MEMS Sensor Market Size, Share, Growth & Industry Analysis, By Sensor Type (Accelerometers, Gyroscopes, Magnetometers, Pressure Sensors, Microphones, Temperature Sensors, Others) By Application (Consumer Electronics, Automotive, Industrial, Medical Devices, Telecommunications, Aerospace & Defense, Others) By End-User (OEMs, System Integrators, Research Institutions, Government Agencies), and Regional Analysis, 2024-2031

MEMS Sensor Market: Global Share and Growth Trajectory

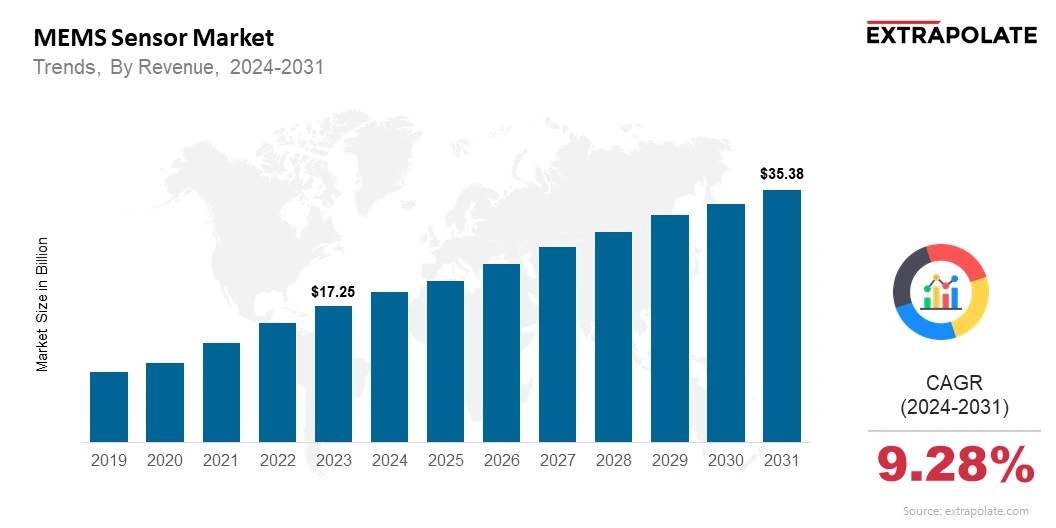

Global MEMS Sensor Market size was recorded at USD 17.25 billion in 2023, which is estimated to be valued at USD 19.01 billion in 2024 and reach USD 35.38 billion by 2031, growing at a CAGR of 9.28% during the forecast period.

The MEMS (Micro-Electro-Mechanical Systems) sensor market is booming with the rapid advancements in miniaturization technology and growing demand across various industries.

These tiny and high performance sensors have mechanical elements, sensors, actuators and electronics on a single silicon substrate and can be used in consumer electronics, automotive, industrial automation, medical devices and telecommunications.

Wearable technology, smartphones, autonomous vehicles and IoT devices have put MEMS sensors in the spotlight. Their small size, low power consumption and high precision makes them perfect for real time monitoring and automated responses in complex systems.

As the world gets more connected, MEMS sensors are becoming essential to make devices intelligent, safe and efficient. Technological convergence such as AI, edge computing, and 5G further intensifies the capabilities of MEMS sensors.

These innovations ensure that the sensors can handle more data-intensive applications with minimal latency. With growing demand across consumer and industrial domains, the MEMS sensor market is poised to maintain a strong growth trajectory in the years ahead.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several key trends are pushing the use of MEMS sensors:

IoT and Smart Devices:

As the Internet of Things (IoT) grows, MEMS sensors are becoming essential. They help collect real-time data and support automation. Smart homes, industrial systems, and connected healthcare devices all use MEMS-based accelerometers, gyroscopes, and pressure sensors. These sensors make performance smoother and user interaction better.

Consumer Electronics:

Smartphones and wearables are a big reason for the rising demand for MEMS sensors. They support features like screen rotation, activity tracking, fall detection, and gesture control. As brands try to stand out, adding advanced MEMS sensors has become a key selling point.

Autonomous Vehicles and ADAS:

In cars, MEMS sensors play a big role in safety and automation. They are used in systems like ADAS and support autonomous driving. Sensors such as accelerometers, gyroscopes, and pressure sensors help monitor the vehicle’s movement. They also assist with navigation and ensure safety features work well. As more electric vehicles hit the road, the need for reliable sensors is increasing.

Industrial Automation and Robotics:

With the rise of smart factories, MEMS sensors are being used more in machines. They help monitor equipment health, support predictive maintenance, and enable precision control. This improves efficiency and cuts down on downtime in automated systems.

Healthcare and Biomedical Innovations:

MEMS technology is changing the medical world. It allows for small and advanced diagnostic and monitoring devices. These include implantable devices, wearable biosensors, and drug delivery tools. They collect real-time health data with high accuracy.

Major Players and their Competitive Positioning

The MEMS sensor market is highly competitive. It is driven by constant innovation. Top global companies are investing in R&D to stay ahead. They’re also forming partnerships and making strategic acquisitions. This is mainly to grow their market presence and offer more products. Some of the major players in the market include:- Bosch Sensortec, STMicroelectronics, Texas Instruments, Analog Devices Inc., TDK Corporation (InvenSense), NXP Semiconductors, Infineon Technologies AG, Honeywell International Inc., TE Connectivity, and Murata Manufacturing Co., Ltd.

These companies are leveraging core competencies in MEMS fabrication, packaging, and integration to deliver cutting-edge solutions. They are actively expanding their sensor portfolios to address emerging applications in autonomous driving, health monitoring, and industrial automation.

Consumer Behavior Analysis

Consumer preferences and expectations are evolving rapidly, influencing the adoption of MEMS sensors:

Emphasis on Device Functionality and Responsiveness: Consumers demand faster, smarter, and more intuitive gadgets. MEMS sensors enable touchless interfaces, gesture recognition, and enhanced responsiveness in consumer electronics, directly influencing buying decisions.

Growing Preference for Health and Fitness Wearables: Health-conscious users are increasingly adopting wearables that track activity, heart rate, sleep patterns, and even hydration levels. MEMS-based accelerometers, gyroscopes, and pressure sensors provide accurate and real-time health metrics.

Environmental Awareness and Energy Efficiency: Consumers are drawn to devices that consume less power without compromising performance. MEMS sensors are prized for their low power requirements and ability to function effectively in compact, battery-operated systems.

Desire for Safer Vehicles: Drivers are increasingly valuing safety features like lane departure warning, collision detection, and auto-parking—functions made possible by MEMS sensors. These sensors enhance the reliability and intelligence of ADAS technologies, contributing to user satisfaction and trust.

Pricing Trends

The pricing of MEMS sensors varies depending on the type, complexity, and intended application. Generally, prices have declined steadily over the past decade due to:

- Economies of Scale: High-volume production of MEMS sensors, particularly for smartphones and consumer devices, has significantly reduced per-unit costs.

- Improved Manufacturing Processes: Advances in MEMS fabrication techniques, such as wafer-level packaging and system-on-chip integration, have streamlined production and cut costs.

- Competition and Commoditization: Intense competition among suppliers has led to commoditization in segments like accelerometers and gyroscopes, prompting aggressive pricing strategies.

While commoditized sensors see narrowing margins, specialized and application-specific MEMS sensors—especially those used in automotive, industrial, and medical domains—command premium pricing due to their precision, reliability, and compliance with stringent standards.

Growth Factors

The MEMS sensor market is growing due to several growth drivers:

5G and Edge Computing: 5G and edge processing requires real-time, low latency sensing. MEMS sensors are perfect for this environment, enabling fast, distributed decision making across applications.

Smart Cities and Infrastructure Monitoring: Urban planners and infrastructure developers are deploying MEMS sensors for traffic management, air quality monitoring and structural health monitoring. These deployments offer scalable, cost effective sensing across large geographies.

AR/VR and Gaming: Immersive technologies like AR, VR and gaming require MEMS based motion tracking for seamless interaction. This growing industry is opening up new opportunities for sensor deployment.

Biomedical Innovation: MEMS sensors are at the heart of innovations like smart inhalers, glucose monitors and ingestible sensors. As personalized medicine takes off, the need for small and accurate sensors continues to grow.

Regulatory Landscape

Compliance and quality is key. This is because MEMS sensors are used in regulated industries. The regulatory environment ensures sensors meet safety, reliability and performance standards. Key regulations are:

- ISO 13485 Certification: For medical device manufacturers, MEMS sensors used in healthcare. It ensures compliance with strict quality management standards.

- Automotive Safety Standards (ISO 26262): Automotive grade MEMS sensors must meet functional safety requirements. It enhances reliability in harsh conditions.

- RoHS and REACH Compliance: Environmental regulations across the EU and other markets require the restriction of hazardous substances in electronic components, including MEMS sensors.

- FDA Approvals: For MEMS used in diagnostic or therapeutic medical devices, clearance or approval from the US FDA is required.

Following these regulations gives OEMs, medical professionals and consumers trust and market access.

Recent Developments

Major innovations are influencing the MEMS sensor industry:

AI and Edge Processing: MEMS designs are now including AI. This enables edge level data analysis and decision making. Reduces dependence on central data centers. Faster and more intelligent system responses.

June 2025: Bosch released the SMP290, a fully integrable MEMS based tire pressure sensor with ultra low power consumption and built in Bluetooth Low Energy (BLE) connectivity. The sensor combines pressure, temperature and acceleration sensing with a microcontroller and wireless communication, up to 10 years of operation and easy integration with in-vehicle BLE systems.

Next Gen Sensor Platforms: Big players are launching new sensor platforms. Compact, precise and wireless. For the IoT.

Automotive Sensor Innovations: Leading firms like TDK, Bosch, and STMicroelectronics are releasing MEMS sensors for next-gen vehicles. Key features include high-temperature tolerance and strong vibration resistance.

Increased Investment in Healthcare Applications: R&D funding is increasing across startups and major players. The goal is to develop biosensors for health monitoring solutions.

Advances are expanding MEMS sensor use across sectors. They enhance both function and long-term stability.

Current and Potential Growth Implications

Demand-Supply Analysis: Various industries now require more MEMS sensors. Scaling production without quality loss is a key challenge. Supply chain disruptions are affecting the industry. Semiconductor fabrication issues limit consistent availability.

Gap Analysis: Sensor use is widespread in consumer electronics. In contrast, sectors like healthcare and heavy manufacturing remain in early adoption stages. Balancing sensor capability with deployment cost is difficult. This remains a core issue for the market.

Efforts focus on easier integration and better cost-efficiency. End-user education in emerging and underserved markets is also a key goals.

Top Companies in the MEMS Sensor Market

- Bosch Sensortec

- STMicroelectronics

- Texas Instruments

- Analog Devices Inc.

- TDK Corporation (InvenSense)

- NXP Semiconductors

- Infineon Technologies AG

- Honeywell International Inc.

- TE Connectivity

- Murata Manufacturing Co., Ltd.

MEMS Sensor Market: Report Snapshot

Segmentation | Details |

By Sensor Type | Accelerometers, Gyroscopes, Magnetometers, Pressure Sensors, Microphones, Temperature Sensors, Others |

By Application | Consumer Electronics, Automotive, Industrial, Medical Devices, Telecommunications, Aerospace & Defense, Others |

By End-User | OEMs, System Integrators, Research Institutions, Government Agencies |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

MEMS Sensor Market: High-Growth Segments

- Accelerometers and Gyroscopes: Industry adoption of integrated solutions is rising. Core sectors include mobility, consumer wearables, and automotive. These applications require accurate sensor technologies.

- Pressure Sensors: Use of these sensors is growing in industry and medical tools. They help track pressure with high accuracy.

- MEMS Microphones: These sensors are widely used in voice-enabled smart devices. They also support virtual assistants and hearing aids .

Major Innovations

- System-in-Package (SiP) Solutions: Integrated MEMS systems are gaining wider industry acceptance. Their embedded software enables miniaturization and economic scalability.

- Self-Calibrating Sensors: Technical progress in MEMS has led to self-calibrating architectures. These improvements result in superior accuracy and prolonged functional life.

- Flexible MEMS: Research in flexible substrates is advancing rapidly. It is enabling MEMS integration into wearables and skin-mounted devices.

MEMS Sensor Market: Potential Growth Opportunities

- Expansion in Emerging Markets: Rapid urban expansion is ongoing. Asia, Africa, and Latin America are adopting sensor-based technologies at scale.

- Integration into Smart Infrastructure: Governments are funding smart city projects. This creates big chances to use MEMS sensors on a wide scale.

- Collaboration with AI and Cloud Providers: Sensor makers now work with AI and cloud tech firms. Together, they build systems to boost data use and results.

Extrapolate says

The market for MEMS sensors is undergoing swift transformation. Their role is central to the development of future connected systems. Though compact, these sensors offer significant capabilities. They are driving intelligent innovation in diverse sectors. They are integrated across a wide range of applications. This broad adoption reflects their foundational role in current technologies.

MEMS sensors are becoming smarter and more versatile. AI and next-gen materials will drive their use into emerging fields. Technological advancement and expanding applications are key growth enablers. The MEMS sensor market is now positioned for robust expansion. R&D, manufacturing scale, and strong partnerships are key. Stakeholders must align these priorities to succeed in the MEMS sensor market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

MEMS Sensor Market Size

- August-2025

- 140

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020