Linerless Labels Market Size, Share, Growth & Industry Analysis, By Printing Technology (Thermal Transfer, Laser, Inkjet, Direct Thermal, Others), By Component (Facestock, Adhesive, Topcoat), By Application (Pharmaceuticals & Personal Care, Food & Beverage, Retail, Logistics, Others), and Regional Analysis, 2024-2031

Linerless Labels Market Size

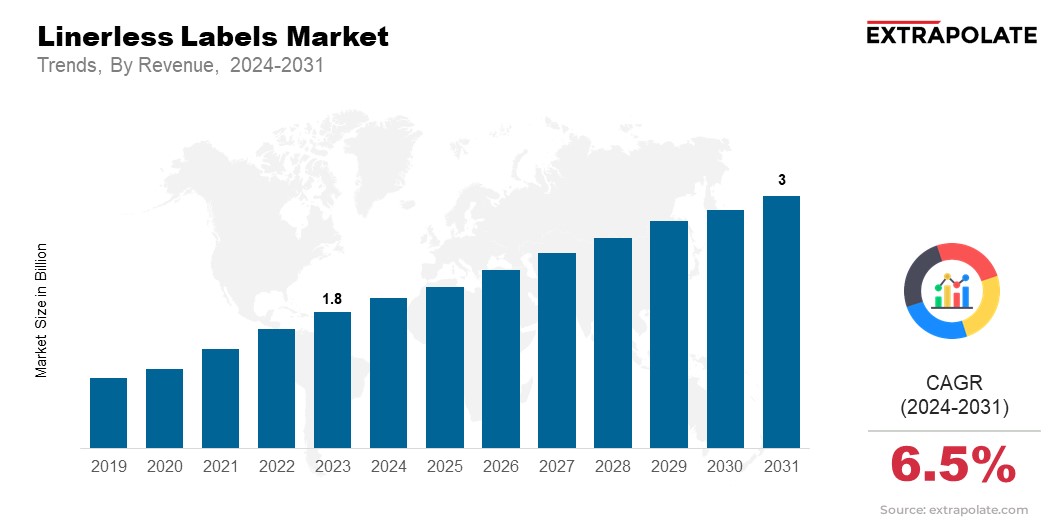

The global Linerless Labels Market size was valued at USD 1.8 billion in 2023 and is projected to reach USD 3 billion by 2031, exhibiting a CAGR of 6.5% during the forecast period, driven by sustainability, operational efficiency, and technological innovation. Linerless labels are emerging as a sustainable packaging solution for businesses looking to lower the environmental impact of their packaging solutions. Traditional labels have a silicone backing liner that often becomes waste and pollutes the environment. Linerless labels remove the need for backing, which cuts waste by up to 50% and lowers carbon emissions. The market for linerless labels is fueled by the rise of eco-friendly packaging in food & beverage, retail, and logistics.

Linerless labels lack a release liner, which has many advantages. They cut waste and costs and also boost efficiency. The growing use of eco-friendly labels in food, logistics, and retail is driving market growth. The food & beverage sector has the largest market share. It accounts for nearly 40% of total revenue. This is due to the need for efficient labeling solutions that must support high-speed operations while reducing environmental impact. Also, better printing technologies and RFID tags for tracking are driving the market. With regulatory authorities pushing for sustainable packaging, the demand for linerless labels will likely rise sharply.

Linerless Labels Market Trends

The rising adoption of sustainable practices in packaging, advanced technology integrations in labeling systems, and their adoption in the food & beverage industry are the significant trends shaping the linerless labels market. Sustainability is central objective for industries that look to minimize waste and carbon footprints. Linerless labels eliminate the need for backing paper, reducing waste by up to 50%. This environmentally friendly approach aligns with the global push for greener packaging solutions.

Advancements, like digital and variable data printing, have made linerless labels more versatile. They allow for greater customization and efficiency in labeling. These technologies enable high-quality prints on various substrates, meeting diverse industry requirements.

The food and beverage industry is a major end-user that demands fast, reliable labeling systems for high production volumes. Linerless labels offer flexibility that helps manage different product lines. They also meet strict food safety and traceability regulations. The proliferation of e-commerce platforms has instilled the need for efficient logistics labeling, which is expected to further the adoption of linerless labels driving their demand over the forecast period.

Linerless Labels Market Growth Factors

The global Linerless Labels market is experiencing growth due to a plethora of factors. The global Linerless Labels market is growing. Key factors include a growing focus on sustainability, cost efficiency, and advances in labeling technology. A survey reveals that consumers are willing to spend more or naturally sources and sustainable products. Nearly 85% consumers experience the impact of global climate change in their daily life. Therefore, they are willing to pay 9.7% extra on sustainably produced goods.

As industries worldwide aim for sustainability, linerless labels are witnessing growth in their market share. They reduce waste by eliminating the liner materials. This lowers disposal costs and supports eco-friendly business practices.

Cost efficiency is another factor. Linerless labels are more economical over time. They cut material use and streamline operations. Longer label rolls reduce roll changes and downtime in production. In addition, significant technological advances enhance the performance and application of linerless labels. These advances include improvements in adhesive formulations and printing technologies, which ensure the versatility and durability of these labels for various surfaces and adverse settings.

Further, a high and continuous demand from food & beverage, logistics, and retail segments is expected to fuel the linerless labels market. The need for efficiency and compliance with labeling regulations are major factors generating demand from the above segments. Increasing stringency of environmental regulations and more consumers opting for eco-friendly packaging solutions are expected to fuel the linerless labels market over the forecast period.

Segmentation Analysis

The global Linerless Labels market has been segmented into three key categories. They are: By Printing Technology, By Component, and By Application. These categories provide a comprehensive understanding of market dynamics and each segment plays a significant role in driving the growth of the market.

By Printing Technology

The lineless labels market has been segmented by printing technology into Flexographic, Digital, and Others. Flexographic printing is the largest market segment, and held over 45% of the global market in 2023. This technology is widely used to efficiently create high-quality prints at low costs.

Digital printing, however, is rapidly gaining traction. It's popular for custom and short-run labeling. At a CAGR of 8%, the digital printing segment is expected to grow in popularity. This is because businesses are looking to incorporate variable data and high-definition graphics in their labels. Other printing technologies, including inkjet and thermal transfer, are used in applications that need durability and color accuracy.

By Component

The market for Linerless Labels is categorized by components into Adhesives, Face Stocks, and Others. Adhesives are a crucial component, accounting for nearly 40% of the market share. Advanced adhesives impart a strong bond, enable easy application, and offer ease of removal. This is a key driver generating high demand for this segment.

The face stocks segment, including paper and film-based materials, also holds a significant share of the market. Face stocks affect the labels' durability, print quality, and surface suitability. Innovations in recyclable and biodegradable face stocks are expected to drive growth in this segment. The The others segment includes coatings and release agents. They improve the performance and lifespan of linerless labels.

By Application

The global linerless labels market has been segmented by application into Food & Beverage, Retail, Logistics, and Others. The Food & Beverage industry leads the application segment and held over 35% of the market share in 2023. This segment is driven by a demand for fast, reliable labeling solutions that meet strict regulations.

The Retail sector is also significant where linerless labels are used for price tags, shelf labels, and promotional stickers. The Logistics segment is observing rapid growth due to extensive purchases via various e-commerce platforms and the demand for efficient supply chain labeling solutions. As traceability and inventory management grow in importance, many industries are adopting linerless labels to improve their operations.

Linerless Labels Market Regional Analysis

The global Linerless Labels market shows varied growth by region. This reflects differences in industrialization, regulations, and environmental awareness. North America dominated the market by capturing a significant share. The early adoption of sustainable packaging solutions and strong demand from the food & beverage and logistics segments have positioned North America as a major region. The U.S. leads in this region.

Stringent environmental rules and key market players support its growth. These players are investing in advanced labeling technologies, which is expected to further aid its market share. Europe is close behind. Germany, France, and the UK are the leading countries spearheading the adoption of sustainable labeling solutions.

The European market has strong government efforts to promote sustainability. Consumers are also very aware of environmental issues. In Europe, better product labels and incentive programs could boost sales of sustainably packaged products.

The food & beverage industry remains the largest end-user of linerless labels market in Europe. The demand for efficient and sustainable labeling options to package various food and beverage items is generating a constant demand for sustainable solutions like lineless labels.

The Asia-Pacific region is expected witness the fastest-growing market during the forecast period, at a CAGR of over 7%. This growth is mainly due to rapid industrialization and urbanization in China, India, and Japan. The growing manufacturing and retail sectors are driving demand for affordable, green packaging solutions in these economies. In China, government support for green initiatives and e-commerce are driving growth. India's growing logistics sector and the influx of more multinational companies are boosting demand.

Rising awareness of sustainable packaging fuels moderate growth in Latin America and the Middle East & Africa. Brazil and Mexico lead Latin American markets, propelled by retail expansion and waste reduction efforts.

The Middle East & African market, though nascent, gains traction through sustainability regulations and industrial development. These regions showcase diverse drivers: from retail dynamics to environmental policies, shaping a gradually expanding landscape for eco-friendly packaging solutions.

Competitive Landscape

Linerless Labels' global market thrives on fierce competition. Giants like 3M, Avery Dennison, and RR Donnelley lead with diverse products and robust distribution. They pour resources into R&D, refining adhesives and printing methods. The industry buzzes with strategic moves – partnerships form, companies merge, acquisitions unfold. Label makers join forces with tech firms, crafting efficient, eco-friendly solutions.

Meanwhile, nimble startups carve out niches in sustainable packaging, meeting the rising call for green alternatives. This dynamic landscape fosters constant innovation, pushing the boundaries of label technology and sustainability.

List of Key Players in Linerless Labels Market

- Coveris

- Avery Dennison Corporation

- Ravenwood Packaging

- Innovia Films

- Constantia Flexibles

- Lexit Group Norway AS

- R. Donnelley & Sons Company.

- Gipako UAB

- Hub Labels

- 3M

Key Industry Developments

Recent industry developments highlight the growing focus on sustainability and technological advancements. In 2023, Avery Dennison launched a new range of eco-friendly linerless labels with advanced adhesive technologies designed for high-speed labeling applications. This product launch is expected to capture a significant market share, especially in the food & beverage sector. Another key development is the acquisition of Bizerba’s labeling division by 3M, aimed at expanding 3M’s presence in the European market and enhancing its linerless labeling offerings. The acquisition is projected to boost 3M’s regional sales by 12%.

Additionally, a notable partnership between RR Donnelley and a leading logistics company was announced, focusing on integrating RFID technology with linerless labels to improve supply chain visibility and reduce operational costs. These industry developments underscore the market’s shift toward innovation, sustainability, and enhanced operational efficiency.

The global Linerless Labels Market has been segmented:

By Printing Technology

- Thermal Transfer

- Laser

- Inkjet

- Direct Thermal

- Others

By Component

- Facestock

- Adhesive

- Topcoat

By Application

- Pharmaceuticals & Personal Care

- Food & Beverage

- Retail

- Logistics

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- South Africa

- North Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Linerless Labels Market Size

- October-2024

- 148

- Global

- retail

Related Research

Activewear Market Size, Share, Growth & Industry Analysis, By Product Type (Athletic Shoes, Sports B

March-2025

Agrobacterium tumefaciens Competent Cells Market Insights 2022, Global Analysis and Forecast to 2030

July-2021

Aluminium Composite Panels (ACP) Market Insights 2022, Global Analysis and Forecast to 2030

July-2021