Medical Syringe Market Size, Share, Growth & Industry Analysis, By Product Type (Safety Syringes, Prefilled Syringes, Insulin Syringes, Traditional Syringes), By Application (Drug Delivery, Vaccination, Insulin Injections, Biologic Deliveries), By End User (Hospitals, Clinics, Homecare, Pharmaceutical Companies), and Regional Analysis, 2024-2031

Medical Syringe Market: Global Share and Growth Trajectory

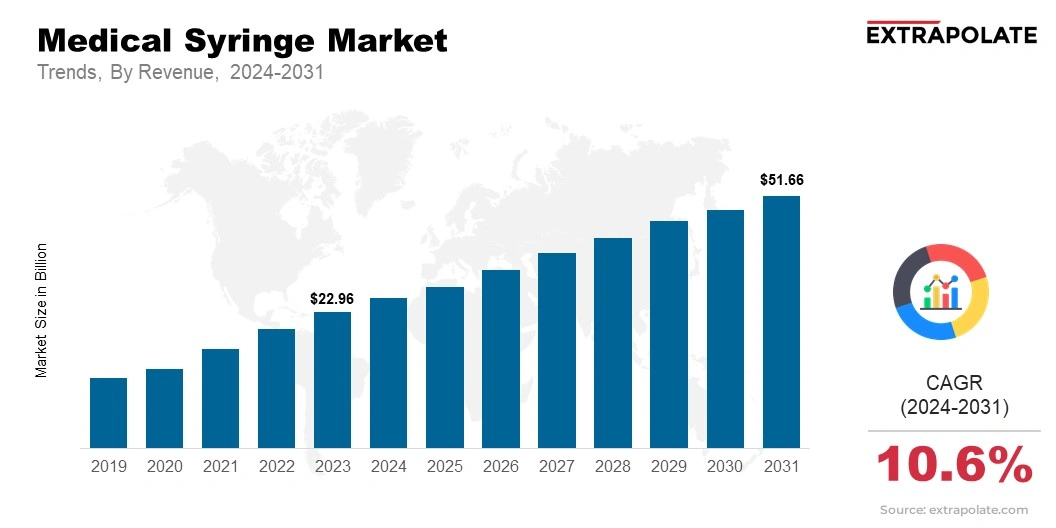

The global Medical Syringe Market size was valued at USD 22.96 billion in 2023 and is projected to grow from USD 25.60 billion in 2024 to USD 51.66 billion by 2031, exhibiting a CAGR of 10.6% during the forecast period.

The global market is growing rapidly, due to increasing healthcare needs, advances in drug delivery, and demand for safe & efficient medical devices. This market covers a broad range of syringes. We can see disposable syringes, prefilled syringes, insulin syringes, vaccinations, and biologic therapies gaining traction.

Medical syringes ensure precision, convenience, and patient safety. These include safety syringes, auto-disable syringes, and prefilled syringes. They prevent needle injuries, reduce mistakes, and make frequent injections more convenient.

Prefilled syringes are becoming popular for their ease of use, accurate dosing, and reduced contamination risk. Innovations like needleless syringes are also aiding in market growth.

People with chronic diseases like diabetes, cancer, and heart problems need regular injections, increasing syringe use. Post COVID-19, vaccination programs have raised syringe use. Now, home healthcare and self-administered drugs are making medical syringes more popular.

Advanced drug delivery systems are becoming popular, due to their improved safety and efficiency. The market is expected to grow, offering opportunities for manufacturers and healthcare providers to improve patient care globally.

Key Market Trends Driving Product Adoption

Several trends are influencing the growth of the medical syringe market:

- Many patients with chronic diseases like diabetes need regular injections. They prefer using insulin or prefilled syringes themselves.

- Syringes, such as safety syringes with retractable needles and prefilled syringes for biologics, are safer and efficient.

- Vaccination efforts takes all over the world, particularly in developing countries, are increasing syringe use.

Major Players and Competitive Positioning

Big companies like Becton Dickinson, Terumo Corporation, Medtronic, and B. Braun Melsungen lead the medical syringe market with advanced technologies, diverse products, and strong distribution networks. Meanwhile, smaller firms focus on specialized syringes for specific medical needs.

Consumer Behavior Analysis

Key consumers of medical syringes are:

- Healthcare Providers such as hospitals & clinics use syringes for various treatments.

- Patients, particularly those with chronic conditions like diabetes, often use syringes for self-administered medications, such as insulin.

- Pharmaceutical Companies use prefilled syringes to ensure accurate dosing and efficient delivery of medications, often for biologics and other injectable drugs.

Pricing Trends

Medical syringe prices vary based on the type, brand, application, and several other factors. Safety syringes and prefilled syringes command higher prices than traditional syringes. This is primarily due to their advanced features and technology. Growing competition and advancements are making syringes affordable, especially in emerging markets.

Growth Factors

- Increasing incidence of diabetes and cardiovascular diseases drives the need for regular injections and, consequently, syringes.

- New syringe designs, like needle-free and safety syringes, make injections easier and safer.

- Expanding hospitals and clinics, especially in developing countries, is increasing the demand for syringes.

Regulatory Landscape

Regulations for medical syringes are different in each region. For instance, in the U.S., the FDA regulates the safety and effectiveness of syringes. The EMA manages syringe regulations in Europe. In Asia, regulations vary by country, with some countries like India following the Medical Device Rules, 2017, and others having their own specific regulations. Companies in these regions must follow strict standards to ensure syringes are safe, of high quality, and reliable.

Recent Developments

- Safety Needles: Several companies create syringes with retractable needles or safety shields to prevent needle injuries. Companies like Hindustan Syringes and Medical Devices (HMD) are launching single-use syringes with safety needles (like Dispojekt) to reduce NSIs among healthcare workers.

- Demand for Prefilled Syringes: Such syringes are convenient, accurate, and reduce contamination risks.

- Needle-free Injections: NFIs are being explored as a sustainable alternative to syringes. These syringes are popular among patients afraid of needles.

Current and Potential Growth Implications

Demand Supply Analysis: More people need medical syringes. Injectable drugs and vaccines are driving demand. Supply chain problems affect the market and raw material shortage slow growth.

Gap Analysis: The market has changed over time. Needle-stick injuries and better syringe designs are still challenges. More people want syringes that are easy to use. Safety features are also in high demand.

Top Companies in the Medical Syringe Market

- Becton Dickinson

- Terumo Corporation

- Medtronic

- B. Braun Melsungen

- Smiths Medical

- Hoffmann-La Roche

Medical Syringe Market: Report Snapshot

Segmentation | Details |

By Product Type | Safety Syringes, Prefilled Syringes, Insulin Syringes, Traditional Syringes |

By Application | Drug Delivery, Vaccination, Insulin Injections, Biologic Deliveries |

By End User | Hospitals, Clinics, Homecare, Pharmaceutical Companies |

By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

High-growth Segments

- Prefilled Syringes: For accurate, efficient drug delivery.

- Safety Syringes: Essential to prevent injuries & infections.

- Insulin Syringes: Prevalence of diabetes and heightened insulin use.

Potential Growth Opportunities

The market offers several opportunities for growth:

- Technological Advancements: Retractable needles and smart syringes are in demand.

- Expanding Healthcare Access: Development of healthcare infrastructure in emerging markets.

- Aging Population: Growing syringe use among elderly patients requiring injectable treatments.

Extrapolate Research says:

Rising healthcare needs, adoption of new technologies, and a focus on safety contribute to the market growth. Companies creating advanced syringes may benefit from this growth. Looking ahead, the medical syringe market is expected to boom.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Medical Syringe Market Size

- April-2025

- 160

- Global

- healthcare-medical-devices-biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021