Steam Turbine Market Size, Share, Growth & Industry Analysis, By Type (Condensing, Non-condensing, Extraction, Back-pressure), By Capacity (<50 MW, 50–150 MW, >150 MW), By Application (Power Generation, Industrial, Petrochemical, Nuclear), By End-User (Utilities, Industrial Plants, Refineries, Chemical Plants), and Regional Analysis, 2024-2031

Steam Turbine Market: Global Share and Growth Trajectory

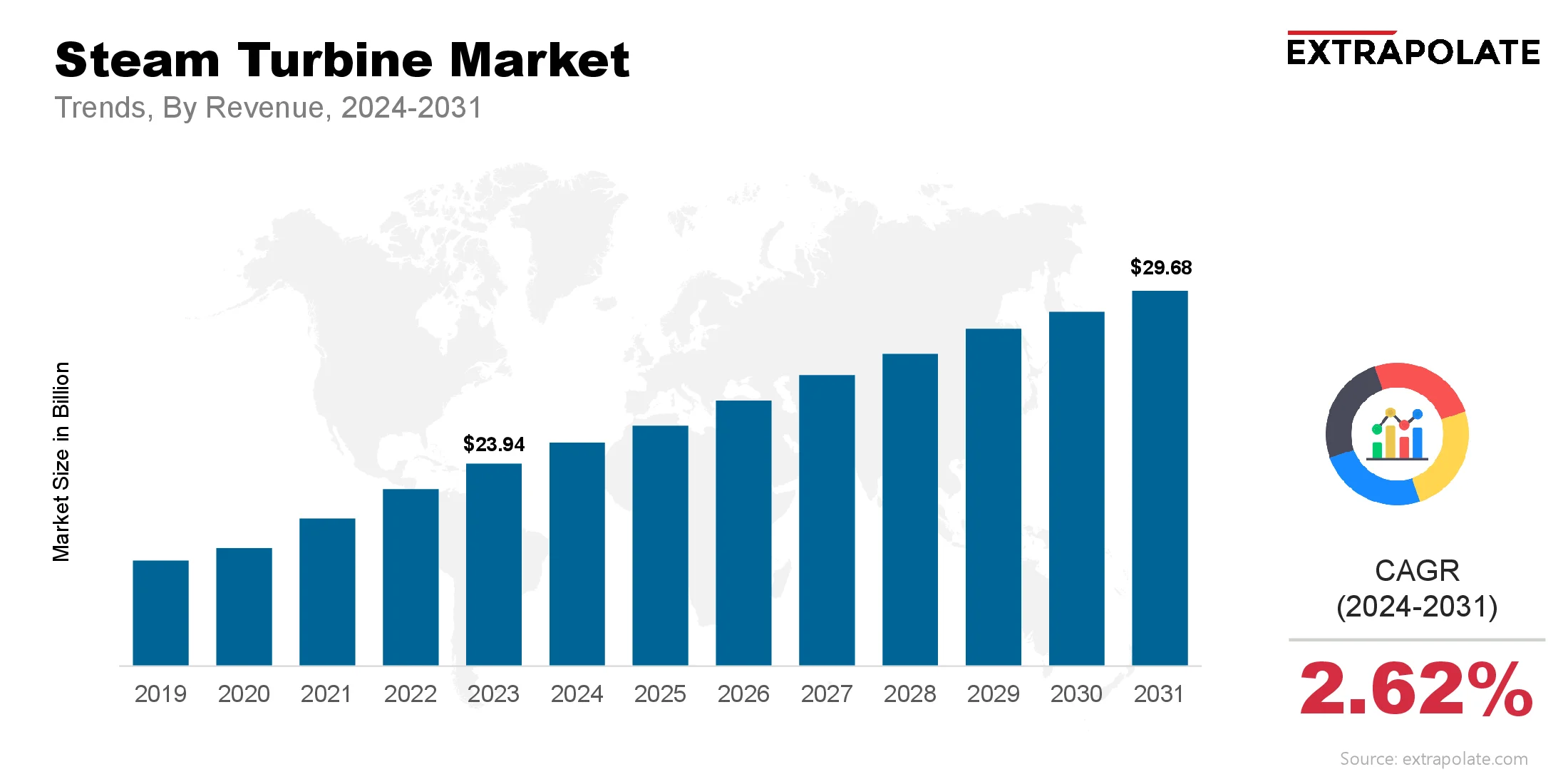

The global Steam Turbine Market size was valued at USD 23.94 billion in 2023 and is projected to grow from USD 24.76 billion in 2024 to USD 29.68 billion by 2031, exhibiting a CAGR of 2.62% during the forecast period.

The global steam turbine market is expanding steadily. This growth is driven by their critical role in power generation, industrial operations, and mechanical drive systems. As energy diversification becomes a priority, steam turbines continue to play a key role in delivering reliable base-load power and supporting industrial applications. Their ability to efficiently convert thermal energy into mechanical power makes them valuable across various sectors, including utilities, petrochemicals, manufacturing, and cogeneration.

A major factor contributing to market growth is the modernization of aging thermal power infrastructure. Countries in Asia and Eastern Europe are leading efforts to upgrade old fossil-fuel plants with more efficient and cleaner technologies. Steam turbines are central to this transition due to their scalability, long operational life, and compatibility with combined heat and power (CHP) systems. CHP systems are gaining popularity as they provide both electricity and useful heat, improving overall energy efficiency and reducing emissions.

While renewable energy sources such as wind and solar are growing rapidly, steam turbines remain relevant. They are essential for base-load supply and in industrial settings where both heat and power are required. In regions like China, India, the U.S., and the Middle East, where coal, gas, and nuclear power remain dominant, steam turbines continue to meet rising energy demand. They also support district heating and provide mechanical power for industries such as chemicals, food and beverage, pulp and paper, and oil refining.

In conclusion, steam turbines will remain a vital part of the global energy mix, even as cleaner technologies emerge. As the world transitions toward sustainable energy, the need for stable and reliable power will ensure continued demand. Manufacturers that focus on innovation, service optimization, and integration with low-carbon energy systems will be best positioned to lead the market.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

- Continued Use in Thermal and Nuclear Power Generation: Thermal and nuclear plants account for a large share of global electricity generation. While coal usage is declining in some regions due to environmental regulations, steam turbines remain vital in gas, biomass, and nuclear plants. Nuclear power, especially in countries like China, Russia, and France, heavily relies on large-scale steam turbines for efficient power conversion. As more advanced nuclear reactors and small modular reactors (SMRs) emerge, the demand for reliable steam turbine technology will rise.

- Growth in Industrial Cogeneration and CHP Systems: Industrial facilities are increasingly adopting cogeneration or combined heat and power systems to optimize energy use. Steam turbines in these systems help utilize waste heat from processes or fuel combustion to generate electricity and steam for other uses. This dual utility enhances overall efficiency and reduces fuel consumption and emissions—making them attractive for energy-intensive industries.

- Technological Advancements in Turbine Design: Material innovations, such as advanced alloys and coatings, are improving turbine blade longevity and heat resistance. Additionally, developments in supercritical and ultra-supercritical steam conditions are pushing efficiency boundaries. Modern turbines are designed with advanced control systems, condition monitoring, and predictive maintenance capabilities, improving operational efficiency and reducing downtime.

- Energy Transition and Hybrid Power Systems: As power systems become more diversified, hybrid solutions combining renewables with thermal backup are gaining traction. Steam turbines are playing supporting roles in hybrid plants, acting as stable energy sources when solar or wind output fluctuates. This trend is particularly visible in utility-scale projects in emerging economies where energy security and grid stability are top priorities.

Major Players and Their Competitive Positioning

The steam turbine market is highly consolidated, with a few global players dominating due to the complexity and capital-intensive nature of turbine manufacturing. These companies compete through technological innovation, service offerings, and global project execution capabilities.

Key players included are General Electric Company, Siemens Energy AG, Mitsubishi Power, Ltd., Toshiba Energy Systems & Solutions Corporation, Doosan Škoda Power, Ansaldo Energia, Bharat Heavy Electricals Limited (BHEL), Harbin Electric Corporation, Fuji Electric Co., Ltd., MAN Energy Solutions and others.

These firms are focusing on upgrading aging fleets, developing high-efficiency turbines, and offering integrated service packages for maintenance, retrofitting, and digital solutions.

Consumer Behavior Analysis

- Preference for Long Lifespan and Reliability: Industrial and power users trust steam turbines for their long life. They run steady and have fewer sudden failures. These are big, long-term buys. So, users want machines that stay strong and work well for years.

- Demand for Customized Engineering Solutions: Buyers often need custom-built turbines. They base needs on steam flow, plant space, and heat cycles. To meet this, vendors offer modular parts and flexible layouts. Options like back-pressure or condensing setups are now common.

- Emphasis on Service and Lifecycle Support: After-sales service is key for buyers. They want long support, spare parts, and smart tools for upkeep. Digital features like real-time checks and AI help cut repair costs. This lowers total spend over the turbine’s life.

- Environmental Awareness and Efficiency: Green rules and carbon costs are rising fast. Firms now want turbines that save energy and cut emissions. Turbines that work under supercritical steam or link with carbon capture are in high demand.

Pricing Trends

Turbine prices change a lot based on size, use, and custom features. Small turbines under 50 MW may cost less than $10 million. Big turbines for thermal or nuclear plants can go over $100 million with setup.

Key Pricing Influencers

- Size and Capacity: Larger turbines cost more due to higher output.

- Steam Conditions and Extraction Points: More extraction stages and tough steam settings raise the price.

- Materials Used: High-temp parts need special metals, which adds to cost.

- Auxiliary Systems: Add-ons like generators, condensers, and control units increase total price. In February 2025, Siemens Energy partnered with Rolls-Royce SMR to be the exclusive supplier of steam turbines, generators and auxiliary systems for their new Generation 3+ small modular reactors. This is a major launch of compact, factory-built steam turbine systems for SMR use cases

- Transport and Setup: Big and complex projects cost more to move and install.

Market Trends

Suppliers now offer loans, leases, and service plans. These help lower upfront costs for buyers. In cost-sensitive areas like Southeast Asia and Africa, low-cost designs are in demand. These balance price with good performance.

Growth Factors

Here are the key drivers for the steam turbine market:

- Industrialization in Emerging Markets: India, Vietnam, Brazil and Indonesia are investing in infrastructure and industry. They are building thermal and cogeneration plants and will continue to do so, creating a steady demand for steam turbines.

- Flexible Power Generation: Steam turbines provide grid stability and backup power when variable renewable energy sources underperform. They can ramp up or down and are perfect for modern, flexible power systems.

- Life Extension and Retrofitting: A large portion of the global steam turbine fleet is over 25 years old. Utilities and industries are investing in retrofits and efficiency upgrades rather than new units. This supports aftermarket growth for turbine manufacturers. In October 2024, GE Steam Power launched its largest ever 75-inch last stage blade for the Arabelle low pressure rotor for Hinkley Point C nuclear power plant. This new blade is designed to boost efficiency and power output in large nuclear steam turbines

- Biomass and Waste-to-Energy Projects: The global push for decarbonization is driving investment in biomass fired and waste to energy plants. Steam turbines are key to converting the heat energy from these sources into electricity.

Regulatory Landscape

Steam turbines have to comply with safety, emission and efficiency regulations across regions. Manufacturers have to adhere to national and international regulations for power plant emissions, thermal efficiency and equipment safety.

Notable regulations include:

- EPA for power plant emissions in the US

- EU’s Industrial Emissions Directive (IED) for large combustion plants

- ISO 9001 and ISO 14001 for quality and environmental management

- ASHRAE and ANSI for industrial systems

- Nuclear regulatory compliance for turbines used in nuclear reactors (e.g. US NRC, IAEA standards)

With the increasing focus on reducing greenhouse gas emissions, manufacturers are offering steam turbines that can work with carbon capture systems and advanced steam cycles.

Recent Developments

- Supercritical and Ultra-Supercritical Steam Technology:

Top power firms now use turbines that work at higher heat and pressure. This helps plants run better and cut emissions. - Digital Twin and Predictive Maintenance Tools:

Firms like GE and Siemens use AI tools in turbines. These tools spot issues early and help avoid shutdowns. - Service-Centric Business Models:

In places with fewer new plants, OEMs focus on service. They now offer upgrades and help boost plant output. - Strategic Collaborations and Global Expansion:

Big makers team up with EPCs and local players. These deals help win projects in Asia, Africa, and Latin America.

Current and Potential Growth Implications

a. Demand-Supply Analysis: Steam turbines are still in high demand for industry and thermal power. Asia-Pacific and the Middle East lead this demand. In North America and Europe, demand is lower. The shift to clean energy has slowed turbine use there. Big OEMs control most of the supply. They have plants worldwide and also run local assembly and service hubs.

b. Gap Analysis: Many industries use steam turbines today. But there’s a lack of new, small, and smart turbines for local and green power. Firms that build compact and efficient turbines can win here. R&D in this area could unlock new chances for growth.

Top Companies in the Steam Turbine Market

- General Electric Company

- Siemens Energy AG

- Mitsubishi Power, Ltd.

- Toshiba Energy Systems & Solutions Corporation

- Doosan Škoda Power

- Bharat Heavy Electricals Limited (BHEL)

- Fuji Electric Co., Ltd.

- Harbin Electric Corporation

- MAN Energy Solutions

- Ansaldo Energia

Steam Turbine Market: Report Snapshot

Segmentation | Details |

By Type | Condensing, Non-condensing, Extraction, Back-pressure |

By Capacity | <50 MW, 50–150 MW, >150 MW |

By Application | Power Generation, Industrial, Petrochemical, Nuclear |

By End-User | Utilities, Industrial Plants, Refineries, Chemical Plants |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, Latin America |

High Growth Segments

- Condensing Steam Turbines: These turbines are used in large power plants. Asia-Pacific sees high demand due to their strong steam-to-power output.

- Back-Pressure Turbines: These are used where both power and steam are needed. They’re common in chemical, sugar, and paper plants.

- >150 MW Segment: Big turbines over 150 MW lead the market. They are key in thermal and nuclear plants in growing nations.

Major Innovations

- High-Efficiency Blade Designs: New 3D blades and cooling improve airflow. This boosts power and heat use.

- Integrated Control Systems: Digital control tools help run turbines better. They also raise safety during use.

- Modular Turbine Platforms: Modular designs make parts faster to build. This cuts delays for big projects.

Growth Opportunities

- Emerging Markets Investment: Cities and industries in Asia, Africa, and Latin America are growing. They need more power, pushing turbine use.

- Waste Heat Recovery: Firms want to turn waste heat into energy. Small steam turbines are used for this.

- Carbon-Neutral Projects: There’s rising need for clean fuel turbines. Hydrogen, ammonia, and bioenergy drive this trend.

- Retrofitting for Digitalization: AI and IoT help track turbine health. This leads to smarter and safer upkeep.

Extrapolate Research Says:

The steam turbine market will grow till 2031. Industry use and steady power needs will lead the way. Green goals and better tech will shape future designs. New blades, smart tools, and fuel mixes will help. Power safety, factory needs, and market growth all support turbines. They will stay key in world energy plans.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Steam Turbine Market Size

- August-2025

- 148

- Global

- energy-and-power

Related Research

Organic Rankine Cycle Market Size, Share, Growth & Industry Analysis, By Application (Solar Thermal

February-2023

Air Electrode Battery Market Size, Share, Growth & Industry Analysis, By Product (Zinc-Air Batteries

September-2024

Battery Recycling Market Size, Share, Growth & Industry Analysis, By Battery Chemistry (Lead-Acid, L

August-2025

Biodiesel Market By Feedstock (Soybean, Rapeseed, Palm, Palm, Poultry, Tallow, White Grease, and Oth

January-2023

Biomass Boiler Market Size, Share, Growth & Industry Analysis, By Product Type (Fully Automated Boil

August-2025

Biomass Power Generation Market Size, Share, Growth & Industry Analysis, By Feedstock (Woody Biomass

August-2025

Biomethane Market by Application (Automotive, Power Generation, and Others), Production Method (Ferm

February-2023

Cable Entry Systems and Components Market Size, Share, Growth & Industry Analysis, By Product Type (

February-2025

Carbon Capture and Storage Market Size, Share, and COVID-19 Impact Analysis, By Capture Source (Chem

August-2025

Diesel Market Size, Share, Growth & Industry Analysis, By Application (Transportation (On-road, Off-

April-2025