Air Filters Market Size, Share, Growth & Industry Analysis, By Type (HEPA Filters, Activated Carbon Filters, Electrostatic Filters, UV Filters, Others), By Application (HVAC Systems, Automotive, Industrial, Commercial, Residential, Healthcare), By End User (Consumer, Industrial, Healthcare, Automotive, Commercial Buildings), and Regional Analysis, 2024-2031

Air Filters Market: Global Share and Growth Trajectory

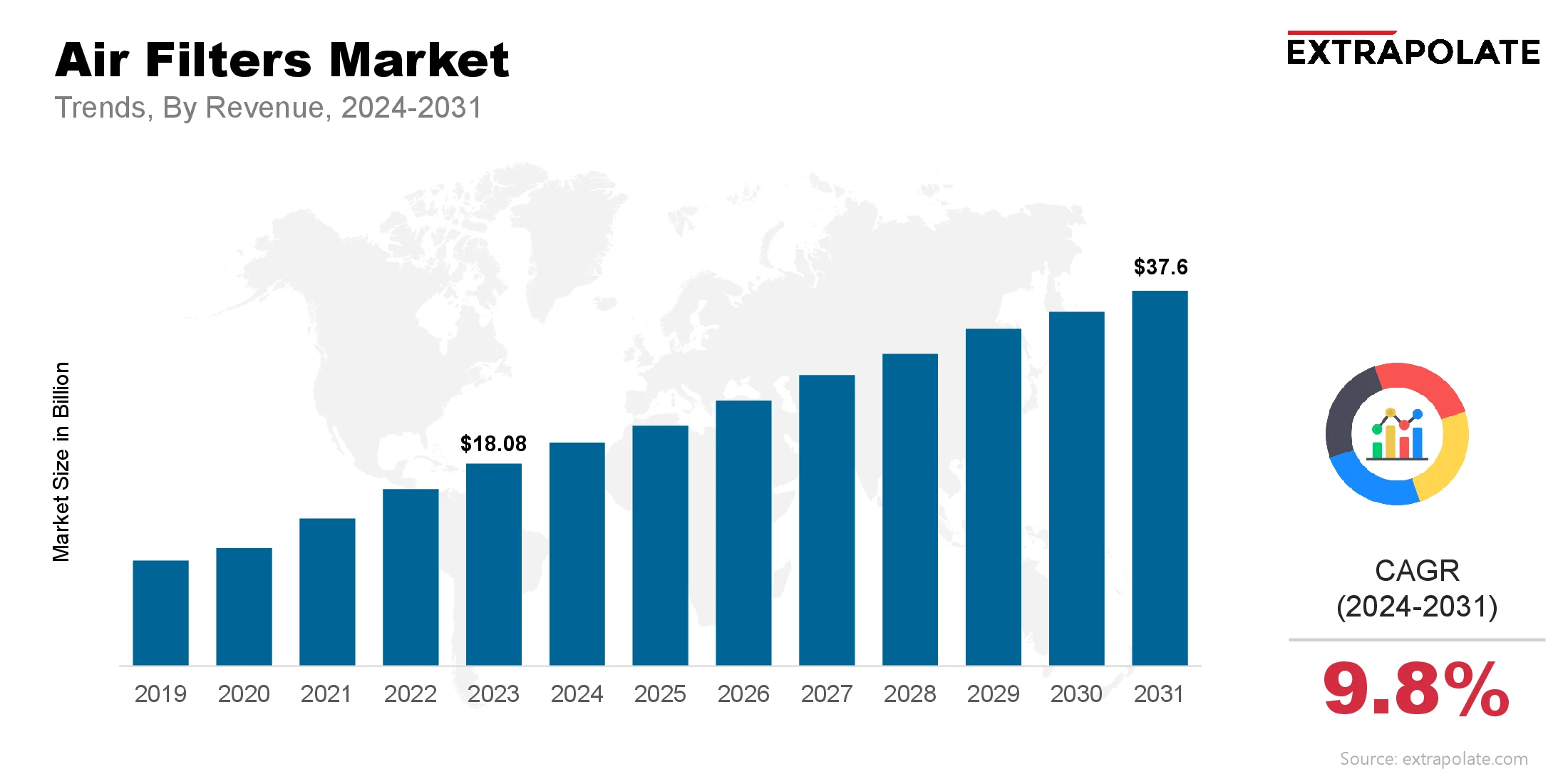

The global Air Filters Market size was valued at USD 18.08 billion in 2023 and is projected to grow from USD 19.44 billion in 2024 to USD 37.6 billion by 2031, exhibiting a CAGR of 9.8 % during the forecast period.

The global market is observing substantial growth, driven by the rise in concerns over air quality, increased industrialization, and strict environmental regulations. Air filters play an essential role in purifying air by removing harmful particles, contaminants, and pollutants in residential, commercial, and industrial environments.

From HVAC systems in buildings to engine air intake systems in automobiles, air filters are crucial for maintaining healthy air conditions and enhancing operational efficiency. The demand for high-efficiency particulate air (HEPA) filters, carbon filters, and electrostatic filters is on the rise, as consumers and industries become more aware of the importance of clean air.

A vast number of factors are contributing to the growth of the air filters. The growing prevalence of respiratory diseases and allergies, particularly in urban and industrial areas, is leading to a surge in demand for advanced filtration systems. Additionally, governments worldwide are introducing strict emission and air quality standards, compelling manufacturers and facility managers to adopt efficient filtration solutions.

Technological innovations have also given rise to smart air filtration systems that integrate with IoT-enabled devices, allowing real-time monitoring of air quality and filter performance.Industries such as automotive, healthcare, manufacturing, and pharmaceuticals are major end-users of air filters, where maintaining a contamination-free environment is necessary.

In the automotive sector, for example, air filters ensure clean airflow to engines, which helps in enhancing performance and fuel efficiency. In healthcare settings, high-grade filters are critical for preventing the spread of airborne pathogens, especially in operating rooms and intensive care units. Meanwhile, in industrial and manufacturing plants, air filters protect sensitive equipment and improve workplace safety by filtering out hazardous substances.

Geographically, the Asia-Pacific region is leading the market due to rapid urbanization, expanding industrial activities, and rising consumer awareness in countries such as China, India, and Japan. North America and Europe are also key regions, fueled by strict rules and strong infrastructure for technological adoption. In addition to this, the market is benefiting from increased investments in sustainable and energy-efficient air filtration technologies.

With growing focus on environmental sustainability, companies are developing sustainable and recyclable filter materials. As demand for cleaner indoor and outdoor air continues to rise, the global air filters is poised for robust growth in the coming years, with opportunities emerging across various sectors and applications.

Key Market Trends Driving Product Adoption

The market grows with new ideas and more care for the environment. Stringent regulations also push the market growth. Key trends include:

- Health and Safety Awareness: People are learning more about how air pollution harms health. This is creating a larger demand for air filters in homes, jobs, and vehicles.

- Stringent Environmental Regulations: Governments around the world are setting strict regulations to lower emissions and protect the air. These make air filters a must-have in many industries to meet legal standards and keep the environment clean.

- Smart and Connected Filters: Smart technology is being built into air filters. This is to track air quality in real time and send alerts for maintenance, making filters work better and easier to manage.

- Eco-Friendly Materials: More filters now use recyclable and biodegradable materials. This helps lower the harm to the environment.

- HEPA and Activated Carbon Technologies: HEPA (High-Efficiency Particulate Air) and activated carbon filters highly used for clean air. They remove tiny pollutants, allergens, and bad odors effectively.

Major Players and their Competitive Positioning’

The air filters industry is led by major players such as 3M, Honeywell, Daikin Industries, Parker Hannifin, and MANN+HUMMEL. These companies are constantly introducing new ideas to enhance filter performance, effectiveness, and affordability. Additionally, a range of regional and niche players are becoming popular by offering customized solutions and targeting specific industries.

Consumer Behavior Analysis

Consumers are increasingly recognizing the value of air filters for:

- Health Protection: Filters help in cutting exposure to allergens and bacteria. They also block harmful pollutants from the air.

- Indoor Air Quality: Clean air boosts comfort in homes and offices. It also help in improving health and wellness.

- Vehicle Safety: Ensures clean cabin air and protects engine parts.

- Energy Efficiency: High-efficiency filters are being highly used. They help in reducing energy use in HVAC systems.

Pricing Trends

Pricing in the air filters market differs greatly on basis of the application, material, filtration efficiency, and brand. While premium filters offer advanced features like high MERV ratings and multi-layer filtration, there is also strong growth potential in the mid- and low-range segments, fueled by affordable and disposable options for everyday use.

The market is expanding globally, with high growth potential in North America, Europe, and Asia-Pacific, particularly in rapidly industrializing countries like India and China.

Growth Factors

Several drivers are contributing to the air filters market’s expansion:

- Urbanization and Industrialization: Rapid development causes pollution levels to rise. This fuels strong demand for filtration solutions.

- Public Health Initiatives: Fighting respiratory illnesses boosts filter use in healthcare and residential sectors. More homes are opting for air filters to keep air clean and safe.

- Automotive Growth: Rising vehicle production and growing concern for in-cabin air quality boosts air filter use. Automotive air filters help in keeping car interiors clean and healthy.

- Construction Boom: A large number of homes and offices are being built every year. This creates a strong need for good HVAC systems with strong filters.

Regulatory Landscape

Governments and international bodies are imposing air quality standards and emission limits that greatly affect the adoption and design of air filters. Compliance with standards like ASHRAE, ISO 16890, and EPA guidelines is essential for manufacturers and consumers.

Recent Developments

The air filters market is evolving with advancements and innovations such as:

- Smart Air Purifiers: Filters integrated with IoT for data-driven maintenance.

- Nano-Fiber Filters: Enhanced particle capture and airflow performance.

- Antimicrobial Filters: Growing demand in healthcare and commercial sectors.

- Portable Filtration Systems: Surge in compact, personal air filtration devices.

Current and Potential Growth Implications

a. Demand Supply Analysis

Demand for clean air solutions is rising. This drives strong growth in the air filter market. But raw material shortages and supply issues cause production delays. These challenges also affect product prices.

- Gap Analysis

The air filters market is showing fast-paced growth. But it also faces challenges that can lead to better solutions:

- Standardization Issues: Lack of unified global standards can lead to confusion and inefficiency.

- Maintenance Awareness: Consumers often lack knowledge about when to replace filters.

- Disposal Concerns: Growing waste from disposable filters needs sustainable solutions.

- Performance Consistency: Ensuring long-term filter efficiency under varied conditions is a persistent challenge.

Top Companies in the Air Filters Market

Some of the leading players in the global air filters industry include:

- 3M Company

- Honeywell International Inc.

- Daikin Industries Ltd.

- MANN+HUMMEL Group

- Parker Hannifin Corporation

- Camfil Group

- Cummins Inc.

- Donaldson Company Inc.

- Filtration Technologies

- Lennox International Inc.

Air Filters Market: Report Snapshot

Segmentation | Details |

By Type | HEPA Filters, Activated Carbon Filters, Electrostatic Filters, UV Filters, Others |

By Application | HVAC Systems, Automotive, Industrial, Commercial, Residential, Healthcare |

By End User | Consumer, Industrial, Healthcare, Automotive, Commercial Buildings |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

High Growth Segments

Some market segments will show rapid growth. These areas show strong demand and opportunity:

- HEPA Filters: Air filters help keep healthcare spaces safe and clean. They are vital in cleanrooms for stopping dust and germs.

- HVAC Filters: The market grows as homes and businesses expand. More buildings lead to higher demand for air filters.

- Automotive Filters: Driven by increasing vehicle sales and environmental awareness.

Major Innovation

Innovation remains a key driver in the air filters market. Notable developments include:

- Smart Filters: Real-time air quality monitoring and automatic alerts.

- Recyclable Filter Materials: Eco-friendly alternatives gaining popularity

- AI-Driven Systems: Predictive maintenance and filter life optimization.

Potential Growth Opportunities

The air filter market has great potential. But it faces some key challenges:

Intense Competition: Well-known and local makers fight with prices. This lowers profits and affects the market.

- Technological Barriers: Changing rules need quick updates in work. New customer needs push for better products.

- Environmental Concerns: Single-use filters create high waste. Proper steps help cut down that waste.

- Consumer Education: Timely swaps help prevent breakdowns. Good care keeps machines working well.

- Supply Chain Bottlenecks: Raw material shortage slows work. Unreliable transport causes delays.

Extrapolate Research says:

The global air filter market will show rapid growth in the coming years. Growth is driven by rising environmental awareness, strict rules, and new technology. Companies that invest in smart designs and eco-friendly products gain an edge. Clear information for buyers boosts trust and helps sales grow.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Air Filters Market Size

- May-2025

- 148

- Global

- chemicals-and-advanced-materials

Related Research

Carbohydrases Market Size, Share & Trends Analysis Report By Application (Food and beverages, Anima

January-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status & Trend Report 2022-2030

August-2021

1,2,3,4-Tetrahydroquinaldine Reagent (CAS 1780-19-4) -Global Market Status and Trend Report 2022-203

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status & Trend Report 2022-2030 Top

August-2021

1,2,3,4-Tetrahydroquinoline Reagent (CAS 635-46-1)-Global Market Status and Trend Report 2022-2030

August-2021