Global Retail Logistics Market Size, Share, Growth & Industry Analysis, By Service Type (Transportation, Warehousing, Last-Mile Delivery), By End-User (E-commerce, Retailers, Manufacturers, Wholesalers), and Regional Analysis, 2024-2031

Retail Logistics Market: Global Share and Growth Trajectory

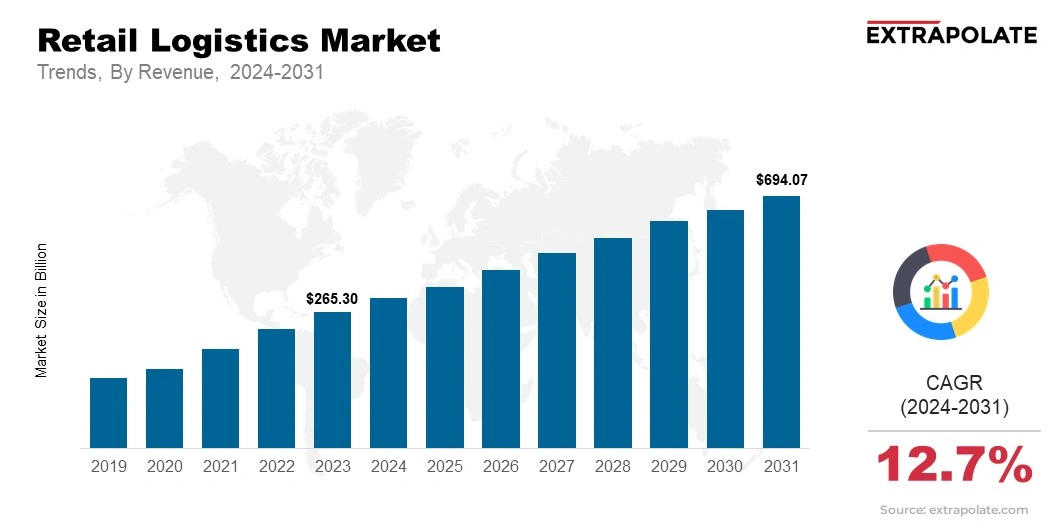

The global Retail Logistics Market size was valued at USD 265.30 billion in 2023 and is projected to grow from USD 301.40 billion in 2024 to USD 694.07 billion by 2031, exhibiting a CAGR of 12.7% during the forecast period.

The global retail logistics market is surging, fueled by digital evolution. Consumers are shifting their preferences, seeking lightning-fast delivery and tailored experiences. Retailers are rising to the challenge, revolutionizing logistics with innovative solutions. This dynamic landscape encompasses every supply chain step, from manufacturers to consumers. It includes warehousing goods, tracking inventory, transporting products, and delivering right to the consumer.

E-commerce growth has been key to the rise of retail logistics. The E-commerce surge has added to the demand for better logistics services in terms of efficiency and reliability. The high-paced life of consumers demands faster deliveries. Retail leaders are sharpening their focus on optimizing supply chains for better service. With the rise of AI, automation, and data analytics, they’re seizing fresh opportunities. These breakthroughs enhance logistics with real-time tracking, efficient inventory management, and streamlined route optimization.

A prominent trend is the spotlight on last-mile delivery. As consumers demand faster service, retailers are rising to the challenge. Embracing innovative last-mile solutions like crowdsourced delivery, drones, and autonomous vehicles is becoming mainstream. These futuristic methods promise not only speed but also operational efficiency at lower costs. By doing so, they aim to elevate the customer experience over the forecast period.

Major investments for warehousing and inventory management are also gaining prevalence. prominent retailers witnessing a major shift toward omnichannel retailing. In response, their strategies are evolving toward flexible and efficient distribution that can manage online as well as offline sales. This strategic pivot allows them to meet customer demands and enhance shopping experiences across every platform. Optimization of operations, enhanced automation, and accurate and efficient order fulfillment are all handled by warehouse management systems (WMS) and robotics.

North America and Europe are the largest retail logistics markets. They are categorized as having a well-established infrastructure along with a considerable penetration of e-commerce. The Asia Pacific, meanwhile, is undergoing rapid urbanization, disposable income hikes, and e-commerce expansion. In addition, countries like China and India are seeing increased smartphone ownership. Therefore, the continuous adoption of digital technologies in several emerging and established regions of Asia Pacific is expected to shape the future growth landscape of retail logistics.

The retail logistics market is on a remarkable rise. Innovations in technology, the e-commerce explosion, and evolving consumer expectations are propelling this growth. Companies are driven to enhance efficiency and reduce costs, all while catering to the modern consumer's needs. As these players adapt and innovate, the logistics sector is destined to become a cornerstone of the global retail ecosystem.

Key Market Trends Driving Product Adoption

The retail logistics market is characterized by rapid innovation and evolving consumer demands. Key trends driving market growth include:

- Growth of Online Retail: The surge of e-commerce and online shopping is reshaping retail logistics. As consumers shift towards virtual aisles, demand for swift delivery rises. Companies are fueling this evolution with cutting-edge logistics networks that are ensuring reliability. Fast and efficient delivery in retail is a direct result of logistical transformation.

- Omnichannel Retailing: Retailers are merging their offline and online channels to create a shopping experience that flows effortlessly. This integration demands more agile logistics solutions that can swiftly manage and fulfill orders from various sources.

- Advances in Technology: Automation is taking center stage in warehouses, transforming logistics as we know it. With artificial intelligence, machine learning, and robotics joining forces, efficiency is on the rise. Costs are kept in check, enabling resourceful operations to flourish. This not only streamlines processes but also elevates the entire logistics process.

- Improved Last-Mile Deliveries: The last leg of delivery, known as last-mile delivery, is essential for customer satisfaction. Therefore, to expedite deliveries, retailers are venturing into innovative solutions such as drones and self-driving vehicles. Crowdshipping is also gaining traction, helping to boost delivery speed and cut costs.

- Sustainability Adoption in Logistics: Logistics providers are increasingly prioritizing sustainability. They focus on trimming carbon footprints, refining packaging, and employing eco-friendly transportation methods.

Major Players and Their Competitive Positioning

The retail logistics market is characterized by several dominant and emerging players showcasing their global and regional presence, respectively. Major players operating in this market are DHL, FedEx, UPS, Maersk, XPO Logistics, and others. These companies are leveraging technology to enhance their service offerings and maintain their competitive edge. Smaller companies are focusing on niche markets, providing tailored solutions to specialized retail segments.

Consumer Behavior Analysis

Consumers are raising the bar for delivery speed, flexibility, and transparency. They have come to expect rapid, complimentary, and trustworthy deliveries for their online purchases. Features like real-time tracking, adjustable delivery windows, and seamless return policies have become key to satisfying customers. In turn, retailers are making significant investments in logistics to keep up with these ever-changing expectations.

Pricing Trends

Pricing trends in retail logistics are shaped by several key players. Delivery speed, order volume, geographic location, and service level all factor into costs. Those seeking rapid delivery, like same-day or next-day options, find themselves paying more. Meanwhile, budget-conscious consumers opt for shipping alternatives that do not incur high charges.

Additionally, companies are venturing into subscription-based delivery models. These approaches aim to provide regular customers with more affordable options, making deliveries more affordable.

Growth Factors

Several factors are driving the growth of the retail logistics market:

- E-commerce Expansion: The rise of online shopping is fueling a logistics revolution. In emerging markets, this trend is creating a high demand for services. As a click becomes a purchase, logistics must innovate and adapt quickly.

- Technological Advancements: Automation, AI, and IoT are reshaping logistics with more efficient and cost-effective operations.

- Consumer Expectations: The need for quick, agile, and accessible delivery options is fostering innovation in retail logistics.

- Cross-Border Trade: The globalization of retail and international e-commerce is driving the need for advanced logistics solutions to manage cross-border shipping effectively.

Recent Developments/Market Highlights

The retail logistics market is continuously evolving, with new technologies and services being introduced regularly. Some recent developments include:

- Automation in Warehousing: Using robotic systems and automated sorting facilities helps to streamline operations and cut costs.

- Smart Logistics Solutions: Optimizing routes, monitoring inventory, and predicting demand through the integration of IoT and AI technologies.

- Sustainability Initiatives: The adoption of green logistics practices, such as using electric delivery vehicles and sustainable packaging.

- Improved Last-Mile Solutions: The introduction of micro-fulfillment centers, drones, and autonomous vehicles helps to speed up delivery times and cut costs.

Current and Potential Growth Implications

Demand-Supply Analysis

The demand for retail logistics services is growing steadily, driven by the expansion of e-commerce. However, logistics providers may struggle to meet demand due to supply chain disruptions like the COVID-19 pandemic, raw material shortages, and labor shortages. As retailers rely more heavily on logistics services to fulfill customer orders, building supply chain resilience and flexibility is becoming increasingly important.

Gap Analysis

While the retail logistics market has made significant progress, certain areas still need improvement:

- Infrastructure and Capacity: The need for more efficient infrastructure to handle the rising volume of online orders.

- Cost Efficiency: Balancing the rising costs of logistics operations with customer expectations for fast and affordable delivery.

- Last-Mile Delivery Solutions: Despite innovations, last-mile delivery remains a significant challenge, particularly in urban areas and remote regions.

- Data Integration: The integration of data across multiple platforms and supply chain partners to streamline operations and improve decision-making.

Top Companies in the Retail Logistics Market

Some of the top companies in the retail logistics market include:

- DHL

- FedEx

- UPS

- Maersk

- XPO Logistics

- DB Schenker

- CEVA Logistics

- Kuehne + Nagel

- J.B. Hunt Transport Services

- DSV Panalpina

Retail Logistics Market: Report Snapshot

Segmentation | Details |

By Service Type | Transportation, Warehousing, Last-Mile Delivery |

By End-User | E-commerce, Retailers, Manufacturers, Wholesalers |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

Retail Logistics Market: High Growth Segments

The following market segments are expected to experience significant growth:

- E-commerce Logistics: The growth of online shopping is driving the demand for specialized logistics solutions for e-commerce retailers.

- Last-Mile Delivery: The need for faster, more efficient last-mile delivery solutions is pushing innovations in this segment.

Major Innovations

Innovation is central to the growth of the retail logistics market. Some of the latest innovations include:

- Robotic and Automated Systems: The use of drones, autonomous vehicles, and robotic sorting systems to streamline operations.

- Real-Time Tracking: Advanced tracking technologies that provide consumers and retailers with real-time updates on shipments.

- AI and Machine Learning: The integration of AI and machine learning to optimize routes, manage inventory, and predict consumer demand.

Retail Logistics Market: Potential Growth Opportunities

The retail logistics market encounters various challenges, such as competition, cost pressures, and the necessity for technological innovation. Nevertheless, the rising demand for quicker delivery, enhanced efficiency, and better customer experiences offers significant growth opportunities. Companies that can utilize technology to optimize operations, lower costs, and improve their service offerings will be ideally positioned to thrive in this evolving market.

Kings Research says:

The global retail logistics market is expected to keep growing, driven by the rise of e-commerce, new technologies, and shifting consumer expectations. To stay ahead in this competitive market, companies must adapt to the changing landscape by prioritizing efficiency, customer experience, and sustainability.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Global Retail Logistics Market Size

- January-2025

- 140

- Global

- retail

Related Research

Agrobacterium tumefaciens Competent Cells Market Insights 2022, Global Analysis and Forecast to 2030

July-2021

Aluminium Composite Panels (ACP) Market Insights 2022, Global Analysis and Forecast to 2030

July-2021

Backpack Market By Product Type (Travel, Hiking, Work and Others), Material (Nylon, Polyester & Othe

February-2023