Hydraulic Cylinder Market Size, Share, Growth & Industry Analysis, By Type (Single Acting Cylinders, Double Acting Cylinders, Telescopic Cylinders), By Application (Construction, Agriculture, Aerospace & Defense, Industrial Equipment), By Bore Size (Less than 50 mm, 51–100 mm, 101–150 mm, More than 150 mm), and Regional Analysis, 2024-2031

Hydraulic Cylinder Market: Global Share and Growth Trajectory

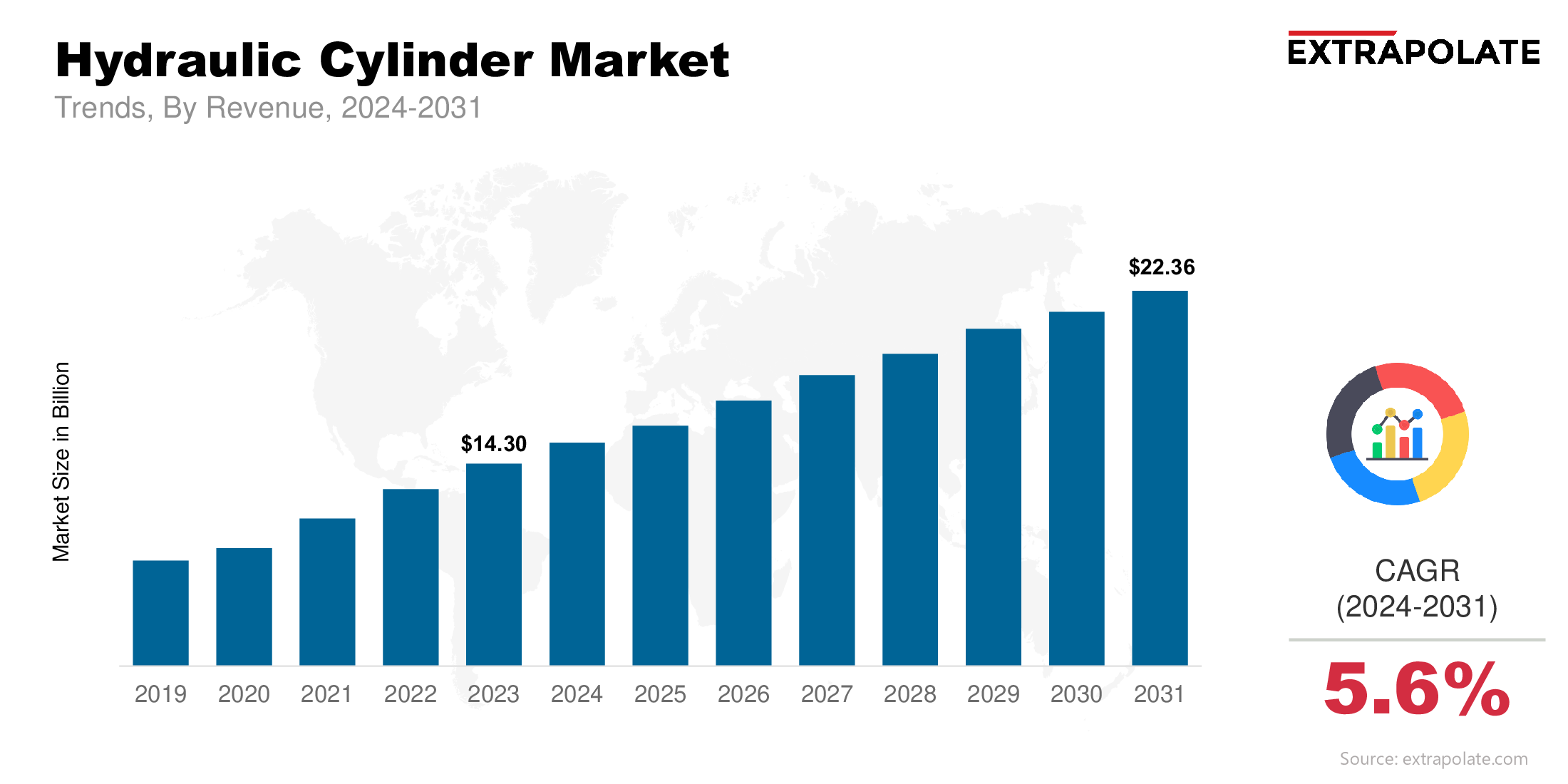

The global hydraulic cylinder market size was valued at USD 14.30 billion in 2023 and is projected to grow from USD 15.24 billion in 2024 to USD 22.36 billion by 2031, exhibiting a CAGR of 5.6% during the forecast period.

The global market is growing rapidly as the demand for automation and mechanization is increasing across various industries. Hydraulic cylinders, which convert hydraulic energy into mechanical force, are the backbone of heavy machinery, industrial equipment and automotive sectors. Their ability to deliver high force in compact form makes them essential in construction, agriculture, manufacturing, aerospace and defence applications.

Meanwhile, the Asia-Pacific region is rapidly emerging as a key growth hotspot. Countries such as China, India, Japan, and South Korea are witnessing soaring demand fueled by urbanization, infrastructure projects, and expanding industrial sectors. The rapid expansion of construction activities, modernization of agriculture, and growing automotive production lines in this region contribute significantly to market expansion. Additionally, government initiatives promoting smart manufacturing and Industry 4.0 adoption further accelerate the deployment of hydraulic cylinders integrated with advanced sensors and automation capabilities.

The hydraulic cylinder industry is segmented by type into single-acting, double-acting and telescopic cylinders. Double-acting cylinders are leading due to their versatility in providing force in both directions making them suitable for wide range of machinery. Telescopic cylinders are gaining traction for applications where extended stroke length is required in compact space like material handling and mobile cranes.

Key Market Trends Driving Product Adoption

Several key trends are accelerating the adoption of hydraulic cylinders:

- Infrastructure Projects: Rapid urbanization and infrastructure investment, especially in emerging markets, is driving demand for hydraulic powered construction equipment. Excavators, loaders and bulldozers – many of which use hydraulic cylinders – are in high demand for road, bridge and smart city projects.

- Automation and Industry 4.0: As factories go automated, hydraulic cylinders are becoming essential in robotics and industrial automation. Precision, durability and ability to handle heavy loads make them a part of automated systems. These cylinders are now being paired with smart actuators and sensors to create integrated motion control systems.

- Agriculture: Modernization of farming techniques is leading to increased use of hydraulic powered equipment. Tractors, harvesters and loaders with hydraulic cylinders help farmers to improve efficiency and output. Climate change and food security concerns are also driving the need for more efficient farming machinery.

- Energy Efficiency: Manufacturers are developing hydraulic systems with higher energy efficiency to reduce emissions and operational costs. Energy efficient cylinders are gaining traction especially in sectors with strict environmental regulations. Variable displacement pumps and electro-hydraulic hybrids are examples of such innovations.

Major Players and Their Competitive Positioning

The hydraulic cylinder industry is highly competitive with key players investing heavily in R&D to offer innovative, durable and energy efficient solutions. Some of the major players are Parker Hannifin Corporation, Gates Corporation, ContiTech AG (Continental AG), Eaton Corporation, Trelleborg AB, HBD Industries, Aero-Hose Corp., Elaflex Hiby GmbH & Co. KG, Pacific Hoseflex, Kuriyama Holdings Corporation and others.

These companies are expanding their product portfolio, forming strategic partnerships and entering new geographies to stay ahead. For example, Bosch Rexroth’s investment in digital hydraulics and Caterpillar’s expansion in Asia-Pacific is changing the market dynamics.

Consumer Behavior Analysis

Consumer behavior in the hydraulic cylinder market is shaped by several core factors:

- Operational Reliability: End users prioritize reliability and durability especially for equipment operating under high pressure and extreme conditions. Hydraulic cylinders are chosen based on their performance in real world conditions – deserts, snowfields or saltwater regions.

- Custom Solutions: Many industries need custom hydraulic cylinder designs to meet their application requirements. Manufacturers who offer customization and quick turnaround times are better placed in the market. This is more prominent in industries like aerospace, oil & gas and construction.

- Aftermarket Services: Buyers also value efficient aftermarket services – repairs and component replacements. Companies with strong service networks have higher customer loyalty. Service contracts, preventive maintenance plans and quick-spare logistics are becoming key differentiators.

- Total Cost of Ownership (TCO): Buyers are looking at the long term value of hydraulic systems – cost effective solutions with low maintenance, high efficiency and long service life. Warranty offerings and predictive maintenance technologies are increasingly influencing buying decisions.

Pricing

Hydraulic cylinder prices vary by size, pressure rating, material and customization. Standard single acting cylinders are more affordable, while double acting and telescopic cylinders are more expensive due to their complexity.

Raw material cost (steel and aluminum) and global metal price volatility impact cylinder cost. Labor and energy cost in manufacturing hubs also impact production cost. But economies of scale, modular design and global sourcing helps leading manufacturers to offer competitive pricing. Companies are also offering cost effective leasing and subscription based ownership models.

Growth Factors

Several key factors are driving the growth of market:

- Heavy Equipment Demand: Growth in mining, defense, construction and marine industries is driving the need for powerful and durable actuators including hydraulic cylinders.

- Industrial Modernization: Need for high performance motion control solutions in industries like automotive and aerospace is driving the demand for technologically advanced cylinders.

- Rising Adoption in Renewable Energy: Wind turbines and solar panel positioning systems are starting to use hydraulic actuators, contributing to the growth. Hydraulic pitch control systems in wind turbines is a good example.

- Global Trade Expansion: As global trade grows, logistics and material handling industries are investing in hydraulic powered equipment, further driving demand. Ports, warehouses and intermodal transport systems are all increasing their automation.

Regulatory Landscape

Hydraulic cylinder manufacturing is governed by multiple quality, safety and environmental standards:

- ISO Standards (ISO 6020, ISO 6022): Ensures dimensional interchangeability, material quality and design performance.

- RoHS and REACH Regulations: In Europe, restricts the use of certain hazardous substances in hydraulic components.

- OSHA and ANSI Compliance: In the U.S., hydraulic systems in industrial and construction equipment must comply with occupational safety standards.

- Energy Efficiency Directives: Government regulations in various regions are pushing for adoption of energy efficient and eco-friendly hydraulic solutions.

Recent Developments

Hydraulic cylinder market is seeing some exciting developments:

- Smart Hydraulic Cylinders: Manufacturers are integrating sensors and control systems into hydraulic cylinders, enabling real time monitoring, predictive maintenance and automation.

- Eco-Friendly Manufacturing: Companies are adopting environmentally sustainable processes, using recyclable materials and reducing energy consumption during production.

- Partnerships: Leading companies are partnering with OEMs to develop custom hydraulic solutions, to improve performance and reliability.

- Product Line Expansion: Caterpillar and Parker Hannifin have launched new range of heavy duty cylinders to operate in extreme environment for mining and offshore applications.

- R&D Investment: Companies are investing more in R&D to develop lightweight, high strength materials and advanced sealing technology to improve cylinder efficiency and life.

Current and Potential Growth Implications

- Demand-Supply Analysis: With growing demand for hydraulic cylinders, capacity is increasing. But raw material availability and geopolitics can disrupt supply chains. Manufacturers are dual-sourcing and near-shoring to mitigate risks.

- Gap Analysis: There’s a big gap between developed and developing markets. In Africa and Latin America, lack of awareness and infrastructure is limiting market penetration. Bridging this gap with education, training and cost effective solutions can unlock future growth. Also lack of skilled labor to operate and maintain advanced hydraulic systems is another bottleneck.

Challenges and Restraints

- High Initial Investment: Advanced hydraulic systems require huge upfront capital which may deter small and medium enterprises.

- Maintenance Complexity: Hydraulic systems are prone to leakage and contamination if not maintained properly which can lead to costly downtime.

- Environmental Concerns: Leakage of hydraulic fluids can cause environmental damage and hence increased scrutiny and regulations.

Regional Outlook

- North America: Leading in innovation and adoption of heavy machinery. US and Canada are investing heavily in construction and mining equipment.

- Europe: Focused on energy efficiency and sustainable manufacturing. Germany and UK are key markets.

- Asia-Pacific: Will grow the fastest due to infrastructure development in China, India and Southeast Asia.

- Latin America and Middle East & Africa: Growth is steady but hindered by infrastructure. But industrial activity and FDI is creating positive momentum.

Top Companies in the Hydraulic Cylinder Market

- Bosch Rexroth AG

- Eaton Corporation PLC

- Parker Hannifin Corporation

- Enerpac Tool Group

- SMC Corporation

- KYB Corporation

- Wipro Infrastructure Engineering

- Bucher Hydraulics GmbH

- Caterpillar Inc.

- Texas Hydraulics Inc.

Hydraulic Cylinder Market: Report Snapshot

Segmentation | Details |

By Type | Single Acting Cylinders, Double Acting Cylinders, Telescopic Cylinders |

By Application | Construction, Agriculture, Aerospace & Defense, Industrial Equipment |

By Bore Size | Less than 50 mm, 51–100 mm, 101–150 mm, More than 150 mm |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Telescopic Cylinders: Gaining popularity in material handling and construction equipment as they can extend further while taking up less space.

- Double Acting Cylinders: Preferred in precision machinery where force is required in both directions, expanding in automation and manufacturing sectors.

Major Innovations

- Sensor Cylinders: Sensor equipped cylinders allow real time diagnostics, helping industries to optimize system performance and maintenance cycles.

- Corrosion Resistant Materials: New coatings and materials being used to extend life of hydraulic cylinders in marine and offshore applications.

Potential Growth Opportunities

- Emerging Economies: Industrialization and government infrastructure projects in India, Southeast Asia and Africa are opening up new avenues.

- Electro-Hydraulic Integration: Combining electrical control with hydraulic power makes it more efficient and smoother.

- Custom Cylinders for Niche Applications: Demand for custom built cylinders for space exploration and deep sea mining is new business opportunities.

Future Outlook and Forecast Highlights

According to Extrapolate Research, the hydraulic cylinder industry will grow significantly over the next 10 years. Smart hydraulic systems and energy efficient designs will be the new norm. With increased investments in construction, defense and automation, global demand for hydraulic cylinders will continue to rise. Companies that focus on sustainability, R&D and global expansion will lead the way.

Extrapolate Research says:

The hydraulic cylinder market will continue to grow as industries expand and infrastructure develops. As automation and sustainability changes the world, hydraulic technology is evolving to meet the future demands. Advanced materials, smart features and energy efficiency will be the next generation of hydraulic cylinders. Companies investing in innovation, sustainability and market diversification will thrive in this space.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Hydraulic Cylinder Market Size

- June-2025

- 148

- Global

- energy-and-power

Related Research

Organic Rankine Cycle Market Size, Share, Growth & Industry Analysis, By Application (Solar Thermal

February-2023

Air Electrode Battery Market Size, Share, Growth & Industry Analysis, By Product (Zinc-Air Batteries

September-2024

Battery Recycling Market Size, Share, Growth & Industry Analysis, By Battery Chemistry (Lead-Acid, L

August-2025

Biodiesel Market By Feedstock (Soybean, Rapeseed, Palm, Palm, Poultry, Tallow, White Grease, and Oth

January-2023

Biomass Boiler Market Size, Share, Growth & Industry Analysis, By Product Type (Fully Automated Boil

August-2025

Biomass Power Generation Market Size, Share, Growth & Industry Analysis, By Feedstock (Woody Biomass

August-2025

Biomethane Market by Application (Automotive, Power Generation, and Others), Production Method (Ferm

February-2023

Cable Entry Systems and Components Market Size, Share, Growth & Industry Analysis, By Product Type (

February-2025

Carbon Capture and Storage Market Size, Share, and COVID-19 Impact Analysis, By Capture Source (Chem

August-2025

Diesel Market Size, Share, Growth & Industry Analysis, By Application (Transportation (On-road, Off-

April-2025