Electric Ships Market Size, Share, Growth & Industry Analysis, By Vessel Type (Passenger Ships, Cargo Ships, Hybrid Vessels, Others), By Propulsion Type (Fully Electric, Hybrid Electric, Hydrogen Fuel Cells), By End-User (Commercial Shipping, Passenger Shipping, Military, Others), and Regional Analysis, 2024-2031

Electric Ships Market: Global Share and Growth Trajectory

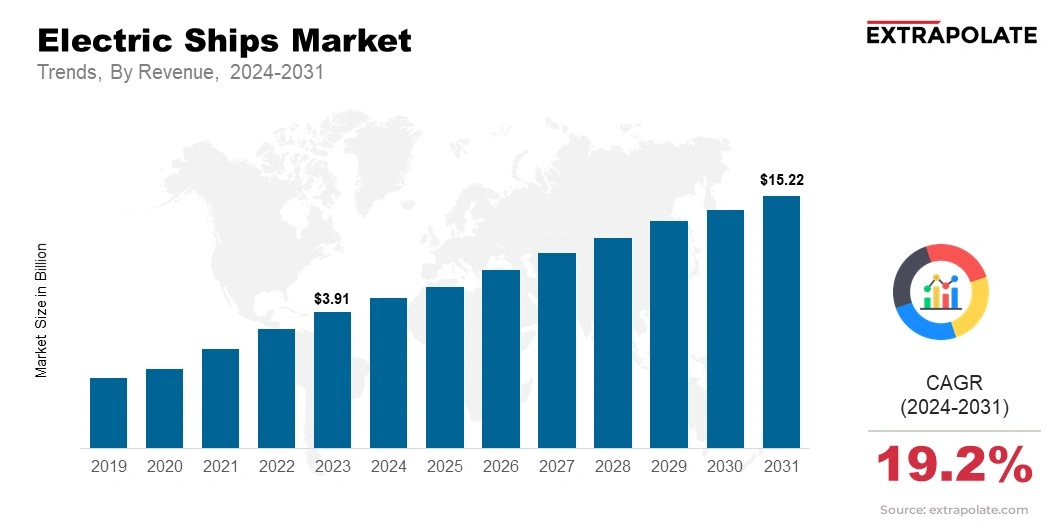

The global Electric Ships Market size was valued at USD 3.91 billion in 2023 and is projected to grow from USD 4.46 billion in 2024 to USD 15.22 billion by 2031, exhibiting a CAGR of 19.2% during the forecast period.

The market for electric ships is expanding quickly worldwide. The need for sustainable transportation, growing environmental concerns, and developments in renewable energy are the main drivers of this rise.

Both fully electric and hybrid ships are considered electric ships. They are employed in leisure boating, passenger ferries, and freight transportation. The primary reasons for switching to electric ships are to minimize carbon emissions, lower fuel expenses, and adhere to more stringent environmental regulations.

These ships are more efficient because of advancements in electric propulsion, fuel cells, and batteries. Compared to diesel-powered vessels, they are less polluting and have reduced running costs.

Electric ships will be crucial to the maritime industry's transition to a more sustainable sector as technology advances.

Governments and industry leaders are also investing in essential infrastructure like charging stations and grid connections. This investment is speeding up the adoption of electric ships.

In addition to helping the environment, electric ships are changing the market. They improve efficiency and reduce dependence on fossil fuels. Commercial shipping companies and ferry operators are exploring electric and hybrid models. This helps them meet strict regulations, save fuel, and cut maintenance costs.

Another factor propelling market expansion is the need for eco-friendly cruise ships and passenger ferries. Regional factors are encouraging this progress. These include government incentives, emission regulations, and initiatives to create cleaner oceans. The market is anticipated to expand dramatically as electric ships become more affordable and widely available.

Key Market Trends Driving Product Adoption

The electric ships market is growing due to rapid innovation, stricter emission rules, and a push for sustainable shipping. Key trends include:

- Environmental Regulations and Sustainability: Governments are enforcing stricter rules for cleaner shipping. Electric ships help cut carbon emissions and reduce fuel use, supporting global sustainability goals.

- Advancements in Battery and Energy Storage: Batteries now have higher energy capacity and charge faster. This makes electric propulsion possible for larger ships and longer trips.

- Hybrid Power Solutions: Many ships use a mix of batteries and fuel engines. This improves range and performance.

- Autonomous Shipping: Automation is shaping the future of shipping. Electric ships play a key role in autonomous vessels, improving efficiency and reducing errors.

- Government Incentives and Support: Many countries offer subsidies, tax benefits, and grants to boost electric and hybrid ship adoption.

Major Players and their Competitive Positioning

The electric ships market is becoming increasingly competitive, with both established maritime companies and startups driving innovation. Leading players in the market include ABB Ltd., Wärtsilä Corporation, Schneider Electric, and Siemens AG. These companies are working on the development of more efficient electric propulsion systems, integrated energy storage solutions, and hybrid systems to enhance the overall performance of electric vessels.

Consumer Behavior Analysis

The growing use of electric ships is influenced by these consumer behaviors:

- Environmental Responsibility: Shipping operators and passengers are more aware of their impact on the environment. This increases demand for cleaner and greener ships.

- Operational Cost Reduction: Electric ships help companies save money. They use less fuel and need less maintenance.

- Technology Adoption: The maritime industry is using new technologies to stay competitive. Electric ships are a step toward the future of shipping.

Pricing Trends

Pricing trends in the electric ships market depend on vessel size, battery capacity, and technology. Initial costs are higher due to advanced systems and batteries. However, lower fuel and maintenance costs make them more affordable over time. As battery technology improves and production scales up, prices are expected to drop. This will make electric ships more accessible to more operators.

Growth Factors

Several factors are driving the growth of the electric ships market:

- Technological Advancements: Improvements in battery storage, energy management, and electric propulsion allow larger ships to use electric power.

- Environmental Regulations: Stricter emission rules push the shipping industry toward electric propulsion.

- Cost Efficiency: Electric ships save money in the long run. They use less fuel, need less maintenance, and avoid carbon penalties.

- Infrastructure Development: More charging stations at ports make it easier for electric ships to refuel, boosting market growth.

Regulatory Landscape

- Stricter Emission Rules: Countries are introducing tougher regulations to cut pollution from ships.

- Global Standards: Organizations like the IMO are setting goals to lower greenhouse gas emissions.

- Push for Clean Tech: New rules are encouraging the use of eco-friendly ship engines.

Recent Developments

The electric ships market is growing fast. Many new developments are shaping the industry.

- Better Batteries: New battery technologies, like solid-state batteries, are making electric ships more efficient. Improved charging stations are also helping.

- Hybrid Ships: Some ships now use both electric power and fuel engines. This gives them more flexibility and a longer range.

- Government Support: Many governments are funding research, development, and infrastructure to promote electric ships.

Current and Potential Growth Implications

Demand-Supply Analysis

The demand for electric ships is growing fast. More companies and countries see the environmental and operational benefits. However, there are challenges. The initial cost is high. Battery capacity is still limited. Charging infrastructure needs improvement.

Gap Analysis

The electric ship business is expanding, however several areas require development.

- Battery life and energy density: For extended journeys, ships use batteries with greater power capacity and longer lifespans.

- Charging Infrastructure: To accommodate the growing fleet, more port-side charging stations and ways to charge quickly are required.

- Cost parity: For broader adoption, electric ships must be as economical as fuel-powered ships.

Top Companies in the Electric Ships Market

- ABB Ltd.

- Wärtsilä Corporation

- Siemens AG

- Schneider Electric

- Rolls-Royce

- Vard Electro

- GE Power Conversion

Electric Ships Market: Report Snapshot

Segmentation | Details |

By Vessel Type | Passenger Ships, Cargo Ships, Hybrid Vessels, Others |

By Propulsion Type | Fully Electric, Hybrid Electric, Hydrogen Fuel Cells |

By End-User | Commercial Shipping, Passenger Shipping, Military, Others |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

High-Growth Segments

- Hybrid Electric Vessels: These ships use both electric propulsion and fuel engines. They are growing fast because they are flexible and eco-friendly.

- Passenger Electric Ships: More ferries and cruise ships are going electric. People want greener travel options.

- Cargo Electric Ships: Short-distance cargo ships are switching to electric. Rules and cost savings are driving this change.

Major Innovations

Innovation is key in the market. Key developments include:

- Solid-State Batteries: These next-generation batteries have higher energy density. They allow longer trips without frequent recharging.

- Autonomous Electric Ships: These ships combine autonomous navigation with electric propulsion. They improve efficiency and reduce environmental impact.

- Fast Charging Infrastructure: High-speed charging solutions at ports help ships recharge faster. This reduces waiting times and boosts efficiency.

Potential Growth Opportunities

Despite challenges, the market has many growth opportunities.

- Technological Advancements: Research in batteries, propulsion, and hydrogen fuel will drive growth.

- Government Support: Policies and subsidies will encourage electric vessel adoption.

- Supply Chain Evolution: New infrastructure and partnerships will support the shift to electric shipping.

Extrapolate Research says:

The electric ship market is expected to increase rapidly. Technological improvements are fueling this shift. Environmental regulations also facilitate its expansion. More organizations are looking for long-term maritime transport options. Overcoming cost, infrastructural, and battery concerns is critical. Companies that succeed will eventually lead the market.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Electric Ships Market Size

- April-2025

- 150

- Global

- aerospace-and-defence

Related Research

Aerospace Robotics Market Size, Share, Growth & Industry Analysis, By Robot Type (Articulated Robots

June-2025

AESA Radar Market Size, Share, Growth & Industry Analysis, By Platform (Airborne, Naval, Ground-Base

July-2025

Aviation Refueling Hose Market Size, Share, Growth & Industry Analysis, By Material (Rubber, Thermop

June-2025

Dog Automatic Feeder-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

Drone Market Size, Share, Growth & Industry Analysis, By Type (Consumer Drones, Commercial Drones, M

March-2025

Electric Ships Market Size, Share, Growth & Industry Analysis, By Vessel Type (Passenger Ships, Carg

April-2025

Global Military Radar Market Size, Share, and COVID-19 Impact Analysis, By Component (Digital Signal

July-2022

Rockets and Missiles Market Size, Share, Growth & Industry Analysis, By Product (Rockets, Missiles),

June-2025

Satellite Propulsion Systems Market Size, Share, Growth & Industry Analysis, By Propulsion Type (Che

June-2025

Small Satellite Market Size, Share, Growth & Industry Analysis, By Satellite Type (CubeSat, MiniSat,

April-2025