N95 Grade Medical Protective Mask Market Size, Share, Growth & Industry Analysis, By Product Type (N95 Respirators, Reusable N95 Masks, Disposable N95 Masks), By Application (Healthcare, Industrial, Construction, Military, General Use), By End User (Healthcare, Industrial Workers, General Public, First Responders, Military), and Regional Analysis, 2024-2031

N95 Grade Medical Protective Mask Market: Global Share and Growth Trajectory

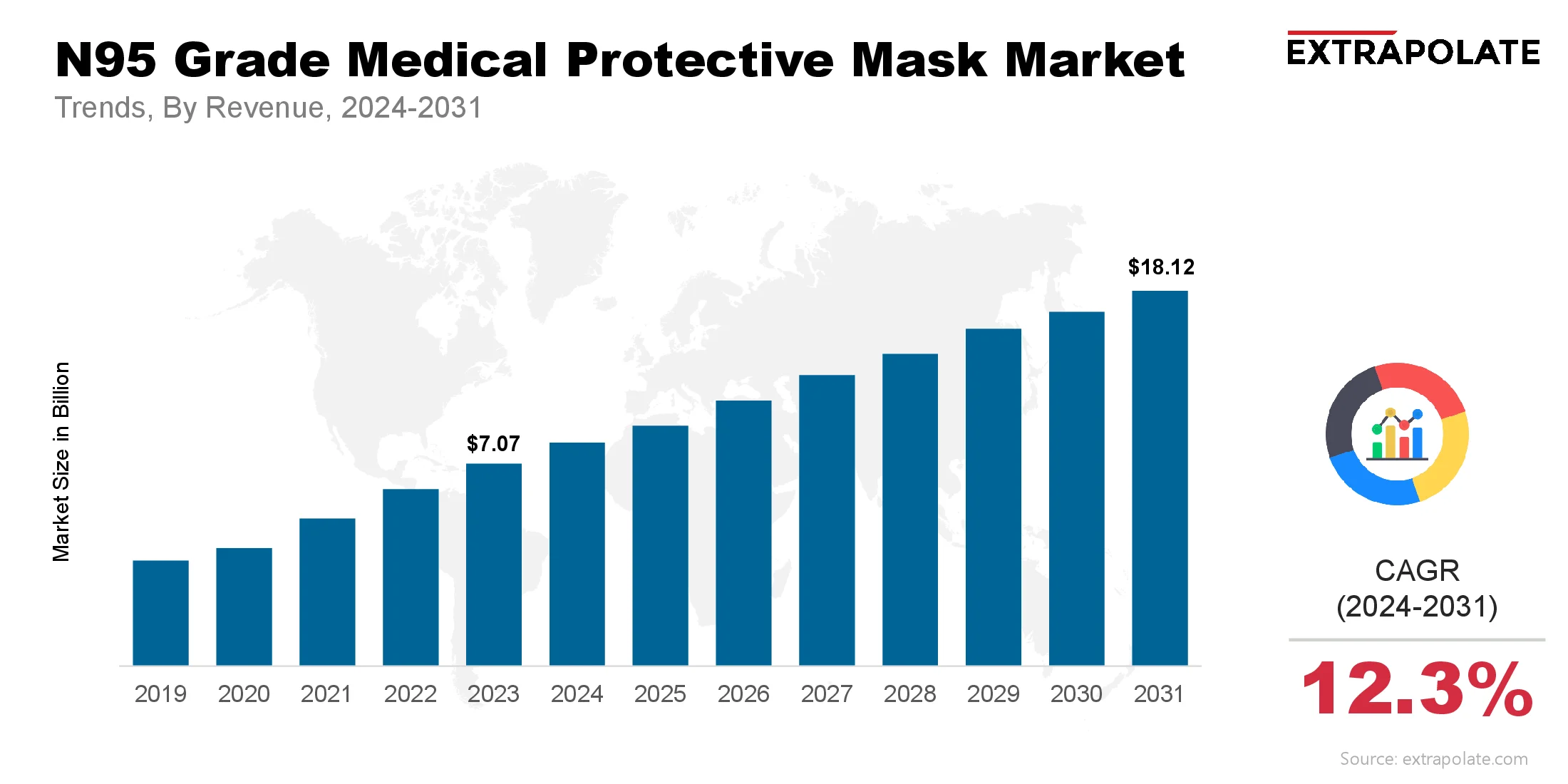

The global N95 Grade Medical Protective Mask Market size was valued at USD 7.07 billion in 2023 and is projected to grow from USD 8.02 billion in 2024 to USD 18.12 billion by 2031, exhibiting a CAGR of 18.12 % during the forecast period.

The market will experience robust growth. This is because of improved health safety awareness, technological improvements in mask manufacturing, and high demand for personal protective equipment (PPE) during health emergencies such as COVID-19. N95 masks filter out a minimum of 95% of airborne particles, hence playing an important role in medical facilities, industrial environments, and polluted regions. As worldwide health threats increase, so will demand for protective masks of good quality.

The N95 mask industry also reaps more respiratory illnesses and heightened personal protection sensitization. Harsher health legislations across the globe are forcing demand for superior-grade masks across healthcare and other industries.

The N95 masks are now established as the new benchmark for quality protection, particularly in hospitals and clinics where employees' and patients' safety matters most. These masks are also becoming popular in other industries such as construction, mining, and manufacturing, where it is dangerous to breathe in toxic dust and fumes.

Developments in manufacturing and material sciences have made N95 masks more comfortable, fitted, and effective. Freshly developed breathable fabrics, stretchy straps, and seal improvement technology create better comfort for wearers without the trade-off on safety for prolonged periods.

In addition to that, increased emphasis on reusable and eco-friendly N95 masks should help enhance the growth in the market. Given issues surrounding environmental footprint by disposable masks, industries are working toward adopting eco-friendly varieties while not compromising protection strength.

Regional N95 mask markets are promising growth. North America and Europe are expected to be dominant in demand because of robust healthcare infrastructures, government incentives, and air awareness.

Asia Pacific and Latin America could, however, have the highest growth rates because of urbanization, industrialization, and health protocol awareness. More use of protective equipment in the workplace and public spaces is also observed in emerging markets, particularly after the recent global health crises.

In summation, the worldwide N95 mask market has a strong outlook for growth. This is led by technological progress, safety and health issues, and continuous PPE requirements in industries. With the development of the market, businesses will work to improve the performance of their products, design sustainable products, and increase growth in emerging economies to take greater shares of this rapidly expanding business.

Key Market Trends Driving Product Adoption

The N95 Grade Medical Protective Mask industry is evolving as a result of medical requirements, emerging regulations, and customer demand for improved protection. Some of the major trends behind growth are:

- Health and Safety Issues: Increasing numbers of individuals are concerned about airborne infections, pollution, and viral outbreaks. This creates increased demand for N95 masks, which are highly efficient at filtration.

- Government Standards and Regulations: New regulations by the government are boosting the use of protective gear, particularly in the industrial and healthcare industries.

- Advances in Technology: Continuous technological developments in design and materials enhance comfort, durability, and effectiveness of N95 masks. New designs provide improved breathability and filtration.

- Eco-friendly and Sustainable Options: With concerns about the disposal of disposable PPE rising, individuals are increasingly looking for reusable or sustainable alternatives to traditional N95 masks.

Major Players and their Competitive Positioning

The N95 Grade Medical Protective Mask market is dominated by major players such as 3M, Honeywell, Kimberly-Clark, and Makrite. These companies innovate continuously to remain competitive. They add new features, improve mask designs, and comply with regulations. Small companies are coming up with specialized masks for a particular environment or industry in the meantime.

Consumer Behavior Analysis

Consumers are increasingly using N95 masks for these reasons:

- Health and Protection: N95 masks help keep people safe from airborne diseases and pollutants.

- Workplace Safety: Healthcare workers, industrial staff, and first responders wear N95 masks daily for protection.

- Government and Workplace Mandates: Many areas and organizations require N95 masks in healthcare and high-risk settings.

- Personal Comfort and Fit: Consumers want masks that fit well, have adjustable straps, and use breathable materials.

Pricing Trends

Pricing trends in the N95 Grade Medical Protective Mask market depend on the mask's design, brand, and certification. High-quality branded masks are usually more expensive. However, bulk options are often cheaper for institutions or healthcare use. The rise in demand for sustainable, reusable N95 masks is also affecting prices. Eco-friendly masks can be pricier because of their advanced materials.

The market for N95 masks has increased tremendously, particularly in Europe, North America, and Asia-Pacific. Growing awareness for health and government policies in the United States, India, and China are driving demand for these masks.

Growth Factors

Multiple forces power the growth of the market:

- Pandemic Response and Health Crises: The global reaction to pandemics, like COVID-19, has raised the demand for quality personal protective equipment.

- Technological Advancements in Filtration: New filtration technology makes N95 masks more effective and comfortable.

- Rising Air Pollution: In areas with high air pollution, N95 masks are becoming a popular choice for respiratory safety.

- Growing Awareness and Regulation: Health authorities and governments are enforcing stricter rules, leading to more use of high-quality protective gear.

Regulatory Landscape

The rules for N95 Grade Medical Protective Masks are vital for safety and effectiveness. Countries have strict regulations, like NIOSH certification in the U.S. and CE marking in Europe. Companies must follow these standards to keep trust and guarantee product reliability.

Recent Developments

The N95 Grade Medical Protective Mask industry is witnessing major transformations:

- Improved Filtration Materials: Innovative materials are enhancing the effectiveness and comfort of N95 masks.

- Improvement in Comfort: Companies are providing adjustable straps, nose clips, and breathable linings for improved comfort.

- Green initiatives: Firms are producing reusable N95 masks and employing biodegradable material in a bid to cut down on wastage.

- Automated Production: Greater automation of mask manufacturing increases efficiency and covers rising demand.

Current and Potential Growth Implications

- Demand-Supply Analysis

The need for N95 masks is high. This is due to increased health concerns and safety requirements. But production capacity may be affected by issues of supply chain and availability of raw materials.

- Gap Analysis

The N95 mask market is increasing rapidly, yet there is room for improvement:

- Capacity: Increasing the manufacturing capacity to serve global needs might be challenging, particularly in the event of a health crisis.

- Fit and Comfort: N95 masks have good filtering but can be painful to wear over long periods. We must create new innovations for better comfort.

- Access and Affordability: Making N95 masks accessible and affordable, particularly in developing regions, is a significant challenge.

Top Companies in the N95 Grade Medical Protective Mask Market

Some of the top companies in the N95 Grade Medical Protective Mask industry include:

- 3M

- Honeywell

- Kimberly-Clark

- Makrite

- Cardinal Health

- Dräger

- Gerson

- VB Medical

- ClearMask

- Ansell

N95 Grade Medical Protective Mask Market: Report Snapshot

Segment | Details |

By Product Type | N95 Respirators, Reusable N95 Masks, Disposable N95 Masks |

By Application | Healthcare, Industrial, Construction, Military, General Use |

By End User | Healthcare, Industrial Workers, General Public, First Responders, Military |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

High Growth Segments

The following market segments are set for significant growth:

- Healthcare Sector: The demand for N95 masks in healthcare is high due to ongoing global health crises.

- Industrial Sector: Workers in construction and manufacturing are increasingly using N95 masks for respiratory protection.

- General Public: More people are adopting N95 masks for personal use amid health concerns, especially during flu seasons or pollution spikes.

Major Innovations

Innovation is the key to remaining competitive in the market. Some of the most recent developments include:

- Improved Filtration: Advances in materials in N95 masks increase filtration of minute particles.

- Comfort Advances: Designs are now improved for long wear with better comfort, including adjustable ear loops and breathable materials.

- Intelligent Mask Technologies: Intelligent N95 masks now feature sensors to monitor air quality and wear duration.

Potential Growth Opportunities

Firms in the N95 Grade Medical Protective Mask industry have a number of opportunities:

- Increased Competition: There are more manufacturers coming into the market with increased demand for N95 masks.

- Innovation in Technology: Firms need to weigh off increased technology against affordability.

- Compliance with Regulations: They have to abide by numerous global standards and regulations.

- Supply Chain Issues: Maintaining an uninterrupted supply of raw materials and parts during health emergencies is important.

Kings Research says:

The N95 Grade Medical Protective Mask market has potential for dramatic growth. It is stimulated by demand from medical, industrial, and general consumer sectors. Companies that upgrade product characteristics, increase output, and satisfy regulatory requirements will dominate the shifting market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

N Grade Medical Protective Mask Market

- May-2025

- 148

- Global

- healthcare-medical-devices-biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021