Electric Vehicle Charging Station Market Size, Share, Growth & Industry Analysis, By Charger Type (Level 1, Level 2, DC Fast Chargers) By Application (Residential, Commercial, Public) By End User (Private Vehicles, Commercial Fleets, Public Transportation), and Regional Analysis, 2024-203

Electric Vehicle Charging Station Market: Global Share and Growth Trajectory

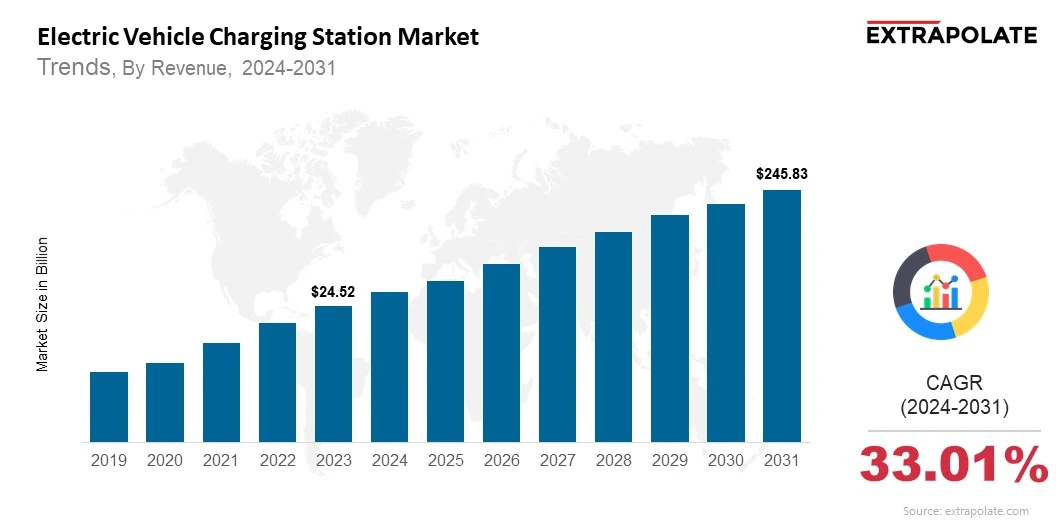

The global Electric Vehicle Charging Station Market size was valued at USD 24.52 billion in 2023 and is projected to grow from USD 33.37 billion in 2024 to USD 245.83 billion by 2031, exhibiting a CAGR of 33.01% during the forecast period.

The global electric vehicle (EV) charging station market is witnessing a powerful increase, driven by the rapid adoption of electric vehicles, supportive government policies, and growing environmental concerns. This market encompasses a wide array of charging infrastructure, including fast chargers, slow chargers, and ultra-fast DC charging stations, being installed in public spaces, residential areas, commercial buildings, and highway corridors.

With the growing pressure to reduce carbon emissions and transition away from fossil fuels, the deployment of EV charging stations is becoming a cornerstone in the global shift towards sustainable transportation. As electric vehicles become more mainstream, consumers and businesses alike are demanding reliable and easy to access charging solutions.

This has prompted substantial investments from automakers, energy companies, and governments into charging infrastructure. Technological developments like smart charging systems, vehicle-to-grid integration, and wireless charging are further improving the efficiency and appeal of EV stations. These innovations not only optimize energy consumption but also support the stability of the electric grid.

Additionally, the growth of renewable energy sources such as solar and wind power is creating synergies with EV charging networks. Many charging stations are now being designed to operate in tandem with clean energy sources, making the overall ecosystem even more sustainable. The market is also being shaped by strategic partnerships and collaborations across industries to accelerate the development of widespread charging infrastructure.

Urban centers are focusing on the installation of fast-charging networks to support city dwellers, while rural and remote areas are beginning to see the advantages of broader infrastructure planning. Moreover, commercial fleets, ride-sharing services, and public transportation authorities are increasingly adopting EVs, which is driving demand for high-capacity and efficient charging hubs.

Emerging markets in Asia-Pacific, Latin America, and parts of Africa are showing immense potential as EV adoption begins to pick up pace, supported by favorable government initiatives and growing consumer awareness. Meanwhile, established markets in North America and Europe continue to invest in modernization and grid resilience to support the future of electric mobility.

As the electric vehicle charging station market continues to make progress, stakeholders across the automotive, energy, and tech sectors are poised to play crucial roles in shaping its trajectory. The market’s expansion represents not only a transformative shift in transportation infrastructure but also a significant opportunity for innovation, investment, and global collaboration toward a cleaner, more sustainable future.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

The electric vehicle charging station market is characterized by rapid technological innovation, infrastructure development, and evolving energy strategies. Key trends driving market growth include:

• Government Incentives and Regulations: Tax breaks and subsidies encourage people to buy EVs. Public charging networks also get government support.

• Technological Advancements: New tech like smart and wireless charging improves convenience. Ultra-fast chargers reduce wait times.

• Integration with Renewable Energy: Charging stations are increasingly being integrated with solar and wind energy sources to promote sustainability.

• Network Expansion: Public and private sector investments are accelerating the deployment of EV charging networks across urban and rural areas.

• Vehicle-to-Grid (V2G) Technology: EVs can now share energy with the grid using bidirectional charging. It boosts grid reliability.

Major Players and their Competitive Positioning

The EV charging station market is dominated by major players like ChargePoint, Tesla, ABB, Siemens, and Schneider Electric. These companies are constantly expanding their charging networks and investing in R&D to be at the forefront. New entrants and startups are also making their mark with innovative solutions and localized services.

Consumer Behavior Analysis

Consumers are increasingly opting for EVs and, by extension, seeking convenient and efficient charging solutions:

• Convenience: Nearby, dependable chargers help customers decide on EVs. Good infrastructure boosts EV sales Access to nearby and reliable charging infrastructure is a key factor influencing EV purchasing decisions.

• Cost-Effectiveness: Lower costs to operate EVs attract more users. Subsidies from the government boost this trend.

• Sustainability: Growing environmental awareness makes consumers choose EVs. They want cleaner ways to travel.

• Technological Savviness: Consumers like smart charging tools with app control. They also want remote monitoring and live data.

Pricing Trends

Pricing trends differ based on charger type, speed, and location. Level 1 chargers are the most cost-effective, while DC fast chargers command premium prices due to higher installation and equipment costs. However, economies of scale and technological developments are gradually reducing prices, making EV easy to access.

According to the International Energy Agency (IEA) and the Ministry of Heavy Industries, India’s EV charging station market is projected to grow at a CAGR of over 35% from 2023-2028, with the number of stations expected to exceed 100,000 by 2025.

The global market is surging, with significant innovations across North America, Europe, and Asia-Pacific. Countries such as China, the U.S., Germany, and India are leading the way due to strong policy frameworks and increase in EV adoption.

Growth Factors

Several drivers are accelerating the growth of the EV charging station market:

• Electrification of Transportation: Passenger and commercial EV sales are increasing. This shift supports cleaner transport overall.

• Urbanization and Smart City Initiatives: A large number of users seek eco-friendly transport options. Sustainable mobility is growing fast.

• Green Energy Integration: Growing emphasis on reducing carbon emissions.

• Public-Private Partnerships: Many partners help set up EV chargers. They also share the job of running the networks.

Regulatory Landscape

The regulatory landscape is evolving with mandates for EV infrastructure in new buildings, interoperability standards, and guidelines for charger safety and efficiency. Compliance with local and international standards is critical for manufacturers and operators.

Recent Developments

The EV charging market is evolving rapidly with several notable developments:

• Ultra-Fast Chargers: EVs can now charge 200 miles in under 20 minutes. This makes long trips easier and faster.

• Mobile Charging Solutions: Portable EV chargers help during roadside breakdowns. They are also used at short-term event sites.

• Energy Management Systems: Smart systems now share power across chargers. This avoids overload and keeps charging stable.

• EV Charging Apps: Real-time updates help drivers find open chargers fast. Simple payment tools make charging smoother.

Current and Potential Growth Implications

Demand Supply Analysis

Charger demand is rising faster than supply. People face delays and not enough stations. Speeding up rollout is now a major goal.

Gap Analysis

Key areas needing attention include:

• Infrastructure Density: More chargers are needed in suburban and rural areas.

• Interoperability: Standardized protocols for cross-network compatibility.

• User Awareness: Educating consumers about charging options and benefits.

• Energy Demand: Managing the increased load on local grids.

Top Companies in the EV Charging Station Market

• ChargePoint

• Tesla

• ABB

• Siemens

• Blink Charging

• Eaton

• Schneider Electric

• BP Pulse

• Webasto Group

• EVgo

EV Charging Station Market: Report Snapshot

Segmentation | Details |

By Charger Type | Level 1, Level 2, DC Fast Chargers |

By Application | Residential, Commercial, Public |

By End User | Private Vehicles, Commercial Fleets, Public Transportation |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

EV Charging Station Market: High-Growth Segments

The following market segments are expected to witness robust growth:

• DC Fast Charging: Meeting the demand for quick and efficient charging.

• Residential Charging: Convenience of home-based charging infrastructure.

• Public Charging Networks: Expansion to support mass EV adoption.

• Fleet Charging Solutions: Serving logistics, ride-sharing, and delivery services.

Major Innovations

Innovation is necessary for competitive advantage in this market. Some key innovations include:

• Battery Swapping Technology: Minimizing downtime and enhancing convenience.

• AI-Based Load Management: Predictive analytics to manage charging loads.

• Wireless Charging: Inductive charging pads for effortless operation.

• Solar-Powered Charging Stations: Off-grid and eco-friendly sustainable solutions.

EV Charging Station Market: Potential Growth Opportunities

Companies in this market face challenges but also significant opportunities:

• High Initial Investment: Infrastructure and equipment costs.

• Grid Capacity Issues: Need for grid upgrades and energy storage.

• Consumer Education: Enhancing understanding of EV benefits and usage.

• Regulatory Uncertainty: Varying policies and standards across regions.

• Technology Integration: Seamless user experience through connected platforms.

Kings Research says:

The global electric vehicle charging station market is on a strong growth path, propelled by eco-friendly transportation goals, infrastructure investments, and innovation. Companies that can scale efficiently, partner strategically, and embrace emerging technologies will be at the forefront of this dynamic and transformative market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Electric Vehicle Charging Station Market Size

- June-2025

- 148

- Global

- automotive

Related Research

"Automotive Towbar, Market Size, Share & Trends Analysis Report By Application (OEM ,OES ,), By Type

February-2021

(AVM) with Moving Object Detection (MOD) Market Size, Share & Trends Analysis Report By Application

February-2021

1:18 Scale Diecast Automotive Market Size, Share & Trends Analysis Report By Application (Collection

February-2021

3-in-1 Electric Drive Module (eDrive Modules) Market Size, Share & Trends Analysis Report By Applica

February-2021

3D Map System For Automotive Market Size, Share & Trends Analysis Report By Application (Passenger V

February-2021

3PL Service Market Size, Share & Trends Analysis Report By Application (Consumer Goods, Healthcare,

February-2021

4WS Vehicle Market Size, Share & Trends Analysis Report By Application (Passenger Use, Commercial Us

February-2021

8X8 Armored Vehicle Market Size, Share & Trends Analysis Report By Application (Defense,Homeland Sec

February-2021

>14T Duty Truck Market Size, Share & Trends Analysis Report By Application (Construction, Manufactur

February-2021