SONAR System Market Size, Share, Growth & Industry Analysis, By Product Type (Active SONAR, Passive SONAR, Imaging SONAR, Acoustic Modems), By Application (Defense, Marine Research, Oil & Gas, Commercial Fishing, Others), By End User (Military, Commercial, Scientific Research, Consumer), and Telecommunications, Manufacturing, Others), and Regional Analysis, 2024-2031

SONAR System Market: Global Share and Growth Trajectory

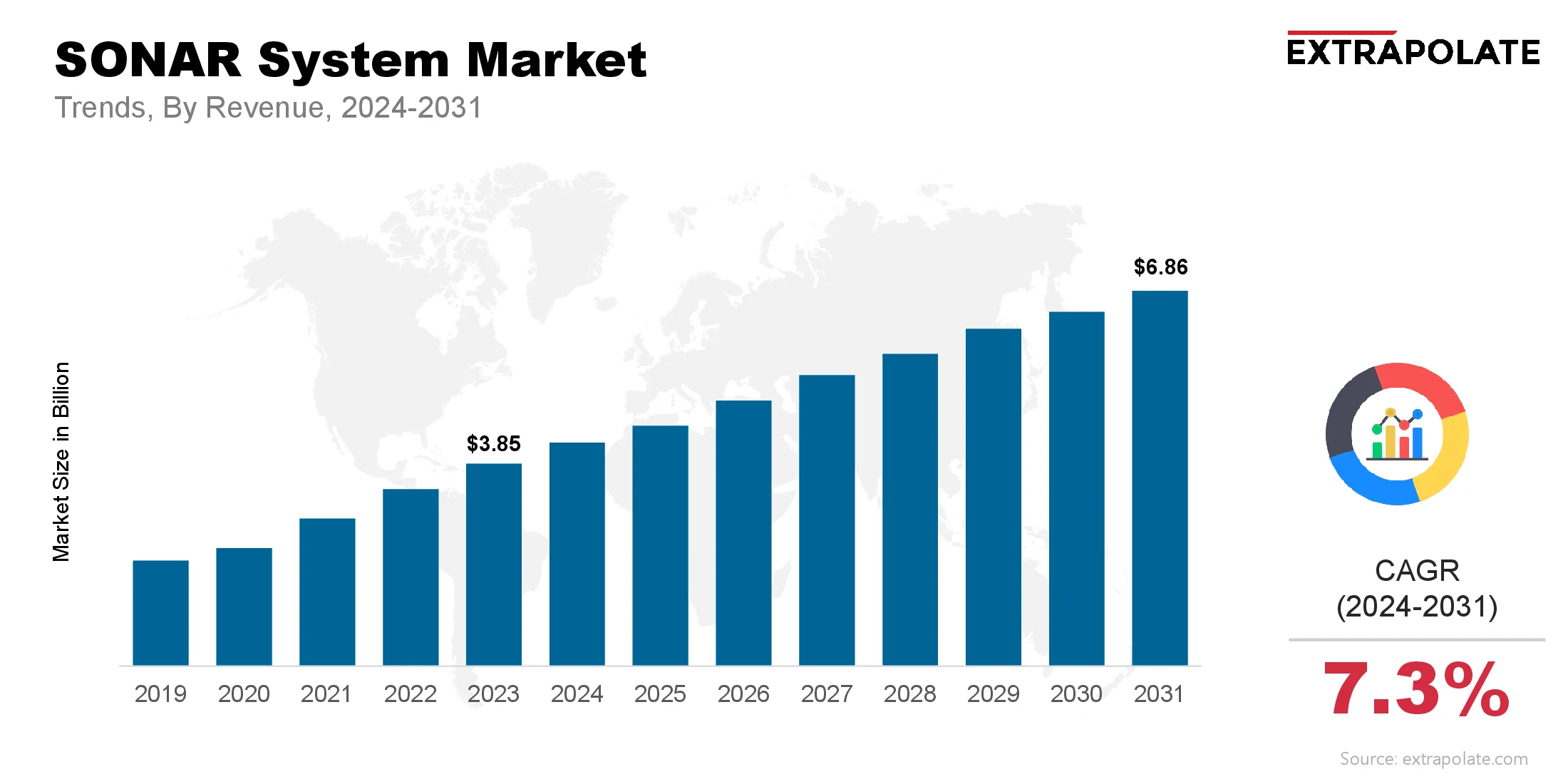

The global SONAR System Market size was valued at USD 3.85 billion in 2023 and is projected to grow from USD 4.17 billion in 2024 to USD 6.86 billion by 2031, exhibiting a CAGR of 7.36% during the forecast period.

The global SONAR system market is witnessing significant growth, propelled by technological advancements, increasing demand for maritime safety, and widespread adoption across various industries. SONAR systems, which use sound waves to detect and locate objects underwater, are crucial in applications ranging from naval defense to fisheries, oil and gas exploration, and scientific research.

As the demand for improved navigation, surveillance, and safety solutions intensifies, the SONAR system market is poised for substantial expansion.Technological innovations, such as the development of high-frequency sonar systems and improved signal processing algorithms, have made SONAR devices more accurate, efficient, and cost-effective.

These advancements have enhanced the capability of SONAR systems to detect smaller or more distant objects, making them indispensable in underwater exploration, mapping, and search-and-rescue operations. Moreover, the increasing need for underwater surveillance and monitoring in sectors like defense and maritime safety is further driving market growth.

The growing need for marine exploration, particularly for oil and gas extraction, has made SONAR systems indispensable. In addition to their role in detecting underwater objects, these systems are vital in seabed mapping, offshore drilling, and marine resource management. The fisheries industry also contributes significantly to the SONAR market, with sonar devices being widely used for fish finding and monitoring the health of aquatic ecosystems.

The rise of autonomous underwater vehicles (AUVs) is another key trend fueling growth in the SONAR system market. These vehicles, which rely heavily on SONAR technology for navigation and mapping, are gaining traction in applications such as deep-sea exploration, environmental monitoring, and defense. As industries seek more autonomous and efficient solutions, the integration of SONAR systems with AUVs is expected to create new opportunities for growth.

Geographically, North America and Europe are leading the SONAR system market, primarily due to the strong presence of defense agencies, maritime industries, and advanced technological infrastructure. However, the Asia-Pacific region is expected to witness the highest growth rate, driven by expanding maritime and defense sectors, as well as increasing investments in marine research and exploration activities.

In conclusion, the global SONAR system market is on a robust growth trajectory, fueled by technological innovation, increased demand from defense and maritime industries, and advancements in autonomous vehicle technologies. As industries continue to seek more reliable, cost-effective, and precise underwater detection systems, the market is poised for continued expansion, offering substantial opportunities for both established players and new entrants.

Key Market Trends Driving Product Adoption

The SONAR system market is defined by constant innovation, shifting industry requirements, and advancements in acoustics technology. Key trends driving market growth include:

- Defense & Military Applications: SONAR systems are key in naval defense. They help with underwater monitoring, anti-submarine tasks, and navigation.

- Marine Exploration & Research: SONAR tech is improving marine research. It helps with mapping ecosystems, seismic work, and underwater archaeology.

- Automation and Integration: Automated SONAR systems are being used more. They integrate with GPS and radar to provide real-time data.

- Environmental Monitoring: SONAR aids in ecological studies. It maps the seafloor and tracks fish, helping with ocean conservation.

- Miniaturization and Portability: Smaller, portable SONAR devices are becoming popular. They are used in fishing, diving, and offshore exploration.

Major Players and their Competitive Positioning

Big companies lead the SONAR system market. These include Lockheed Martin, Thales, L3 Technologies, and Raytheon. These companies lead in tech advancements. They keep improving SONAR systems to stay ahead in the market. Smaller players are launching new products. They focus on niche industry segments like AUVs and remote sensing.

Consumer Behavior Analysis

The adoption of SONAR systems is driven by several factors:

- Military & Defense: Governments and defense agencies are the main buyers. They invest in advanced SONAR systems for maritime security.

- Marine Research: Universities and research groups are using more SONAR tech. It helps with scientific studies and environmental tracking.

- Commercial Marine Operations: Shipping, fishing, and oil companies are investing in SONAR. They use it for navigation, exploring resources, and safety.

- Leisure & Sport: Diving and fishing sectors are using smaller, cheaper SONAR devices. These improve the overall experience.

Pricing Trends

SONAR system prices differ widely. They depend on complexity, use, and tech features. Military and large marine systems cost more. Smaller, portable models for commercial and recreational use are cheaper. Prices are expected to drop. This is due to lower manufacturing costs and wider technology accessibility.

Growth Factors

Several factors are contributing to the growth of the SONAR system market:

- Technological Advancements: Better signal processing and sensitivity are improving SONAR. This, along with enhanced data analysis, broadens its uses.

- Rising Maritime Security Threats: Defense agencies are investing more in SONAR tech. This is due to the growing focus on maritime security.

- Marine Conservation: Concerns about marine ecosystems are rising. This is increasing demand for SONAR in environmental tracking and sustainable fishing.

- Increase in Offshore Exploration: Offshore exploration in oil and gas is driving demand. High-performance SONAR systems are needed for resource mapping.

Regulatory Landscape

The SONAR system market is subject to regulations governing maritime safety, environmental impact, and military defines technologies International conventions and national policies shape SONAR system development. This is particularly important in sensitive marine environments. Companies must adhere to these regulations to ensure compliance and avoid penalties.

Recent Developments

The SONAR system market is evolving, with significant technological innovations:

- High-Resolution Imaging: SONAR systems are becoming capable of capturing high-resolution 3D images of the seafloor, enhancing underwater mapping capabilities.

- Advanced Signal Processing: New signal processing techniques are enabling better object detection and noise reduction, improving the reliability of SONAR systems.

- Autonomous Systems: The integration of SONAR systems with autonomous underwater vehicles (AUVs) and drones is opening new avenues for commercial and military applications.

Current and Potential Growth Implications

a. Demand Supply Analysis

The demand for SONAR systems is expanding, driven by advancements in marine technology and growing security needs. However, supply chain challenges, such as delays in the manufacturing of specialized components, could affect market growth in the short term.

b. Gap Analysis

While the SONAR system market is growing, there are still areas for improvement:

- Data Integration: Improved integration of SONAR data with other maritime technologies, such as radar and GPS, is needed to enhance operational efficiency.

- Cost Efficiency: Cost-effective solutions for commercial and recreational markets will help drive broader adoption.

- Miniaturization: Continued advancements in miniaturization of SONAR systems are needed for greater portability and ease of use.

Top Companies in the SONAR System Market

- Lockheed Martin

- Thales Group

- L3 Technologies

- Raytheon Technologies

- Kongsberg Gruppen

- Teledyne Marine

- Furuno Electric

- Atlas Elektronik

- Sonardyne International

SONAR System Market: Report Snapshot

Segmentation | Details |

By Product Type | Active SONAR, Passive SONAR, Imaging SONAR, Acoustic Modems |

By Application | Defense, Marine Research, Oil & Gas, Commercial Fishing, Others |

By End User | Military, Commercial, Scientific Research, Consumer |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

High Growth Segments

The following segments are expected to witness significant growth:

- Military Applications: Increased demand for defense-based SONAR systems.

- Marine Research: Expanding usage in scientific and environmental monitoring.

- Oil & Gas Exploration: Enhanced SONAR systems for resource detection and mapping.

Major Innovations

Innovation is essential in the SONAR system market, with some key developments including:

- 3D Sonar Imaging: Advanced imaging technology for more detailed underwater maps.

- Integration with AI: AI-powered SONAR systems that improve object recognition and data interpretation.

- Portable SONAR Devices: Portable SONAR devices are now miniaturized. They are more affordable for recreation and small commercial use.

Potential Growth Opportunities

The SONAR system market faces several challenges, including:

- Technological Advancements: Technological advancements require ongoing innovation. This helps stay competitive in the market.

- Environmental Concerns: Environmental concerns focus on SONAR systems' impact. Minimizing harm to marine ecosystems is key.

- Global Security Needs: Global security needs are rising. This increases demand for advanced defense-related SONAR systems.

Kings Research says:

The global SONAR system market is poised for significant growth, driven by technological advancements, increasing demand across defense and commercial sectors, and the need for improved marine safety and exploration. Companies that can address the challenges and capitalize on opportunities will be well-positioned for success in this dynamic market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

SONAR System Market Size

- January-2023

- 148

- Global

- aerospace-and-defence

Related Research

Aerospace Robotics Market Size, Share, Growth & Industry Analysis, By Robot Type (Articulated Robots

June-2025

AESA Radar Market Size, Share, Growth & Industry Analysis, By Platform (Airborne, Naval, Ground-Base

July-2025

Aviation Refueling Hose Market Size, Share, Growth & Industry Analysis, By Material (Rubber, Thermop

June-2025

Dog Automatic Feeder-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

Drone Market Size, Share, Growth & Industry Analysis, By Type (Consumer Drones, Commercial Drones, M

March-2025

Electric Ships Market Size, Share, Growth & Industry Analysis, By Vessel Type (Passenger Ships, Carg

April-2025

Global Military Radar Market Size, Share, and COVID-19 Impact Analysis, By Component (Digital Signal

July-2022

Rockets and Missiles Market Size, Share, Growth & Industry Analysis, By Product (Rockets, Missiles),

June-2025

Satellite Propulsion Systems Market Size, Share, Growth & Industry Analysis, By Propulsion Type (Che

June-2025

Small Satellite Market Size, Share, Growth & Industry Analysis, By Satellite Type (CubeSat, MiniSat,

April-2025