Battery Recycling Market Size, Share, Growth & Industry Analysis, By Battery Chemistry (Lead-Acid, Lithium-Ion, Nickel-Cadmium, Nickel-Metal Hydride, Others) By Source (Automotive,Industrial, Consumer Electronics, Energy Storage) By Process (Hydrometallurgical, Pyrometallurgical, Mechanical/Physical) By End-User (OEMs, Recycling Companies, Utilities, Government Agencies), and Regional Analysis, 2024-2031

Battery Recycling Market: Global Share and Growth Trajectory

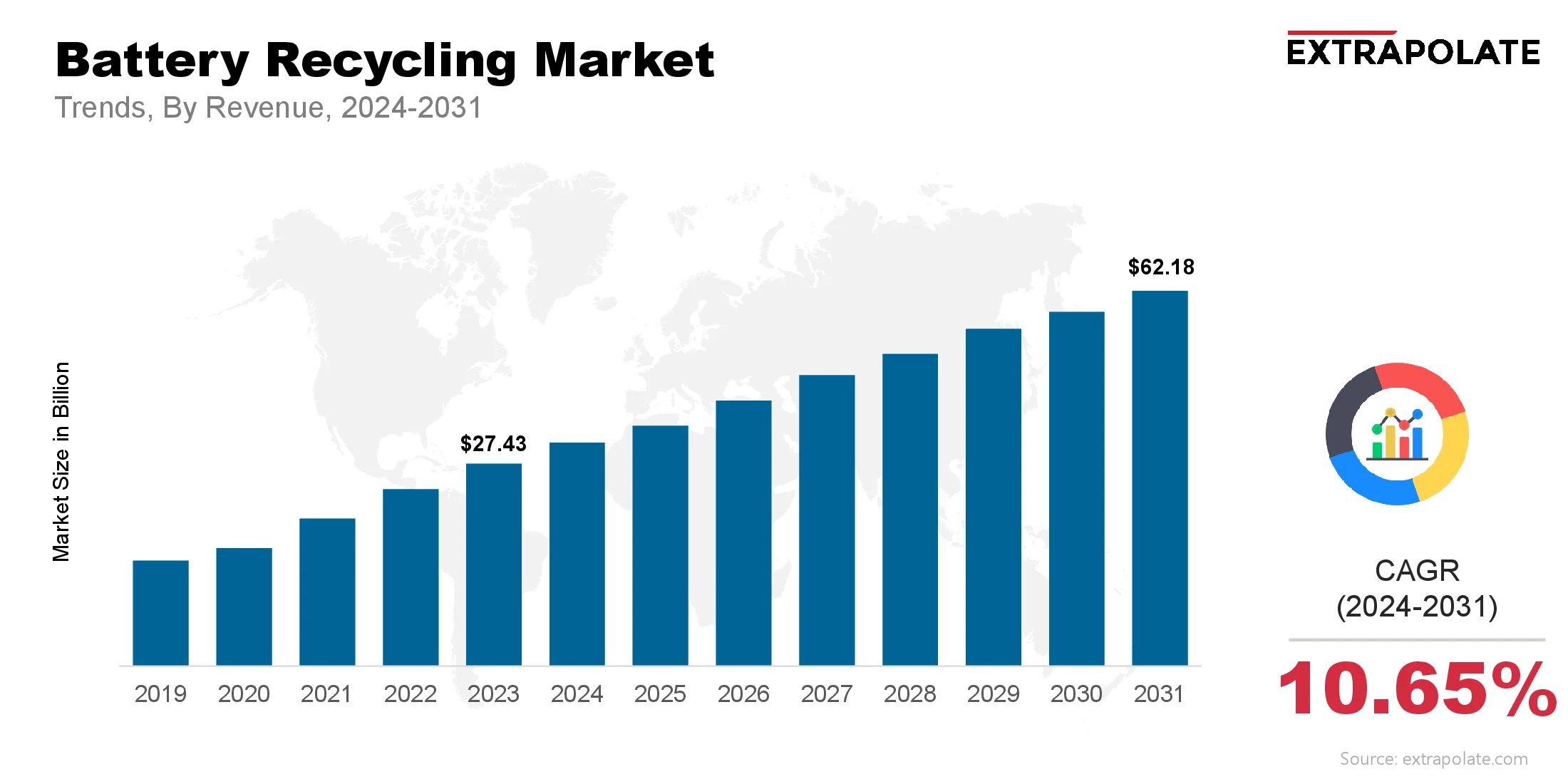

The global Battery Recycling Market size was valued at USD 27.43 billion in 2023 and is projected to grow from USD 30.61 billion in 2024 to USD 62.18 billion by 2031, exhibiting a CAGR of 10.65% during the forecast period.

The battery recycling market is booming and is a key part of the transition to a circular economy. As the world is rapidly electrifying – especially with the surge in electric vehicles (EVs), portable consumer electronics and renewable energy storage systems – the demand for rechargeable batteries has gone through the roof. The surge in battery usage – especially lithium-ion and lead-acid batteries – has created the need for responsible end of life management and battery recycling has never been more important.

At the heart of this market growth is the dual challenge of environmental protection and resource conservation. Batteries contain valuable and finite metals like lithium, cobalt, nickel and lead many of which are sourced from environmentally and geopolitically sensitive regions. By recycling used batteries these metals can be recovered and reused reducing the need for mining and carbon emissions and environmental degradation.

Companies too are stepping up. Big battery makers, automotive companies and energy storage firms are integrating recycling into their value chains – either by partnering with specialized recyclers or setting up in-house recycling facilities. Automakers like Tesla, BYD and Volkswagen are investing in closed loop systems to recover materials from used EV batteries and feed them back into the manufacturing process. This strategic move not only boosts sustainability credentials but also ensures long term resource security.

Key Market Trends Driving Product Adoption

Rising Electric Vehicle Adoption

The EV industry is growing exponentially and battery recycling is a key driver. Lithium-ion batteries in electric vehicles degrade over time and need safe and efficient disposal or repurposing. With EV sales expected to hit 60 million units a year by 2030 the stockpile of spent batteries is growing at the same rate and the demand for scalable recycling solutions is increasing.

Circular Economy Push

Governments are introducing strict regulations and extended producer responsibility (EPR) programs to promote battery recycling. The European Union’s Battery Directive, US EPA guidelines and similar legislation in China and India are mandating safe disposal and minimum recycling efficiencies and putting pressure on manufacturers and recyclers to innovate and comply.

Urban Mining and Resource Recovery

Mining raw materials like cobalt and lithium is resource intensive, environmentally damaging and geopolitically sensitive. Urban mining – recovering materials from used products – is gaining popularity as a safer and more sustainable option. Companies are investing in advanced hydrometallurgical and pyrometallurgical processes to reclaim metals at higher purity and lower energy costs.

Technology in Recycling

New technologies are changing how batteries are dismantled, sorted and processed. From AI enabled disassembly robots to direct recycling methods that preserve cathode integrity these are increasing recovery rates and making recycling more economic. Closed loop recycling where materials are reused to make new batteries is becoming the industry goal.

Second-Life Applications

Before recycling many EV batteries still have up to 80% usable capacity. These batteries are being repurposed for energy storage systems in homes, commercial buildings and solar grids. Second-life use extends the battery life, reduces waste and delays recycling but ultimately feeds more material into the recycling stream.

Major Players and Their Competitive Positioning

The battery recycling market is competitive and evolving rapidly, with a mix of established companies and emerging startups vying for market share. These players focus on technological innovation, strategic partnerships, and global expansion to secure their positions.

Leading companies include: Umicore, Retriev Technologies Inc., Li-Cycle Holdings Corp., American Battery Technology Company, Aqua Metals Inc., Glencore plc, Battery Solutions LLC, TES (Sims Lifecycle Services), GEM Co., Ltd., SungEel HiTech Co., Ltd.

These companies specialize in various battery chemistries and recycling methods, from traditional lead-acid recycling to cutting-edge lithium-ion recovery processes. Many are entering into joint ventures with battery manufacturers and automotive OEMs to establish integrated recycling supply chains. In October 2024, Hydrovolt launched the most automated battery recycling line in the world at its Fredrikstad facility in Norway. It can recover 1 GWh of residual energy per year and make EV and industrial battery recycling safer and more efficient

Consumer Behavior Analysis

- Sustainability Focused: Individuals and corporations are going green. Consumers want to know where batteries come from, how they are used and recycled. Brands that offer responsible battery disposal and environmental stewardship get more trust and loyalty.

- Corporate EPR Programs: Corporations are adopting extended producer responsibility and offering battery take-back programs and drop-off points for used batteries. EV manufacturers like Tesla, BYD and Ford are investing in recycling facilities or partnering with recyclers to manage end-of-life battery responsibly.

- Industrial & Commercial: Large industries and utilities are investing in battery storage for renewable energy. These batteries once degraded are either refurbished or recycled in bulk. This sector values recyclers with technical expertise, regulatory compliance and cost effective processes.

- Awareness and Disposal: While awareness of battery recycling is growing, many consumers still dispose of batteries improperly because they don’t have access to collection points. Governments and businesses are working to educate and make recycling more convenient and over time this will change consumer behavior.

Pricing Trends

Battery recycling economics are influenced by fluctuating raw material prices, processing costs, and technological efficiency. When metals like lithium, cobalt, or nickel command high prices, recycling becomes more profitable. Conversely, low commodity prices can challenge profitability unless offset by subsidies or mandates.

Lead-acid battery recycling remains economically favorable due to high recovery rates and established infrastructure. Lithium-ion battery recycling, though more complex, is becoming increasingly viable as technologies improve and metal prices rise. Market participants are also exploring revenue streams through resale of refurbished cells and by-products.

However, battery collection, transport, and labor still cost a lot. These steps take time, money, and effort. To cut costs, many are using smart tools like AI sorting and automation. New low-energy methods are also helping reduce daily running costs.

Growth Factors

- Electric Vehicle Boom: The rise of EVs is boosting battery recycling. More used batteries are now hitting the market. EV batteries last for 8 to 10 years. Old ones are now ready for reuse. Recycling helps manage this growing waste. It also cuts harm to the planet. A strong EV loop needs good recycling. This makes the whole system clean and safe.

- Raw Material Scarcity: Lithium, cobalt, and nickel are key for EV batteries. But they are hard to find. Many come from risky places. These areas may face political or ethical issues. Recycling cuts the need for fresh mining. It saves rare stuff and helps the planet. It also keeps costs in check. And it makes sure the availability of new batteries.

- Technological Innovation: New tools make battery recycling better. They help get more value from old cells. Methods like direct recycling and hydro tech are growing fast. They boost metal recovery. Some firms now use tiny bugs to get metals. These bugs help clean and sort waste. They also make recycling more useful and cheap.

- Supportive Regulations: Laws are pushing firms to recycle more. This includes clear rules and rewards. Governments now give tax cuts and grants. These help firms build better systems. The EU has a new law for batteries. It sets targets for reuse and raw material content. These steps are shaping the market. More firms now see value in battery recycling.

Regulatory Landscape

Battery recycling is heavily regulated across regions due to the toxicity of battery components. Key regulations include:

- EU Battery Directive (and upcoming EU Battery Regulation): Sets collection and recycling targets, requires due diligence on supply chains and minimum recycled content in new batteries.

- U.S. EPA and State Guidelines: Regulates battery storage, transport and disposal. Some states like California have take-back and labeling requirements.

- China’s Battery Recycling Rules: Requires auto manufacturers to set up battery tracking systems and recycling networks. China is also investing in domestic recycling to reduce import dependence.

- UN Basel Convention: Regulates transboundary movement of hazardous battery waste and requires exporting countries to ensure environmentally sound management.

Recyclers must also comply with ISO 14001 (environmental management) and OHSAS 18001 (occupational health and safety).

Recent Developments

- Tesla and Redwood Materials: JB Straubel, one of Tesla’s co-founders, now runs Redwood Materials. His company is working with Tesla and other automakers to recycle lithium-ion batteries. Together they’re building closed-loop supply chains in the US.

- Li-Cycle Expansion: Li-Cycle is setting up large scale recycling facilities across North America and Europe. They use a hydrometallurgical process that can recover over 95% of battery materials.

- American Battery Technology Company’s Pilot Plant: ABTC just opened a pilot plant in Nevada. They use advanced tech to recover valuable materials like lithium, cobalt and nickel.

- Automated Battery Disassembly: Companies in Europe like Duesenfeld and Volkswagen’s Salzgitter plant are using robots to disassemble batteries. This makes the process safer and more efficient.

- New Regulations: A new EU Battery Regulation is coming into full effect by 2025. It will change how batteries are made, labeled and recycled in Europe.

Current and Potential Growth Implications

Demand-Supply Analysis

The quantity of spent batteries is growing along with the use of devices and electric cars. But demand is outpacing the world's current recycling capacity, especially for lithium-ion batteries. For recyclers and IT companies, this mismatch offers both a difficulty and a significant opportunity.

Recycling businesses are trying to increase the size of their facilities. High capital expenditures, license regulations, and technological scalability limitations are some of the major challenges they still face. Investors and governments are beginning to acknowledge the significance of this industry. Consequently, it is receiving increased finance and infrastructure support.

Gap Analysis

Despite growing momentum, several key gaps remain:

- Collection Infrastructure: In many countries, consumers do not have access to convenient or reliable battery collection points.

- Technology Access: In emerging economies, recycling technologies are often too expensive or not fully developed.

- Information Transparency: Public awareness about how and where to recycle used batteries remains low.

Addressing these gaps will be essential to realizing the full potential of global battery recycling.

Top Companies in the Battery Recycling Market

- Umicore

- Retriev Technologies Inc.

- Li-Cycle Holdings Corp.

- American Battery Technology Company

- Aqua Metals Inc.

- Glencore plc

- TES (Sims Lifecycle Services)

- Battery Solutions LLC

- GEM Co., Ltd.

- SungEel HiTech Co., Ltd.

Battery Recycling Market: Report Snapshot

Segmentation | Details |

By Battery Chemistry | Lead-Acid, Lithium-Ion, Nickel-Cadmium, Nickel-Metal Hydride, Others |

By Source | Automotive, Industrial, Consumer Electronics, Energy Storage |

By Process | Hydrometallurgical, Pyrometallurgical, Mechanical/Physical |

By End-User | OEMs, Recycling Companies, Utilities, Government Agencies |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Fast-Growing Areas

- Lithium-Ion Battery Recycling is booming. This is mainly because of the rise in electric vehicles and mobile gadgets.

- Hydrometallurgical Processes are gaining traction. They offer better recovery rates and are more eco-friendly.

- Second-Life Battery Management is becoming a smart move. Batteries are reused before recycling, creating extra revenue.

- The Asia-Pacific Region is leading the way. It's ahead in both battery production and recycling innovation.

New Innovations

- Direct Cathode Recycling is a game-changer. It keeps cathode materials intact, cutting down reprocessing work.

- AI and Robotics are making things easier. They improve safety, speed, and efficiency in breaking down batteries.

- Eco-Friendly Extractants are replacing harsh chemicals. Bio-based or safer options are taking over.

- Blockchain Traceability is being used more. It helps track batteries from start to end, ensuring proper handling.

Big Opportunities in the Market

- Urban Mining in Big Cities is growing. These areas have tons of e-waste that can be turned into valuable materials.

- Public-Private Partnerships are making a difference. Companies and governments are teaming up to invest in infrastructure and R&D.

- Regulation-Driven Innovation is pushing tech improvements. New laws are pushing companies to create better solutions.

- Education and Awareness Campaigns are key. They help get more people involved in proper battery disposal.

Extrapolate Research Says:

The global battery recycling market is on the edge of big change. The world needs cleaner and more sustainable energy systems.

Battery demand is going through the roof—especially for EVs and green energy storage. That makes it even more urgent to handle old batteries the right way.

Recycling helps save valuable materials. It also cuts down environmental harm and makes the supply chain stronger.

Thanks to fast innovation and growing rules, recycling is no longer a side topic. It's becoming a key part of the clean energy world.

Companies that invest in smart, scalable, and eco-friendly recycling tech today will be the leaders of tomorrow’s energy shift.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Battery Recycling Market Size

- August-2025

- 148

- Global

- energy-and-power

Related Research

Organic Rankine Cycle Market Size, Share, Growth & Industry Analysis, By Application (Solar Thermal

February-2023

Air Electrode Battery Market Size, Share, Growth & Industry Analysis, By Product (Zinc-Air Batteries

September-2024

Battery Recycling Market Size, Share, Growth & Industry Analysis, By Battery Chemistry (Lead-Acid, L

August-2025

Biodiesel Market By Feedstock (Soybean, Rapeseed, Palm, Palm, Poultry, Tallow, White Grease, and Oth

January-2023

Biomass Boiler Market Size, Share, Growth & Industry Analysis, By Product Type (Fully Automated Boil

August-2025

Biomass Power Generation Market Size, Share, Growth & Industry Analysis, By Feedstock (Woody Biomass

August-2025

Biomethane Market by Application (Automotive, Power Generation, and Others), Production Method (Ferm

February-2023

Cable Entry Systems and Components Market Size, Share, Growth & Industry Analysis, By Product Type (

February-2025

Carbon Capture and Storage Market Size, Share, and COVID-19 Impact Analysis, By Capture Source (Chem

August-2025

Diesel Market Size, Share, Growth & Industry Analysis, By Application (Transportation (On-road, Off-

April-2025