mRNA Vaccine and Therapeutics Market Size, Share, Growth & Industry Analysis, By Product Type (mRNA Vaccines, mRNA Therapeutics (Oncology, Infectious Diseases, Rare Diseases)) By Application (Infectious Disease Prevention, Cancer Immunotherapy, Protein Replacement, Others) By End User (Hospitals, Clinics, Research Institutes, Biopharmaceutical Companies), and Regional Analysis, 2024-2031

mRNA Vaccine and Therapeutics Market: Global Share and Growth Trajectory

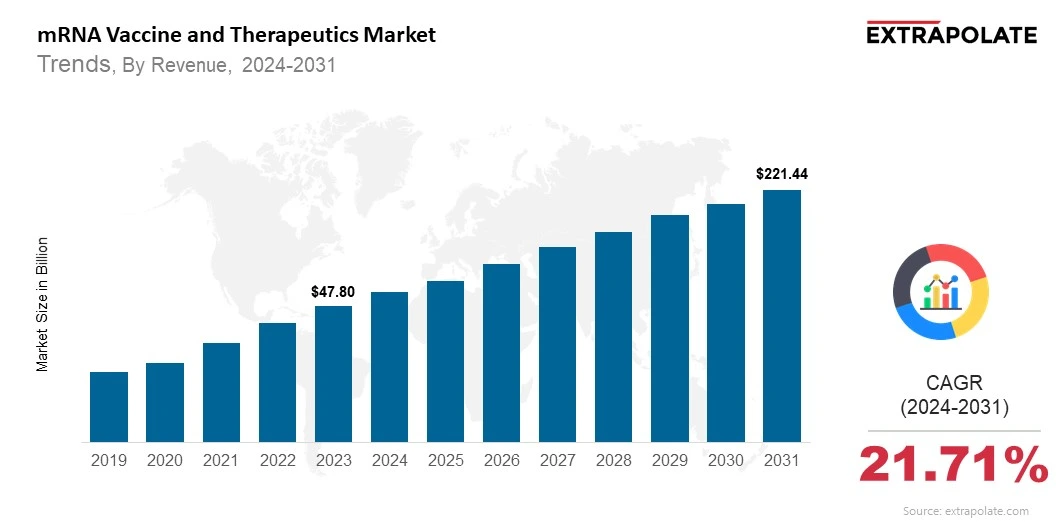

The global mRNA Vaccine and Therapeutics Market size was valued at USD 47.80 billion in 2023 and is projected to grow from USD 55.94 billion in 2024 to USD 221.44 billion by 2031, exhibiting a CAGR of 21.71% during the forecast period.

The global market is witnessing remarkable expansion, propelled by ground breaking scientific advancements, rising investments in biotechnology, and the urgent need for effective treatments against infectious diseases and genetic disorders.

This dynamic market covers a broad spectrum of mRNA-based products, including vaccines targeting infectious diseases such as COVID-19, influenza, and cytomegalovirus, as well as therapeutics aimed at cancer, rare diseases, and autoimmune conditions.

The surge in demand for mRNA vaccines can be largely attributed to their rapid development timeline, high efficacy, and adaptability against emerging pathogens, making them a pivotal tool in global public health responses.

Additionally, the ability of mRNA therapeutics to instruct cells to produce proteins that can treat or prevent disease is opening new avenues in personalized medicine and targeted therapies.

Technological advancements in delivery systems, such as lipid nanoparticles, have significantly enhanced the stability and efficacy of mRNA molecules, further accelerating market growth. Pharma firms are forming strategic partnerships and governments are increasing funding support.

At the same time, awareness of new treatments is rising. This is driving global research and development. Geographically, North America currently dominates the market due to strong healthcare infrastructure, substantial R&D investment, and early adoption of mRNA technology.

However, emerging economies in Asia-Pacific and Europe are rapidly expanding their capabilities, supported by favorable regulatory environments and growing biotechnology hubs.

Furthermore, the COVID-19 pandemic has underscored the critical importance of mRNA technology, with emergency use authorizations and widespread vaccination campaigns boosting market visibility and acceptance.

This momentum is expected to persist as companies diversify their pipelines to address other diseases, including cancer immunotherapy and rare genetic disorders.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

The mRNA vaccine and therapeutics market is marked by continual innovation, growing clinical acceptance, and expanding therapeutic applications. Key trends propelling market growth include:

• Rapid Vaccine Development: mRNA technology allows fast design and production. Its success during the COVID-19 pandemic highlighted this advantage.

• Personalized Medicine: mRNA enables tailored therapies. This is especially valuable in oncology and rare disease treatment.

• Improved Delivery Systems: Advances in lipid nanoparticles are improving delivery. These innovations enhance both stability and therapeutic impact.

• Expanding Applications: mRNA use is broadening beyond vaccines. It's now applied in protein replacement and immune modulation therapies.

• Collaborations and Partnerships: Biotech and pharma alliances are increasing. These partnerships are speeding up development across pipelines..

Major Players and their Competitive Positioning

The mRNA market is primarily led by pioneers like Moderna, BioNTech, and CureVac, alongside established pharmaceutical companies investing heavily in mRNA platforms. Emerging biotech startups and contract manufacturing organizations (CMOs) also contribute by developing novel delivery technologies and scaling production capacities.

Consumer Behavior Analysis

Adoption of mRNA vaccines and therapeutics is influenced by:

• Efficacy and Safety: Strong clinical performance builds trust. Patients and healthcare providers value proven effectiveness and low risk.

• Urgent Medical Needs: Fast responses to health crises matter. mRNA solutions are favored for pandemics and unmet conditions.

• Awareness and Education: Understanding of mRNA is growing. This is boosting confidence among the public and medical professionals.

• Accessibility: Policy and reimbursement shape access. Government support influences global market reach.

Pricing Trends

Pricing in the mRNA market varies depending on the complexity of the therapeutic, manufacturing costs, and regional healthcare policies. Premium pricing is common for novel therapies. While efforts to improve production efficiency aim to reduce costs and increase accessibility.

Growth is particularly strong in North America, Europe, and Asia-Pacific regions, driven by significant funding, advanced healthcare infrastructure, and increasing disease burden.

Growth Factors

Several factors are catalyzing the growth of the mRNA vaccine and therapeutics market:

• Technological Innovations: Progress in mRNA design and delivery systems is accelerating. Manufacturing is also becoming more scalable.

• Increased R&D Investments: Governments and private sectors are providing strong financial backing. Funding supports faster development and innovation.

• Emerging Disease Outbreaks: New infectious threats drive demand. mRNA platforms offer rapid response capabilities for pandemics and epidemics.

• Regulatory Support: Faster approval processes are emerging. Collaborative frameworks help streamline clinical advancement.

• Expanding Pipeline: More mRNA-based candidates are entering trials. Both clinical and preclinical stages are seeing rapid growth.

Regulatory Landscape

The regulatory environment is evolving with agencies like the FDA, EMA, and others providing guidance on mRNA-based products. Compliance with safety and efficacy standards is crucial. Meeting manufacturing rules is also key for market approval.

Recent Developments

The mRNA vaccine and therapeutics market continues to evolve with notable advancements including:

• Next-Generation Vaccines: New mRNA vaccines are in development. Targets include influenza, Zika, and other emerging pathogens.

• Cancer Vaccines: Personalized mRNA cancer vaccines are advancing. Many are now progressing through clinical trials.

• Improved Formulations: Lipid nanoparticle technology is improving. Enhancements boost stability and immune response.

• Expanded Manufacturing: mRNA production capacity is scaling up. Facilities are expanding across global regions.

• Strategic Collaborations: Biotech firms are collaborating with well-established pharma companies. These alliances speed up research and development.

Current and Potential Growth Implications

Demand Supply Analysis

Demand for mRNA vaccines and therapeutics is surging, driven by urgent medical needs and expanding indications. However, raw material shortages pose challenges. Production delays can also disrupt supply chains.

Gap Analysis

Despite rapid progress, the market faces hurdles including:

• Delivery Optimization: Current delivery methods need improvement. Safer and more efficient mechanisms are still required.

• Cold Chain Requirements: Temperature sensitivity raises logistics costs. Storage and transport remain costly and complex.

• Long-term Safety Data: More clinical data is needed. Long-term studies are essential to confirm safety and efficacy.

• Cost Reduction: Manufacturing must become more efficient. Lowering production costs is critical for broader access.

Top Companies in the mRNA Vaccine and Therapeutics Market

• Moderna, Inc.

• BioNTech SE

• CureVac AG

• Pfizer Inc.

• Translate Bio (now part of Sanofi)

• Arcturus Therapeutics

• GSK plc

• Sanofi S.A.

• Novartis AG

• Johnson & Johnson

mRNA Vaccine and Therapeutics Market: Report Snapshot

Segmentation | Details |

By Product Type | mRNA Vaccines, mRNA Therapeutics (Oncology, Infectious Diseases, Rare Diseases) |

By Application | Infectious Disease Prevention, Cancer Immunotherapy, Protein Replacement, Others |

By End User | Hospitals, Clinics, Research Institutes, Biopharmaceutical Companies |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

mRNA Vaccine and Therapeutics Market: High-Growth Segments

Segments expected to drive substantial growth:

• Infectious Disease Vaccines: Especially for COVID-19 and influenza.

• Oncology Therapeutics: Personalized cancer vaccines and immunotherapies.

• Rare Disease Treatments: mRNA is being used for protein replacement. This is opening new options for treating rare genetic disorders.

Major Innovations

Key innovations transforming the market include:

• Self-Amplifying mRNA (saRNA): Enables reduced dosage. Efficacy is maintained while lowering material use.

• Lipid Nanoparticle Improvements: Enhances delivery efficiency. Side effects are reduced through improved formulations.

• Combination Therapies: mRNA is being integrated with other therapies. This approach expands treatment potential across conditions.

• AI in mRNA Design: Accelerating candidate discovery and optimization.

mRNA Vaccine and Therapeutics Market: Potential Growth Opportunities

Market players face challenges and opportunities such as:

• Manufacturing Scale-Up: Global demand is rising. Robust and scalable production facilities are essential.

• Regulatory Approvals: Regulatory pathways are complex. Companies must navigate them efficiently.

• Cold Chain Logistics: Storage remains a key issue. Innovative solutions are needed to simplify distribution.

• Competition and IP: Patent landscapes are tightening. Managing intellectual property and new entrants is critical.

• Public Perception: Vaccine acceptance depends on awareness. Clear communication can help build public trust.

Extrapolate Research says:

The global mRNA vaccine and therapeutics market is positioned for transformative growth, driven by its potential to address critical unmet medical needs rapidly and effectively. Companies that innovate and collaborate will lead. They must also handle regulatory challenges well. This will help them succeed in the fast-changing market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

mRNA Vaccine and Therapeutics Market Size

- May-2025

- 148

- Global

- healthcare-medical-devices-biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021