Specialty Chemicals Market Size, Share, Growth & Industry Analysis, By Product Type (Agrochemicals, Specialty Polymers, Construction Chemicals, Electronic Chemicals, Water Treatment Chemicals, Industrial Chemicals, Others), By Application (Automotive, Aerospace, Construction, Agriculture, Electronics, Healthcare, Consumer Goods, Personal Care, Others), By End User (Chemical Manufacturers, Automotive OEMs, Electronics Manufacturers, Construction Firms, Agricultural Companies, Healthcare Providers), and Regional Analysis, 2024-2031

Specialty Chemicals Market: Global Share and Growth Trajectory

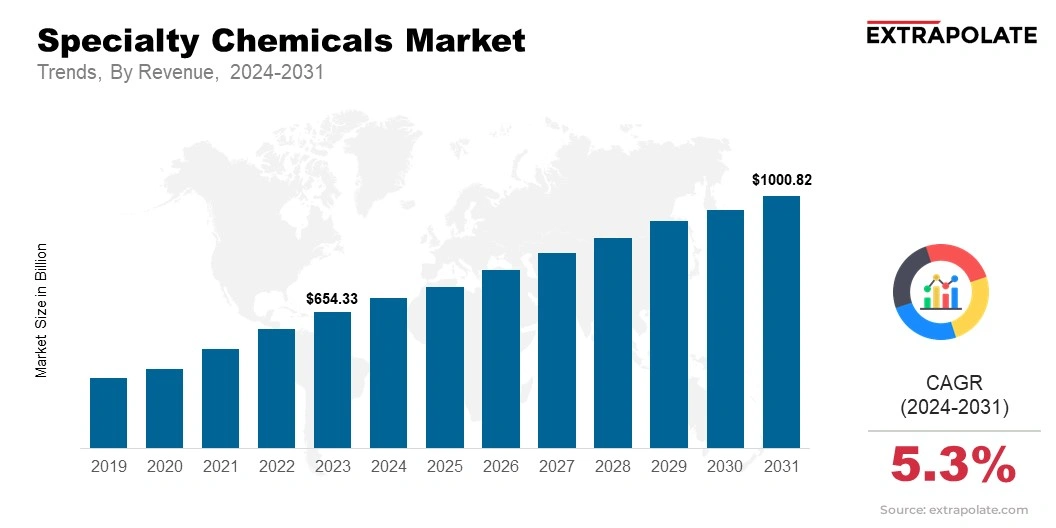

The global specialty chemicals market size was valued at USD 654.33 billion in 2023 and is projected to grow from USD 695.10 billion in 2024 to USD 1000.82 billion by 2031, exhibiting a CAGR of 5.3% during the forecast period.

The global specialty chemicals market is experiencing an exponential growth, impelled by technological breakthroughs, the surge in demand for eco-friendly and tailored chemical solutions, and the growing requirements of multiple fields.

Specialty chemicals are deliver superior performance and are widely used across an extensive spectrum of industries, encompassing automotive, construction, electronics, healthcare, agriculture, and consumer goods. These chemicals, which comprise additives , adhesives, coatings, and catalysts, play a prominent role in improving the practicality and performance of the final product.

As industries progress, the demand for specialty chemicals with customized properties to meet tailored demands is on the rise, making them essential in modern manufacturing techniques.

The rising focus on sustainability is aiding the growth trajectory, with a major focus on developing environmental friendly chemicals and solutions that lower the environmental effect.

Rules encouraging sustainable technology and the demand for sustainable products in industries such as agriculture and consumer goods are facilitating the use of specialty chemicals designed to reduce energy consumption, minimize waste, and optimize product functionality.

Additionally, the expanding demand for environmentally friendly materials in applications like construction, automotive, and renewable energy sectors is supporting the expansion of the market.

Technological advancements and the rising trend of digitalization in industries like electronics and automotive are also fostering demand for sophisticated specialty chemicals.

For example, the expansion of electric vehicles and the incorporation of smart technologies in consumer goods are presenting new possibilities for specialty chemical manufacturers to create high-efficiency designs for these areas.

Geographically, regions like North America, Europe, and Asia-Pacific are dominating the market, with North America and Europe reaping benefits from severe restrictions and industrial infrastructure, while Asia-Pacific is experiencing notable growth due to the increasing production capacity and surging demand for chemicals emerging markets.

With ongoing development in chemical formulations and major emphasis on eco-friendly practices and efficiency, the market is set to witness significant expansion, creating lucrative opportunities for innovation and growth in the near future.

Key Market Trends Driving Product Adoption

Emerging trends are boosting the use of specialty chemicals and transforming the market:

- Sustainability and Green Chemistry: With rising ecological threats, there is a major emphasis on developing environment-friendly and sustainable specialty chemicals, in line with the need for green chemistry solutions.

- Industrial Automation and Innovation: The growing adoption of automation and innovation in industrial procedures is stimulating demand for sophisticated specialty chemicals that optimize the efficiency and quality of the product.

- Consumer Demand for High-Performance Products: The elevating consumer demand for high-performance products in multiple fields, comprising electronics, automotive, and healthcare, is promoting the market.

- Regulatory Compliance: Strict environmental guidelines are prompting businesses to opt for specialty chemicals that adhere to safety regulations and mitigate the environmental impact.

- Customization and Formulation Advancements: Specialty chemicals are progressively being customized for niche applications, with companies concentrating on innovative formulations to meet the varied requirements across sectors.

Major Players and their Competitive Positioning

The specialty chemicals industry is characterized by high fragmentation , with both global and district players competing in various domains. Major players in the market include BASF, Dow Chemical, Evonik Industries, and SABIC, which hold a dominant market share with their broad product mix and extensive distribution channels.

These companies are focused on innovation, mergers, acquisitions, and collaborations to enhance their position in the market. In addition to this, niche domestic players are emerging, focusing on specialized applications and products customized according to particular needs of customers.

Consumer Behavior Analysis

The primary consumers of specialty chemicals include manufacturers in industries such as automotive, aerospace, construction, electronics, personal care, agriculture, and healthcare. Key factors driving adoption are:

- Need for Innovation: Industries are placing greater priority on integrating high-performing and advanced chemicals into their products to fulfill market requirements for enhanced quality and effectiveness.

- Sustainability Goals: Several businesses are placing importance on sustainability goals and are investing in specialty chemicals that promote sustainable initiatives and minimize their ecological footprint.

- Regulatory Pressure: Compliance with robust regulatory frameworks facilitates companies to seek out specialty chemicals that meet eco-friendly and safety standards.

- Cost-Effectiveness: Companies are opting for specialty chemicals that offer prolonged financial benefits, enhanced performance, and longevity.

Pricing Trends

Pricing in the specialty chemicals market is shaped by a blend of elements. Material costs, tech progress, and supply chain details are key influences. Specialty chemical prices vary according to product type, raw materials, and market demand. These elements combine, shaping a pricing model that addresses the industry's distinct challenges and opportunities.

While some segments experience high-end pricing due to innovative formulations, others, like commodity chemicals, are more economical. As the market progressively focuses on eco-friendly solutions, the cost of ecological specialty chemicals is also being persuaded by the innovation and scaling-up of production processes.

Regional Analysis

Asia Pacific accounted for around 35.8% share of the Specialty Chemicals market in 2023, with a valuation of USD 253.62 billion. Increasing industrialization in emerging markets, specifically in Asia-Pacific and Latin America, is boosting the demand for specialty chemicals in diverse sectors.

Asia Pacific Specialty Chemicals market is poised to grow at a CAGR of 8.2% through the projection period.

Growth Factors

Various factors contributing to the rise of the market:

- Industry Demand: High demand in various industries like automotive, construction, electronics, and agriculture boosts the demand for specialty chemicals.

- Technological Advancements: Advancements in material science and chemistry, as well as progress in automation and formulation techniques, are creating potential opportunities in the market.

- Regulatory Mandates: The stringent measures around environmental effects, emissions, and safety are promoting a transition to eco-friendly specialty chemicals.

- Emerging Markets: Increasing industrialization in emerging markets, specifically in Asia-Pacific and Latin America, is boosting the demand for specialty chemicals in diverse sectors.

Regulatory Landscape

Regulatory standards play a crucial role in shaping the specialty chemicals industry, especially regarding product safety, ecological impact, and sustainability. Diverse international standards are transforming the development and adoption of specialty chemicals. REACH in the EU and the TSCA in the U.S. are the vigilant guardians of chemical safety.

They enforce strict regulations on how chemicals are made, used, and disposed of. Meanwhile, eco-awareness is dominating consumer sentiment in the market. Green chemistry and environmental impact reduction are reshaping demand. This is accelerating the demand for sustainable chemical solutions in everyday applications.

Recent Developments

Recent developments in the market include:

- Investment in Green Chemistry: Primary players are investing in green chemistry initiatives to create energy-efficient specialty chemicals and comply with regulations

- Mergers and Acquisitions: Companies are strengthening their market standing by forming strategic mergers and acquisitions to broaden their product line and expand their market presence.

- Sustainable Product Innovations: There has been a remarkable shift toward the development of sustainable and bio-based specialty chemicals, fueled by consumer demand and evolving guidelines.

Current and Potential Growth Implications

a. Demand-Supply Analysis

The demand for specialty chemicals is anticipated to stay resilient across multiple end-user industries. As industrialization flourishes in emerging markets, the demand for specialized chemicals will expand. Concurrently, supply chains must adjust to the rising demand for eco-friendly and products with high performance, which may demand capital in R&D and sophisticated production capabilities.

b. Gap Analysis

The specialty chemicals market is entangled by multiple challenges. Fluctuating raw material prices, supply chain obstacles, and high formulation costs are significant barriers. Additionally, as sustainability demand surges, the industry must innovate and develop groundbreaking alternatives to keep pace with these eco-conscious expectations.

Top Companies in the Specialty Chemicals Market

Specialty Chemicals Market: Report Snapshot

Segmentation | Details |

By Product Type | Agrochemicals, Specialty Polymers, Construction Chemicals, Electronic Chemicals, Water Treatment Chemicals, Industrial Chemicals, Others |

By Application | Automotive, Aerospace, Construction, Agriculture, Electronics, Healthcare, Consumer Goods, Personal Care, Others |

By End User | Chemical Manufacturers, Automotive OEMs, Electronics Manufacturers, Construction Firms, Agricultural Companies, Healthcare Providers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The following segments are projected to see major development:

- Agrochemicals: With the increasing population all over the world and the need for sustainable agriculture, the demand for specialty agrochemicals, inclusive of pesticides, fertilizers, and biocides, is on the rise.

- Water Treatment Chemicals: As industries and municipalities face growing water shortages and air quality issues, the demand for specialty chemicals used in water treatment is anticipated to rise.

- Sustainable Chemicals: Fueled by governing restrictions and market demand for sustainable products, the demand for eco-friendly and bio-based specialty chemicals is gaining prominance.

Major Innovations

Innovation in the specialty chemicals market is necessary for its sustained growth. Major innovations include

- Green Chemistry: Innovations in the development of green chemicals that are both efficient and sustainable are influencing the specialty chemicals landscape.

- Bio-Based Specialty Chemicals: The rising trend toward renewable raw materials is stimulating innovation in bio-based specialty chemicals, which offer sustainable alternatives to conventional chemicals.

- Smart Coatings and Functional Polymers: The innovation of smart coatings and functional polymers for use in industries such as automotive and electronics is presenting lucrative growth potential.

Potential Growth Opportunities

Various growth opportunities exist in the specialty chemicals market, which include:

- Emerging Economies: Industrial expansion in regions like Asia-Pacific, Latin America, and the Middle East presents notable possibilities for the specialty chemicals market.

- Customization and Personalization: The growing trend toward customization of products across various industries offer potential for specialty chemicals manufacturers to offer customized solutions.

- Circular Economy Initiatives: As industries embrace circular economy principles, there are opportunities to innovate specialty chemicals that are a crucial factor in the recycling and reuse of materials.

Extrapolate Research says:

The specialty chemicals industry is poised for continued growth, fueled by technological developments, rising demand for high-performance products, and an unwavering dedication to eco-friendly initiatives. As industries progress and regulatory pressures escalate, the need for specialized chemical solutions will steadily increase, offering remarkable opportunities for innovation and market expansion.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Specialty Chemicals Market Size

- February-2025

- 148

- Global

- chemicals-and-advanced-materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021