Agrigenomics Market Size, Share, Growth & Industry Analysis, By Technology (Gene Editing, Genetic Sequencing, Molecular Breeding, Marker-Assisted Selection), By Application (Crop Improvement, Livestock Improvement, Seed Development, Disease Resistance, Others), By End User (Agribusinesses, Research Institutions, Government Bodies, Farmers), and Regional Analysis, 2024-2031

Agrigenomics Market: Global Share and Growth Trajectory

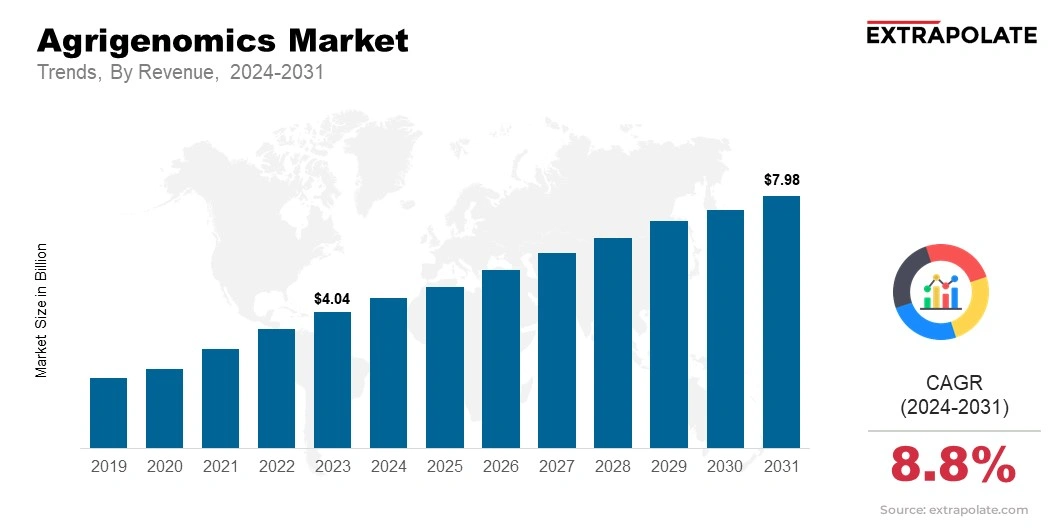

The global Agrigenomics Market size was valued at USD 4.04 billion in 2023 and is projected to grow from USD 4.43 billion in 2024 to USD 7.98 billion by 2031, exhibiting a CAGR of 8.8% during the forecast period.

The global market is experiencing significant growth, driven by advancements in genomic technologies, increasing demand for sustainable agricultural practices, and the need to improve crop yields and livestock productivity.

Agrigenomics, the application of genomics in agriculture, is revolutionizing the way farmers, researchers, and companies approach plant and animal breeding, pest control, and disease resistance. The integration of genomic data with agricultural practices has led to enhanced productivity, improved crop quality, and more resilient livestock.

This market includes a wide range of applications such as crop genomics, livestock genomics, and agrochemical genomics, each of which is gaining traction in both developed and developing regions. Genomic technologies, including gene sequencing, CRISPR, and DNA profiling, are helping scientists and farmers to develop genetically modified crops and animals that are more resistant to diseases, pests, and environmental stressors, while also being more nutritious and higher yielding.

The increasing adoption of precision agriculture is another key factor fueling market growth. By utilizing genomic insights, farmers are able to optimize input usage, reduce waste, and enhance overall crop and livestock management. This approach not only supports sustainability but also helps meet the growing global demand for food, driven by population growth and changing dietary patterns.

Technological advancements and innovations in bioinformatics, along with decreasing costs of genomic sequencing, are making agrigenomics more accessible to farmers and agricultural researchers worldwide.

Additionally, the growing demand for organic and genetically modified (GM) crops, as well as the rising awareness of the environmental impact of traditional farming practices, are contributing to the widespread adoption of genomic technologies in agriculture.

The market is poised for further expansion, driven by continued advancements in genomic research, the increasing availability of genomic data, and the growing emphasis on sustainable agriculture.

With the ongoing focus on improving agricultural productivity and food security, agrigenomics is expected to play a vital role in shaping the future of global agriculture, offering immense growth opportunities across various sectors.

Key Market Trends Driving Product Adoption

The agrigenomics market is marked by technological innovations, evolving agricultural practices, and a growing emphasis on sustainability. The key trends influencing market growth include:

- Precision Agriculture: With the integration of genomics and data analytics, farmers are able to optimize farming practices, leading to improved crop management and resource use efficiency.

- Gene Editing and CRISPR Technology: CRISPR and other gene-editing tools are increasingly being utilized to develop crops with enhanced traits such as resistance to pests, diseases, and environmental stress.

- Sustainability in Agriculture: Agrigenomics technologies are being used to develop crops that require fewer resources, such as water and fertilizers, and are more resilient to climate change, promoting sustainable agricultural practices.

- Increased Focus on Crop Yields: High-yield crops developed through genomics are being designed to meet the growing food demand, especially in developing regions facing food insecurity.

Major Players and their Competitive Positioning

Some of the prominent players in the agrigenomics market are Monsanto, Syngenta, Bayer and DuPont. These companies have the strongest R&D departments and patent portfolios around genetic sequencing and crop biotechnology which makes them more competitive. Lesser-known biotechnology companies are also springing up with creative solutions to specific agricultural problems.

Consumer Behavior Analysis

Farmers and agribusinesses are increasingly adopting agrigenomics technologies for a range of reasons, including:

- Higher Productivity: Maximizing crop yield per acre and reducing production costs.

- Disease Resistance: Developing crops that are less susceptible to diseases and pests.

- Sustainability: Reducing environmental impact by using fewer chemicals and resources.

- Cost Efficiency: Lowering overall production costs through improved crop resilience.

Pricing Trends

Several factors determine pricing in the agrigenomics market including technologies, applications and segmented geographic regions. Genomic tools like sequencing services and gene-editing solutions are generally top-of-the-line products but costs are anticipated to drop as technology continues to evolve and proliferate. Funding for agricultural innovations is also being provided by governments and organizations to make them more accessible for farmers.

Growth Factors

Several factors are propelling the agrigenomics market:

- Technological Advancements: The evolution of sequencing technologies, data analytics, and gene-editing tools are enabling more efficient crop development and improved agricultural productivity.

- Government Support: Many governments worldwide are investing in agrigenomics research to enhance food security and promote sustainable farming practices.

- Climate Change: With the increasing impact of climate change on traditional agricultural methods, there is a rising demand for genetically modified crops that are more adaptable to changing environmental conditions.

- Rising Global Population: The need to increase global food production to meet the dietary needs of a growing population is driving the adoption of agrigenomics technologies.

Regulatory Landscape

Agrigenomics, the new innovation in agriculture, has a rapidly evolving regulatory framework, adapting different guidelines on gene-edited crops and use of biotechnology in informed applications across countries.

Regulatory authorities are focusing on safety evaluations, ecological assessments, and consumer acceptance. Such factors like these significantly contribute to the market growth and the adoption of new technologies. Abiding by regulatory standards and navigating individual region, the companies are liable to govern consumer trust and market access.

Recent Developments

The agrigenomics industry is making a steady progress, driven by constant technological and scientific discoveries:

- CRISPR-Cas9 Developments: Highly accurate gene-editing methods are being used for creating disease-resistant, pest-resistant, and climate-resilient crops.

- Integrating Biotechnology in Breeding: Incorporation genomics into traditional breeding is accelerating the development of crops that deliver better and more precise results.

- Genetic Testing for Livestock: Innovations based on genomics are modifying livestock breeding, enhancing both sustainability and resilience.

Current and Potential Growth Implications

Demand-Supply Analysis

As food security continues to be a global concern, agrigenomics technologies are becoming popular, however, ensuring a solid supply chain for genetic resources and infrastructure is essential. Companies are working to address these gaps by improving accessibility and reducing costs.

Gap Analysis

The agrigenomics industry is making progress, but few sectors that need further improvement are:

- Keeping Consumers Informed: Fostering education about GM crops cultivates greater potential for developments in agriculture.

- Cost-Effectiveness: Agrigenomics solutions that are easy to access and affordable make the potential for farming stronger in regions under development.

- Partnerships: Effective coordination between research institutions, regulators, and agribusinesses is a vital force for achieving success despite setbacks and advancing the process.

Top Companies in the Agrigenomics Market

- Monsanto (Bayer)

- Syngenta

- DuPont

- BASF

- Cargill

- Corteva Agriscience

- Illumina

- Thermo Fisher Scientific

Agrigenomics Market: Report Snapshot

Segmentation | Details |

By Technology | Gene Editing, Genetic Sequencing, Molecular Breeding, Marker-Assisted Selection |

By Application | Crop Improvement, Livestock Improvement, Seed Development, Disease Resistance, Others |

By End User | Agribusinesses, Research Institutions, Government Bodies, Farmers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High-Growth Segments

Areas that are expected to undergo notable growth:

- Gene Editing: An innovative technology which helps in transforming the genetics of the crop for enhanced sustainability and yield.

- Crop Genomics: The increase in food security challenges are becoming a key force for the integration of crop genomics in the development of crops that are high in yield and robust.

- Livestock Genomics: Improving the health and effectiveness of lifestock is growing in necessity.

Major Innovations

Innovation continues to be a driving force in the market, impelled y next-generation technologies:

- Optimized Breeding Techniques: Improved molecular techniques help in enhancing the quality of crops and the yield.

- CRISPR and Cutting-Edge Genomic Tools: Gene-editing tools opening-up new chances for improving the genetics of crops and livestock.

Potential Growth Opportunities

The agrigenomics sector creates multiple avenues, which include:

- Growth in Emerging Markets: Increasing presence in areas that are less-developed for enhancing food security.

- Integration of Technology: Leveraging AI, IoT and robotics to upgrade the applications of genomics in agriculture.

- Partnerships with the Government: Private and public sectors coming together for accelerating sustainable agriculture.

Extrapolate Research says:

The agrigenomics market is prepared for substantial growth, propelled by innovations being made in technology, heightened food crisis risks, and the demand for eco-friendly agricultural practices. Developments in agrigenomics are speeding-up progress toward more effective and flexible farming solutions. Companies that are embracing advanced technologies will have an upper hand in this dynamic industry. As the agrigenomics market is evolving, companies must overcome compliance challenges to stay ahead of the game. Companies that give priority to regulatory alignments and technological progress will attain enduring success.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Agrigenomics Market Size

- March-2025

- 140

- Global

- agritech

Related Research

Agricultural Biologicals Market Size, Share, and COVID-19 Impact Analysis, By Function Type (Biopest

July-2022

Agricultural Supply Chain Service Market Size, Share, Growth & Industry Analysis, By Service Type (P

June-2025

Agrigenomics Market Size, Share, Growth & Industry Analysis, By Technology (Gene Editing, Genetic Se

March-2025

Agritourism Market Size, Share, Growth & Industry Analysis, By Activity Type (Farm Stays, Direct Mar

May-2025

Feed Grade Vitamin and Mineral Premixes Market Insights 2022, Global Analysis and Forecast to 2030

July-2021

Global Acid And Nutrient In Animal Nutrition Market Research Report 2022 (Status and Outlook)

June-2022

Global Advanced Herbicides Market Research Report 2022

December-2022