Simultaneous Localization and Mapping Market Size, Share, Growth & Industry Analysis, Sensor Type (LiDAR, Cameras (Visual), Inertial sensors, Ultrasonic, Radar), By Method (Feature-based, Direct, Semantic, RGB-D, Visual-Inertial), By Applications (Autonomous vehicles, Robotics, AR/VR, Drones, Industrial automation, Consumer electronics), Regional Analysis, 2025 to 2032.

Market Definition

Simultaneous Localization and Mapping is a technology that helps robots, drones, and other smart machines understand where they are while creating a map of their surroundings at the same time. It uses sensors like cameras, lasers (LiDAR), and motion detectors to figure out the machine’s exact position and build a detailed map in real time.

The Simultaneous Localization and Mapping market includes companies that make the hardware, develop the software, and provide services for uses like self-driving cars, robots, virtual and augmented reality (AR/VR), drones, and factory automation. This market covers everything needed to help machines navigate safely and accurately in different environments.

Simultaneous Localization and Mapping Market Overview

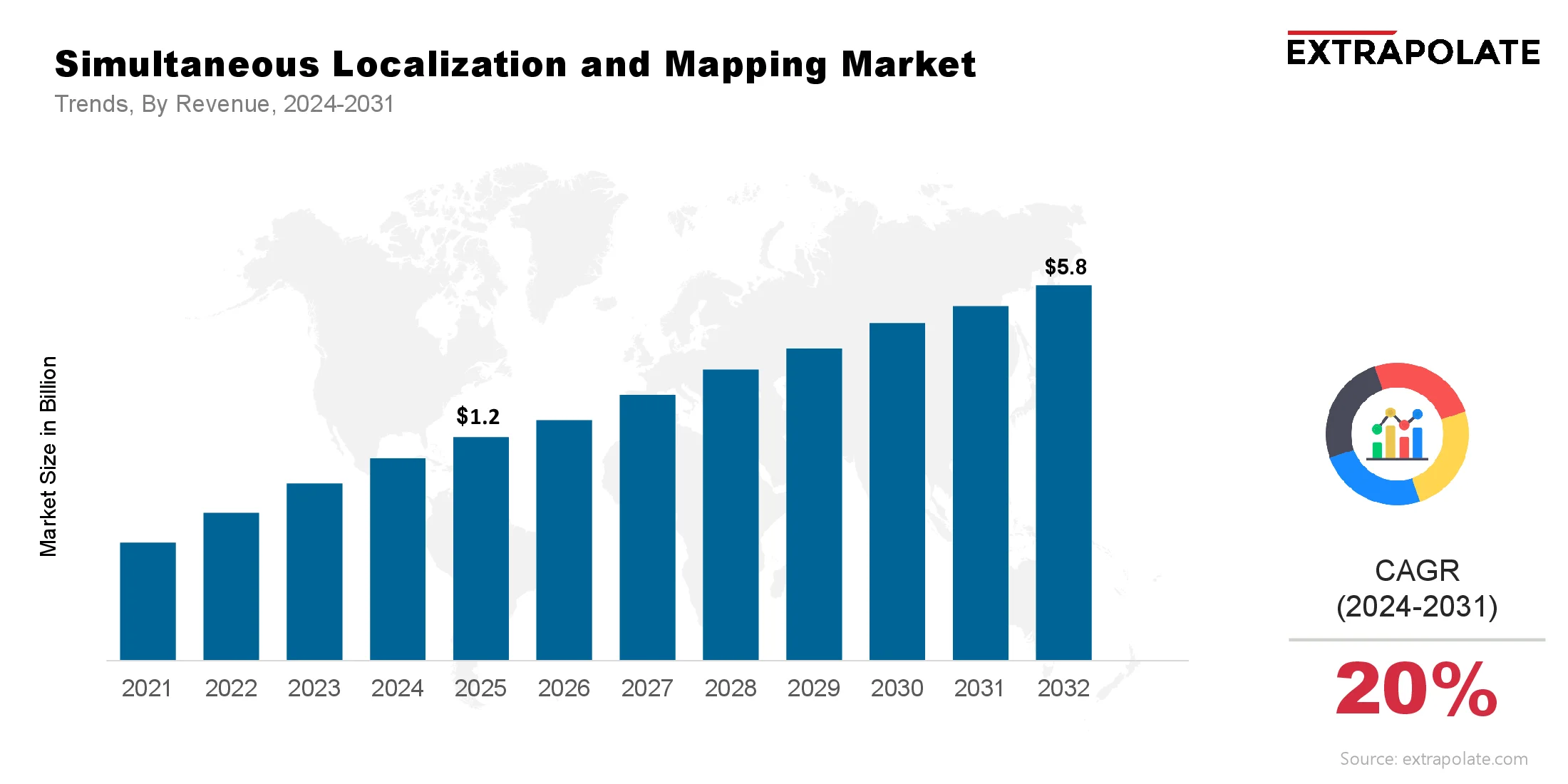

In 2025, the global Simultaneous Localization and Mapping market was worth about USD 1.2 billion, and it’s expected to grow to around USD 5.8 billion by 2032, growing at an annual rate of over 20%. This fast growth is because more industries like automotive, robotics, and AR/VR are using Simultaneous Localization and Mapping to improve performance and safety.

Better sensors, more powerful computers, and smarter software are making Simultaneous Localization and Mapping technology easier to use and more reliable. This growth is driven by the need for autonomous vehicles to safely navigate roads, robots to work in factories, and AR devices to interact with the real world accurately.

Major players in the market include well-known companies such as Google (Waymo), Nvidia, Microsoft, Qualcomm, Bosch, Velodyne Lidar, Leica Geosystems, Intel, DJI, and iRobot. These companies invest heavily in research to create smarter, faster, and more efficient Simultaneous Localization and Mapping systems, often working together to combine hardware and software innovations.

Key Market Highlights:

- The Simultaneous Localization and Mapping market was valued at USD 1.2 billion in 2024.

- It is expected to grow at a rate of 20.1% per year from 2025 to 2032.

- North America held around 38% of the market in 2024, worth USD 456 million.

- The LiDAR-based Simultaneous Localization and Mapping systems made up USD 420 million of sales in 2024 because they are highly accurate and reliable.

- Visual Simultaneous Localization and Mapping software, used in AR/VR and robots, is expected to reach USD 2.3 billion by 2032.

- Autonomous vehicles are a big user segment, projected to hit USD 2.1 billion by 2032.

- Asia Pacific is the fastest-growing region, with a growth rate above 22%, due to rising demand for automation, drones, and AR devices.

Market Driver

More Self-Driving Cars and Robots

The rising number of self-driving cars needing Simultaneous Localization and Mapping helps the market grow. Simultaneous Localization and Mapping lets these cars understand and react to the road and surroundings safely.

Car makers use sensors like LiDAR and cameras with Simultaneous Localization and Mapping to help their vehicles “see” and map the environment perfectly. Government support for smart transport and new city infrastructure also pushes more use of Simultaneous Localization and Mapping.

For example, in April 2025, Waymo upgraded their autonomous cars with improved LiDAR and visual Simultaneous Localization and Mapping to make navigation safer in busy cities. They are also building bigger data centers to update maps frequently for better performance.

Market Challenge

High Power Use and Complex Computing

Simultaneous Localization and Mapping requires a lot of computing power to process sensor data in real-time, which can drain batteries quickly in small devices like drones and AR glasses. Running Simultaneous Localization and Mapping smoothly without delays while keeping battery life is challenging. To fix this, companies are making smaller, more energy-efficient Simultaneous Localization and Mapping algorithms and special processors, but these solutions can be costly and complex.

For instance, Nvidia released a new Jetson platform in 2025 that uses AI to speed up Simultaneous Localization and Mapping while using less power, making it ideal for robots and autonomous systems.

Market Trend

Using AI and Cloud for Better Simultaneous Localization and Mapping

More companies are adding artificial intelligence (AI) and cloud computing to Simultaneous Localization and Mapping. AI helps make maps more accurate and reduce errors over time, while cloud computing allows multiple devices to share and update maps in real-time. This is especially useful in factories, AR/VR games, and fleets of autonomous vehicles where devices work together and need up-to-date maps.

In March 2025, Microsoft launched a cloud-based Simultaneous Localization and Mapping service called Azure Digital Twins, providing scalable mapping and localization solutions to industries and AR/VR platforms.

Simultaneous Localization and Mapping Market Snapshot

Segment | Categories |

Sensor Type | LiDAR, Cameras (Visual), Inertial Sensors, Ultrasonic, Radar |

SLAM Method | Feature-based, Direct, Semantic, RGB-D, Visual-Inertial |

Applications | Autonomous Vehicles, Robotics, AR/VR, Drones, Industrial Automation, Consumer Electronics |

Regions | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

Market Segmentation

- LiDAR sensors led the market in 2024 with USD 420 million in sales because of their accuracy in cars and industrial robots.

- Feature-based Simultaneous Localization and Mapping is widely used due to its reliability, but AI-driven semantic Simultaneous Localization and Mapping is gaining popularity for smarter robots.

- Autonomous vehicles make up the largest portion of demand, but robots and AR/VR devices are fast-growing areas too.

Regional Market Analysis

North America is the biggest market, making up 38% in 2024, thanks to advanced tech development, many self-driving car companies, and strong government backing for smart systems. The region also benefits from widespread cloud services that aid Simultaneous Localization and Mapping adoption.

Asia-Pacific is growing the fastest with over 22% yearly growth due to booming industrial automation, heavy drone use in agriculture and delivery, and growing AR/VR industries in China, Japan, and South Korea. Government support for smart manufacturing and digital innovation helps the growth.

Europe is steadily growing, focusing on automotive innovations and factory robots through partnerships between car makers and technology firms.

Regulatory Framework

In the United States, agencies like the National Highway Traffic Safety Administration (NHTSA) and the Federal Aviation Administration (FAA) regulate how autonomous cars and drones operate, impacting Simultaneous Localization and Mapping technology use. Rules around data privacy, safety, and security also affect the market.

Competitive Landscape

The Simultaneous Localization and Mapping market is competitive, with companies teaming up to improve technology and expand reach. They focus on creating precise, scalable Simultaneous Localization and Mapping systems for urban navigation, factories, and AR/VR experiences. Firms invest heavily in research, buy smaller startups, and partner with platforms to stay ahead.

For example, in April 2025, Nvidia joined forces with Leica Geosystems to develop AI-powered Simultaneous Localization and Mapping solutions for construction and infrastructure monitoring, combining Nvidia’s computing power with Leica’s sensor tech.

Key Companies in Simultaneous Localization and Mapping Market

- Google (Waymo)

- Nvidia

- Microsoft

- Qualcomm

- Bosch

- Velodyne Lidar

- Leica Geosystems

- Intel

- NavVis

- DJI

- iRobot

- ROBOTIS

- Ouster

Recent Product Launches

- In July 2025, DJI launched the Matrice 350 RTK drone featuring a built-in Visual-Inertial Simultaneous Localization and Mapping system for precise flight and obstacle avoidance in industrial inspections.

- In February 2025, Qualcomm released its Snapdragon XR2 Gen 2 chip with improved Simultaneous Localization and Mapping hardware to boost AR/VR device accuracy and reduce delays.

Extrapolate Says

The Simultaneous Localization and Mapping (SLAM) market is poised for significant evolution, driven by increasing integration across industries such as automotive, robotics, AR/VR, and industrial automation. Extrapolate observes that the market is benefiting from advancements in sensor technologies, artificial intelligence, and cloud computing, which are making SLAM systems more accurate, scalable, and efficient.

As companies push for real-time spatial awareness and intelligent navigation, SLAM is becoming a foundational technology across various smart systems. While North America remains a technology leader, emerging economies in Asia-Pacific are rapidly adopting SLAM-enabled solutions, signaling a shift in innovation and demand centers.

Businesses that embrace agile development, cross-industry collaboration, and cutting-edge R&D will be best positioned to capitalize on the next wave of opportunities in this dynamic market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Simultaneous Localization and Mapping Market Size

- August-2025

- 140

- Global

- information-technology-communication-iot

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021