Global Footwear Market Size, Share, and COVID-19 Impact Analysis, By Type (Athletic Footwear and Non-Athletic Footwear), By End-User (Men, Women, and Kids), By Distribution Channel (Offline Retail Stores, and Online Retail Stores), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022-2030

KEY MARKET INSIGHTS

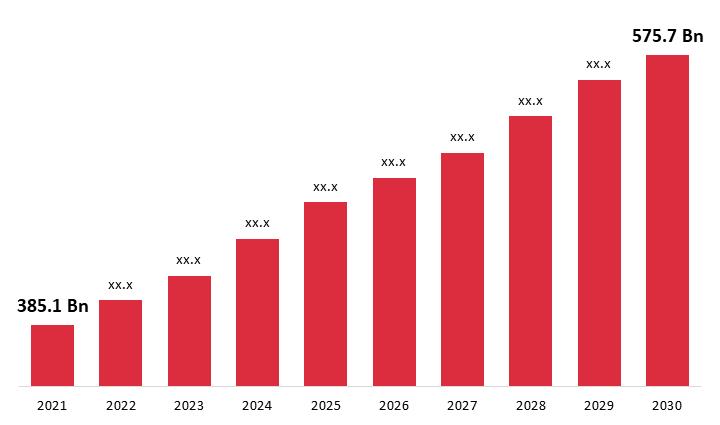

The Global Footwear Market is projected to grow from USD 385.1 billion in 2021 to USD 575.7 billion by 2030 at a CAGR of 5.5% during the forecast period.

The market is being driven by an increase in demand for high-quality footwear, as well as product innovation. Manufacturers are increasingly focusing on developing unique designs while also highlighting the importance of comfort. As a result, novel goods that are both comfortable and fashionable have been introduced. Increased interest in sports and a preference for athletic and physical activities such as running have also aided market expansion. Despite the fact that online marketing has surpassed physical purchasing in most consumer goods divisions, people still prefer to shop for shoes in person. This has resulted in an increase in organized retail locations as well as increased customer-manufacturer relationships. Furthermore, active promotional activities by manufacturers and increased consumer spending capacity have fuel the market growth.

COVID-19 ANALYSIS

Physical distancing is the most effective way to prevent the coronavirus from spreading. As a result, during the pandemic, local governments around the world halted most activities where the mass assembly is conceivable but not necessary. The Olympics, FIFA, and other major sporting events set for 2020 have been postponed or canceled. In reaction to government laws, all sports academies and clubs were closed. Furthermore, in most nations, schools and universities were shuttered and have yet to reopen; limiting sports activity in these institutions. As a result, lockdown regulations have had a significant impact on the footwear business.

Few sports tournaments, such as the Football 2020 K League, cricket, and tennis, are permitted in certain nations while adhering to all safety regulations. As a result, virus containment and the removal of the lockdown will gradually restore market condition.

LATEST TREND

Increasing Preference for Eco-friendly Shoes

One of the significant trends that will positively affect market growth is the use of environmentally friendly materials in the manufacturing of sports shoes. Because of the growing emphasis on environmental preservation, consumers are increasingly demanding sustainable shoes. Furthermore, numerous producers are working hard to meet client demands and are continually focusing on producing sustainable and environmentally friendly footwear. Adidas released its first environmentally friendly 100 percent recyclable running shoes in April 2019.

DRIVING FACTORS

Growing Government Initiatives Will Aid Market Growth

Local government entities are focusing on health and new techniques to encourage people to participate in physical activity. Several wealthy countries' government bodies are continually working to build enticing healthcare offers. This will also boost the sports footwear industry, as a large section of the population will be interested in sports and fitness activities. Furthermore, governments all across the world are focusing on expanding spending in sports, which will help to boost consumption rates. According to PRS India Org, the Ministry of Youth Affairs and Sports has set aside USD 314.8 million for 2019-2020. As a result, this type of endeavor will enhance the future of sports and provide a boost to the market's growth.

Consumers' expanding purchasing power and disposable incomes have fueled the rise of the sports footwear market. With rising income levels, people are willing to spend more for certain performance qualities including waterproofing, moisture management, temperature control, and friction reduction. Furthermore, the growing number of different retail locations, hypermarkets, and supermarkets is likely to aid the market's growth during the projection period.

RESTRAINTS

Local Products Are Limiting Sales for Branded Footwear

The market expansion would be limited by the limited several sports opportunity and lower adoption of high-cost footwear in low-income countries as well as rural areas. Furthermore, the availability of counterfeit products, as well as the rise of a number of small-scale market participants, has posed threats to high-priced branded footwear.

SEGMENTATION

The Global Footwear Market is segmented by Type, End User, Distribution Channel, and Region. Based on the Type, the market is categorized into Athletic Footwear and Non-Athletic Footwear. Based on End User, the market is categorized into Men, Women, and Kids. Based on Distribution Channel, the market is categorized into Offline Retail Stores, and Online Retail Stores. Based on the Region, the market is categorized into North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

REGIONAL INSIGHTS

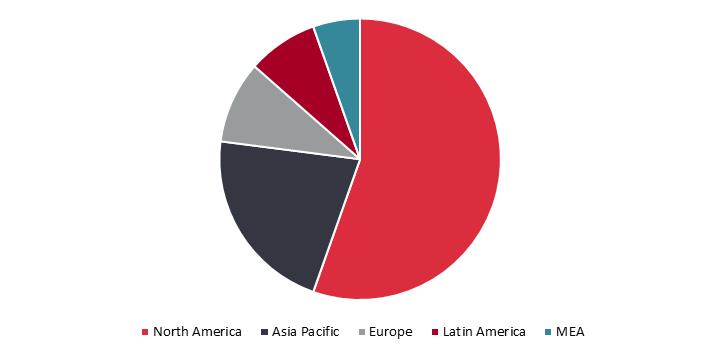

The Global Footwear Market is categorized into North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

North America is the largest market for footwear due to the increasing popularity of sports and other related activities. The large number of people who engage in outdoor sports and adventurous activities is expected to boost market growth. For example, the Outdoor Industry Association reported in January 2020 that in 2018, 50.5 percent of the US population was estimated to be engaged in outdoor activities. Furthermore, the rising rise of e-commerce businesses driving product purchases is expected to stimulate demand. Business-to-consumer e-commerce sales in the United States were USD 1,098 billion in 2018, according to data from the United Nations Conference on Trade and Development.

Asia Pacific is expected to be the fastest-growing region during the projected period. The footwear market in this region is expected to increase due to rising consumer spending, fueled by robust economic growth and higher disposable income. According to data from the World Bank, East Asia and the Pacific's GDP per capita income increased to 26.925 trillion in 2019, up from 26.351 trillion in 2018. Furthermore, the robust growth of numerous sports sectors, such as cricket, football, basketball, and others, would assist generate traction by encouraging more people to participate in sports as a hobby or a vocation.

Due to the dropping employment rate in several South American countries throughout the years, the region is expected to expand significantly. As a result, their purchasing power increased, which aided market growth.

KEY INDUSTRY PLAYERS

The global footwear market is highly competitive, with major market share held by major players such as Nike Inc., Puma SE, Asics Corporation, Fila Group, and Adidas AG, among others, owing to their higher market penetration and strong industry grip through their brands, products, partnerships, and advertising. These forward-thinking brands have tried every strategy to meet the demand for footwear, including aggressive digital campaigns, offering a wide range of innovative and customizable products, including sustainable footwear, unique, and gender-neutral designs that cater to the preferences of all age groups, including athletic shoes specifically designed for kids, and brand collaborations.

KEY INDUSTRY DEVELOPMENTS:

In October 2021, Puma SE established its largest store in north India in Gurgaon. The store, which is located in Gurgaon's CyberHub retail area, is a "digitally-enabled experience store" with digital touchpoints designed to attract digitally savvy clients who are increasingly purchasing online.

In July 2021, Nike unveiled its 'Rawdacious colorway palette,' which features white as the primary colour with pink blast, total orange, and bright crimson accents, for its new line of athletic footwear, which includes the Pegasus 38, Invincible Run, ZoomX Vaporfly NEXT percent 2, and Air Zoom Alphafly NEXT percent 2.

In July 2021, Nike officially introduced the Nike App in the Philippines, Singapore, Malaysia, Thailand, Taiwan, and India, making it the company's fastest-growing platform. The debut of the Nike App signifies a significant extension of Nike's digital ecosystem in Southeast Asia and India, where the corporation aspires to establish a strong online presence.

LIST OF KEY COMPANIES PROFILED:

- Nike Inc. (Beaverton, U.S.)

- Adidas Group (Herzogenaurach, Germany)

- Mizuno Corporation (Chiyoda City, Japan)

- PUMA SE (Herzogenaurach, Germany)

- Under Armour®, Inc. (Baltimore, U.S.)

- SKECHERS USA, Inc. (Manhattan Beach, U.S.)

- FILA Holdings Corp. (Seoul, South Korea)

- Converse (Boston, U.S.)

- Diadora S.p.A. (Caerano di San Marco, Italy)

- ASICS Corp. (Chuo City, Japan)

SEGMENTATION

By Type

- Athletic Footwear

- Non-Athletic Footwear

By End User

- Men

- Women

- Kids

By Distribution Channel

- Offline Retail Stores

- Online Retail Stores

By Region

- North America- U.S., Mexico, Canada

- Europe- UK, France, Germany, Italy, Spain, Rest of Europe

- Asia-Pacific- China, Japan, India, South Korea, Rest of Asia Pacific

- South America- Brazil, Argentina, Colombia, Rest of South America

- The Middle East and Africa- GCC, South Africa, Rest of Middle East & Africa

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Global Footwear Market Size

- June-2022

- 140

- Global

- retail

Related Research

Activewear Market Size, Share, Growth & Industry Analysis, By Product Type (Athletic Shoes, Sports B

March-2025

Agrobacterium tumefaciens Competent Cells Market Insights 2022, Global Analysis and Forecast to 2030

July-2021

Aluminium Composite Panels (ACP) Market Insights 2022, Global Analysis and Forecast to 2030

July-2021