Transplant Diagnostic Market Size, Share, Growth & Industry Analysis, By Product Type (Molecular Diagnostics, Immunoassays, Tissue Typing Kits, Others), By Application (Organ Transplant Compatibility Testing, Post-Transplant Monitoring, Transplant Rejection Detection, Others), and Regional Analysis, 2024-2031

Transplant Diagnostic Market: Global Share and Growth Trajectory

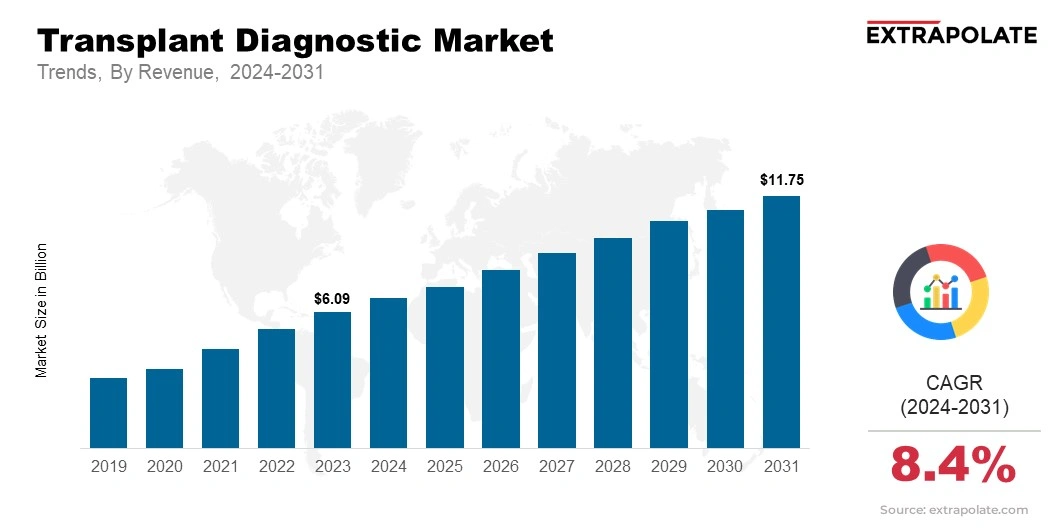

The global Transplant Diagnostic Market size was valued at USD 6.09 billion in 2023 and is projected to grow from USD 6.66 billion in 2024 to USD 11.75 billion by 2031, exhibiting a CAGR of 8.4% during the forecast period.

The global market is experiencing robust growth, driven by advancements in medical technologies, the increasing prevalence of organ transplants, and the growing need for precise diagnostic tools to ensure transplant success.

This market encompasses a wide range of diagnostic tests and technologies used to evaluate organ compatibility, monitor post-transplant health, and prevent organ rejection.

As the demand for organ transplants rises and the understanding of transplant immunology advances, transplant diagnostic solutions are becoming more sophisticated, offering more accurate and reliable results for better patient outcomes.

Technological advancements in diagnostic tools, including molecular testing, biomarker identification, and genomic profiling, are significantly enhancing the ability to assess organ compatibility and monitor the recipient's immune response.

These innovations are critical in preventing transplant rejection, ensuring the long-term success of organ transplants, and reducing the risk of complications. As diagnostic technologies become more refined, they are helping healthcare providers optimize treatment protocols, minimize the risk of rejection, and improve patient survival rates.

The transplant diagnostic market is further growing due to increasing global efforts to improve organ donation rates, along with heightened awareness surrounding the need for organ transplantation.

With the rising demand for more personalized and effective diagnostic methods, the market is seeing increased adoption of advanced technologies that offer high sensitivity and specificity in detecting transplant-related complications.

As the market evolves, the growing emphasis on precision medicine, combined with advancements in biotechnology and healthcare infrastructure, is expected to further drive the demand for transplant diagnostics.

The market is poised for continuous expansion, as both emerging markets and established healthcare systems recognize the importance of efficient and reliable diagnostic solutions in enhancing the success of organ transplantation.

With the continual progress of medical research and the increasing number of transplant surgeries worldwide, the market is expected to grow steadily in the coming years.

Key Market Trends Driving Product Adoption

The transplant diagnostic market is growing rapidly. Several key trends are driving this growth.

- Advancements in Molecular Diagnostics: New techniques like polymerase chain reaction (PCR) and next-generation sequencing (NGS) are improving transplant diagnostics. These methods help detect organ rejection. They do so more accurately and quickly.

- Rising Organ Transplants: More organ transplants are taking place worldwide. This includes kidneys, livers, and hearts. The increase in transplants is creating a greater need for diagnostic solutions. These solutions help ensure organ compatibility.

- Personalized Medicine: The trend toward personalized medicine is growing. This approach tailors treatments based on a person’s genetic and immunological profile. It makes transplant diagnostics more important. It helps prevent rejection and improves outcomes.

- Regulatory Advancements: New regulations and guidelines are being introduced. These aim to improve transplant success rates. These advancements are encouraging the use of advanced diagnostic tests in transplantation procedures.

Major Players and their Competitive Positioning

The transplant diagnostic market is very competitive. Big companies like Thermo Fisher Scientific, Abbott Laboratories, Qiagen, and Hologic are leading the way.

These companies provide various transplant diagnostic solutions. This includes molecular tests, immunoassays, and tissue typing kits. These tests help make organ transplants successful. Smaller companies are also becoming more popular.

They offer new solutions for transplant compatibility testing, post-transplant monitoring, and rejection detection.

Consumer Behavior Analysis

Industries and healthcare facilities using transplant diagnostic solutions include:

- Hospitals & Clinics: Healthcare providers are using advanced tests. These tests help improve the success of organ transplants. They also reduce the risk of transplant rejection.

- Transplant Centers: These centers focus on transplant procedures. They use diagnostic tools to match organ donors with recipients. They also monitor the health of transplant recipients.

- Research & Academia: Research institutions and universities are making progress in transplant diagnostics. They conduct studies on genetic profiling, immunological testing, and transplant immunology.

Pricing Trends

Pricing in the transplant diagnostic market depends on several factors. These include the complexity of the diagnostic technology, the type of organ being transplanted, and how personalized the test is.

Molecular diagnostic tests, like NGS and PCR-based assays, are usually more expensive. This is because they use advanced technology and offer high accuracy. However, as the market grows and more competition enters, companies are working to lower costs. This will make these tests more affordable for hospitals, transplant centers, and clinics worldwide.

Growth Factors

The transplant diagnostic market is growing due to several factors:

- More Chronic Diseases: Chronic conditions like diabetes, heart disease, and kidney failure are increasing. This raises the need for organ transplants and diagnostic tests.

- Better Technology: New tools like PCR, NGS, and immunoassays are making tests more accurate, helping the market grow.

- More Organ Donation Awareness: As people learn more about organ donation, the number of transplants increases. This drives the need for better diagnostic tests.

- Personalized Medicine: Personalized medicine uses genetic and immunological data for better treatment. This improves transplant outcomes and increases the need for diagnostics.

Regulatory Landscape

The transplant diagnostic market is governed by various regulations. These regulations are in place to ensure the safety and effectiveness of diagnostic tests used in organ transplantation.

Key regulatory bodies, such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other national health authorities, set these standards. Companies must comply with these regulations to enter or expand in the market. Adhering to these standards is essential for success in the transplant diagnostics industry.

Recent Developments

Transplant diagnostics is a rapidly changing market. Several noteworthy inventions are behind this change:

- Next-Generation Sequencing (NGS): The diagnosis of transplants are increasingly using NGS. It aids in providing precise genetic profiles of both receivers and donors. Transplant success rates increase as a result.

- Molecular Diagnostics: Advances are being made in PCR-based and other molecular testing. Better patient outcomes result from the prompt diagnosis of transplant rejection made possible by these testing.

- Non-Invasive Diagnostics: Non-invasive diagnostics are being developed by businesses. Without requiring a biopsy, these tests assist in monitoring transplant recipients and identifying rejection early.

Current and Potential Growth Implications

Demand Supply Analysis:

The demand for organ transplants is increasing. This is creating a need for better diagnostic tests. These tests help check if the organ will match and prevent rejection. However, providing high-quality tests can be difficult. The technologies used are complex and expensive.

Gap Analysis:

The market faces many challenges. These challenges include:

- High Costs: Advanced diagnostic technologies, like NGS and PCR, are expensive. This makes them hard to afford in low- and middle-income countries.

- Lack of Awareness: Many people in some regions do not know the importance of transplant diagnostics. This can slow down market growth.

- Complexity of Tests: Some diagnostic tests are complicated. They need special training and equipment. Smaller hospitals and clinics may find this challenging.

Top Companies in the Transplant Diagnostic Market

- Thermo Fisher Scientific

- Abbott Laboratories

- Qiagen N.V.

- Hologic, Inc.

- Bio-Rad Laboratories

- CareDx, Inc.

- GenDx

- One Lambda (Thermo Fisher)

- STRATA Pathology Services, Inc.

- Roche Diagnostics

Transplant Diagnostic Market: Report Snapshot

Segmentation | Details |

By Product Type | Molecular Diagnostics, Immunoassays, Tissue Typing Kits, Others |

By Application | Organ Transplant Compatibility Testing, Post-Transplant Monitoring, Transplant Rejection Detection, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High-Growth Segments

- Organ Transplant Compatibility Testing: This area has the highest demand. Accurate tests are important to lower the risk of transplant rejection. They also help improve success rates.

- Molecular Diagnostics: Advanced methods like PCR and NGS are becoming more common. These technologies offer precise and personalized transplant testing. This is driving the growth of the segment.

Major Innovations

The market is evolving with new innovations. These advancements aim to improve transplant success rates.

- Next-Generation Sequencing (NGS): NGS is transforming transplant diagnostics. It provides a deeper and more accurate understanding of organ compatibility.

- Non-Invasive Testing: New non-invasive tests help detect transplant rejection. They improve patient comfort and lower healthcare costs.

- Personalized Diagnostics: Medicine is becoming more personalized. Custom transplant tests are now designed for each person’s genetic and immune profile.

Potential Growth Opportunities

The market has great opportunities for growth.

- Market Expansion: Organ transplant rates are rising worldwide. This increases the demand for advanced transplant diagnostic solutions. Both developed and developing markets will see growth.

- Technological Innovation: New advancements in molecular diagnostics, genetic testing, and non-invasive monitoring will drive market growth. These innovations will create big opportunities for companies.

- Emerging Markets: Countries in Asia-Pacific have strong growth potential. As healthcare systems improve, the need for organ transplants will also increase.

Extrapolate Research says:

The transplant diagnostic market is growing. More people need organ transplants. New technologies are making testing easier and better. This helps both big and small companies. People seek better organ matches and successful transplants. The market is growing fast, especially in North America, Europe, and Asia-Pacific.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Transplant Diagnostic Market Size

- April-2025

- 148

- Global

- healthcare-medical-devices-biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021