EPharmacy Market Size, Share, Growth & Industry Analysis, By Product Type (Prescription Medicine, Over-the-Counter (OTC) Products) By Platform Type (App-Based, Web-Based) By Drug Type (Branded Drugs, Generic Drugs) By End-User (Individuals, Healthcare Institutions), and Regional Analysis, 2024-2031

ePharmacy Market: Global Share and Growth Trajectory

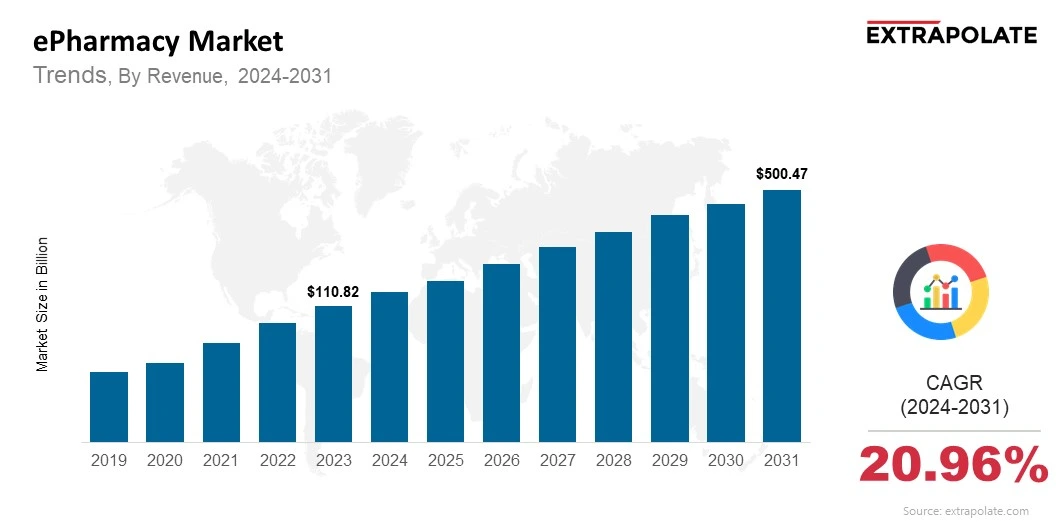

The global EPharmacy Market size was valued at USD 110.82 billion in 2023 and is projected to grow from USD 132.04 billion in 2024 to USD 500.47 billion by 2031, exhibiting a CAGR of 20.96% during the forecast period.

The global market is experiencing accelerated growth, which is fueled by the digital transformation of healthcare and shifting consumer preferences. ePharmacies, or online pharmacies, enable the remote ordering, dispensing, and delivery of prescription and over-the-counter (OTC) medications. This market is gaining prominence as patients and healthcare systems seek greater convenience, efficiency, and access especially in the post-pandemic digital health era.

Several drivers, including increasing internet penetration, growing smartphone use, rising demand for home healthcare, and a surge in chronic diseases, are propelling this market forward. In addition, regulatory support and improvements in data privacy and digital infrastructure are helping ePharmacy platforms scale globally.

ePharmacies are transforming the way medications are delivered by reducing in-person interactions, optimizing inventory management, and making drug purchases more accessible. As demand continues to rise across urban and rural settings alike, the ePharmacy market is positioned for long-term expansion and structural innovation.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Surging Digital Health Adoption:

The integration of digital health technologies is transforming pharmaceutical delivery. Consumers are increasingly preferring digital platforms for medical consultations and prescription refills. ePharmacies complement telemedicine platforms by enabling the smooth delivery of prescribed medications. This convenience is accelerating product adoption across demographics.

Increased Use of Smartphones and Internet Penetration:

The widespread adoption of smartphones and internet connectivity, especially in emerging economies has substantially increased access to ePharmacy services. This allows for real-time prescription uploads, automated refill reminders, and mobile app-based purchases, improving user experience and engagement.

Post-Pandemic Shift in Consumer Behavior:

COVID-19 advanced the change toward digital health solutions, with several consumers adopting ePharmacies to avoid physical visits to pharmacies. Even post-pandemic, this behavior remains. Consumers now prefer the safety, speed, and convenience of doorstep delivery.

Integration with Health Management Platforms:

ePharmacy platforms are increasingly integrating with electronic health records (EHRs), chronic care management systems, and telehealth platforms. This allows effortless data sharing and prescription syncing, improving medication adherence and personalized care.

Subscription-Based and Auto-Replenishment Models:

Subscription services that offer automatic medication refills, discounts, and doorstep delivery are becoming popular. These models enhance customer retention and ensure timely medication adherence, especially among chronic care patients.

Major Players and Their Competitive Positioning

The global ePharmacy market features a mix of established pharmaceutical retailers, technology-driven startups, and healthcare logistics firms. Key players are focusing on offering platforms that are user-friendly, expanding delivery networks, and integrating AI-driven features like personalized dosage reminders, digital prescriptions, and inventory tracking. Major players in the ePharmacy market: CVS Health, Walgreens Boots Alliance, Amazon Pharmacy, Apollo Pharmacy (India), Netmeds (Reliance Retail), PharmEasy, 1mg (Tata Digital), LloydsPharmacy Online Doctor, Zur Rose Group (DocMorris), Alodokter (Indonesia)

These companies continue to invest in mobile health apps, AI-powered logistics, and digital prescription management. Key acquisitions and cross-sector partnerships with healthcare systems and insurance providers further enhance their competitive positions.

Consumer Behavior Analysis

Growing Preference for Convenience:

Consumers are increasingly prioritizing convenience, particularly for refilling chronic condition medications. The ease of placing orders from home, tracking deliveries, and setting up reminders appeals to younger and older populations as well.

Price Sensitivity and Discounts:

Online pharmacies often offer substantial discounts compared to traditional brick-and-mortar stores. With transparent pricing and bundled deals, ePharmacies cater to cost-conscious consumers, specifically in developing markets where out-of-pocket healthcare expenses are high.

Adoption by Chronic Disease Patients:

Patients managing chronic diseases such as diabetes, hypertension, and arthritis highly rely on consistent medication access. ePharmacy platforms cater to this demographic with repeat order options, auto-shipping, and medication adherence programs, which increases loyalty.

Trust and Privacy Concerns:

Despite the increase in adoption, some consumers still remain cautious because of concerns regarding the authenticity of drugs, privacy of medical data, and misuse of prescriptions. Companies are addressing these concerns by improving verification processes and securing digital platforms via encryption and compliance with healthcare regulations.

Demographic Shifts and Tech-Savviness:

Millennials and Gen Z, who are technophiles, are main factors of ePharmacy adoption. At the same time, awareness campaigns and user-friendly interfaces are helping older adults feel more comfortable with medication purchases that are done digitally.

Pricing Trends

The pricing structure in the ePharmacy market is shaped by various dynamics:

- Lower Overhead Costs: ePharmacies benefit from reduced operational expenses compared to traditional pharmacies. These savings are passed on to consumers in the form of lower prices.

- Bulk Purchasing and Manufacturer Partnerships: Online pharmacies often engage in bulk procurement and establish partnerships directly with manufacturers, enabling them to offer competitive pricing and exclusive generics.

- Dynamic Pricing Algorithms: Pricing models that are AI-driven help ePharmacies adjust prices based on demand, stock levels, and consumer behavior.

- Tiered Memberships and Loyalty Programs: For retaining customers, platforms offer loyalty points, cashbacks, and premium memberships that provide extra discounts or faster delivery.

- Geographic Variability: Pricing can substantially differ across regions, on basis of local drug regulations, logistics costs, and intensity of the competition.

Growth Factors

Urbanization and Lifestyle Changes:

Urban populations with dynamic lifestyles are increasingly seeking convenient access to medications. The demand for ePharmacies aligns with this trend, especially in metro areas with high digital literacy.

Government Initiatives and E-Health Infrastructure:

Governments are encouraging eHealth ecosystems with the launch of national health portals, electronic prescriptions, and digital ID-linked health records. These initiatives are making it easier for integrating and regulating ePharmacy services.

Rise of Health Insurance Penetration:

As health insurance grows, especially in emerging markets, insurers now cover ePharmacy platforms. This helps people buy medicines without cash and boosts customer use.

Innovative Logistics and Last-Mile Delivery:

Real-time tracking, cold chain storage, and drone drops in remote areas are helping deliver drugs quickly and reliably. These solutions improve the way medicines get to people who need them.

Increased Funding and M&A Activity:

Money from investors is flowing into ePharmacy. Funding and mergers speed up expansion, tech updates, and market reach, driving more competition and innovation.

Regulatory Landscape

ePharmacies must adhere to strict rules to ensure public health and safety. Regulatory frameworks vary according to the region but often include the following:

- Prescription Verification: Online platforms must check if prescriptions for controlled and prescription-only drugs are valid. They use automated tools and pharmacist reviews to ensure compliance.

- Licensing and Accreditation: Companies require licenses from health or pharmacy groups to run legally. Regulators ensure that only trained entities give out medicines.

- Data Security and Privacy Compliance: ePharmacies handling personal health information must comply with laws like HIPAA (U.S.), GDPR (EU), or IT Rules (India) to protect consumer data.

- Drug Authenticity Checks: To address concerns around counterfeit drugs, regulators mandate traceability systems such as barcoding, serial number tracking, and source authentication.

- Cross-Border Restrictions: Selling medications across borders is often restricted due to differences in drug approval standards. Platforms must adhere to country-specific laws and maintain localized operations.

Recent Developments

Amazon Pharmacy Expansion:

Amazon expanded its ePharmacy services in the U.S., offering free two-day delivery for Prime members, pharmacist consultations, and prescription management via its app—reshaping the market with its scale and logistics network.

India's Consolidation Wave:

India’s ePharmacy space has seen quick changes with major firms entering the market. Reliance now owns Netmeds, and Tata Digital owns 1mg to grow their health services. These conglomerates are integrating health services, labs, and medicine delivery on unified platforms.

Digital Prescriptions Gaining Ground:

E-prescription adoption is rising among doctors and hospitals. This shift supports faster processing, reduces errors, and enhances compatibility with online ordering systems.

Cold Chain Technology for Biologics:

Companies are investing in cold storage and smart packs to deliver insulin, vaccines, and other special drugs. This ensures high quality while shipping.

AI-Powered Chatbots and Consultation Services:

AI chatbots are being used more for checking symptoms, reminding users about medicine, and giving 24/7 support. This helps in keeping users engaged and reduces pressure on call teams.

Current and Potential Growth Implications

Demand-Supply Analysis:

With more people ordering online, ePharmacies are expanding work, adding storage, and fixing supply lines. But the steady supply of rare or special drugs is still tough to ensure.

Gap Analysis:

ePharmacies do well in cities, but they are still rare in rural areas due to low digital skills, weak delivery, and lack of trust. Closing this gap needs better awareness, strong transport, and local help.

Top Companies in the ePharmacy Market

- CVS Health

- Walgreens Boots Alliance

- Amazon Pharmacy

- Netmeds

- PharmEasy

- 1mg

- Apollo Pharmacy

- DocMorris (Zur Rose Group)

- LloydsPharmacy

- Alodokter

These companies are spearheading innovation in medication delivery, user interface design, AI integration, and digital consultation services.

ePharmacy Market: Report Snapshot

Segmentation | Details |

By Product Type | Prescription Medicine, Over-the-Counter (OTC) Products |

By Platform Type | App-Based, Web-Based |

By Drug Type | Branded Drugs, Generic Drugs |

By End-User | Individuals, Healthcare Institutions |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

ePharmacy Market: High-Growth Segments

Prescription Medicines:

Growing reliance on chronic disease medications and online consultations is fueling the adoption of prescription medicines via ePharmacies.

App-Based Platforms:

Mobile-first behavior is driving faster growth in app-based ePharmacy platforms. They offer push notifications, easy refills, and real-time order tracking.

Generic Drugs:

Affordability concerns are leading to increased demand for generics. ePharmacies offer wide selections and highlight generic alternatives to consumers during purchase.

Major Innovations

Blockchain for Drug Traceability:

Blockchain is being explored to enhance transparency and traceability in the pharmaceutical supply chain. It ensures authenticity and reduces counterfeit risks.

TelePharmacy Integration:

Pharmacists now offer remote consultations through video and chat, helping consumers understand dosages, side effects, and interactions—all through a digital interface.

Predictive Analytics for Inventory Management:

AI-driven demand forecasting helps platforms stock efficiently, reducing wastage and avoiding shortages.

ePharmacy Market: Potential Growth Opportunities

Expansion into Tier-2 and Rural Areas:

The rural population is largely underserved by traditional pharmacies. With better internet and logistics, ePharmacies have immense potential to penetrate these untapped regions.

Elderly-Centric Services:

With the aging global population, ePharmacies are introducing senior-friendly interfaces, voice-assisted ordering, and caregiver-linked accounts.

Global Telehealth Collaboration:

As telemedicine platforms expand internationally, cross-integration with ePharmacies will drive new markets for chronic care medication and wellness products.

Extrapolate Research says:

The global ePharmacy market is witnessing a revolutionary change, shaped by the adoption of digital healthcare, growing expectations of consumers, and constantly changing regulatory frameworks. As online platforms are changing the way medications are accessed and managed, this market is positioned for steady and durable advancement. Our research indicates that ePharmacies are not just accessible options, they are becoming essential for healthcare ecosystems, particularly for the management of chronic conditions and improving medication adherence.

Technological developments like AI-driven personalization, cold chain logistics, and blockchain-based authentication are improving service reliability and consumer trust. While regulatory compliance and last-mile delivery challenges still remain, the opportunities in emerging markets and deprived areas are vast. For stakeholders, there are enormous possibilities to scale, innovate, and collaborate. As the healthcare landscape becomes more connected and consumer-centric, ePharmacies will continue to be crucial in delivering easy to access, cost-effective, and efficient care all over the world.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

EPharmacy Market Size

- June-2025

- 148

- Global

- healthcare-medical-devices-biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021