Self-Driving Cars Market Size, Share, Growth & Industry Analysis, By Component (Radar, LiDAR, Ultrasonic, Camera Unit), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Type of Autonomy (Fully Autonomous, Semi-Autonomous), and Regional Analysis, 2024-2031

Self-Driving Cars Market Size

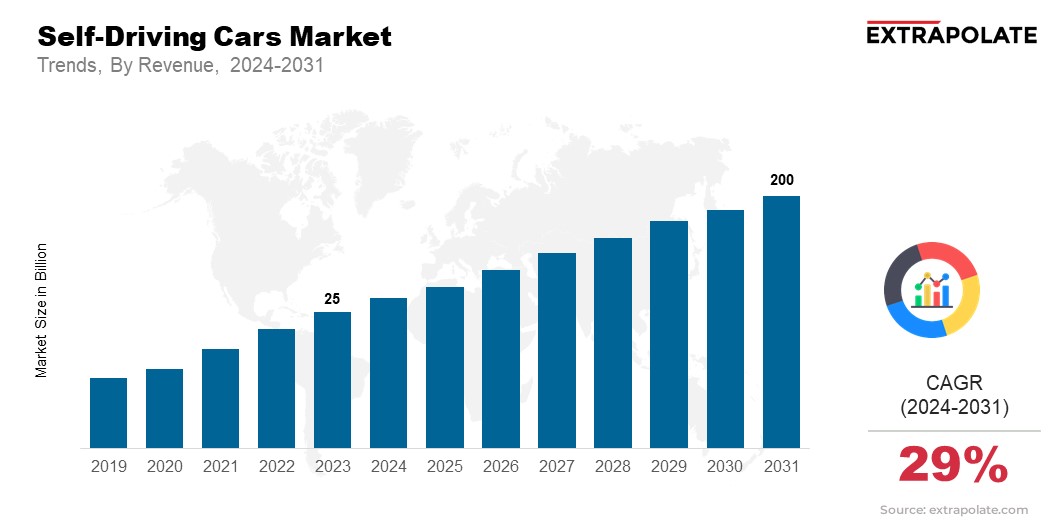

The global self-driving cars market size was valued at USD 25 billion in 2023 and is projected to reach USD 200 billion by 2031, exhibiting a CAGR of 29% during the forecast period, due to significant technological advancements, consumer demand for safety and convenience, and investments by automotive giants and tech companies. Self-driving cars, or driverless cars, have 5 levels of autonomy.

Level 1 offers driver assistance, whereas Level 5 is fully autonomous. There is a growing trend to integrate AI, LiDAR, radar, and sensors into these vehicles to enhance their navigation and safety. Governments are backing autonomous vehicles and promoting their adoption through favorable regulations and smart city initiatives.

The market's growth comes from the integration of AI, LiDAR, radar, and sensor technology. They improve the safety, accuracy, and reliability of self-driving cars. The market for self-driving cars consists of Tesla, Waymo, and General Motors that are leading in autonomous vehicle technology, and companies like Nvidia that provide key hardware and software support. By 2031, over 15% of global car sales will be fully autonomous vehicles. This will show a shift in the industry toward autonomy. The Insurance Institute for Highway Safety expects 3.5 million self-driving vehicles on U.S. roads by 2025, and 4.5 million by 2030. They will have varying levels of autonomy.

Self-Driving Cars Market Trends

The self-driving cars market is shaped by three major trends. First is the integration of AI and machine learning making vehicles more sophisticated. This development has enabled vehicles to make real-time decisions based on vast data inputs. By 2030, AI in self-driving cars will generate over $100 billion in revenue. It is key to improving vehicle safety and performance. According to the World Economic Forum, from 2021 to 2023, the U.S. spent around USD 70 billion as business funding in AI for scientific discovery. This data indicates AI’s position as an emerging technology in the coming years.

Second, the rise of autonomous ride-sharing services is transforming urban mobility. Waymo, Cruise, and Baidu are leading efforts to deploy self-driving taxis. They aim to provide cheap and convenient rides. Adoption of such services is expected to grow at a 35% CAGR due to major cities worldwide embracing a shift to shared, autonomous mobility.

Third, regulatory developments are driving market growth. Governments are setting up frameworks for testing self-driving vehicles. The US, Germany, and China are leading in this effort. As regulations clarify, automakers are racing to launch fully autonomous vehicles. This will pave the way for mass adoption of driverless cars in the next decade.

Self-Driving Cars Market Growth Factors

The growth of driverless cars is fueled by several key factors. One of the primary drivers is the increasing focus on road safety. Self-driving cars aim to cut human error, which causes over 90% of road accidents. Both consumers and governments want to promote driverless cars. They see them as a safer alternative to traditional driving. It is critical to integrate ADAS and AI decision tools in the vehicles to achieve safety in self-driving cars.

Another key growth factor is the surge in investments in driverless cars from both car makers and tech firms. Giants like Tesla, Waymo, and GM are leading the way. They are pouring billions into R&D to refine autonomous tech. By 2030, studies show that global investments in autonomous vehicle technology will exceed USD 300 billion. This shows the high stakes and growth potential in this market.

Consumer demand for convenience and luxury is also driving market growth. Autonomous vehicles have sophisticated technology features. They include voice controls, personalized infotainment, and seamless connectivity. These features enhance the driving experience. This blend of safety, convenience, and luxury is attracting more urban consumers, who are concerned about traffic and long commutes.

Segmentation Analysis

The self-driving cars market has been segmented into three areas: critical components, vehicle types, and levels of autonomy. Each area is key to the industry's growth.

By Component

The market is categorized into Radar, LiDAR, Ultrasonic, and Camera Units. Radar systems dominate the segment. They reliably detect objects and provide vital data for navigation and safety. LiDAR is costly but is gaining popularity. It offers better 3D mapping and object detection. By 2031, LiDAR is expected to grow at a CAGR of over 25%. This is due to advances in technology and lower costs. Ultrasonic sensors are used for short-range applications like parking assistance, whereas Camera Units are used for visual perception and image processing. These features also play significant roles in enhancing vehicle autonomy.

By Vehicle Type

The market is divided into Passenger Cars and Commercial Vehicles. In 2023, passenger cars held the largest market share and accounted for over 70% of revenue. This was due to a rising demand for luxury features and safety systems in private vehicles. However, the Commercial Vehicles segment is expected to grow rapidly. Logistics and delivery companies and public transport systems will adopt autonomous technologies to boost efficiency. By 2031, the commercial segment will make up 40% of the market. This is due to autonomous ride-hailing and smart logistics.

By Type of Autonomy

The market is segmented into Fully Autonomous and Semi-Autonomous vehicles. Semi-autonomous vehicles lead the market. Their popularity is due to the rising advanced driver assistance systems (ADAS). However, Fully Autonomous vehicles will likely see huge growth in the next decade. Their market share is projected to be 35% by 2031. This growth is due to advances in AI and machine learning. Governments are also supporting self-driving car deployment.

These segments drive the adoption and evolution of self-driving cars. They enable more tailored, advanced solutions for different use cases in the automotive industry.

Self-Driving Cars Market Regional Analysis

The market for self-driving cars is still developing. There are big differences in adoption and growth across regions. North America, Europe, and Asia-Pacific are the major regions leading the market. North America leads this market, holding a dominant position. This region's technological infrastructure, early adoption, and significant investments from key players are expected to generate growth over the forecast period.

The U.S. is at the forefront of developing autonomous vehicles. It has progressive laws and extensive testing initiatives. In 2023, the U.S. held over 40% of the global market. This share is expected to stay high as Waymo and Cruise expand their self-driving fleets.

Europe is another key region, driven by countries such as Germany, the UK, and France. The EU's tough safety rules and green goals are pushing automakers to speed up their self-driving car programs. Germany’s dominance in automotive manufacturing and the government-led promotional schemes for autonomous and electric vehicle development position Europe as a critical market for growth. By 2031, Europe’s self-driving car market is projected to exceed USD 50 billion.

Asia-Pacific is the fastest-growing region. Countries like China, Japan, and South Korea are investing heavily in autonomous vehicle technologies. China aims to lead the global self-driving car market. Its initiatives including "Made in China 2025" and smart city projects are expected to reaffirm its position as a major country in the self-driving cars market. By 2031, Asia-Pacific is expected to hold over 35% of the global market. There will be a strong focus on using self-driving cars in public transport and ride-hailing services.

Competitive Landscape

The self-driving cars market has intense competition. Established car makers, tech firms, and startups are all vying for dominance. Tesla, Waymo, and General Motors dominate the market. They have advanced self-driving car technology and strong partnerships. For instance, Waymo has expanded its self-driving ride-hailing service in major U.S. cities. Also, General Motors' Cruise division recently got a USD 1.35 billion investment to grow its operations.

Also, technology companies like Nvidia provide AI-powered chipsets and software that boost autonomous driving systems. The market is seeing major mergers and acquisitions. Companies seek to consolidate their capabilities. For example, Amazon acquired Zoox in 2020 to boost its delivery fleet. These developments show how competition is changing. Companies are racing to capture market share over the forecast period.

List of Key Players in Self-Driving Cars Market

Key Industry Developments

In 2023, Waymo expanded its self-driving taxi service to New York City. This was a big step in the push to commercialize self-driving taxis. The service is expected to cover over 10,000 rides per month by the end of 2024.

Tesla is improving its Full Self-Driving (FSD) software. It has over 500,000 global subscribers. The company reported a 30% rise in FSD adoption, year-on-year. Software upgrades and wider availability drove this increase.

In mid-2024, Baidu's Apollo program partnered with several Chinese cities. The company deployed autonomous buses and ride-hailing services. This expansion aims to cover 50 cities by 2026. It will make Baidu a leader in Asia's self-driving ecosystem.

The global Self-Driving Cars Market is segmented as:

By Component

- Radar

- LiDAR

- Ultrasonic

- Camera Unit

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Type of Autonomy

- Fully Autonomous

- Semi-Autonomous

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- South Africa

- North America

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Self-Driving Cars Market Size

- October-2024

- 148

- Global

- automotive

Related Research

"Automotive Towbar, Market Size, Share & Trends Analysis Report By Application (OEM ,OES ,), By Type

February-2021

(AVM) with Moving Object Detection (MOD) Market Size, Share & Trends Analysis Report By Application

February-2021

1:18 Scale Diecast Automotive Market Size, Share & Trends Analysis Report By Application (Collection

February-2021

3-in-1 Electric Drive Module (eDrive Modules) Market Size, Share & Trends Analysis Report By Applica

February-2021

3D Map System For Automotive Market Size, Share & Trends Analysis Report By Application (Passenger V

February-2021

3PL Service Market Size, Share & Trends Analysis Report By Application (Consumer Goods, Healthcare,

February-2021

4WS Vehicle Market Size, Share & Trends Analysis Report By Application (Passenger Use, Commercial Us

February-2021

8X8 Armored Vehicle Market Size, Share & Trends Analysis Report By Application (Defense,Homeland Sec

February-2021

>14T Duty Truck Market Size, Share & Trends Analysis Report By Application (Construction, Manufactur

February-2021