Food Processing and Handling Equipment Market Size, Share, Growth & Industry Analysis, By Equipment Type (Processing Equipment, Packaging Equipment, Automation & Control Equipment) By Application (Bakery & Confectionery, Dairy, Meat & Poultry, Seafood, Beverages, Others) By End-User (Food Manufacturers, Food Service Companies, Others), and Regional Analysis, 2024-2031

Food Processing and Handling Equipment Market: Global Share and Growth Trajectory

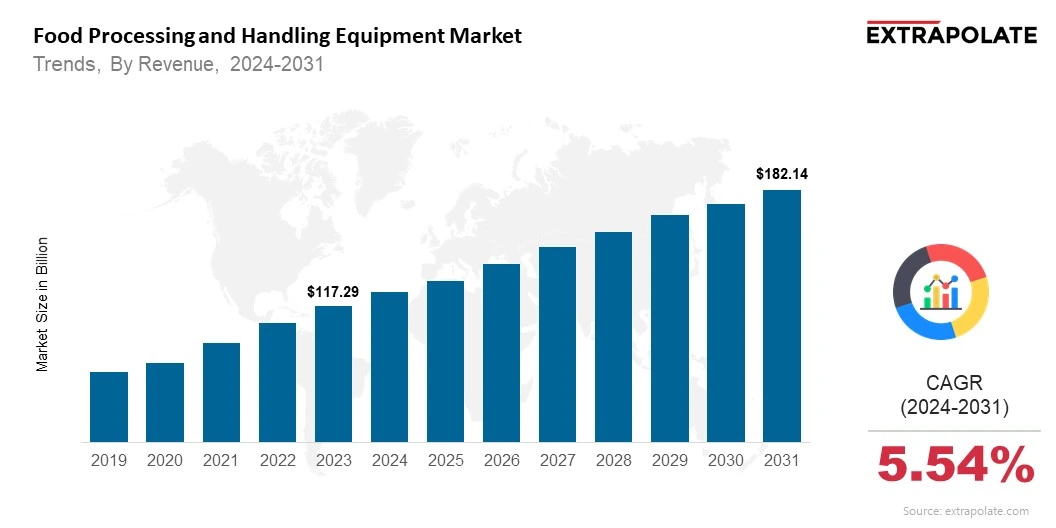

Global Food Processing and Handling Equipment Market size was recorded at USD 117.29 billion in 2023, which is estimated to be valued at USD 124.83 billion in 2024 and reach USD 182.14 billion by 2031, growing at a CAGR of 5.54% during the forecast period.

The food processing and handling equipment market is set to grow rapidly in the coming years driven by technological advancements, increasing demand for packaged and processed foods and stricter food safety regulations.

This market includes a wide range of machinery and tools used to convert raw agricultural inputs into ready to eat or packaged food products. It includes equipment for processing, preparation, packaging, storage and transportation, the backbone of the modern food industry.

One of the main growth drivers is increasing demand for packaged and convenience foods especially in urban areas and emerging economies. As more people move to cities and adopt busy lifestyles the preference for ready to eat and easy to prepare meals is growing.

This shift in consumption behavior is prompting food manufacturers to increase production volumes while ensuring consistency, safety and quality – goals that can only be achieved with advanced processing and handling equipment.

Food safety and regulatory compliance are other key drivers for investment in sophisticated processing and handling equipment. Governments and international bodies have implemented strict regulations to ensure food safety and prevent contamination.

In response food, producers are adopting equipment that supports Clean-in-Place (CIP) technologies, maintains optimal temperature controls and facilitates traceability throughout the supply chain. Equipment that meets global safety standards such as FDA or European Food Safety Authority (EFSA) is in high demand.

From a regional perspective, Asia-Pacific is emerging as a key growth market due to rapid industrialization, growing middle class population and increasing demand for processed foods in countries like China, India and Indonesia.

North America and Europe are mature markets with high adoption of latest technologies and strong emphasis on food safety regulations. Latin America and Middle East are seeing investments in modernizing their food production infrastructure.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several key trends are driving the adoption of food processing and handling equipment globally:

Automation and Smart Technology Integration: Food manufacturers are adopting automation technologies to improve efficiency and reduce operational costs. Smart sensors, IoT enabled machinery and AI based systems are enhancing real-time monitoring and predictive maintenance. These systems ensure consistent product quality and reduce downtime-making operations more resilient and responsive to market changes.

Food Safety and Hygiene: With increasing foodborne, illnesses and global regulations getting stricter food processors are investing in equipment designed for hygiene made from stainless steel and easy to clean materials. The need to comply with HACCP and ISO 22000 standards has led to widespread adoption of equipment that reduces contamination risks.

Processed and Packaged Food Consumption: Urbanization, changing consumer behavior and increasing demand for convenience foods is driving consumption of ready to eat and processed foods. This trend is driving demand for advanced food processing machinery that can handle high volume high precision production.

Major Players and their Competitive Positioning

The global food processing and handling equipment market is highly competitive and features several key players that lead the market through technological innovation, strong global distribution networks, and strategic collaborations. Notable companies include: - GEA Group AG, JBT Corporation, Bühler AG, Alfa Laval AB, Marel hf, Tetra Pak International S.A., SPX FLOW, Inc., The Middleby Corporation, Heat and Control, Inc., and Krones AG.

These companies are continuously developing and launching new product lines to meet specific end-user needs. Strategic mergers, acquisitions, and partnerships are common as these firms aim to expand their global footprint and offer integrated solutions that improve productivity and compliance.

Consumer Behavior

Consumer behavior in the food processing and handling equipment market is influenced by several evolving priorities:

High Quality, Safe Food: Consumers are more informed and demanding about food quality, so food manufacturers are under pressure to ensure high standards. This means more demand for processing equipment that supports traceability and cleanability.

Convenience: As busy lives become the norm, consumers are gravitating towards easy to prepare or ready to eat meals. This means food producer need to increase output and variety, so they need to invest in fast, flexible and reliable equipment.

Sustainability: Consumer demand and company strategy is being shaped by environmental awareness. More consumers are supporting brands that reduce food waste and adopt sustainable manufacturing practices. Food processors are responding by investing in energy efficient, waste reducing equipment.

Emerging Markets: In countries across Asia-Pacific, Latin America and Africa, rising incomes and urbanization is driving consumption of processed food. This is encouraging manufacturers to expand and invest in equipment that can serve mass markets cost effectively.

Pricing Trends

Pricing of food processing and handling equipment depends on type of equipment, level of automation, capacity, brand and technology used. Basic equipment like mixers or blenders are relatively affordable, while fully automated lines, robotics and high capacity packaging systems can be much more expensive.

Initial capital cost is a big consideration for small and medium enterprises (SMEs). However, many manufacturers are mitigating this by offering financing, leasing options or modular systems that can be upgraded gradually. The long term ROI driven by increased efficiency and reduced waste often justifies the upfront cost for larger organizations.

Growth Drivers

Several factors are driving the growth of the food processing and handling equipment market:

Technology: Automation, robotics and control systems have revolutionized food processing. Smart machines that can cut, mix and pack with minimal human intervention are the norm, enabling higher throughput and consistency.

Global Food Demand: Population growth and changing food consumption patterns is increasing global food production needs. To meet these demands efficiently, companies are turning to equipment that can produce high volumes while maintaining quality and safety.

Government Support and Policies: Many governments are supporting modernization of food industries through subsidies, low interest loans and regulatory reforms. For example, the Indian government’s “Pradhan Mantri Kisan SAMPADA Yojana” is modernizing food-processing infrastructure to reduce waste and increase rural income.

Cold Chain Expansion: Growth in frozen and refrigerated food segments is driving demand for equipment that can handle temperature sensitive products. Cold storage and logistics advancements are driving investments in handling equipment that can maintain product integrity across the supply chain.

Regulatory Landscape

The food processing and handling equipment market operates under stringent regulatory frameworks to ensure food safety and equipment reliability. Key standards and regulations include:

- HACCP (Hazard Analysis and Critical Control Points): A mandatory guideline for identifying and mitigating food safety risks during processing.

- ISO 22000: An international standard for food safety management systems.

- FDA Regulations (for U.S. market): Machinery must comply with standards that ensure food contact surfaces are safe and non-toxic.

- EHEDG (European Hygienic Engineering & Design Group): Guidelines on hygienic equipment design to minimize contamination risks.

Compliance with these regulations is crucial for market access and to maintain consumer trust in food brands.

Recent Developments

Notable developments in the food processing and handling equipment market:

- Robotics: Robotic arms and automated systems are becoming more common in food factories, improving accuracy and reducing contamination. This is particularly relevant in meat processing, bakery automation and dairy production.

- Smart Packaging Lines: Manufacturers are investing in AI-powered packaging equipment that can auto-detect product sizes, weights and defects. This ensures consistency, minimizes material waste and compliance with labelling regulations.

- Mergers and Partnerships: Big companies are buying smaller specialist companies to get access to proprietary technology and new regional markets. For example, Marel’s acquisition of Valka to strengthen their fish processing capabilities.

- Sustainable Machinery: There is growing focus on energy efficient equipment that uses less water, reduces carbon emissions and operates at optimal power levels. This is attractive to regulators and environmentally conscious buyers.

Current and Future Growth Implications

Demand-Supply Analysis: As demand for processed food increases, manufacturers are increasing production capacity and therefore demand for equipment. There is a supply-demand imbalance in certain segments like robotic automation and companies are accelerating product development and manufacturing capacity.

Gap Analysis: While advanced food processing technology is widely adopted in North America and Western Europe, emerging markets face challenges around affordability and technical expertise. Bridging this gap through training programs, modular equipment and public-private partnerships can unlock new growth opportunities.

Top Companies in the Food Processing and Handling Equipment Market

- GEA Group AG

- Bühler AG

- JBT Corporation

- Alfa Laval AB

- Marel hf

- SPX FLOW, Inc.

- The Middleby Corporation

- Tetra Pak International S.A.

- Krones AG

- Heat and Control, Inc.

Food Processing and Handling Equipment Market: Report Snapshot

Segmentation | Details |

By Equipment Type | Processing Equipment, Packaging Equipment, Automation & Control Equipment |

By Application | Bakery & Confectionery, Dairy, Meat & Poultry, Seafood, Beverages, Others |

By End-User | Food Manufacturers, Food Service Companies, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High-Growth Segments

The following segments are poised for significant growth:

Processing Equipment: Core food machines like mixers, grinders, and ovens are in demand. Production is scaling up across many food types. This drives steady equipment growth.

Automation & Control Systems: Automation systems are seeing more use. They speed up production and improve tracking. They also cut human errors, key in clean zones.

Meat & Poultry Application Segment: Meat demand is rising worldwide. This drives need for meat-processing tools. Deboning, cutting, and chilling systems are growing fast.

Major Innovations

Innovation in the food processing and handling equipment market includes:

- Vision Systems: AI vision tech is now used in packaging and quality checks. It spots contaminants and flaws instantly. This boosts safety and product quality.

- Modular Equipment: Modular machines offer flexibility. They can be reconfigured fast for new products. This cuts downtime and saves costs.

- Sanitary Design Enhancements: Sanitary design is improving in food equipment. Machines now have fewer crevices and better access for cleaning. Antimicrobial materials are also widely used.

Potential Growth Opportunities

Opportunities for future growth in the market include:

Expansion into Emerging Economies: Emerging markets are changing fast. Diets and incomes are rising in Asia, Africa, and Latin America. This boosts demand for processed foods and food equipment.

Digitization and Industry 4.0 Integration: Industry 4.0 is changing food equipment. IoT and machine learning are now built in. These tools help cut waste, spot issues early, and boost efficiency.

Plant-Based and Alternative Foods Processing: Plant-based and alternative foods are rising in demand. This trend needs special processing tools. New equipment for these foods is now a fast-growing market.

Extrapolate Says:

The food processing and handling equipment market is going to grow big. As technology gets better equipment is getting smarter, more efficient and cleaner. The market is driven by consumer expectations for safer, better and more convenient food products.

With automation, urbanization and regulatory change the industry is changing. The combination of new tech and global demand is redefining food manufacturing from the factory floor to the plate.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Food Processing and Handling Equipment Market

- August-2025

- 148

- Global

- food-beverage

Related Research

Adaptogens Market Size, Share, Growth & Industry Analysis, By Source (Ashwagandha, Ginseng, Rhodiola

May-2025

Alginate Market By Product (Potassium Alginate, Calcium Alginate, Propylene Glycol Alginate, Sodium

March-2023

Artificial Sweetener Market By Type (Aspartame, Acesulfame-K, Monosodium Glutamate, Saccharin, and S

March-2023

B2B Food Market Size, Share, Growth & Industry Analysis, By Product Type (Fresh Produce, Dairy Produ

July-2025

Barbecue (BBQ) Sauce Market Insights Aircraft Air Brake Market Insights 2022, Global Analysis and Fo

July-2021

Beverage Cans Market Size, Share, Growth & Industry Analysis, By Material (Aluminium, Steel), By App

June-2025