Beverage Cans Market Size, Share, Growth & Industry Analysis, By Material (Aluminium, Steel), By Application (Alcoholic Beverages, Non-Alcoholic Beverages, Energy Drinks, Others), By Can Size (Less than 250ml, 250–500ml, More than 500ml), and Regional Analysis, 2024-2031

Beverage Cans Market: Global Share and Growth Trajectory

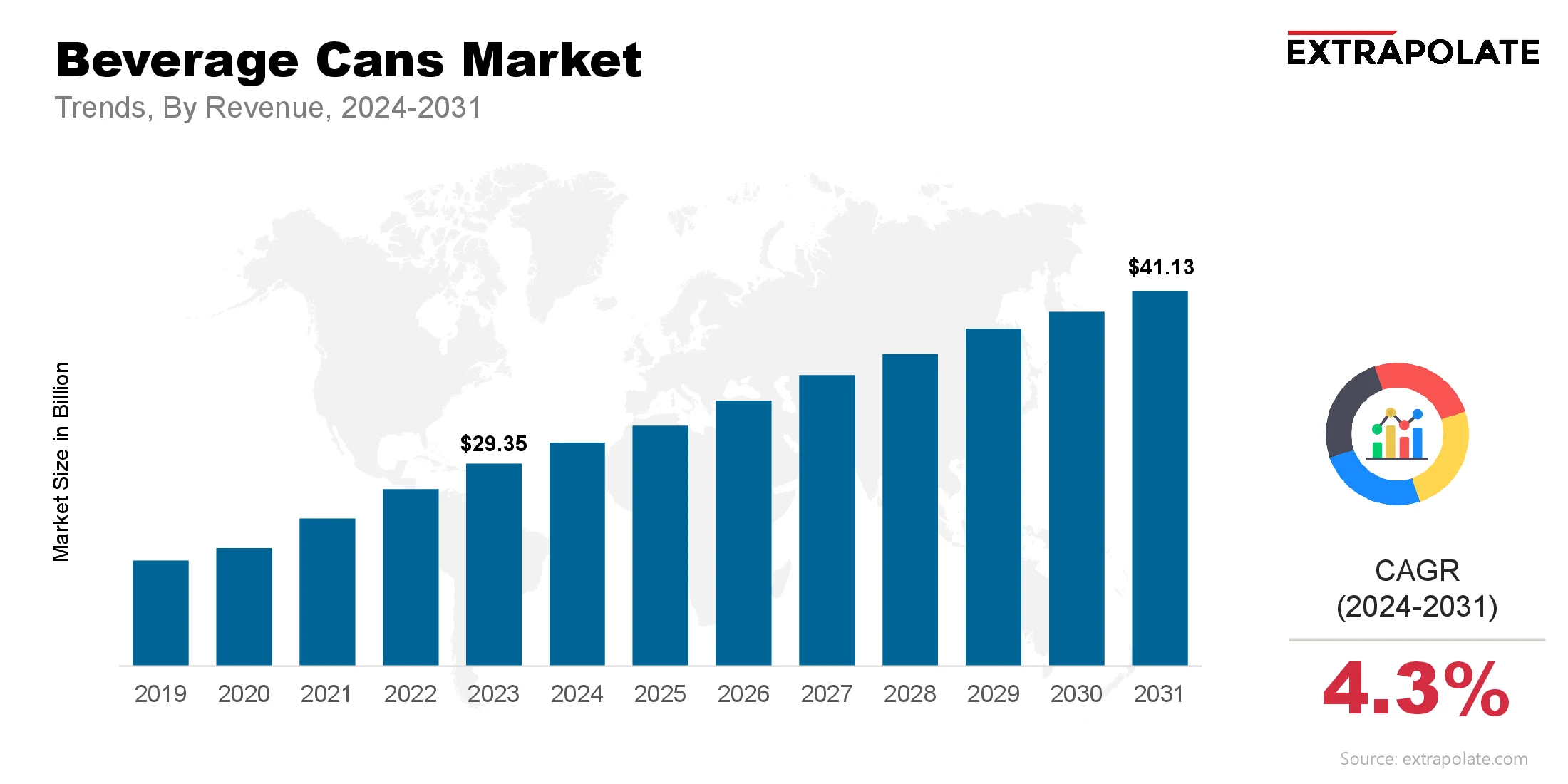

The global beverage cans market size was valued at USD 29.35 billion in 2023 and is projected to grow from USD 30.47 billion in 2024 to USD 41.13 billion by 2031, exhibiting a CAGR of 4.3% during the forecast period.

The global market is rapidly growing, fueled by the increasing demand for eco-friendly, convenient, and lightweight packaging solutions. Beverage cans are used for packaging a vast variety of drinks, including carbonated soft drinks, alcoholic beverages, energy drinks, fruit juices, and ready-to-drink (RTD) products.

As consumer preferences shift toward on-the-go consumption and sustainable choices, aluminum beverage cans are being highly preferred among manufacturers and end-users alike. Their high recyclability, extended shelf life, and ability to preserve the taste and quality of beverages have positioned them as a preferred choice in the beverage industry.

One of the main factors driving the growth of the market is the global shift toward sustainable packaging. Governments, organizations, and consumers are progressively embracing environmental stewardship, leading to a rise in demand for materials that offer lower carbon footprints and high recyclability.

Aluminum cans meet these criteria efficiently, as they are 100% recyclable without compromising on quality. Compared to plastic and glass containers, aluminum requires less amounts of energy to recycle and is often part of a closed-loop recycling system. As a result, beverage manufacturers are transitioning to aluminum cans to meet their sustainability goals and align with increasingly strict environmental regulations.

The increasing consumption of ready-to-drink beverages, particularly among younger demographics and urban populations, is another critical growth driver. RTD beverages, which include cold brew coffee, functional drinks, and flavored water, are increasingly packaged in cans due to their convenience, portability, and aesthetic appeal.

In addition to this, the beverage industry is witnessing growing innovation in can design, including resealable cans, slim cans, and multi-pack options, which improve product differentiation and consumer engagement.

The alcoholic beverage segment, especially beer and hard seltzers, is a significant contributor to market demand. The resurgence of canned beer and the rising popularity of low-alcohol and flavored alcoholic drinks have led to increased use of cans in this segment.

Moreover, beverage cans offer superior protection against light and oxygen, which is necessary for preserving the taste profile of craft and premium beverages. These attributes, combined with innovations in digital printing and customization, enable brands to use cans as a powerful marketing tool.

Geographically, North America and Europe dominate the beverage cans industry due to high consumption of packaged beverages, well-established recycling infrastructure, and strong regulatory support for sustainable packaging.

However, the Asia-Pacific region is expected to observe the fastest growth during the forecast period, driven by rising disposable incomes, rapid urbanization, and expanding beverage production in emerging economies like China, India, and Southeast Asia.

Despite the optimistic outlook, the market faces challenges such as fluctuations in raw material prices (particularly aluminum) and competition from alternative packaging formats like PET bottles and cartons. At the same time, ongoing innovations, strategic partnerships, and increased investment in recycling infrastructure are expected to mitigate these challenges and support long-term market growth.

Key Market Trends Driving Product Adoption

Sustainability, innovation, and design improve the can market. These factors fuel market growth. Important trends include the following:

- Sustainability Focus: Rising plastic waste issues affect producers. Many now choose aluminum cans. These cans are infinitely recyclable. They reduce environmental harm.

- Lightweight and Durable Packaging: Cans protect drinks from light and oxygen. This helps keep flavour and quality. Lightweight cans lower transport costs. They also boost efficiency.

- Customizable and Attractive Designs: Advances in printing and embossing technology are allowing brands to create visually appealing, customizable cans that stand out on store shelves.

- Convenience and Portability: Resalable cans fit modern consumers’ needs. Compact size makes them easy to carry.

- Rising Popularity of Craft Beverages: The craft beer and artisanal beverage industries are increasingly adopting cans due to their affordability, protection from UV light, and ease of distribution.

Major Players and their Competitive Positioning

The global beverage cans industry is highly competitive and features key players like the Ball Corporation, Crown Holdings, Ardagh Group, and Can-Pack. These companies are constantly investing in research and development to improve can performance, sustainability, and design. Moreover, regional players and niche manufacturers are entering the market to address particular demands of consumers.

Consumer Behavior Analysis

Consumers across the globe are increasingly inclined toward beverage cans for several reasons:

- Environmental Awareness: Consumers prefer recyclable packaging. Eco-consciousness drives this trend.

- Convenience: Cans are lightweight and simple to cool. They also dispose of easily, perfect for travel.

- Premium Appeal: Craft and energy drinks are valued for freshness. Buyers focus on product quality too.

- Health Trends: Health-conscious buyers want canned water and kombucha. Low-sugar options are also rising in demand.

Pricing Trends

Pricing in the market is affected by raw material costs (especially aluminum), energy prices, and regional regulatory policies. While premium and customized cans attract higher pricing, the rise of private labels and value brands is supporting growth in the low-cost segment. Bulk production and improved recycling infrastructure are helping mitigate price volatility.

Growth Factors

Several key drivers are contributing to the expansion of the beverage cans industry:

- Eco-Friendly Packaging Demand: More people choose cans over plastic. Cans offer an eco-friendly option.

- Urbanization and Changing Lifestyles: More people in urban spots drink ready-to-use beverages. This trend lifts demand levels.

- Growth in the Alcoholic Beverage Sector: The increasing consumption of beer and hard seltzers is significantly contributing to can demand.

- Expansion of Cold Chain Logistics: Better distribution networks are expanding reach. Canned drinks are now easier to find in remote areas.

- Technological Innovations: Modern cans have new looks and resealable tops. Coatings protect and lengthen product freshness.

Regulatory Landscape

Governments around the world are introducing stringent rules on plastic use, creating favourable conditions for the growth of aluminum beverage cans. Recycling mandates and Extended Producer Responsibility (EPR) schemes are encouraging brands to shift toward eco-friendly packaging.

Recent Developments

The beverage can market keeps evolving. Innovation and strategy drive these changes:

- Introduction of Resealable Cans: Improving ease of use is a priority. Reducing waste helps sustainability.

- Smart Packaging Technologies: Integration of QR codes and temperature indicators for interactive consumer experiences.

- Expansion in Emerging Markets: Key players are setting up production facilities in Asia and Africa to cater to growing demand.

- Use of Recycled Content: More cans use post-consumer recycled aluminum. This boosts sustainability in manufacturing.

Current and Potential Growth Implications

- Demand Supply Analysis

The demand for beverage cans is outpacing supply in several regions due to surging demand for ready-to-drink and craft beverages. Aluminum shortages and supply chain disruptions may impact production timelines and cost structures. - Gap Analysis

Despite the market’s growth, certain gaps still exist:

- Recycling Infrastructure: Underdeveloped recycling systems in some regions hinder circular economy goals.

- Innovation Gaps: Limited options for resealable and tamper-proof cans in some product segments.

- Cost Barriers: Higher initial costs for small brands to adopt premium can technology.

- Awareness Issues: Consumer knowledge about can recyclability and environmental benefits is still lacking in some regions.

Top Companies in the Beverage Cans Market

Leading companies in the market include:

- Ball Corporation

- Crown Holdings

- Ardagh Group

- Can-Pack

- CCL Container

- Toyo Seikan Group

- Silgan Holdings

- Visy Industries

- Hindustan Tin Works Ltd.

- Mahmood Saeed Beverage Cans & Ends Industry Co.

Beverage Cans Market: Report Snapshot

Segmentation | Details |

By Material | Aluminum, Steel |

By Application | Alcoholic Beverages, Non-Alcoholic Beverages, Energy Drinks, Others |

By Can Size | Less than 250ml, 250–500ml, More than 500ml |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

High Growth Segments

The following market segments are expected to show rapid growth:

- Aluminum Cans: Recyclability drives demand. Light weight is another key factor.

- Energy Drinks & Functional Beverages: Fitness-conscious buyers want more products. Young people add to the demand.

- Craft Beer Segment: Small breweries choose cans for branding. Cans also help lower costs.

Major Innovations

Innovation drives market share growth in beverage cans. Key new ideas include the following:

- Digital Printing: Enables faster turnaround and smaller print runs for niche brands.

- Resealable Can Designs: Enhancing functionality and user satisfaction.

- Eco-Friendly Coatings: BPA-free and food-safe internal coatings.

- Smart Labeling: Packaging with NFC tech connects with buyers. It tracks products through the supply chain.

Potential Growth Opportunities

Despite strong momentum, companies must address several challenges:

- Supply Chain Volatility: Securing a stable supply of aluminum amid rising demand.

- Regulatory Compliance: Adhering to packaging waste regulations globally.

- Consumer Education: Promoting the recyclability and benefits of cans over plastic.

- Customization Demand: Managing cost and efficiency while offering highly customized cans.

- Competition from Alternatives: Glass bottles and eco-friendly cartons still pose competition in some segments.

Kings Research says:

The global beverage cans market is set to make significant progress, propelled by sustainability trends, convenience, and rising demand across alcoholic and non-alcoholic beverage segments. Companies that focus on advancements, localization, and consumer engagement will be well-placed to sustain in this competitive landscape.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Beverage Cans Market Size

- June-2025

- 165

- Global

- food-beverage

Related Research

Adaptogens Market Size, Share, Growth & Industry Analysis, By Source (Ashwagandha, Ginseng, Rhodiola

May-2025

Alginate Market By Product (Potassium Alginate, Calcium Alginate, Propylene Glycol Alginate, Sodium

March-2023

Artificial Sweetener Market By Type (Aspartame, Acesulfame-K, Monosodium Glutamate, Saccharin, and S

March-2023

B2B Food Market Size, Share, Growth & Industry Analysis, By Product Type (Fresh Produce, Dairy Produ

July-2025

Barbecue (BBQ) Sauce Market Insights Aircraft Air Brake Market Insights 2022, Global Analysis and Fo

July-2021

Beverage Cans Market Size, Share, Growth & Industry Analysis, By Material (Aluminium, Steel), By App

June-2025