Electric Vehicles Market Size, Share, Growth & Industry Analysis, By Type (Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV)), By Vehicle Type (Passenger Car, Commercial Vehicle), and Regional Analysis, 2024-2031

Electric Vehicles Market: Global Share and Growth Trajectory

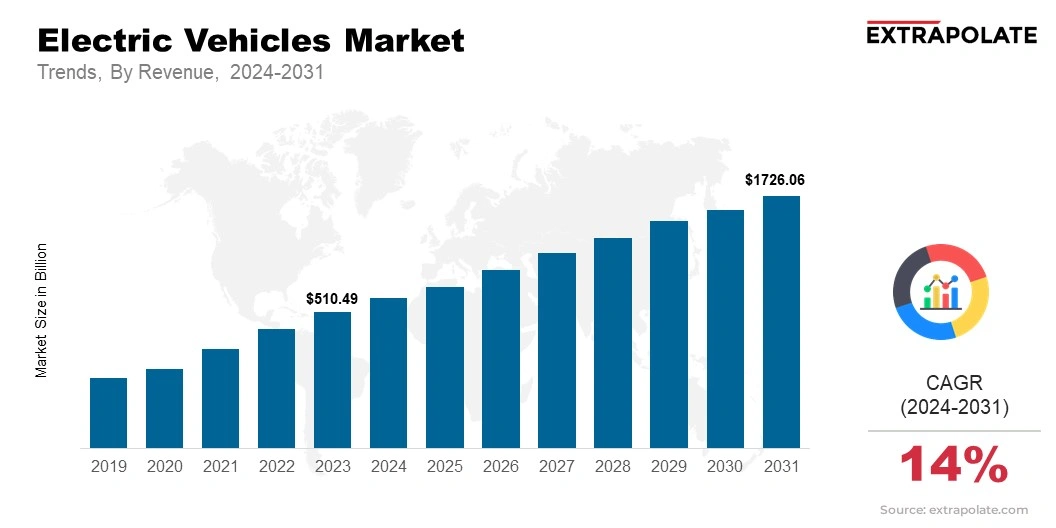

Global Electric Vehicles Market size was recorded at USD 510.49 billion in 2023, which is estimated to be valued at USD 691.61 billion in 2024 and reach USD 1726.06 billion by 2031, growing at a CAGR of 14% during the forecast period.

The global electric vehicles market is witnessing unprecedented growth. Rapid breakthroughs in battery technology, favorable government policies, and growing environmental concerns are fueling the expansion of the market. This market includes Battery Electric Vehicles (BEVs), Plug-In Hybrid Electric Vehicles (PHEVs), and Hybrid Electric Vehicles (HEVs). They cater to the rising demand for sustainable, energy-efficient transport. As EVs get cheaper and charging stations grow, they are transforming the automotive industry. These vehicles are gaining traction as they offer eco-friendly transport options.

Key Market Trends Driving Product Adoption

The electric vehicle market is marked by innovation and strong competition. Key trends fostering market growth include:

- Environmental Awareness: A rising focus on cutting greenhouse gas emissions and combating climate change has supported the shift to electric mobility.

- Battery Advancements: Innovations in solid-state batteries and improved lithium-ion performance are expanding EV range and reducing charging times.

- Government Incentives: Governments are promoting EVs with subsidies, tax benefits, and strict emission rules.

- Expansion of Charging Infrastructure: Fast-charging networks and home chargers are boosting consumer confidence.

- Integration with Smart Technologies: EVs are increasingly equipped with advanced features. These include autonomous driving capabilities, IoT connectivity, and vehicle-to-grid (V2G) technology.

Major Players and their Competitive Positioning

The electric vehicles market features leading players such as Tesla, BYD, Nissan, and General Motors. These companies are at the forefront of innovation and market penetration. New entrants and traditional automakers are prioritizing investments to gain a competitive edge in this dynamic sector. This is leading to increased competition and driving technological progress.

Consumer Behavior Analysis

Consumers are increasingly adopting EVs due to:

- Environmental Responsibility: Growing awareness of the environmental benefits.

- Cost Savings: Reduced dependence on fossil fuels and lower running costs.

- Advanced Features: Access to cutting-edge technology, including autonomous driving and connected car features.

- Government Incentives: Advantages such road tax exemptions, lower registration costs, and refunds.

Pricing Trends

Electric vehicle pricing trends vary by vehicle type, battery capacity, and regional policies. Premium EVs dominate the high-end segment. Affordable models with competitive features are gaining traction in emerging markets.

India's electric vehicle market is set to register a CAGR of around 36% from 2023 to 2028. This growth is largely attributed to government initiatives such as the FAME scheme. A rising focus on reducing oil imports is further supporting market expansion in the country.

Growth Factors

The growth of the electric vehicles market is spurred by:

- Technological Breakthroughs: Innovations in lightweight materials, energy storage, and powertrain efficiency.

- Traffic Congestion and Rapid Urbanization: The need for electric micro-mobility solutions, such as e-bikes and scooters, is being propelled by the growing urban population.

- Corporate Sustainability Goals: To reach carbon neutrality goals, businesses are implementing EV fleets.

- Public Transport Electrification: Governments are decarbonizing public transportation systems by investing in electric buses and taxis.

Recent Developments/Market Highlights

The electric vehicles market is evolving rapidly with notable advancements such as:

- Extended Range EVs: Manufacturing vehicles that can travel over 400 miles on a single charge.

- Fast-Charging Technology: Introduction of ultra-fast chargers that can increase a vehicle's range by 200 miles in less than 15 minutes.

- Innovative Battery Recycling Solutions: Efforts to reduce the negative effects on the environment by recycling EV batteries effectively.

Current and Potential Growth Implications

Demand Supply Analysis

Government regulations and growing consumer interest are fueling the demand for EVs, exceeding the supply. However, there are challenges due to supply chain interruptions and material shortages, especially for cobalt and lithium.

Gap Analysis

Although the EV market has seen significant advancements, key areas require further development:

- Charging Infrastructure: More extensive networks are needed to support mass adoption.

- Battery Costs: Continued reduction in battery manufacturing costs is essential for widespread affordability.

- Range Anxiety: Enhanced vehicle ranges will mitigate consumer concerns.

- Global Equity in Access: Accessibility in developing countries remains a critical focus.

Top Companies in the Electric Vehicles Market

Leading companies shaping the EV market include:

- Tesla

- BYD

- Nissan

- BMW

- General Motors

- Rivian

- Lucid Motors

Electric Vehicles Market: Report Snapshot

Segmentation | Details |

By Type | Energy Drinks, Probiotic Beverages, Functional Water, Sports Drinks, Enhanced Teas & Coffees, Others |

By Application | Health & Wellness, Fitness & Sports, Cognitive Function, Digestive Health, Immune System Support, Others |

By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

High Growth Segments

- BEVs: Fully electric vehicles that emit no pollutants and are widely used.

- PHEVs: For flexibility and a longer range, PHEVs combine conventional and electric power.

- Electric Commercial Vehicles: The electrification of public transit and logistics are driving the growth

Major Innovations

Maintaining market leadership in EVs requires ongoing innovation, with developments including:

- Solid-State Batteries: Delivering quicker charging times and a higher energy density.

- Vehicle-to-Grid Technology: Enabling energy exchange between EVs and power grids.

- Autonomous Electric Vehicles: Incorporating autonomous driving technologies for convenience and safety.

Electric Vehicles Market: Potential Growth Opportunities

Despite the electric vehicles market's potential for rapid expansion, businesses are faced with challenges such as:

- Intense Competition: Balancing innovation with cost competitiveness.

- Regulatory Compliance: Following changing safety and emission standards.

- Raw Material Constraints: Obtaining essential resources from ethical and ecological sources.

Extrapolate Research says:

Extrapolate Research indicates that the electric vehicles market is projected to experience notable growth due to supportive regulations, customer acceptance, and technological developments. Players addressing the challenges and leveraging the opportunities will shape the future of sustainable mobility.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Electric Vehicles Market Size

- December-2024

- 148

- Global

- automotive

Related Research

"Automotive Towbar, Market Size, Share & Trends Analysis Report By Application (OEM ,OES ,), By Type

February-2021

(AVM) with Moving Object Detection (MOD) Market Size, Share & Trends Analysis Report By Application

February-2021

1:18 Scale Diecast Automotive Market Size, Share & Trends Analysis Report By Application (Collection

February-2021

3-in-1 Electric Drive Module (eDrive Modules) Market Size, Share & Trends Analysis Report By Applica

February-2021

3D Map System For Automotive Market Size, Share & Trends Analysis Report By Application (Passenger V

February-2021

3PL Service Market Size, Share & Trends Analysis Report By Application (Consumer Goods, Healthcare,

February-2021

4WS Vehicle Market Size, Share & Trends Analysis Report By Application (Passenger Use, Commercial Us

February-2021

8X8 Armored Vehicle Market Size, Share & Trends Analysis Report By Application (Defense,Homeland Sec

February-2021

>14T Duty Truck Market Size, Share & Trends Analysis Report By Application (Construction, Manufactur

February-2021