In Vitro Fertilization Market Size, Share, Growth & Industry Analysis, By Procedure (Conventional IVF, Egg Donation, Surrogacy, Gender Selection, Cryopreservation), By Technology (Genetic Screening, Artificial Intelligence, Embryo Freezing, Cryopreservation, Stem Cell Technologies), By End User (Fertility Clinics, Hospitals, Research Institutes, At-Home Care), and Regional Analysis, 2024-2031

In Vitro Fertilization Market: Global Share and Growth Trajectory

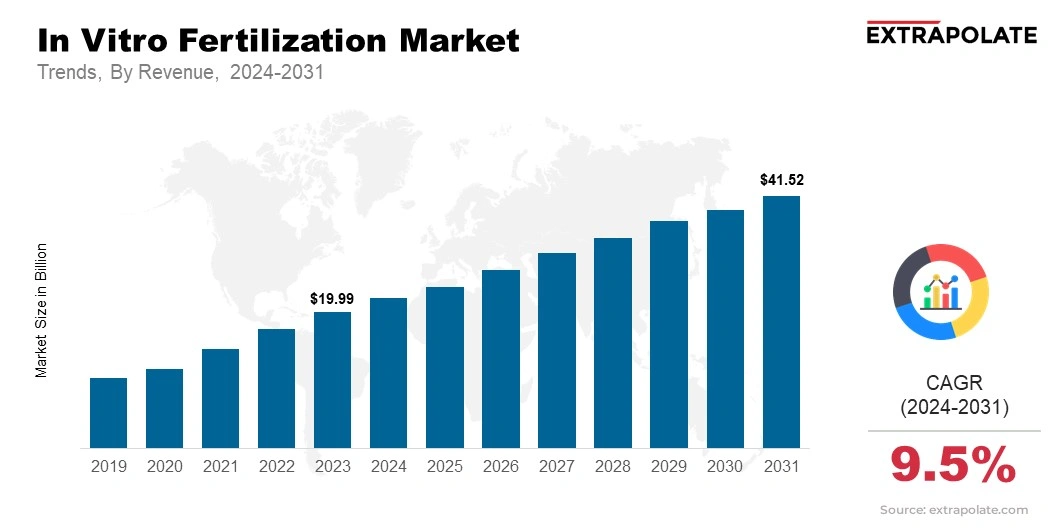

Global In Vitro Fertilization Market size was recorded at USD 19.99 billion in 2023, which is estimated to be valued at USD 22.07 billion in 2024 and reach USD 41.52 billion by 2031, growing at a CAGR of 9.5% during the forecast period.

The global In Vitro Fertilization market is experiencing robust growth, driven by rising infertility rates, advancements in reproductive technology, and increasing awareness around assisted reproductive technologies (ART). This market includes IVF procedures, IVF technologies, fertility clinics, and related services.

As IVF technology continues to evolve, it offers hope to many individuals and couples seeking to build families, making it an increasingly popular choice worldwide.

Key Market Trends Driving Product Adoption

The IVF market is characterized by rapid technological advancements, growing accessibility, and shifting societal attitudes toward fertility treatments. Key trends fueling market growth include:

- Technological Advancements: IVF technologies are constantly improving. These improvements, such as genetic screening, cryopreservation, and embryo freezing, are significantly enhancing success rates.

- Age Factor: Women are increasingly delaying childbearing for career or personal reasons. This has led to increased demand for IVF services, especially among older women.

- Improved Success Rates: Embryo culture and selection techniques are improving. These advances, such as preimplantation genetic testing (PGT), are driving higher IVF success rates.

- Non-invasive IVF: Non-invasive technologies are being introduced in IVF. This is lowering the risks and improving outcomes, encouraging more patients to choose IVF.

- Global Awareness and Acceptance: People are more aware of infertility and IVF solutions. This is reducing the stigma around assisted reproduction, leading to higher adoption rates.

Major Players and their Competitive Positioning

The IVF market is dominated by key global players such as Vitrolife AB, Ferring Pharmaceuticals, and Merck Group, among others. These companies continue to innovate and expand their product portfolios to meet the increasing demand for advanced IVF treatments. Smaller, specialized players are also emerging, offering cutting-edge technologies and services that address specific patient needs.

Consumer Behavior Analysis

Consumers are increasingly seeking IVF services for a variety of reasons, including:

- Delayed Parenthood: A lot of people are postponing having children. They chose IVF as a result of challenges with their fertility, lifestyle, or job objectives.

- Infertility Issues: The rate of infertility is increasing. Consequently, IVF is being used by both male and female patients to treat their infertility issues.

- Personalized Fertility Care: Patients desire IVF procedures customized to meet their unique requirements. This is increasing demand for specialized IVF services.

- Financial Planning: IVF treatments are expensive. Therefore, financial planning and insurance coverage are crucial factors in people's decisions about IVF.

Pricing Trends

Pricing in the IVF market varies significantly based on geographic region, technology used, and the type of IVF procedure. Advanced techniques like genetic screening and egg freezing are more expensive. Standard IVF treatments are generally more affordable. Cost-effective IVF options are becoming available in emerging markets. This is driving an increase in IVF treatments, making them accessible to more patients.

Growth Factors

Several factors are contributing to the growth of the IVF market:

- Technological Advancements: IVF procedures are getting better because to innovations like genetic testing and embryo preservation. Additionally, integrating AI is improving their success rates and efficiency.

- Rising Infertility Rates: Lifestyle choices are all contributing to an increase in infertility rates. This is prompting a growing demand for IVF procedures.

- Awareness and Acceptance: People are growing less stigmatized and more knowledgeable about IVF. This is driving wider adoption. Greater social acceptance is also making fertility treatments more accessible.

- Increasing Government and Private Sector Support: Public and private sectors are providing more financial support for IVF treatments. This is expanding access, especially in developed countries.

Regulatory Landscape

The IVF market is subject to stringent regulations that vary across regions. Regulations related to genetic testing, egg freezing, and embryo selection are evolving. Compliance with these regulations is essential for IVF service providers to maintain high safety standards and ensure ethical practices.

Recent Developments

The IVF market is constantly evolving, with innovations and new treatments emerging regularly. Some recent developments include:

- Advanced IVF Technologies: Next-generation sequencing (NGS) has been introduced for genetic testing. This is improving embryo selection.

- Cryopreservation Innovations: Cryopreservation techniques are improving. This lessens the need for repeated IVF cycles by improving the preservation of eggs, sperm, and embryos.

- Telemedicine Integration: For IVF patients, remote monitoring and virtual consultations are becoming more typical. This improves convenience and access to fertility services.

Current and Potential Growth Implications

a. Demand-Supply Analysis

Infertility rates are rising, and IVF technologies are advancing. These factors are driving a consistent increase in demand for IVF treatments. However, supply chain issues, particularly with medical equipment and trained personnel, could impact this growth.

b. Gap Analysis

Despite progress, several areas still need improvement in the IVF market:

- Affordability: IVF treatments are expensive. This remains a barrier for many patients.

- Access to Services: Access to IVF services is limited in some regions. This is due to regulatory barriers and infrastructure gaps.

- Ethical Considerations: IVF technologies are advancing. Therefore, ethical issues surrounding embryo selection and genetic screening require careful attention.

Top Companies in the In Vitro Fertilization Market

- Vitrolife AB

- Ferring Pharmaceuticals

- Merck Group

- IVF Online

- CooperSurgical

- EmbryoClinic

- Oxford BioMedica

- Bayer AG

- EMD Serono, Inc.

- Ferring B.V.

In Vitro Fertilization Market: Report Snapshot

Segmentation | Details |

By Procedure | Conventional IVF, Egg Donation, Surrogacy, Gender Selection, Cryopreservation |

By Technology | Genetic Screening, Artificial Intelligence, Embryo Freezing, Cryopreservation, Stem Cell Technologies |

By End User | Fertility Clinics, Hospitals, Research Institutes, At-Home Care |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The following segments are expected to experience significant growth:

- Egg Donation: This procedure is becoming more popular. It's especially helpful for women with diminished ovarian reserves.

- Genetic Screening: Advanced genetic screening is improving IVF outcomes. It is also ensuring healthier pregnancies.

- Surrogacy: Surrogacy is becoming a high-growth segment. This is especially true in regions where women have trouble with pregnancy.

Major Innovations

Innovation is critical for maintaining competitiveness in the IVF market. Some of the latest innovations include:

- AI-Driven Embryo Selection: AI is being used in IVF to help select the best embryos.

- Cryopreservation Advancements: Improved freezing techniques are being developed. These techniques allow for better storage and higher survival rates for frozen embryos.

- Wearable IVF Monitoring Devices: These devices improve real-time tracking of fertility parameters. This makes IVF treatments more personalized and effective.

Potential Growth Opportunities

Despite the positive outlook, the IVF market faces several challenges:

- High Cost of Treatments: IVF is expensive for many people. This limits access for those with lower incomes.

- Regulatory Hurdles: IVF providers often want to expand globally. However, different regulatory frameworks in each country create challenges.

- Patient Education and Awareness: Patient education is essential for informed decision-making about IVF. Patients need to understand the full scope of IVF treatments. This includes potential risks and success rates.

Extrapolate Research says:

It is anticipated that the global in vitro fertilization market will expand considerably. Technological developments are the core driver of this increase. Another factor is the growing prevalence of infertility and the increased social acceptability of IVF procedures. Businesses that can handle accessibility and affordability will be in a strong position. Taking advantage of market prospects will also depend on complying with regulations.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

In Vitro Fertilization Market Size

- February-2025

- 148

- Global

- healthcare-medical-devices-biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021