Diabetes Supplements Market Size, Share, Growth & Industry Analysis, By Disease Type (Type-1, Type-2), By Type (Vitamins, Minerals, Herbal, Proteins, Antioxidant & Fatty Acids, Dietary Fibers, Others), By Dosage Form (Tablets, Solution, Powder, Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online, Others), and Regional Analysis, 2024-2031

Diabetes Supplements Market Size

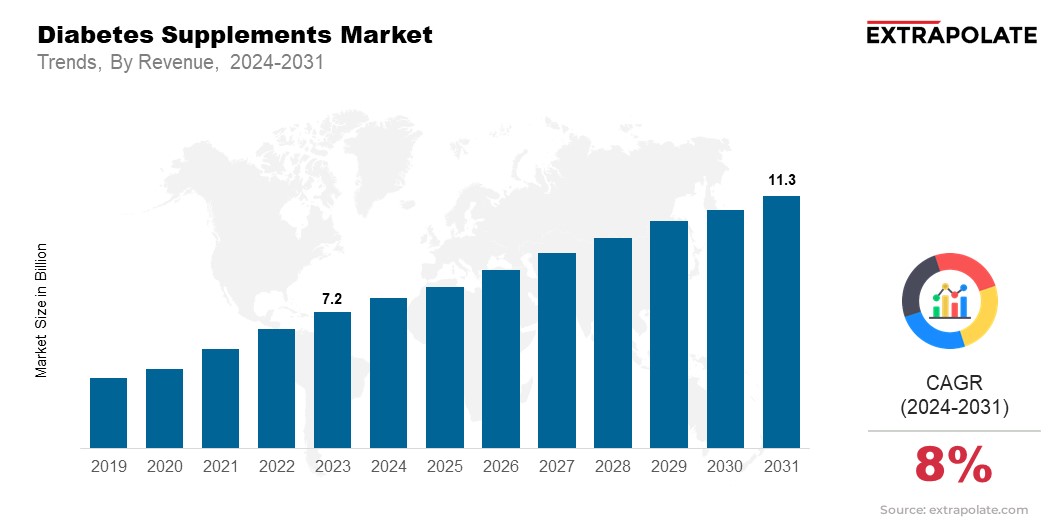

The global Diabetes Supplements Market size was valued at USD 7.2 billion in 2023 and is projected to reach USD 11.3 billion by 2031, exhibiting a CAGR of 8% during the forecast period, driven by the rising prevalence of diabetes worldwide and increasing awareness about the importance of nutritional management in diabetes care.

This growth is due to the rising use of supplements among diabetic patients. Diabetes supplements help manage blood sugar and prevent complications from the disease. As consumers seek healthier alternatives to drugs, the demand for natural, plant-based supplements is rising.

Also, new supplement formulas that include bioactive compounds are expected to boost the market. The market's growth is further supported by the rise of diabetes supplements. They are now available on many channels, including online, pharmacies, and specialty stores.

Diabetes Supplements Market Trends

Several key trends are shaping the growth of the Diabetes Supplements Market. A major trend is the rising demand for natural, plant-based supplements. According to the International Diabetes Federation (IDF) Atlas, in 2023, around 537 million adults aged between 20 and 79 years of age were living with diabetes.

Consumers prefer naturally sourced supplements, like herbs, vitamins, and minerals, to manage their blood sugar. In 2023, natural supplements accounted for nearly 40% of the market share. Another notable trend is the rise of personalized nutrition in diabetes management. Companies are using advanced tech, like AI and genetic tests, to provide personalized supplements for individual needs. This trend is expected to help the market gain momentum in the coming years.

Personalized supplements are projected to grow at a CAGR of 7.2% during the forecast period. Lastly, there is a growing focus on R&D to create innovative formulas that boost the effectiveness of diabetes supplements. This trend aims to meet the diverse needs of diabetic patients and improve their health. Therefore, companies are investing in R&D significantly. The R&D expenditure of key players is expected to rise by 8% year on year from 2023 to 2031.

Diabetes Supplements Market Growth Factors

Several factors are contributing to the growth of the Diabetes Supplements Market. The primary growth driver is the rising prevalence of diabetes globally. According to the International Diabetes Federation, the number of diabetic patients is estimated to reach 643 million by 2030 and 783 million by 2045. IDF also states that in 2021, diabetes was responsible for 6.7 million deaths.

The rise in diabetes is increasing the demand for blood sugar supplements to manage blood sugar and prevent complications. Another key growth factor is the rising awareness of dietary supplements in managing diabetes. As consumers grow more health-conscious, they recognize the role of supplements. Diabetes supplements help control blood glucose, improve insulin sensitivity, and support metabolic health.

Further, the aging population is driving market growth. Older adults are more prone to diabetes. Therefore, they seek supplements to maintain their health and manage their condition. The growth of e-commerce is another market development that has made diabetes supplements more accessible to consumers worldwide. It is estimated that online sales are projected to account for 30% of the market share by 2031, registering an increase from 20% of the market in 2023.

Segmentation Analysis

The Diabetes Supplements Market has been fragmented into key segments. Market segmentation is vital for understanding market dynamics and finding growth opportunities. The global market for diabetes supplements has been segmented on the basis of Disease Type, Type, Dosage Form, and Distribution Channel.

By Disease Type

The market has been segmented by Disease Type into Type 1 and Type 2 diabetes. Type 2 diabetes makes up nearly 90% of all diabetes cases. It dominates the market. In 2023, Type 2 diabetes supplements held around 70% of the global market share. This staggering market share can be due to increasing prevalence of Type 2 diabetes, which is mainly caused by poor diets and a lack of exercise.

Meanwhile, the market for Type 1 diabetes supplements is smaller but growing. There is a rising focus on managing blood sugar and improving insulin sensitivity, which is expected to add to this segment's growth.

By Type

The market is divided by Type into vitamins and minerals, herbal supplements, and others. In 2023, the vitamins and minerals segment led the global market accounting for about 50% share. Vitamin and mineral supplements continue to gain popularity. This is due to their effective support in metabolic health and fixing nutrient deficiencies in diabetics. Herbal supplements, including cinnamon and berberine, are also gaining popularity as consumers have started turning to natural remedies for diabetes management. This segment is projected to grow at a CAGR of 6.2% during the forecast period.

By Dosage Form

The Dosage Form segment includes tablets, capsules, powders, and liquids. In 2023, the tablets and capsules segment dominated the market, with tablets alone accounting for approximately 45% share of the global diabetes supplement market. Their convenience and widespread availability make them the preferred choice for many consumers. Powders and liquids constitute a small segment. However, powders and liquids are gaining popularity. These formulations are easy to absorb and suit those who have trouble swallowing.

By Distribution Channel

The market is also segmented by Distribution Channel. It includes pharmacies, online platforms, and specialty stores. Pharmacies are the main distribution channel, with a 55% market share as of 2023. Online platforms are, however, rapidly growing with e-commerce and home delivery steady gaining a larger share of the market. By 2031, the segment for online sales is expected to account for a 30% share of the global market, witnessing a rise from 20% as calculated in 2023.

Diabetes Supplements Market Regional Analysis

The Diabetes Supplements Market exhibits significant regional variations, with North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa being the key regions. In 2023, North America dominates the market, accounting for nearly 35% of the global market share.

The region's leadership is driven by the high prevalence of diabetes, well-established healthcare infrastructure, and strong consumer awareness regarding the benefits of diabetes supplements. The United States, in particular, is a major contributor to the market, with an estimated market size of USD 2.5 billion in 2023. The presence of leading market players and the availability of a wide range of supplements further bolster North America's dominance.

Europe follows closely, holding around 30% of the market share in 2023. This region is growing due to rising diabetes rate, especially in Germany, the UK, and France. In addition, a focus on preventive healthcare and the rise of natural supplements are driving market growth in Europe. The European market is estimated to grow at a CAGR of 5.5% from 2023 to 2031 and will reach USD 3.4 billion by 2031.

The Asia-Pacific is a growing market for diabetes supplements. It is projected to register a CAGR of 7.1% over the forecast period. This growth is due to rising prevalence of diabetes in China and India. These countries jointly account for nearly 25% of the world's diabetes individuals.

The expanding middle-income groups, rising per capita incomes, and health awareness are driving the demand for diabetes supplements in the region. By 2031, Asia-Pacific is expected to hold a 25% market share, with a market size of approximately USD 2.8 billion.

Latin America and the Middle East & Africa are smaller markets, witnessing a steady growth. In Latin America, Brazil is a key region with a rising diabetes population, driving the adoption of diabetes supplements. The Middle East & Africa region is also growing. In the U.A.E. and South Africa, rising healthcare awareness and government initiatives are boosting the use of diabetes supplements.

Competitive Landscape

The Diabetes Supplements Market is very competitive with many players are vying for market share. The competitive landscape is dotted by both big pharmaceutical companies and new supplement manufacturers. Major players are innovating products, forming partnerships, and merging to boost their market position.

In 2023, the top five players accounted for nearly 40% of the global market share. Companies are expanding their distribution networks, especially in emerging markets as they want to meet the growing demand for diabetes supplements. The trend for natural, plant-based supplements is driving competition. Companies are launching new products to cater to the evolving consumer preferences.

List of Key Players in Diabetes Supplements Market

- Abbott

- AKSUVITAL Natural Products Food Co.

- Arkopharma

- Bionova

- Nestlé

- Caelus Health

- Danone

- Novo Nordisk A/S

- Pfizer Inc.

- Unilever

Key Industry Developments

In 2023, several key industry developments shaped the Diabetes Supplements Market:

GlucoTrust, a market leader, launched a new line of plant-based supplements for insulin resistance. This launch would generate an additional USD 150 million in revenue by 2024.

In January 2023, Diabetic Solutions Inc. acquired NutriCare to expand its product portfolio under the personalized supplements segment. This acquisition would increase NutriCare’s market share by 10% over the next two years.

BioBalance introduced a patented supplement containing a blend of bioactive compounds and probiotics. This product is innovative and has boosted sales by 25% in its first quarter. It has positioned BioBalance as a key player in the diabetes supplements market.

In conclusion, the Diabetes Supplements Market is growing fast due to a rising diabetes rate, new trends, and key industry developments. It is crucial for companies in this dynamic market to understand these factors to stay ahead of the competition.

The global Diabetes Supplements Market has been segmented:

By Disease Type

- Type-1

- Type-2

By Type

- Vitamins

- Minerals

- Herbal

- Proteins

- Antioxidant & Fatty Acids

- Dietary Fibers

- Others

By Dosage Form

- Tablets

- Solution

- Powder

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- South Africa

- North America

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Diabetes Supplements Market Size

- September-2024

- 140

- Global

- healthcare-medical-devices-biotechnology

Related Research

2022-2030 Global and Regional B-Cell Non-Hodgkin`s Lymphoma (NHL) Treatment Industry Production, Sa

February-2021

2022-2030 Global and Regional Organ Transplant Diagnostics Industry Production, Sales and Consumpti

February-2021

2022-2030 Global and Regional Prostacyclin Drug Industry Production, Sales and Consumption Status a

February-2021

2022-2030 Global and Regional Spinal and Bulbar Muscular Atrophy Treatment Industry Production, Sal

February-2021

2% Chlorhexidine Gluconate (CHG) Cloths-Global Market Status & Trend Report 2022-2030 Top 20 Countri

April-2021

2021-2027 Global and RegioAnal Nasal Gels Industry Production, Sales and Consumption Status and Pros

February-2021

2021-2027 Global and Regional 2019-nCoV Detection Server Industry Production, Sales and Consumption

February-2021

2021-2027 Global and Regional ? Collagen Quantitative Determination Kit Industry Production, Sales a

February-2021

2021-2027 Global and Regional Anti-TNF Monoclonal Antibody Industry Production, Sales and Consumptio

February-2021