Foot and Ankle Braces Market Size, Share, Growth & Industry Analysis, By Product (Soft Braces, Rigid Braces, Hinged Braces), By Application (Osteoarthritis, Hammertoe, Neurological Disorders, Rheumatoid Arthritis, Bunions, Osteoporosis, Others), By End-User (Hospitals, Ambulatory Surgery Centers, Orthopedic Clinics, Homecare Setting, Others), By Distribution Channel (Offline, Online), and Regional Analysis, 2024-2031

Foot and Ankle Braces Market Size

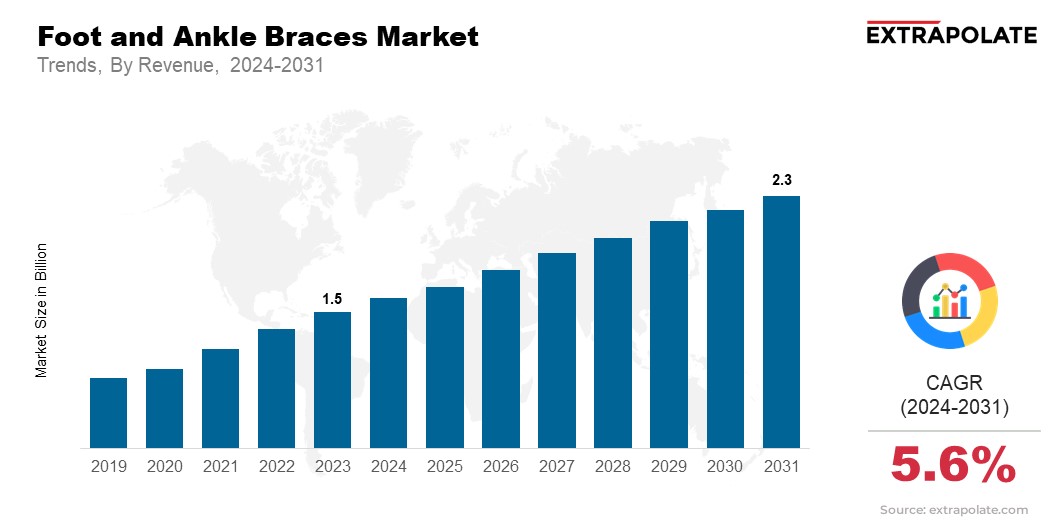

The global Foot and Ankle Braces Market size was valued at USD 1.5 billion in 2023 and is projected to reach USD 2.3 billion by 2031, exhibiting a CAGR of 5.6%, driven by an increasing prevalence of foot and ankle injuries, rising awareness about preventive healthcare, and advancements in brace technology.

Three major factors are accounting for the increasing share of foot and ankle braces market. First, the aging population is expanding. Second, more people are participating in sports. Third, chronic conditions, like diabetes, are rising. Foot and ankle braces are now more common in post-op care, where they help with alignment and speed up recovery.

Demand for the market is rising due to new developments in technology. They include the addition of lightweight materials and better comfort features. Currently, North America holds the largest market share of over 40% of the global revenue. Europe and the Asia-Pacific follow with sizeable market shares. Emerging economies will see strong market growth due to rising healthcare spending and awareness of orthopedic care.

Foot and Ankle Braces Market Trends

The Foot and Ankle Braces Market has been characterized by a number of major trends as of 2023. First trend is the growing preference for custom-fit braces over their off-the-shelf counterparts. Custom-fit braces are made for unique anatomies. They provide better support and comfort especially for patients with unusual foot or ankle structures.

Such braces make use of advanced 3D scanning and printing technologies for precise customization. Many established players in the 3D printing segment are offering industry-grade 3D printing solutions to other companies to facilitate the production of custom-made foot and ankle braces.

Manufacturers are also increasingly incorporating breathable and lightweight materials in foot and ankle braces, which is another major trend of this market. Materials like spandex, neoprene, and mesh fabrics provide necessary support while ensuring comfort and breathability. These materials reduce skin irritation and boost compliance as they make braces more user-friendly for long-term use.

Lastly, there is a trend to integrate smart tech into foot and ankle braces. Smart braces equipped with sensors are emerging as a key technology. These braces can monitor a patient’s movement and provide real-time feedback, which speeds up rehabilitation and provides injury prevention. This technology allows athletes and those in physiotherapy access to a more personalized and effective treatment plan.

Foot and Ankle Braces Market Growth Factors

The Foot and Ankle Braces Market is set to be affected by several direct or indirect factors. The aging population is a key factor. Older adults are more prone to foot and ankle injuries due to weakened bones and joints. The UN says 2.1 billion people will be 60 or older by 2050. This will likely increase the demand for devices like foot and ankle braces. Additionally, the rise in sports-related injuries is another key growth factor.

The number of Americans ages 65 and older will rise from 58 million in 2022 to 82 million by 2050 (a 47% increase). Their share of the total population will grow from 17% to 23%. As more people play sports worldwide, foot and ankle injuries are rising. This has increased the demand for effective braces for prevention and rehab. Ankle sprains are a common sports injury, affecting millions each year, says the American Orthopaedic Foot & Ankle Society.

Also, the rise of chronic conditions is boosting the market. Chronic diseases like diabetes can cause complications, like foot ulcers. The World Health Organization estimates 422 million people worldwide have diabetes. Many exhibiting foot complications and in need of specialized braces for support and protection.

Segmentation Analysis

The Foot and Ankle Braces Market has been segmented into four categories: product, application, end-user, and distribution channel. They provide a complete view of the market dynamics that helps stakeholders find growth opportunities and trends.

By Product

By product, the market is segmented into soft braces, rigid braces, and hybrid braces. Soft braces hold a large share. They are widely used for mild injuries and post-operative recovery. Rigid braces are gaining traction for their higher stability. They are especially popular with patients who have severe injuries.

Hybrid braces combine the benefits of both soft and rigid braces. They are popular for their versatility and comfort. Soft braces dominated the product segment, accounting for around 45% share of the global market in 2023.

By Application

Foot and ankle braces are mainly used for rehabilitation, sports, and prevention. Injury rehabilitation is the largest segment due to increasing instances of sports injuries and an aging population with increasingly severe foot and ankle issues. The sports segment is growing fast. Athletes are using braces to prevent injuries and boost performance. The preventive care segment, though smaller, is gaining market share with the rising awareness of foot health among people.

By End User

Hospitals, clinics, and home care settings are the main end users in the foot and ankle braces market. Hospitals are the dominant end users due to the high volume of surgeries and injury treatments conducted in these settings. Clinics serve patients with minor injuries and those needing regular follow-ups. Therefore, this segment accounts for the second-largest share. Home care is a growing segment due to high preference for at-home treatments and the availability of user-friendly braces.

By Distribution Channel

The major distribution channels of this market are hospital pharmacies, retail pharmacies, and e-commerce platforms. Hospital pharmacies dominate the market as the main sellers of post-surgery braces. Retail pharmacies provide access to braces for mild injuries and constitute a significant market under this segment. E-commerce platforms are growing fast. Online sales are expected to rise 25% a year due to the convenience and availability of a wide range of products.

Foot and Ankle Braces Market Regional Analysis

The Foot and Ankle Braces Market is split into 5 regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America currently dominates the market, accounting for over 40% of global revenue. This dominance is due to the region's advanced healthcare, a focus on preventive care, and a large aging population.

The U.S. contributes mainly due to a high incidence of sports-related injuries and a well-established market for orthopedic products. Europe follows, with Germany, the UK, and France leading the market. The region has a robust healthcare system, higher sports participation, and a sizeable elderly population.

The Asia-Pacific region is expected to grow the fastest, with a 6.3% CAGR due to a higher healthcare expenditure, orthopedic care awareness, and proliferating middle-income groups in China and India. The region also has a large diabetic population. This fuels the demand for foot and ankle braces. Latin America and the Middle East & Africa are growing, but slowly. This is due to better healthcare and a rise in awareness of foot and ankle injuries.

Competitive Landscape in Foot and Ankle Braces Market

The Foot and Ankle Braces Market is competitive. Key players include Bauerfeind AG, DJO Global, and Ottobock SE & Co. KGaA, and Breg, Inc. These companies aim to boost their market position. They innovate products, form partnerships, and pursue mergers to maintain their market hold. For instance, Bauerfeind AG has invested heavily in R&D to launch advanced products with better support and comfort. Similarly, DJO Global, Inc. has launched new braces with better adjustability and lighter materials. The competition is rising. New players are offering low-cost solutions, especially in emerging markets. This pressure is driving innovation and price competition. It benefits end-users with more options.

List of Key Players in Foot and Ankle Braces Market

- Breg Inc.

- The Richie Brace

- BioSkin

- 3M

- Medline Industries LP.

- DARCO International Inc.

- TayCo Brace Inc.

- Brownmed Inc.

- Alex Orthopedic Inc.

- Bauerfeind USA

Key Industry Developments

The Foot and Ankle Braces Market has seen major changes in recent years.

- In 2023, Bauerfeind AG launched a new line of ankle braces. They use advanced 3D knitting technology. It provides better support and comfort while keeping them breathable. The product has already captured the European market and increased 10% company sales in the orthopedic segment.

- In 2023, DJO Global, Inc. partnered with a top U.S. sports team. The company will supply custom-fit braces for the athletes to reduce injuries and boost performance. This partnership may boost DJO's market share by approximately 5% in North America.

- Ottobock SE & Co. KGaA introduced a smart ankle brace equipped with sensors to monitor movement and provide real-time data to users. This innovative product is popular, especially with athletes and physiotherapists. It is expected to generate USD 15 million in revenue by 2024.

These developments show the market's focus on innovation and partnerships to drive growth.

The global Foot and Ankle Braces Market has been segmented as below:

By Product

- Soft Braces

- Rigid Braces

- Hinged Braces

By Application

- Osteoarthritis

- Hammertoe

- Neurological Disorders

- Rheumatoid Arthritis

- Bunions

- Osteoporosis

- Others

By End-User

- Hospitals

- Ambulatory Surgery Centers

- Orthopedic Clinics

- Homecare Setting

- Others

By Distribution Channel

- Offline

- Online

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- South Africa

- North America

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Foot and Ankle Braces Market Size

- September-2024

- 148

- Global

- healthcare-medical-devices-biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021