Advanced Driver Assistance Systems Market Size, Share, Growth & Industry Analysis, By Component (Sensors, ECUs, Software, Cameras, LiDAR, Radar), By System Type (Adaptive Cruise Control, Lane Departure Warning, Blind Spot Detection, Park Assist, Emergency Braking, Traffic Sign Recognition), By Vehicle Type (Passenger Cars, Commercial Vehicles), Large Enterprises), By Level of Autonomy (Level 1, Level 2, Level 3, Level 4, Level 5), and Regional Analysis, 2024-2031

Advanced Driver Assistance System (ADAS) Market: Global Share and Growth Trajectory

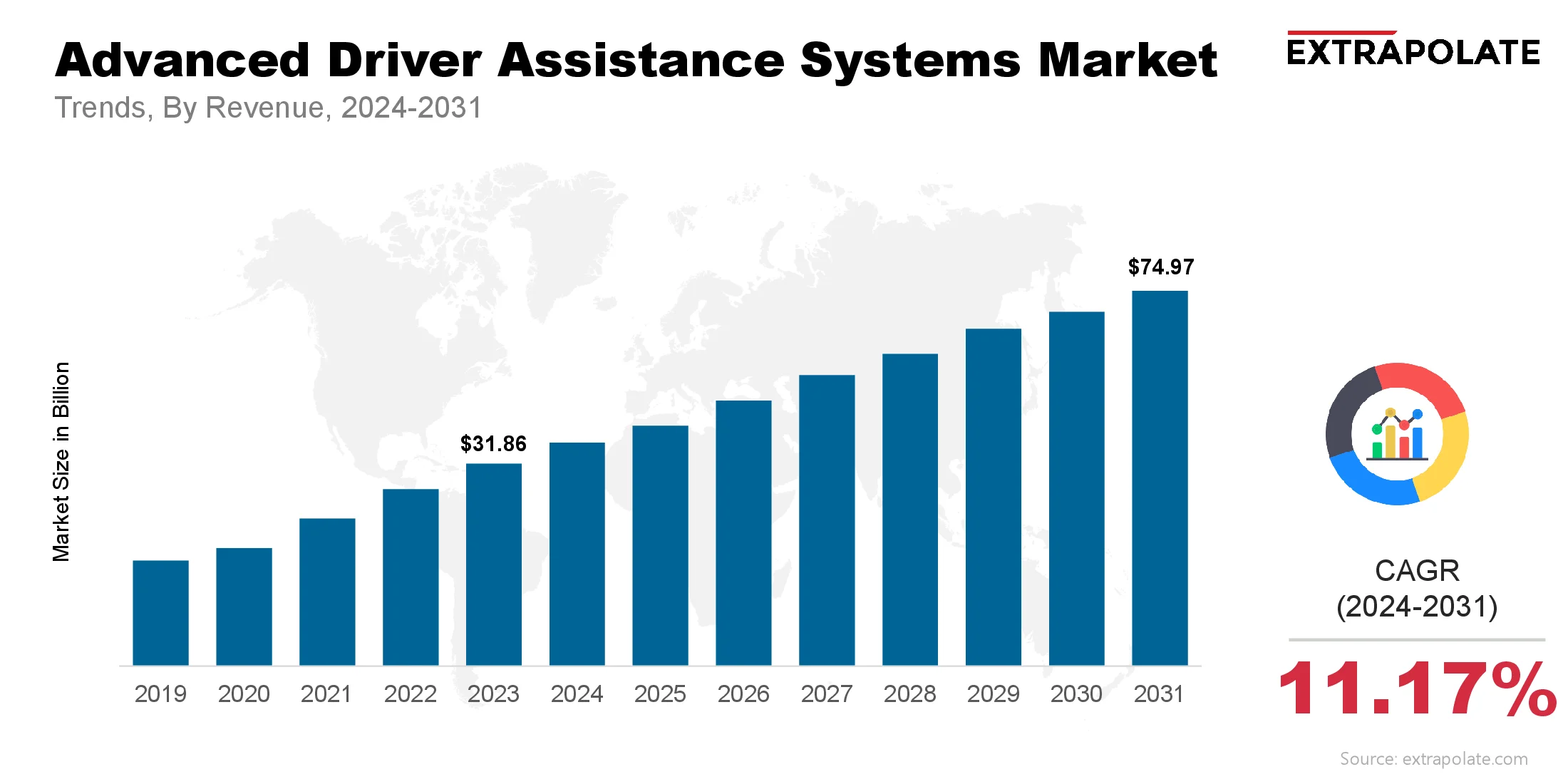

The Advanced Driver Assistance Systems (ADAS) Market size was valued at USD 31.86 billion in 2023 and is projected to grow from USD 35.72 billion in 2024 to USD 74.97 billion by 2031, exhibiting a CAGR of 11.17% during the forecast period.

The global is experiencing significant expansion, driven by a combination of factors including increasing demand for enhanced vehicle safety, stringent government regulations, and the rapid pace of technological advancements in the automotive industry.

Advanced Driver Assistance Systems refers to a collection of electronic systems in vehicles designed to assist drivers in various ways, improving safety, comfort, and overall driving experience. The market includes a diverse range of solutions, such as adaptive cruise control, lane departure warning, collision avoidance systems, blind spot detection, automatic emergency braking, parking assistance, and more.

As the automotive sector continues to prioritize safety, the adoption of Advanced Driver Assistance Systems technologies is on the rise. The primary goal of these systems is to reduce human error, enhance vehicle control, and prevent accidents, thereby contributing to the overall reduction in road fatalities and injuries. Adaptive cruise control, for example, adjusts a vehicle's speed to maintain a safe distance from the car ahead, while lane departure warning systems alert drivers when they unintentionally drift out of their lane.

Blind spot detection ensures drivers are aware of vehicles in their blind spots, and collision avoidance systems provide warnings or even take action to prevent potential crashes. One of the key drivers of growth in the Advanced Driver Assistance Systems market is the increasing emphasis on vehicle safety regulations. Governments across the globe are implementing stricter safety standards, with many countries requiring certain Advanced Driver Assistance Systems features to be standard in new vehicles.

For instance, features like automatic emergency braking and lane-keeping assist are becoming mandatory in several regions, further propelling the demand for Advanced Driver Assistance Systems technology. This regulatory push is not only enhancing the safety of road users but also influencing manufacturers to integrate these systems into their vehicles to remain compliant and competitive.

Moreover, the rise of electric vehicles (EVs) and the ongoing transition toward autonomous driving technology are also contributing to the growing importance of Advanced Driver Assistance Systems in modern vehicles. EV manufacturers are increasingly adopting Advanced Driver Assistance Systems solutions as part of their broader strategy to differentiate their offerings in the market.

Additionally, the convergence of Advanced Driver Assistance Systems with autonomous vehicle technologies is gradually paving the way for a future where fully autonomous vehicles could become commonplace, with Advanced Driver Assistance Systems acting as a stepping stone toward this transformation.

Market growth is driven by rapid technological innovation. Advancements in AI, machine learning, sensors, and camera tech are key. These developments make Advanced Driver Assistance Systems systems smarter and more reliable. Real-time data processing improves system performance.

Advanced algorithms enhance accuracy. This enables better function in complex driving environments. Tech progress boosts Advanced Driver Assistance Systems features. It also cuts system costs. This makes Advanced Driver Assistance Systems more affordable for more people.

Key Market Trends Driving Product Adoption

The Advanced Driver Assistance Systems market is defined by continuous innovation, regulatory momentum, and a strong push toward autonomous driving. Key trends driving market growth include:

- Vehicle Safety Focus: More road crashes are raising demand for safety tech. Advanced Driver Assistance Systems helps prevent accidents. It also supports drivers on the road.

- Government Regulations: Global safety rules and emission norms push OEMs to add Advanced Driver Assistance Systems. This trend is strong in Europe and North America.

- Technological Advancements: AI, machine learning, and sensor fusion are being used in Advanced Driver Assistance Systems. These tools boost feature precision and reliability.

- Electrification and Connectivity: Advanced Driver Assistance Systems now uses AI, machine learning, and sensor fusion. These improve accuracy and system reliability.

- Growing Demand for Semi-Autonomous Vehicles: Advanced Driver Assistance Systems uses AI, machine learning, and sensor fusion. These tools boost accuracy and make systems more reliable.

Major Players and their Competitive Positionin

The Advanced Driver Assistance Systems market is led by established automotive suppliers and technology companies such as Bosch, Continental AG, Denso Corporation, Aptiv, and Valeo. These players are investing heavily in R&D to stay ahead in a competitive landscape. Startups and niche players are entering the market. They offer new sensors, software, and AI-based solutions.

Consumer Behavior Analysis

Consumers are increasingly embracing Advanced Driver Assistance Systems technologies for:

- Safety Assurance: Minimizing accident risks is key. It ensures protection for both drivers and passengers.

- Comfort and Convenience: Adaptive cruise control and automated parking improve the driving experience. These features add convenience and safety.

- Prestige and Modernity: High-end Advanced Driver Assistance Systems packages are found in advanced vehicles. These packages are linked to premium models.

- Technology Adoption: Younger consumers prefer tech-enabled vehicles. They are especially interested in Advanced Driver Assistance Systems-equipped models.

Pricing Trends

Pricing in the Advanced Driver Assistance Systems market depends on the complexity of the system, vehicle class, and OEM strategy. Premium vehicles have advanced Advanced Driver Assistance Systems features. Budget models focus on basic systems. Economies of scale and innovations are lowering costs. This makes Advanced Driver Assistance Systems more accessible for mid-range vehicles.

The global reach of the Advanced Driver Assistance Systems market is expanding, with North America, Europe, and Asia-Pacific leading adoption. Asia-Pacific, especially China, Japan, and South Korea, is a key region. Large vehicle production, government support, and tech-savvy consumers are driving growth.

Growth Factors

Multiple drivers are propelling Advanced Driver Assistance Systems market growth:

- Stringent Safety Standards: Asia-Pacific, including China, Japan, and South Korea, is crucial. Vehicle production, government support, and tech-savvy consumers fuel growth.

- Increasing Traffic Congestion: Urban driving is becoming more complex. This is driving the adoption of assistive driving technologies.

- Advancements in Sensor Technologies: Radar, LiDAR, cameras, and ultrasonic sensors are advancing. They are also becoming more affordable.

- OEM Partnerships and Collaborations: Automotive companies are teaming up with tech firms. Together, they are delivering integrated Advanced Driver Assistance Systems platforms.

- Consumer Awareness: More people understand the benefits of Advanced Driver Assistance Systems. This is influencing their vehicle purchase decisions.

Regulatory Landscape

The regulatory environment is critical for Advanced Driver Assistance Systems growth. The U.S., Germany, and Japan are introducing mandates. These include technologies like automatic emergency braking and lane-keeping assistance. Advanced Driver Assistance Systems compliance also requires adherence to evolving standards for data security, interoperability, and functional safety (ISO 26262).

Recent Developments

The Advanced Driver Assistance Systems market is dynamic, with regular technological advancements and product launches. Recent developments include:

- AI-Driven Sensor Fusion: Data from multiple sensors is being combined. This improves decision-making and accuracy.

- Improved Night Vision and Driver Monitoring Systems: Safety is improved in low visibility and drowsy driving. Technologies help in these challenging scenarios.

- Integration with V2X Communication: Vehicles can now communicate with each other and infrastructure. This helps predict safety risks.

- Compact and Modular Systems: This offers flexibility for OEMs. It also lowers installation costs.

Current and Potential Growth Implications

- Demand Supply Analysis

Demand for Advanced Driver Assistance Systems is surging across vehicle segments; however, chip shortages and supply chain issues are slowing deployment. OEMs are focusing on building resilient supply chains to meet growing consumer expectations. - Gap Analysis

While Advanced Driver Assistance Systems technologies are advancing rapidly, some key challenges persist:

- High Cost of Implementation: Advanced features are still costly. This limits their availability in entry-level vehicles.

- Complex Integration: Ensuring Advanced Driver Assistance Systems works across different vehicle platforms is challenging. This remains a key hurdle.

- Consumer Education: Drivers may misuse or underuse Advanced Driver Assistance Systems. This is often due to a lack of awareness.

- Standardization Issues: Inconsistent standards across regions impact scalability. They also affect interoperability.

Top Companies in the Advanced Driver Assistance Systems Market

Some of the top companies operating in the market include:

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Aptiv PLC

- Valeo SA

- ZF Friedrichshafen AG

- Magna International Inc

- Mobileye (an Intel Company)

- NVIDIA Corporation

- Veoneer, Inc.

Advanced Driver Assistance Systems Market: Report Snapshot

Segmentation | Details |

By Component | Sensors, ECUs, Software, Cameras, LiDAR, Radar |

By System Type | Adaptive Cruise Control, Lane Departure Warning, Blind Spot Detection, Park Assist, Emergency Braking, Traffic Sign Recognition |

By Vehicle Type | Passenger Cars, Commercial Vehicles |

By Level of Autonomy | Level 1, Level 2, Level 3, Level 4, Level 5 |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segment

The following market segments are projected to witness substantial growth:

- Passenger Cars: There is increased adoption of comfort features. Safety features are also being adopted more.

- Level 2 & 3 Autonomy: Interest in semi-autonomous capabilities is growing. More onsumers are seeking these features.

- Radar and LiDAR: Technological innovations and cost reductions are boosting adoption.

- Emergency Braking Systems: Regulatory mandates and consumer demand are accelerating implementation.

Maor Innovations

Innovation continues to shape the Advanced Driver Assistance Systems landscape. Noteworthy innovations include:

- AI-Powered Predictive Algorithms: Enhancing decision-making is crucial in dynamic driving conditions. It helps improve driver safety and vehicle response.

- Edge Computing Integration: Reducing latency is vital for quick response. This improves system efficiency and driver safety.

- Augmented Reality Dashboards: Overlaying real-time Advanced Driver Assistance Systems data improves awareness. It helps drivers understand their surroundings better.

- Sensor Miniaturization: This enables sleeker system designs. It also makes them more efficient.

Potential Growth Opportunities

Despite its rapid progress, the Advanced Driver Assistance Systems market faces notable challenges:

- High Development Costs: Significant R&D and testing expenses.

- Data Privacy and Security: Ensuring user safety while protecting sensitive information.

- Driver Over-Reliance: Users becoming too dependent on Advanced Driver Assistance Systems can lead to riskier driving behaviour.

- Regulatory Uncertainty: Differing regional regulations may delay global product rollouts.

- Infrastructure Readiness: Full benefits of Advanced Driver Assistance Systems require supporting smart infrastructure.

Extrapolate Research says:

The global Advanced Driver Assistance System (Advanced Driver Assistance Systems) market is set for strong growth over the coming years. Regulations now support safer vehicle tech. Rising demand and new tech create strong market opportunities. Companies that invest in R&D, ensure compliance, and build strategic partnerships will be poised for long-term success in this rapidly evolving sector.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Advanced Driver Assistance Systems Market Size

- May-2025

- 148

- Global

- automotive

Related Research

"Automotive Towbar, Market Size, Share & Trends Analysis Report By Application (OEM ,OES ,), By Type

February-2021

(AVM) with Moving Object Detection (MOD) Market Size, Share & Trends Analysis Report By Application

February-2021

1:18 Scale Diecast Automotive Market Size, Share & Trends Analysis Report By Application (Collection

February-2021

3-in-1 Electric Drive Module (eDrive Modules) Market Size, Share & Trends Analysis Report By Applica

February-2021

3D Map System For Automotive Market Size, Share & Trends Analysis Report By Application (Passenger V

February-2021

3PL Service Market Size, Share & Trends Analysis Report By Application (Consumer Goods, Healthcare,

February-2021

4WS Vehicle Market Size, Share & Trends Analysis Report By Application (Passenger Use, Commercial Us

February-2021

8X8 Armored Vehicle Market Size, Share & Trends Analysis Report By Application (Defense,Homeland Sec

February-2021

>14T Duty Truck Market Size, Share & Trends Analysis Report By Application (Construction, Manufactur

February-2021