Paints and Coatings Market Size, Share, Growth & Industry Analysis, By Technology (Water-borne, UV-cured Coating, Solvent-borne, Powder Coating, Others), By Resin Type (Acrylic, Polyester, Alkyd, Epoxy, PU, Others), By End-User Industry (Architectural, Automotive, Packaging, Wood, Protective Coating, General Industrial, Transportation, Others), and Regional Analysis, 2024-2031

Paints and Coatings Market Size

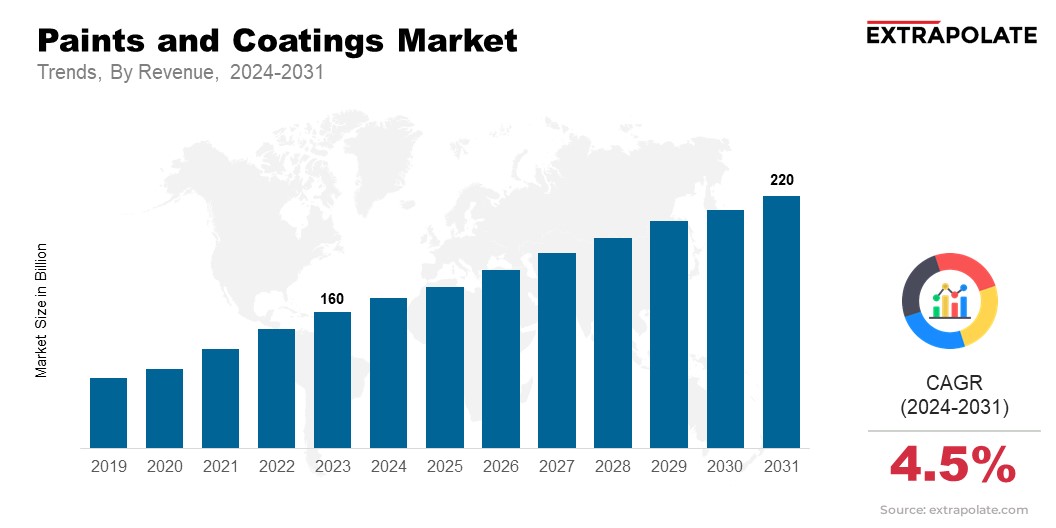

The global paints and coatings market size was valued at USD 160 billion in 2023 and is projected to reach USD 220 billion by 2031, exhibiting a CAGR of 4.5% during the forecast period, is driven by the increasing demand mainly from construction, automotive, and industrial applications.

According to the American Coatings Association, the U.S. paints and coatings market was valued at 32 billion and employed 313,000 workers in 2022. Extensive infrastructure development, urbanization, and popularity of aesthetic residential and commercial improvements have set a backdrop for intense demand for paints and coatings. Paints and coatings are vital in improving durability and protecting against the external weather. They also provide attractive finishes in many applications.

The market has two segments: decorative and industrial coatings. Decorative paints hold a larger share due to their widespread use in homes and businesses. Industrial coatings are expected to grow due to new technologies and their rising use in automotive, aerospace, and marine sectors. The push for eco-friendly coatings, due to strict environmental rules, is shifting market trends. The paints and coatings market is set for steady growth. It will be driven by innovation, new applications, and changing consumer needs.

Paints and Coatings Market Trends

The paints and coatings market is experiencing several key trends shaping its growth trajectory. These trends are the shift toward sustainable and eco-friendly products, demand for high-performance coatings, and digitalization and smart coatings. All these trends have been analyzed in detail below:

According to United States Environmental Protection Agency, approximately 40-65% of a paint or coating is VOC. Governments and consumers want to reduce environmental impact. They now prefer low-VOC (volatile organic compounds) and water-based coatings. By 2030, over 70% of new products are expected to be water-based or eco-friendly. This reflects the industry's push for sustainability.

The growing demand for high-performance coatings in industrial applications is driving innovation. Advanced coatings are being adopted in the automotive, aerospace, and marine sectors. They offer better resistance to corrosion, chemicals, and weathering. These high-performance coatings are vital. They boost the lifespan and efficiency of equipment, infrastructure, and vehicles. The industrial coatings segment is projected to grow at a CAGR of 5% from 2023 to 2031.

Digitalization and smart coatings are emerging as transformative trends. IoT and sensor tech in coatings enable real-time monitoring of temperature, humidity, and structure. Smart coatings are used in infrastructure and automotive sectors. They offer self-healing, anti-corrosion, and energy-saving benefits. By 2031, the smart coatings market should exceed USD 10 billion. This shows its growing importance in the paints and coatings industry.

These trends are driving innovation, sustainability, and better performance. They are key in the changing paints and coatings landscape.

Paints and Coatings Market Growth Factors

Several critical factors are driving the growth of the global paints and coatings market. A key growth driver is the rising demand from the construction sector. Rapid urbanization and infrastructure projects in Asia-Pacific and Latin America are fueling the need for both decorative and protective coatings. The trend of home renovation in developed areas is boosting demand for decorative paints. This is expected to expand the market over the forecast period.

Another significant growth factor is the expansion of the automotive industry. As vehicle production and sales grow, especially in China, India, and Southeast Asia, the demand for high-performance automotive coatings is rising. These coatings enhance vehicle aesthetics, protect against environmental damage, and improve durability. The automotive coatings segment is expected to grow at a 4.8% CAGR from 2023 to 2031. This is due to tech advances and demand for better finishes.

Technological innovation is also a key factor propelling market growth. Advancements in nano-coatings, smart coatings, and self-cleaning paints are creating new opportunities. Industrial applications with extensive durability, corrosion resistance, and energy efficiency requirements are expected to leverage this innovation extensively.

The rise in eco-friendly, sustainable coatings is boosting R&D investments. With strict environmental rules in Europe and North America, manufacturers are shifting to low-VOC, water-based, and bio-based coatings in line with regulatory and consumer requirements.

Segmentation Analysis

The paints and coatings market is diverse. It is segmented by technology, resin type, and end-user industries. Each segment contributes uniquely to the industry's growth and dynamics.

By Technology

The technology segment of the paints and coatings market includes various sub-segments: Water-borne, UV-cured, Solvent-borne, Powder Coating, and Others. Water-borne coatings are popular for their lower VOCs and a smaller impact on air quality. In 2023, water-borne coatings held a 45% market share due to regulations and increasing consumer preference for eco-friendly products.

UV-cured coatings are gaining popularity as they cure quickly and are very durable. Their growth is expected to exceed 6% CAGR by 2031. Solvent-borne coatings are strong and versatile. They are still widely used, but their market share is slowly declining due to environmental concerns. Powder coatings are growing in popularity. They are durable and eco-friendly. This is especially true in industrial and automotive uses.

By Resin Type

By resin type, the market has been segmented into Acrylic, Polyester, Alkyd, Epoxy, Polyurethane (PU), and Others. The acrylic resin type segment leads the market. Acrylic resin excels in color retention and durability, especially in architecture and decor. Polyester resins are used in automotive and industrial coatings for their superior weather resistance.

Alkyd resins are versatile and cost-effective. They are widely used in industrial and protective coatings. Epoxy resins are vital in protective and industrial uses. They have excellent adhesion and chemical resistance. Polyurethane resins are high-performance materials. They are rapidly growing in use, especially in automotive and high-end architectural coatings.

By End-Use Industry

The paints and coatings market has been segmented by end-use industry into Architectural, Automotive, Packaging, Wood, Protective Coating, General Industrial, Transportation, and Others. Architectural coatings dominate the market as they are in high demand for their attractive and durable finishes in homes and businesses.

Automotive coatings follow closely, with advancements in technology enhancing vehicle appearance and protection. The packaging sector is also a significant segment, where coatings are used for both protective and aesthetic purposes. Protective coatings are used in industrial settings to resist corrosion and wear in equipment and infrastructure. Each segment shows the diverse uses and demand in the paints and coatings industry. It highlights its role across sectors and tech advances.

Paints and Coatings Market Regional Analysis

The global paints and coatings market grows at different rates in different regions due to varying economic conditions, industrialization, and regulations. The regional dynamics hinges on a combination of factors. Economic growth, regulatory environment, and sectoral growth trends, each uniquely contribute to the global paints and coatings market.

In 2023, the Asia-Pacific region generated over 45% of the global market revenue as the largest market. The region's dominance comes from rapid urbanization and more construction. A strong manufacturing sector also helps. China and India are key contributors. China alone accounts for nearly 30% of global demand due to its large construction and automotive industries. In addition, rising disposable incomes and government initiatives to develop smart cities are also expected to boost the market in the region.

North America is the second-largest market, where the U.S. is leading with a significant share. The market here is driven by strong demand for decorative paints in homes and high-performance coatings in industry. Home renovation trends and low mortgage rates are boosting demand for decorative paints. Advanced coatings are being introduced as a result of innovation and sustainability, which is driving the paints and coatings market in the region. North America paints and coatings market is forecasted to be valued at USD 60 billion by 2031.

Europe also holds a sizeable share with its mature market due to prevalent regulations and sustainability targets. The UK, Germany, and France, are the leading regional segments witnessing high adoption of low-VOC and water-based coatings. Europe has well-established automotive and aerospace industries. However, technology advancement and regulatory compliance are the current focus in this relatively stagnant market compared to Asia-Pacific.

The paints and coatings market in Latin America and the Middle East & Africa is growing due to increasing construction and infrastructural developments. In Latin America, Brazil and Mexico are witnessing growth in decorative paints adoption, while projects to support tourism and smart city development are driving the market in the Middle East.

Competitive Landscape in Paints and Coatings Market

The paints and coatings market is very competitive where both regional and global players look to increase their market share. For this, the major players use strategic measures such as mergers & acquisition, collaboration, expansion, and new product launches. AkzoNobel, PPG Industries, and Sherwin-Williams are the market leaders with their extensive product portfolios and robust distribution networks. As the regulatory environment changes, these players are prioritizing the development of sustainable and high-performance coatings.

AkzoNobel, for instance, has made significant strides in sustainable product development by launching low-VOC and water-based coatings that offer minimum environmental impact. PPG Industries is also focusing on strategic acquisitions. In December 2020, PPG Industries acquired a globally recognized coatings manufacturer, Ennis-Flint, for USD 1.2 billion. This move was made to enhance the former's position in the industrial and infrastructure coatings segments. Similar to global giants, regional players are also looking to increase their market share by offering customized solutions tailored to local market needs, creating a competitive yet dynamic market environment.

List of Key Players in Paints and Coatings Market

- Axalta Coating Systems

- Akzo Nobel N.V.

- Kwality Paints & Coatings Pvt. Ltd.

- Kansai Nerolac Paints Limited

- Nippon Paint Holdings Co.Ltd.

- The Sherwin-Williams Company

- Dunn-Edwards Corporation

- PPG IndustriesInc.

- TIKKURILA OYJ

- RPM International Inc.

Key Industry Developments

In 2023, Sherwin-Williams' sales rose 12% year-on-year. Strong demand in residential and commercial construction drove this increase. This growth came mainly from the company's expansion of its eco-friendly product line.

In mid-2024, AkzoNobel launched a new range of marine coatings. These high-performance, coatings feature great corrosion resistance with a low environmental impact. The launch is expected to boost the company’s market share in the marine segment.

In late 2023, PPG Industries bought Tikkurila, a top Nordic paint brand, for USD 1.5 billion. The acquisition would boost PPG's presence in Europe's decorative coatings market and its expansion in the global market.

The global Paints and Coatings Market has been segmented:

By Technology

- Water-borne

- UV-cured Coating

- Solvent-borne

- Powder Coating

- Others

By Resin Type

- Acrylic

- Polyester

- Alkyd

- Epoxy

- PU

- Others

By End-User Industry

- Architectural

- Automotive

- Packaging

- Wood

- Protective Coating

- General Industrial

- Transportation

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Paints and Coatings Market Size

- September-2024

- 148

- Global

- chemicals-and-advanced-materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021