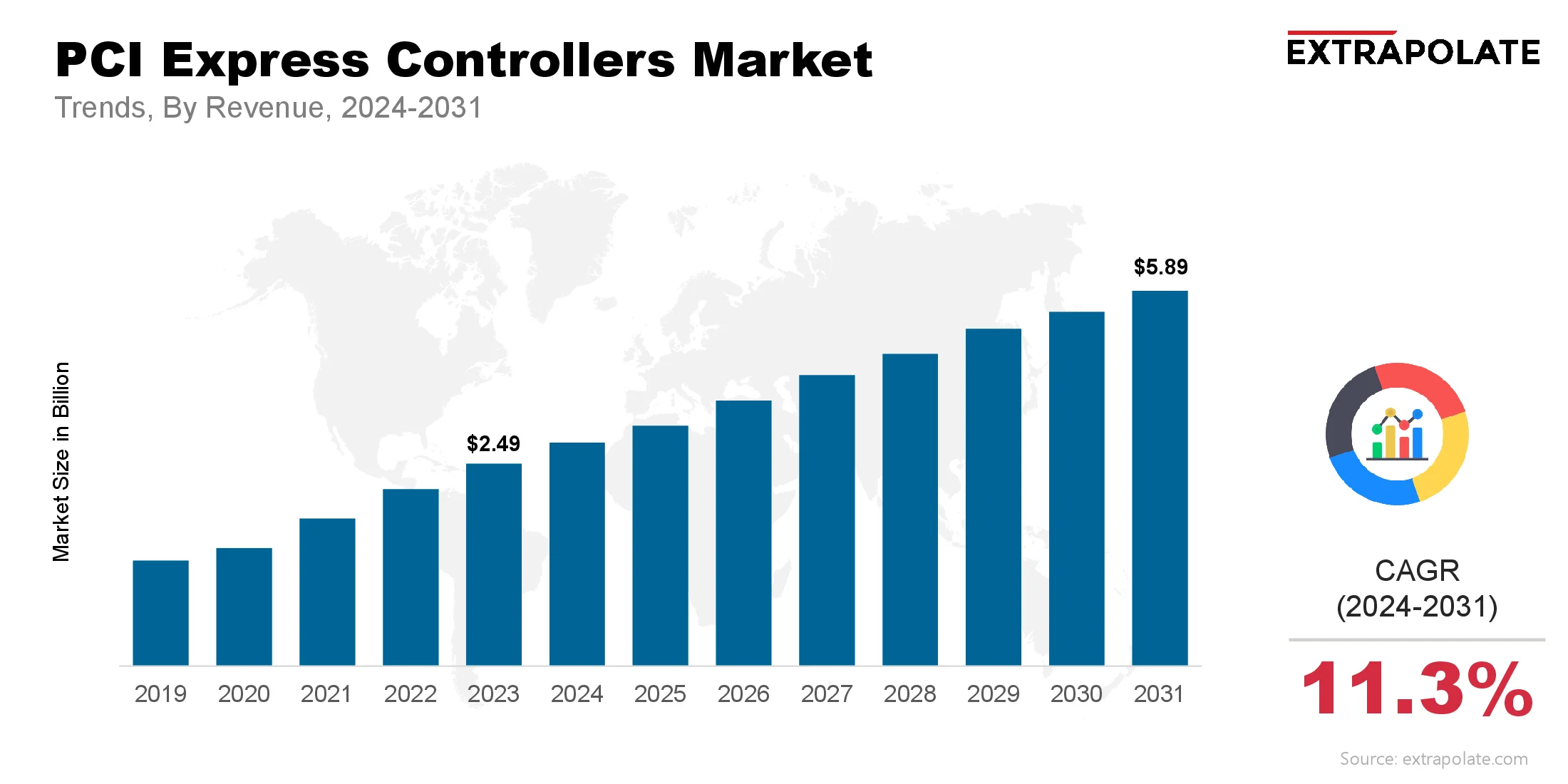

The global PCI Express (PCIe) controllers market size was valued at USD 2.49 billion in 2023 and is projected to grow from USD 2.78 billion in 2024 to USD 5.89 billion by 2031, exhibiting a CAGR of 11.3% during the forecast period.

The global market is growing steadily. This growth is driven by the rising need for high-speed data transfer across various industries. PCIe controllers play a key role in today’s computing and communication systems. They connect processors, memory, and peripheral devices efficiently. As technology advances, the demand for better performance continues to rise. PCIe controllers are adapting to meet new needs for higher bandwidth, improved efficiency, and better scalability.

The use of data-heavy applications like AI, cloud computing, machine learning, and real-time analytics is increasing quickly. This is creating a strong need for faster and more reliable data transmission. Controllers that support the latest PCIe Gen 4 and Gen 5 standards deliver high throughput and low latency. This makes them essential for modern IT setups. With PCIe Gen 6 on the way, the market is expected to see even more growth in the coming years.

Key Market Trends Driving Product Adoption

Several key trends are driving the widespread use of PCIe controllers:

Rising Data Center Expansion:

Enterprises and cloud providers are rapidly scaling up their data centers. This creates a strong need for fast data flow and low-latency communication. PCIe controllers help meet these needs by improving server connections and input/output performance. The shift to Gen 4 and Gen 5 controllers is already in progress. Many next-generation data centers are also planning to use Gen 6-ready components to stay ahead.

Growing Demand for AI and Machine Learning:

AI and ML workloads require fast data processing and smooth communication between CPUs, GPUs, and memory. PCIe controllers support these connections, allowing for parallel processing and high data throughput. Their role is especially important in training large AI models and handling edge-based inference tasks.

Spread of NVMe Storage Devices:

NVMe SSDs, which rely on PCIe interfaces, are quickly becoming standard in both enterprise and consumer storage. PCIe controllers ensure fast and reliable access to this storage. As NVMe-over-Fabrics becomes more common, the need for advanced PCIe switching and control solutions is also growing.

Advancements in Automotive and Industrial IoT:

PCIe controllers are also being used in systems like ADAS, self-driving cars, and industrial automation. These systems need real-time data handling, strong reliability, and minimal delay. Modern PCIe controllers are built to meet these exact demands.

Major Players and their Competitive Positioning

The competitive landscape of the PCIe controllers market is marked by innovation, integration capabilities, and performance benchmarking. Leading semiconductor manufacturers and IP vendors are continuously enhancing their offerings to meet the demands of modern computing environments.

Key players include are Intel Corporation, Broadcom Inc., Microchip Technology Inc., Texas Instruments Inc., Marvell Technology Group, Synopsys Inc., Cadence Design Systems, Analog Devices, Inc., NVIDIA Corporation, Samsung Electronics and others.

These companies are engaged in product launches, strategic collaborations, and acquisitions to strengthen their market positions. For instance, Intel continues to develop high-bandwidth PCIe controllers for its data center processors, while Synopsys and Cadence are expanding their IP portfolios for PCIe Gen 6 compatibility.

Consumer Behavior Analysis

The buying behavior in the PCIe controllers market is driven by performance, compatibility, total cost of ownership and long-term scalability:

- Performance and Reliability as Top Priority: Customers are looking at data throughput, signal integrity and error correction features when choosing PCIe controllers. Performance benchmarks and support for new standards like PCIe 6 are key in enterprise and hyperscale computing segments.

- Cost-Performance Balance: While new PCIe controllers are expensive, the long term benefits, lower latency, higher efficiency and system scalability, justify the spend for most end users. OEMs and system integrators are choosing controllers that offer the best performance at the lowest cost.

- Preference for Integrated Solutions: There is a growing trend towards SoCs (System on Chips) and motherboards that come with built-in PCIe controllers to reduce design complexity and ensure compatibility. Bundled solutions that include controller IP, PHYs and software stacks are in high demand.

- Focus on Standards Compliance and Interoperability: Buyers are looking for PCIe controllers that are standards compliant and interoperable with existing infrastructure. PCI-SIG certification and support for new interconnect technologies are key to adoption.

Pricing Trends

The price of PCIe controllers varies significantly based on performance class, bandwidth support, and target application. Entry-level PCIe Gen 3 controllers are still widely used in budget systems and cost-effectively support general-purpose tasks. However, PCIe Gen 4 and Gen 5 controllers, typically used in high-performance computing and data centers, command a premium due to their superior speed and additional features.

As the market transitions toward PCIe Gen 6, pricing strategies are expected to evolve. While early adoption will likely come with higher costs, mass production and economies of scale are expected to bring prices down. Additionally, IP licensing models offered by design firms like Synopsys and Cadence provide flexibility for semiconductor companies to integrate PCIe controllers without prohibitive upfront costs.

Growth Factors

Several factors are driving the rapid growth of the PCIe controllers market:

- New Standards: PCIe Gen 5 and PCIe Gen 6 are driving the market. These new standards offer more bandwidth and efficiency and open up new applications in AI, networking and high performance computing.

- Edge Computing: Edge computing needs fast and reliable data transfer between distributed components. PCIe controllers are the key to low latency and high throughput at the edge for decentralized AI and real-time analytics.

- Cloud Infrastructure: With global cloud demand growing, hyperscale data centers are expanding fast. These infrastructures use PCIe for internal communication between servers, storage arrays and network devices.

- Consumer Electronics: Consumer electronics, especially high-end laptops, gaming PCs and workstations are incorporating PCIe Gen 4 and Gen 5 controllers to support graphics, storage and processing intensive tasks.

- AI Accelerators: AI accelerators like GPUs, FPGAs and custom ASICs use PCIe to connect to host CPUs. The growing demand for these accelerators in various industries, from automotive to healthcare, is driving PCIe controller adoption. In July 2025, HighPoint announced the launch of the Rocket 7638D, a PCIe Gen5 x16 add-in card with external GPU (e.g. RTX 5090) and up to 4PB of NVMe SSD storage in one slot. For high-density AI, HPC, media workloads. Announced at FMS 2025, available soon.

Regulatory Landscape

While the PCIe controllers market is not regulated like medical or safety critical systems, there are several standards and certifications that govern the design and deployment of these components:

- PCI-SIG Compliance: All PCIe controllers must meet PCI-SIG standards for protocol compliance, signal integrity and interoperability to work across platforms.

- RoHS and REACH Compliance: Manufacturers must comply with environmental regulations for hazardous materials and product safety in both consumer and industrial segments.

- Security and Reliability Standards: In data centers, government infrastructure or critical systems, additional guidelines for data protection, redundancy and fail-safe operations apply.

Recent Developments

The PCIe controllers market has seen some big changes recently:

- PCIe Gen 6 Specification Released: The PCI-SIG finally released the PCIe Gen 6 spec with up to 64 GT/s. Big step forward for future computing.

- IP Ecosystem Growing: Synopsys, Rambus and Cadence have announced PCIe Gen 6 IP. Chipmakers can now design high performance controllers for future applications.

- CXL Adoption: The Compute Express Link (CXL) standard built on top of PCIe is gaining traction for memory coherency and accelerator connectivity. Vendors are developing PCIe controllers with CXL support.

- Automotive Adoption: Major automotive semiconductor suppliers are putting PCIe controllers in SoCs for autonomous driving and ADAS systems. Data transmission within in-vehicle networks is getting a boost.

In May 2025, Realtek released its RTS5781DL PCIe 5.0 x4 DRAM-less NVMe 2.0 SSD controller at Computex 2025. Up to 10GB/s sequential and 1.4M IOPS, mainstream SSDs, TCG OPAL 2.0, Pyrite, AES-256. Samples available now, drives in Q2-2026.

Current and Future Growth Implications

Demand-Supply Analysis

Demand for PCIe controllers is outpacing supply, especially for the latest generations. The semiconductor shortages of the past few years have impacted the availability of advanced PCIe controllers but the supply chain is recovering. Foundries are increasing capacity and design houses are optimizing their production pipelines. The gap is closing.

Gap Analysis

High-end PCIe controllers are widely available in developed markets but there is a big gap for entry-level solutions in emerging markets. Vendors can now develop scalable product lines that address performance and affordability.

Top Companies in the PCI Express Controllers Market

- Intel Corporation

- Broadcom Inc.

- Microchip Technology Inc.

- Texas Instruments Inc.

- Samsung Electronics

- Marvell Technology Group

- Synopsys Inc.

- Cadence Design Systems

- Analog Devices, Inc.

- NVIDIA Corporation

PCI Express Controllers Market: Report Snapshot

Segmentation | Details |

By Type | PCIe 3.0, PCIe 4.0, PCIe 5.0, PCIe 6.0 |

By Application | Data Centers, Consumer Electronics, Industrial Automation, Automotive, Communication Infrastructure |

By Component | Hardware Controllers, IP Cores, SoCs |

By End-User | Enterprises, OEMs, Cloud Service Providers, Industrial Facilities |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- PCIe 5.0 and 6.0 Controllers: As data loads increase, these newer standards are seeing traction in HPC, AI and cloud.

- Data Centers: As cloud scales, PCIe controllers are key to interconnecting systems for performance optimization.

- IP Cores and SoCs: Chiplet architecture and integrated system design is driving demand for PCIe IP cores across industries.

Notable Innovations

- Chiplet Integration: PCIe controllers are being integrated into chiplet based architectures to reduce interconnect bottlenecks and increase modularity.

- CXL Support: PCIe controllers with CXL support enable cache-coherent memory sharing between processors and accelerators.

- Power Efficient Design: Advanced fab and dynamic power management is enabling PCIe controllers to run in thermal sensitive environments.

Growth Opportunities

- Emerging Markets: As digital infrastructure grows in Asia-Pacific, Africa and Latin America, there is a big opportunity for PCIe controller vendors to tap into the growing demand in these regions.

- AI and HPC: PCIe controllers for AI and HPC workloads is a big growth area, especially in healthcare, defense and finance.

- 5G Infrastructure: 5G requires low latency and high throughput hardware, PCIe controllers are critical for base stations and network edge devices.

Extrapolate says:

The PCI Express Controllers Market is estimated to grow as demand for high speed data transfer, seamless connectivity and system scalability increases. As industries adopt AI, cloud computing and edge analytics, PCIe controllers are becoming the foundation across all applications, from hyperscale data centers to autonomous vehicles. The move from PCIe Gen 4 and Gen 5 to Gen 6 and beyond is not just a performance boost but a redefinition of the digital infrastructure. Extrapolate believes companies that align with this shift, by investing in next gen controller designs, forming technology partnerships and targeting emerging markets, will be the leaders. The report says innovation, integration and standards compliance will be the keys to sustainable growth in this fast changing market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

PCI Express Controllers Market Size

- August-2025

- 140

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020