eSIM Market Size, Share, Growth & Industry Analysis, By Solution (Hardware (eUICC), Software (Subscription Management, Remote Provisioning), By Application (Smartphones, Laptops/Tablets, Wearables, Automotive, Industrial IoT, Others), By End-User (Consumers, Enterprises, Telecom Operators, OEMs), and Regional Analysis, 2024-2031

eSIM Market: Global Share and Growth Trajectory

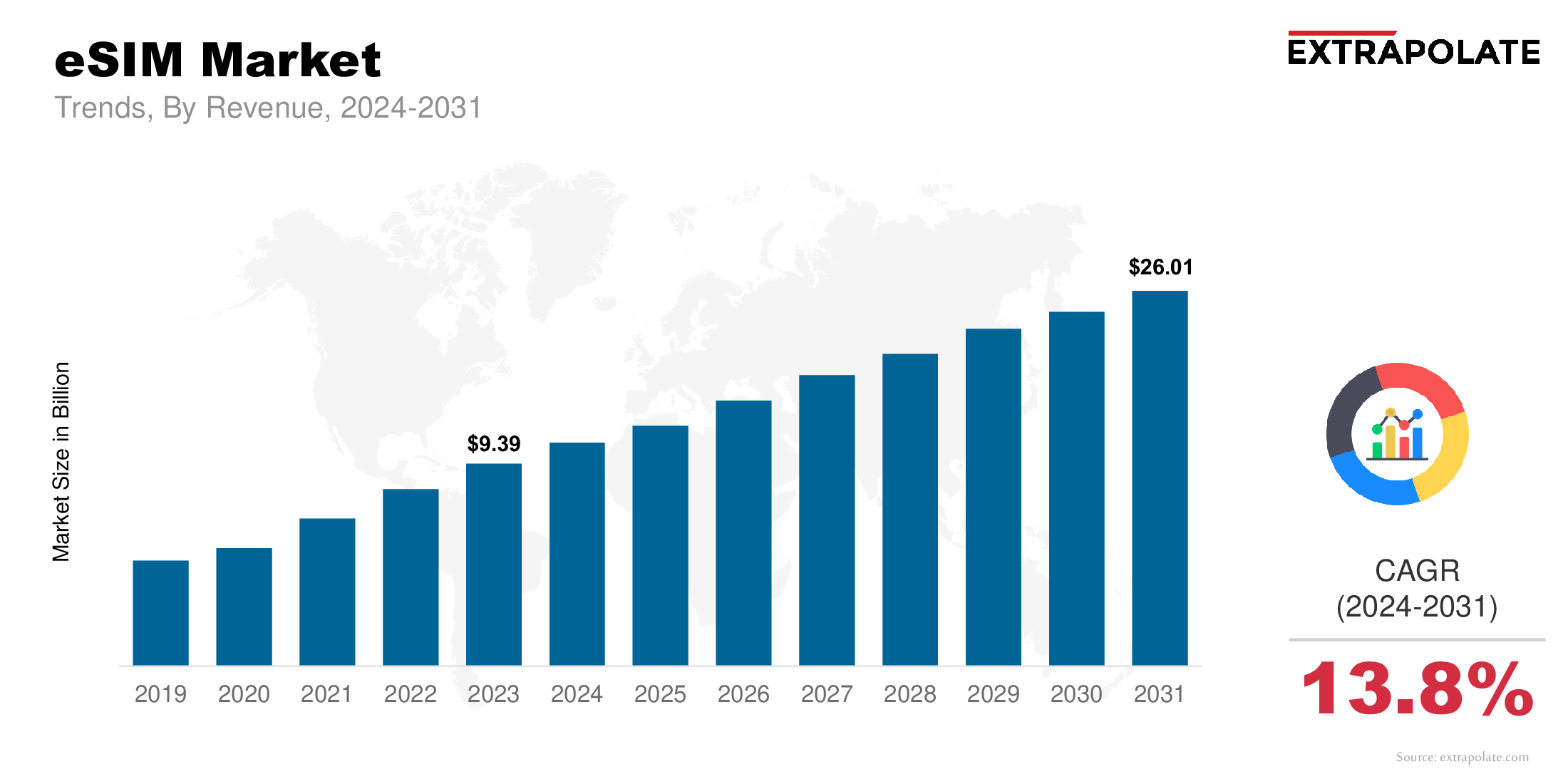

The global eSIM market size was valued at USD 9.39 billion in 2023 and is projected to grow from USD 10.48 billion in 2024 to USD 26.01 billion by 2031, exhibiting a CAGR of 13.85% during the forecast period.

The global is undergoing rapid transformation, with adoption surging across a broad spectrum of industries. eSIM technology, which enables remote provisioning of mobile network profiles without the need for a physical SIM card, is fundamentally changing how connectivity is managed across devices and ecosystems. As digitalization accelerates worldwide, eSIM is emerging as a foundational technology, enabling greater flexibility, operational efficiency, and enhanced customer experience.

Regionally, North America and Europe lead in eSIM adoption, supported by strong regulatory frameworks, widespread 5G infrastructure, and early support from telecom operators. However, Asia-Pacific is expected to register the highest growth rate during the forecast period due to rising smartphone usage, expanding digital ecosystems, and favorable government initiatives aimed at enhancing telecom infrastructure. Markets such as China, India, Japan, and South Korea are investing heavily in eSIM-enabled IoT applications for smart cities, automotive telematics, and industrial automation.

As the technology matures and interoperability improves, the market is expected to continue on a steep growth trajectory. Strategic collaborations among MNOs, hardware vendors, and cloud service providers are expanding the eSIM ecosystem, making the technology more accessible across geographies and verticals. With benefits including enhanced security, improved user experience, and simplified logistics, eSIM is positioned as a transformative force in the global connectivity landscape, poised to reshape how mobile communication services are delivered and consumed.

Key Market Trends Driving Product Adoption

Several defining trends are shaping the rapid adoption of eSIM technology across various sectors:

- Consumer Preference for Digital Experiences:

Consumers are increasingly favoring seamless, digital-first interactions. eSIM aligns with this trend by eliminating the need to physically insert or replace a SIM card. The ability to activate service remotely and switch networks through a smartphone interface aligns with the demands of today’s digital consumers, fueling adoption in consumer electronics, wearables, and smartphones. - Growth of IoT and M2M Connectivity:

IoT and machine-to-machine (M2M) applications—especially in sectors like logistics, automotive, and industrial automation—rely on reliable, scalable, and remotely manageable connectivity. eSIM enables over-the-air provisioning and centralized device management, reducing operational complexity and improving scalability for enterprises with large device fleets. - Expansion of 5G Networks:

The global rollout of 5G networks amplifies the need for agile and interoperable connectivity solutions. eSIM facilitates fast switching between carriers to optimize performance, pricing, and service availability. As 5G becomes the norm, eSIM's ability to support low-latency, high-throughput connections become increasingly vital for both consumers and industrial applications. - Adoption in Automotive and Smart Mobility Solutions:

Modern vehicles are equipped with telematics, infotainment systems, and advanced driver-assistance features—all of which require reliable mobile connectivity. eSIM allows car manufacturers to embed connectivity into vehicles during production, enabling features like eCall, remote diagnostics, and software updates. As electric and connected cars proliferate, automotive eSIM deployments continue to expand. - Supportive Regulatory Environment:

Several governments and regulatory bodies are advocating for open, interoperable telecom environments, indirectly encouraging eSIM deployment. By removing vendor lock-in and simplifying cross-border connectivity, eSIM aligns with broader goals of digital infrastructure enhancement and telecom liberalization.

Major Players and their Competitive Positioning

The eSIM industry is highly competitive and characterized by intense innovation, strategic alliances, and rapid scaling. Key players are integrating eSIM functionality across devices and platforms while working closely with MNOs and device OEMs to optimize network compatibility and service delivery. Notable participants include Thales Group, Giesecke+Devrient (G+D) Mobile Security, STMicroelectronics, Infineon Technologies AG, Deutsche Telekom AG, Telefónica S.A., NTT DOCOMO, Inc., Apple Inc., Samsung Electronics Co., Ltd., Qualcomm Technologies, Inc. and others.

These companies are pursuing product enhancements, acquisitions, and long-term partnerships with telecom operators to strengthen their foothold. Apple and Samsung, for instance, have integrated eSIM into their flagship mobile devices, while Thales and G+D lead in providing secure eSIM infrastructure for IoT and enterprise clients.

Consumer Behavior Analysis

Understanding consumer and enterprise preferences is essential to assessing market dynamics:

- Desire for Seamless Connectivity:

Consumers increasingly expect instant connectivity, especially during device setup. eSIM allows users to activate service plans during device onboarding, a highly attractive feature for travelers, digital nomads, and tech-savvy users seeking convenience. - Demand for Multi-Device Subscriptions:

With users owning multiple devices—smartphones, smartwatches, tablets—eSIM enables linking all devices under a single subscription, offering synchronized experiences. Consumers now prefer ecosystems that provide universal connectivity across devices, which eSIM facilitates with ease. - Flexibility and Control:

eSIM empowers consumers to switch providers without visiting a physical store or ordering a new SIM. This flexibility supports competitive pricing and consumer autonomy, leading to higher satisfaction and loyalty for service providers offering eSIM. - Privacy and Security Awareness:

With rising data privacy concerns, consumers are drawn to technologies that offer enhanced security. eSIMs, with their tamper-resistant hardware and encrypted provisioning, ensure better protection against physical cloning or unauthorized SIM swaps.

Pricing Trends

eSIM-related pricing trends vary depending on application segments and geographic markets. Key insights include:

- Cost Savings for Operators and OEMs:

eSIMs reduce manufacturing and logistics costs by eliminating the need for physical SIM trays and cards. Over time, operators save on distribution while OEMs can design slimmer, more water-resistant devices. - Consumer Plan Flexibility:

Some mobile network operators offer lower-cost data plans or promotional bundles for eSIM users, given reduced distribution overheads. This is particularly evident in markets like the United States, the UK, and parts of Asia-Pacific, where digital onboarding is widely accepted. - Enterprise Scalability:

For IoT deployments, bulk eSIM management solutions allow organizations to reduce per-device costs through centralized provisioning. This is especially important for large-scale industrial applications in utilities, fleet management, and remote asset tracking. - Rising Value from Integration Services:

Vendors now offer eSIM management platforms as a service, charging enterprises on a subscription or per-device basis. These value-added services (e.g., remote SIM provisioning platforms) are becoming a profitable segment for providers.

Growth Factors

Several drivers are fueling the rapid growth of the market:

- Proliferation of Connected Devices:

From smartphones and tablets to smart appliances and connected cars, the number of connected devices is surging. eSIM allows seamless provisioning and management of these devices at scale, serving as the foundation for ubiquitous connectivity. - Support from OEMs and MNOs:

Major device manufacturers and telecom operators are now offering eSIM compatibility as standard. This ecosystem maturity enhances interoperability and paves the way for mass-market adoption. - Enterprise and Industrial Demand:

Businesses managing IoT device networks need scalable, secure, and remotely manageable connectivity. eSIM enables centralized updates, reduces physical servicing costs, and accelerates deployment cycles, making it a natural fit for enterprise environments. - Environmental and Space Efficiency:

eSIM cuts out plastic cards and trims device parts. This supports greener builds and slimmer designs. These advantages are becoming more critical as environmental sustainability becomes a priority.

Regulatory Landscape

eSIM deployments are influenced by national telecom regulations, privacy laws, and global standards:

- GSMA Specifications Compliance:

eSIM implementations must comply with GSMA's Remote SIM Provisioning (RSP) architecture for both consumer and M2M applications. This ensures global interoperability and security. - Consumer Protection Regulations:

In markets like the European Union, data protection regulations such as GDPR influence how eSIM data is managed. Providers must implement robust security and data governance frameworks. - MNO Licensing and Roaming Rules:

Regulators are requiring MNOs to support open access to eSIM profiles to avoid anti-competitive behavior. Some governments mandate local eSIM provisioning for data sovereignty, influencing vendor deployment models. - Push for Digital Inclusion:

Governments are promoting digital infrastructure by supporting eSIM in public services, identity verification, and smart city initiatives. In emerging markets, eSIM can facilitate affordable, scalable connectivity solutions.

Recent Developments

Noteworthy developments in the market underscore its momentum:

- Apple Expands eSIM-Only Models:

With the iPhone 14 in the U.S. shipping without a physical SIM tray, Apple has signaled its full commitment to eSIM. This shift is likely to influence competitors and drive consumer demand globally. - eSIM Adoption in Automotive Telematics:

Carmakers like Tesla, BMW, and GM use eSIMs for built-in connectivity. These help power maps, media, car checks, and emergency help. - Partnerships Among MNOs and Tech Firms:

Operators such as AT&T, Vodafone, and Orange are partnering with companies like Thales and IDEMIA to develop robust eSIM ecosystems and provisioning platforms for global enterprise clients. - Remote eSIM Management Tools:

Vendors now offer software platforms that allow consumers and enterprises to manage eSIM profiles remotely, change service providers, or configure device policies across regions—all through cloud-based dashboards.

Current and Potential Growth Implications

a. Demand-Supply Analysis:

As more devices go online, OEMs and carriers are pushing eSIM use. But gaps in carrier support and low user awareness still slow adoption.

b. Gap Analysis:

While adoption in developed economies is strong, emerging markets still face device compatibility issues, operator support gaps, and regulatory hurdles. Addressing these disparities is crucial for global scaling.

Top Companies in the eSIM Market

Leading players in the global eSIM ecosystem include:

- Thales Group

- Giesecke+Devrient

- STMicroelectronics

- Infineon Technologies AG

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Qualcomm Technologies, Inc.

- Telefónica S.A.

- Deutsche Telekom AG

- NTT DOCOMO, Inc.

eSIM Market: Report Snapshot

Segmentation | Details |

By Solution | Hardware (eUICC), Software (Subscription Management, Remote Provisioning) |

By Application | Smartphones, Laptops/Tablets, Wearables, Automotive, Industrial IoT, Others |

By End-User | Consumers, Enterprises, Telecom Operators, OEMs |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Consumer Devices: Smartphones and wearables lead the shift. Demand for smooth connections and easy carrier changes drives this growth.

- Automotive: Automotive compamies are integrating eSIMs for infotainment and fleet management. eSIMs are also used for vehicle-to-everything (V2X) communication.

- Industrial IoT: Energy, agriculture, and logistics are now adopting eSIM. This is because eSIM provide scalable, low-maintenance connectivity across remote operations.

Major Innovations

- GSMA-Compliant eSIM Management Platforms: Platforms that enable dynamic profile switching and secure provisioning.

- Cloud-Native eSIM Lifecycle Management: SaaS-based tools for managing enterprise device connectivity.

- Dual SIM Dual Active (DSDA) Support: Enhancing user convenience by allowing simultaneous use of two active lines via eSIM.

Potential Growth Opportunities

- Emerging Markets Penetration: Emerging markets are now more connected with growing mobile networks and cheaper devices. eSIM brings low-cost, flexible options that help reach areas with limited access.

- Integration with Blockchain for Secure Identity: eSIMs bring flexible and secure connectivity. When paired with decentralized IDs, they enable safer digital services.

- AI-Driven Network Selection: Leveraging AI for optimal carrier switching based on real-time network quality, cost, and location data.

Extrapolate Research says:

The eSIM market is set to experience transformational growth over the coming years, driven by the convergence of digital convenience, rising connected device ecosystems, and global 5G expansion. With adoption accelerating across consumer electronics, automotive, and industrial sectors, eSIM is no longer an emerging technology but a strategic enabler of next-generation connectivity.

As mobile network operators embrace digital provisioning and OEMs embed eSIMs as standard, the barriers to entry are steadily dissolving. Extrapolate Research believes that businesses positioned to leverage eSIM’s flexibility, cost-efficiency, and scalability will gain a definitive edge in an increasingly competitive digital landscape. Enterprises and service providers that invest early in robust eSIM platforms and partnerships will unlock powerful new revenue streams and operational efficiencies, reshaping the future of mobile connectivity.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

eSIM Market Size

- June-2025

- 148

- Global

- semiconductor-electronics

Related Research

1,5-pentanediamine (Cadaverine)-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

26650 Cylindrical Lithium Ion Battery Market Insights 2022, Global Analysis and Forecast to 2030

May-2021

2K Panel-Global Market Status and Trend Report 2015-2026

November-2020

300mm Wafer Carrier Boxes-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

January-2021

3D IC & 2.5D IC Packaging-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

November-2020