Biogas Market Size, Share, Growth & Industry Analysis, By Feedstock (Agricultural Waste, Animal Manure, Industrial Waste, Municipal Solid Waste, Sewage Sludge) By Application (Electricity Generation, Heat Generation, Vehicle Fuel, Others) By Technology (With Pre-treatment, Without Pre-treatment) By End User (Municipal, Industrial, Agricultural, Commercial), and Regional Analysis, 2024-2031

Biogas Market: Global Share and Growth Trajectory

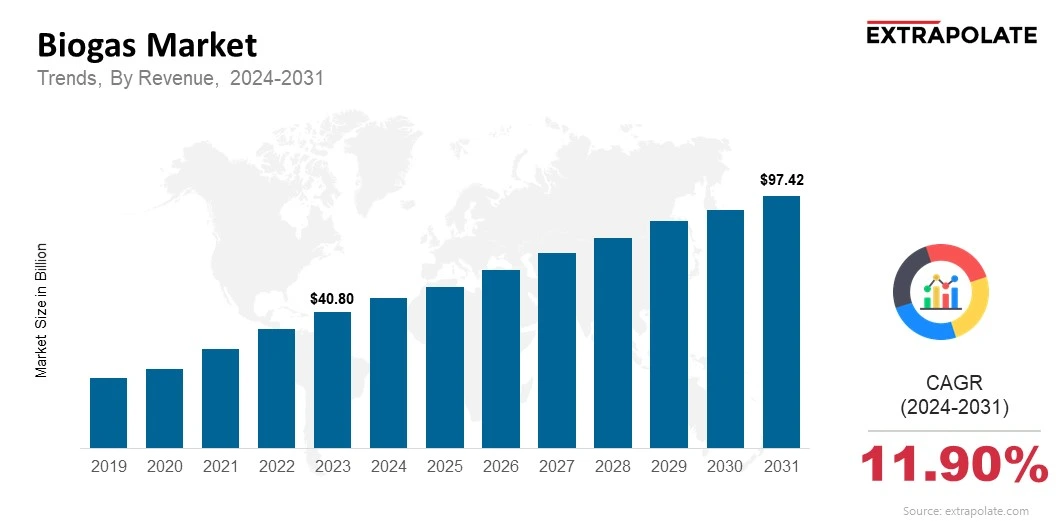

The global Biogas Market size was valued at USD 40.80 billion in 2023 and is projected to grow from USD 44.34 billion in 2024 to USD 97.42 billion by 2031, exhibiting a CAGR of 11.90% during the forecast period.

The global market is experiencing significant growth as the world increasingly turns toward sustainable energy solutions. Biogas, derived primarily from the anaerobic digestion of organic materials such as agricultural waste, food waste, sewage sludge, and manure, has emerged as a clean and renewable alternative to conventional fossil fuels.

With a growing emphasis on reducing greenhouse gas emissions and transitioning toward a circular economy, biogas offers a multifaceted solution that addresses both environmental and energy security concerns.

A key driver of the market's expansion is the rising global demand for energy, particularly in developing economies where energy access is still limited. Governments and regulatory bodies around the world are actively promoting the adoption of renewable energy sources to achieve net-zero emissions targets.

Policies, subsidies, and incentives have been introduced to encourage the development of biogas plants and associated infrastructure. In addition, international agreements focused on climate change mitigation have led to greater investments in low-carbon energy technologies, further boosting the market potential for biogas.

Technological advancements in anaerobic digestion and gas upgrading processes have also played a crucial role in making biogas production more efficient and economically viable. Improved digestion systems, better feedstock pre-treatment, and advanced biogas purification techniques are enabling higher energy yields and broader applicability across sectors.

Furthermore, integration of biogas systems with combined heat and power (CHP) units and smart grid technology is enhancing operational efficiency and energy optimization.

The application spectrum of biogas is broadening rapidly. Traditionally used for electricity and heat generation, biogas is increasingly being upgraded to biomethane—a purified form of biogas with properties similar to natural gas.

This upgraded fuel is now used as a renewable vehicle fuel (bio-CNG), especially in public transportation and logistics fleets aiming to reduce carbon footprints. Biogas is also being explored as a sustainable feedstock for the production of bio-based chemicals, fertilizers, and even hydrogen, thus opening new revenue streams for producers and stakeholders.

Key Market Trends Driving Biogas Adoption

Key Market Trends Driving Biogas Adoption

The biogas market is evolving with dynamic technological innovations, robust policy frameworks, and shifting energy paradigms. Key trends fueling growth include:

• Waste-to-Energy Initiatives: Growing interest in converting agricultural waste, municipal solid waste, and wastewater into energy is boosting biogas production. This trend supports sustainable energy solutions.

• Upgraded Biogas (Biomethane): Technological advancements in purification are enabling biomethane production. Biomethane can now be injected into the gas grid or used as vehicle fuel.

• Carbon Neutrality Goals: Governments and corporations are investing more in low-carbon energy sources. Biogas is a critical component of climate action strategies.

• Integration into Circular Economy Models: Biogas systems contribute to circularity. They recover resources, reduce landfill use, and close the nutrient loop through digestate reuse.

• Digital Monitoring and Automation: IoT, AI, and automation are being implemented in biogas plants. These technologies enhance operational efficiency and scalability.

Major Players and their Competitive Positioning

The biogas market is competitive, with both multinational corporations and regional players vying for market share. Key players include Air Liquide, Engie, Wärtsilä, EnviTec Biogas AG, and Hitachi Zosen Inova. These companies are actively investing in plant expansions, joint ventures, and R&D to enhance process efficiency and diversify feedstock options. Emerging firms are exploring innovative digesters and small-scale solutions for rural and off-grid applications.

Consumer Behavior Analysis

Demand for biogas is influenced by a mix of environmental, economic, and regulatory drivers:

• Sustainability-Conscious Consumers: Individuals and businesses are favoring renewable energy. This helps reduce carbon footprints.

• Farmers and Agribusinesses: On-site biogas plants are being adopted. They manage waste and generate energy for internal use or sale.

• Municipal Authorities: Cities are adopting biogas solutions. These are used for waste management and clean energy generation.

• Transport Sector: Growing interest in green fuels is increasing biogas use. Biomethane is being adopted for public transportation and logistics.

Pricing Trends

Biogas pricing is influenced by factors such as feedstock availability, plant efficiency, local energy tariffs, and government incentives. While initial capital costs for biogas installations remain high, long-term operational savings and subsidies often make them economically viable. The rise of biomethane as a vehicle fuel is creating premium pricing segments, especially in regions with stringent emissions regulations.

According to the International Renewable Energy Agency (IRENA), global biogas capacity is expected to grow at a CAGR of over 6.5% between 2023–2030, reaching nearly 90 GW by 2030. Countries in Europe and Asia-Pacific are leading the adoption, driven by decarbonization goals and favorable policy frameworks.

Growth Factors

The biogas market is being shaped by several critical growth factors:

• Government Incentives and Policies: Feed-in tariffs, tax credits, and grants are driving investments. They are boosting biogas infrastructure development.

• Rising Energy Costs: Fluctuating fossil fuel prices are pushing industries and municipalities. They are turning to biogas as a cost-effective alternative.

• Technological Advancements: Innovations in digester design, gas upgrading, and waste preprocessing are improving yields. These advancements are expanding applications.

• Environmental Mandates: Stringent emissions and landfill reduction laws are encouraging biogas adoption. This helps with waste management and energy production.

Regulatory Landscape

The regulatory environment for biogas varies across regions, with strong frameworks in the EU, the U.S., and parts of Asia. Key regulations address grid injection standards, emissions, feedstock sourcing, and subsidies. Harmonizing standards and ensuring compliance are crucial for market stability and investor confidence.

Recent Developments

The biogas sector is experiencing notable advancements:

• Expansion of Bio-CNG Infrastructure: Several countries are building infrastructure for compressed biomethane. It serves as an alternative to diesel and gasoline.

• Hybrid Renewable Systems: Integrating biogas with solar and wind energy ensures a continuous power supply. This combination enhances energy reliability.

• Digestate Valorization: Digestate is being used more as organic fertilizer. This trend is gaining traction in agriculture.

• Industrial Partnerships: Waste management firms, utilities, and agri-tech companies are collaborating. They are developing scalable biogas projects.

Current and Potential Growth Implications

Demand Supply Analysis

There is a rising demand for biogas across industrial, municipal, and agricultural sectors. However, feedstock supply chains and seasonal variability may pose challenges to consistent production.

Gap Analysis

Despite positive growth, certain barriers persist:

• Lack of Awareness: Smaller communities and farmers have limited understanding of biogas benefits. This hinders broader adoption.

• Feedstock Logistics: Efficient collection, transport, and preprocessing of organic waste remain challenging. These are key operational hurdles.

• High Capital Investment: Upfront costs hinder small-scale adoption despite long-term benefits.

• Policy Gaps: Inconsistencies in regulatory frameworks can deter investments.

Top Companies in the Biogas Market

• Air Liquide

• Engie

• EnviTec Biogas AG

• Wärtsilä

• Hitachi Zosen Inova

• PlanET Biogas Group

• Xebec Adsorption Inc.

• Future Biogas

• BTS Biogas

• Gasum Oy

Biogas Market: Report Snapshot

Segmentation | Details |

By Feedstock | Agricultural Waste, Animal Manure, Industrial Waste, Municipal Solid Waste, Sewage Sludge |

By Application | Electricity Generation, Heat Generation, Vehicle Fuel, Others |

By Technology | With Pre-treatment, Without Pre-treatment |

By End User | Municipal, Industrial, Agricultural, Commercial |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

Biogas Market: High-Growth Segments

Segments expected to witness rapid growth include:

• Vehicle Fuel: On-farm digesters are being installed more. This boosts energy self-sufficiency.

• Agricultural Sector: On-farm digesters are being installed more. They promote energy self-sufficiency.

• Municipal Waste Management: Membrane separation, water scrubbing, and PSA ensure high-purity gas. These methods improve gas quality.

Major Innovations

The biogas industry is embracing several innovations to improve efficiency and scale:

• Biomethane Upgrading Technologies: Membrane separation, water scrubbing, and PSA are used for high-purity gas. These methods enhance gas quality.

• Mobile Digesters: Portable solutions for small-scale applications in rural areas.

• Smart Monitoring Systems: AI and IoT integration for predictive maintenance and process optimization.

• Carbon Capture Integration: Coupling biogas systems with carbon capture for enhanced sustainability.

Biogas Market: Potential Growth Opportunities

Opportunities abound in the sector, though certain challenges persist:

• Untapped Rural Markets: Expanding small-scale digesters in off-grid regions.

• Public-Private Partnerships: Collaborations to build large-scale biogas infrastructure.

• Policy and Subsidy Alignment: Developing uniform policies to attract investors.

• Export Potential: Surplus biomethane can be exported. This boosts trade revenues.

• Integration with Hydrogen: Exploring synergies between biogas and green hydrogen production offers potential. It can enhance sustainability and energy efficiency.

Extrapolate Research says:

The biogas market is expected to expand considerably. Increasing demand for cleaner and sustainable energy drives this expansion. Policies that support the industry, development in technology as well as increased understanding of environmental issues fuel this expansion. Companies that produce new biogas technologies and increase production will lead the biogas sector.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Biogas Market Size

- May-2025

- 148

- Global

- chemicals-and-advanced-materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021