Aviation Refueling Hose Market Size, Share, Growth & Industry Analysis, By Material (Rubber, Thermoplastics, Composite), By Pressure Rating (Low Pressure, Medium Pressure, High Pressure), By Application (On-Wing Refueling, In-Hangar Refueling, Remote Refueling), and Regional Analysis, 2024-2031

Aviation Refueling Hose Market: Global Share and Growth Trajectory

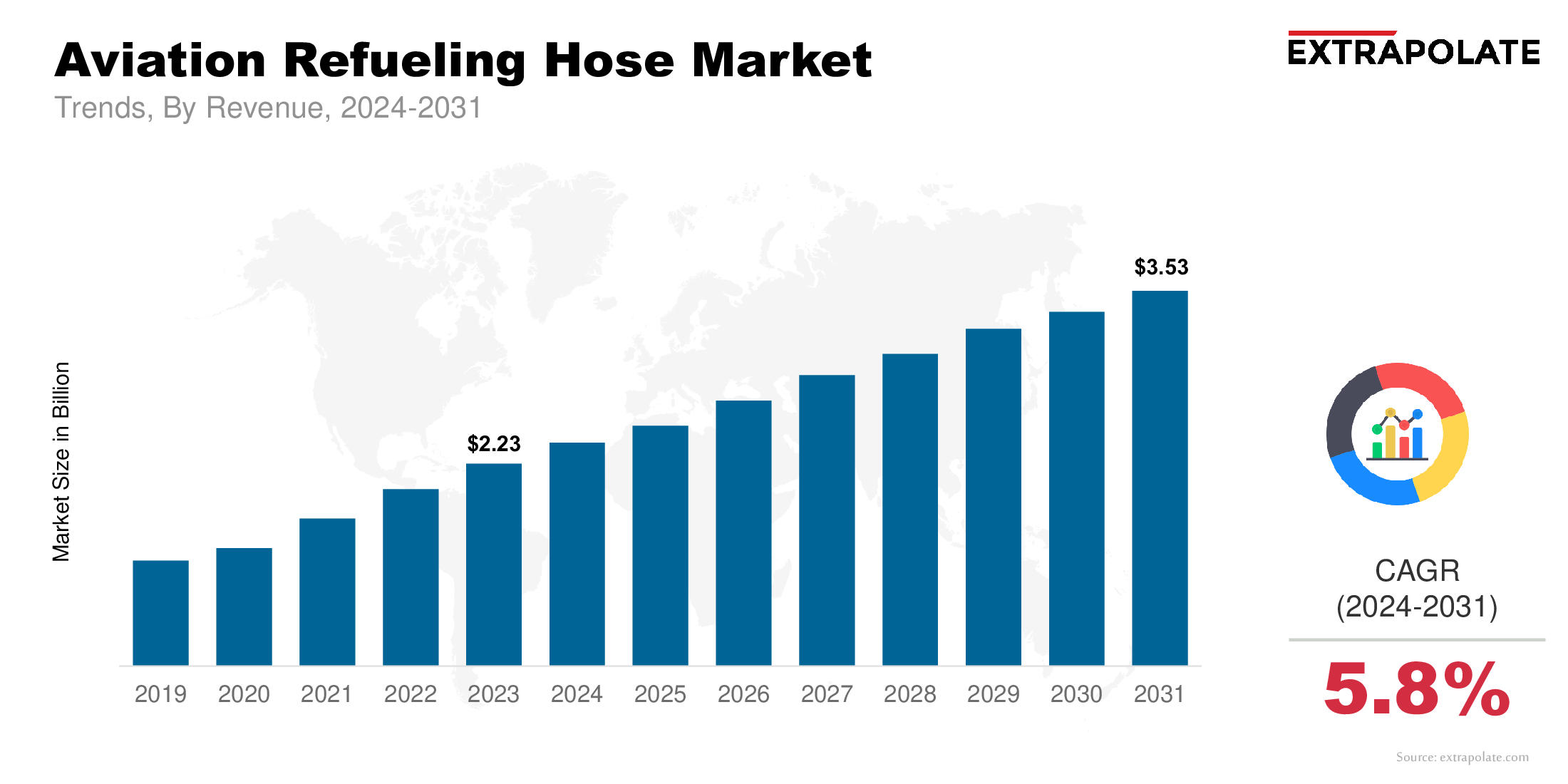

The global aviation refueling hose market size was valued at USD 2.23 billion in 2023 and is projected to grow from USD 2.36 billion in 2024 to USD 3.53billion by 2031, exhibiting a CAGR of 5.8% during the forecast period.

The global market is experiencing steady growth, propelled by the rising demand for air travel and the expansion of both commercial and military aviation sectors. These specialized hoses are critical components in the fueling infrastructure, ensuring the safe and efficient transfer of fuel to aircraft. As aviation becomes more safety-focused and technologically advanced, the importance of high-quality refueling hoses has grown substantially.

One of the major growth drivers is the increasing number of aircraft worldwide, especially in fast-growing regions such as Asia-Pacific and the Middle East. Airports and military bases alike are upgrading their fueling systems to meet modern performance and safety standards. Additionally, technological improvements in hose design—such as anti-static, flame-resistant, and lightweight materials—are expanding product applications and lifecycle efficiency.

Defense modernization programs have also played a vital role in market expansion. Armed forces globally are investing in tactical refueling systems that require flexible, durable hoses capable of operating under extreme conditions. Meanwhile, in the commercial sector, airports are replacing aging infrastructure to improve turnaround times and reduce fuel spillage risks.

From a regulatory standpoint, stringent compliance requirements—including ISO 1825 and EI 1529—are shaping product innovation and driving the replacement of outdated hose systems. Leading players in the market are actively focusing on R&D, partnerships, and regional expansion to strengthen their competitive edge.

As per Kings Research analysis, the aviation refueling hose industry is expected to grow significantly in the coming years. Continuous innovations, increased aircraft deliveries, and infrastructure upgrades are expected to sustain this momentum. With strong demand across civil and defense aviation, the market presents lucrative opportunities for manufacturers and suppliers committed to delivering safe, high-performance, and regulation-compliant refueling solutions.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

- Surge in Air Traffic and Commercial Aviation Growth

The rapid increase in domestic and international air traffic is significantly boosting the demand for aviation refueling hoses. Airlines are expanding their fleets, and airports are undergoing upgrades to meet rising passenger volumes. As a result, ground support systems—particularly refueling equipment—are seeing heightened investment. This drives the demand for high-quality, durable, and safe aviation refueling hoses that can perform under varying conditions.

- Technological Advancements in Hose Materials

Material science advancements are transforming aviation refueling hoses. New-age hoses are built using reinforced synthetic rubber and thermoplastic materials, offering high resistance to weathering, UV radiation, abrasion, and static electricity. These improvements extend the service life of hoses while minimizing environmental risks. Additionally, new hose designs now incorporate anti-kinking, static dissipation, and fire-resistant features.

- Growing Focus on Fuel Safety and Environmental Standards

With increasingly stringent safety and environmental regulations, aircraft fueling processes are under the microscope. Hoses with anti-leak and anti-static properties are now in demand. Refueling hose manufacturers are responding by producing products that comply with standards like ISO 1825 and EI 1529, ensuring high performance and reduced risk of spillage or ignition.

- Military Modernization and Tactical Refueling Needs

Defense forces worldwide are modernizing their equipment, which includes rapid-deployment and in-the-field aircraft refueling capabilities. This has led to greater demand for rugged, flexible, and high-pressure refueling hoses designed for mobile and tactical refueling applications. The integration of these systems is critical in defense operations, driving the market forward.

Major Players and Their Competitive Positioning

The aviation refueling hose industry is marked by intense competition among manufacturers focused on safety, reliability, and compliance. Key players are investing in R&D, product certifications, and geographic expansion. Prominent companies in this space include Parker Hannifin Corporation, Gates Corporation, ContiTech AG (Continental AG), Eaton Corporation, Trelleborg AB, HBD Industries, Aero-Hose Corp., Elaflex Hiby GmbH & Co. KG, Pacific Hoseflex, Kuriyama Holdings Corporation and others

These players are emphasizing partnerships with airport operators, OEMs, and defense agencies to strengthen their market position and expand their global footprint.

Consumer Behavior Analysis

- Fueling Safety and Compliance

Airports and aviation authorities put safety first. Consumers (airport ground services, defense contractors and airlines) want hoses that have been tested and certified for extreme performance. As awareness grows about the risks of poor quality hoses – leaks, bursts or static discharge – buyers are moving towards premium, compliant products.

- Lightweight, Flexible Solutions

Operators want ease of handling and deployment. Lightweight hoses that maintain strength and integrity under pressure are preferred, especially in busy airport environments. Hose reels, mobile dispensers and hydrant systems benefit from hoses that bend easily, don’t kink and retain shape for quick turnarounds and operational efficiency.

- Lifecycle Cost and Maintenance

Although high performance aviation refueling hoses cost more upfront, they offer long term value through durability and lower maintenance. Consumers are now evaluating total cost of ownership, factoring in weathering, corrosion and fuel degradation. Maintenance friendly hose assemblies with modular fittings are gaining popularity.

- Customization and Integrated Systems

Airlines and ground handlers are looking for customized hose solutions that integrate with existing fueling systems. This means hoses of specific diameters, lengths and pressure ratings, with specialized end fittings and couplings. Customization ensures compatibility, reduces downtime and boosts fueling efficiency.

Pricing

Aviation refueling hose pricing is influenced by material type, diameter, pressure rating, certification standards and end use application (civil or military). Standard grade hoses are moderately priced, specialized hoses with multi layer construction and advanced protective features command a premium.

Prices range from USD 10-50 per foot for commercial hoses and up to USD 80 per foot for military grade, high pressure hoses. Volume discounts, government procurement contracts and OEM partnerships help drive down costs. Manufacturers are now offering leasing and maintenance packages for large volume buyers to make it more affordable.

Growth Factors

- Air Travel Growth: With global air travel numbers recovering post pandemic and expected to surpass pre 2020 levels, the need for ground handling infrastructure – including refueling systems – is increasing. Airlines and airports are investing in new equipment including aviation grade hoses.

- Defense Spending Increases: Defense budgets are growing globally, especially in the US, China, India and the Middle East. Tactical aircraft refueling capabilities, critical for rapid operations, rely on reliable hose assemblies. This will drive demand for rugged, field grade hoses.

- Environmental and Safety Regulations: International aviation authorities are implementing strict environmental and safety standards, forcing operators to replace old hose systems with compliant, modern ones. This is driving replacement demand even in mature markets.

- Fleet Upgrades: Airline fleets are being upgraded for fuel efficiency, requiring ground support systems to be upgraded too. Refueling equipment, especially hoses that match the specs of new aircraft, is in high demand.

Regulatory Landscape

Aviation refueling hoses must meet various global standards to ensure safety and operational reliability:

- ISO 1825: Sets standards for rubber hoses used in aircraft ground fueling.

- EI 1529: Published by the Energy Institute (UK), it governs hoses for aircraft refueling and defueling.

- NFPA 407: From the U.S. National Fire Protection Association, this outlines requirements for aircraft fueling operations.

- FAA and EASA Approvals: Aviation hose systems must comply with regional aviation authority regulations (U.S. Federal Aviation Administration and European Union Aviation Safety Agency).

Compliance with these regulations is mandatory for market participation and procurement in commercial and defense aviation sectors.

Recent Developments

- Product Innovations: Companies like Parker Hannifin and ContiTech have launched ultra-light hoses with flame-retardant, UV-stable jackets, suitable for high-volume refueling.

- Eco-Friendly Hoses: There is a growing interest in recyclable and low-emission materials, pushing manufacturers to develop more sustainable hose options.

- Digital Monitoring Integration: Smart hose solutions are emerging, incorporating sensors that monitor pressure, flow rate, and hose condition in real time.

- Strategic Partnerships: Gates Corporation recently expanded its aviation product line through partnerships with airport fuel service companies in Southeast Asia and the Middle East.

- Geographic Expansion: Elaflex has expanded its distribution network across Asia-Pacific to meet growing airline demand.

Current and Potential Growth Implications

a. Demand-Supply Analysis

Rising demand for aviation-grade hose systems is prompting manufacturers to ramp up production and invest in automation. However, the industry faces supply chain challenges related to rubber sourcing, metal fitting availability, and transportation delays—factors that could affect pricing and delivery times.

b. Gap Analysis

While the aviation refueling hose market is mature in North America and Western Europe, developing regions like Africa, Southeast Asia, and Latin America remain underpenetrated. Infrastructure constraints, limited OEM presence, and procurement delays hinder growth in these areas. Strategic investments and local partnerships are necessary to close these gaps.

Top Companies in the Aviation Refueling Hose Market

Leading players shaping the future of this market include:

- Parker Hannifin Corporation

- ContiTech AG

- Gates Corporation

- Eaton Corporation

- Trelleborg AB

- HBD Industries

- Elaflex Hiby GmbH & Co. KG

- Pacific Hoseflex

- Kuriyama Holdings Corporation

- Aero-Hose Corp.

These firms are leveraging their technical expertise, global networks, and customer relationships to lead innovation and standardization in the industry.

Aviation Refueling Hose Market: Report Snapshot

Segmentation | Details |

By Material | Rubber, Thermoplastics, Composite |

By Pressure Rating | Low Pressure, Medium Pressure, High Pressure |

By End-Use | Commercial Aviation, Military Aviation, Private Aviation |

By Application | On-Wing Refueling, In-Hangar Refueling, Remote Refueling |

By Region | North America, Europe, Asia-Pacific, Latin America, MEA |

High Growth Segments

- Thermoplastic Hoses: Rising demand due to their lightweight and superior durability.

- High-Pressure Military Hoses: Tactical fueling applications are pushing innovation in high-strength, anti-kink designs.

- Asia-Pacific Region: With booming aviation infrastructure and increasing air traffic, this region offers strong growth prospects.

Major Innovations

- Anti-Static Hose Linings: New linings that dissipate electrostatic charges quickly and safely.

- Smart Hoses with IoT: Emerging technologies allow ground crews to monitor hose wear, pressure loss, and real-time fuel flow remotely.

- Rapid-Connect Couplings: Innovations in quick-release coupling mechanisms enhance fueling speed and operator safety.

Potential Growth Opportunities

- Expansion into Emerging Economies: Africa and Southeast Asia are ripe for infrastructure development, and aviation fuel delivery systems will follow.

- R&D in Composite Materials: Manufacturers investing in composite hoses could offer lighter and more durable solutions at lower costs.

- Integration with Automated Fueling Systems: Fully automated fueling units will rely on precision hose systems, opening a new application vertical.

Kings Research says:

The aviation refueling hose market is on a robust growth path, driven by a convergence of factors such as increasing global air travel, stringent safety regulations, defense modernization, and technological advancements in hose materials and design. As both commercial and military aviation sectors demand higher operational efficiency and safer fueling systems, the need for high-performance, compliant hose solutions is accelerating. Moreover, manufacturers are focusing on innovation and customization to meet diverse client needs across developed and emerging regions. According to Kings Research, the market will continue to witness steady expansion as airports upgrade infrastructure, defense agencies modernize refueling capabilities, and sustainability and digital monitoring become integral to product development. For stakeholders, this presents a compelling opportunity to invest in next-generation hose technologies and expand into high-growth geographies with rising aviation infrastructure demand.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Aviation Refueling Hose Market Size

- June-2025

- 148

- Global

- aerospace-and-defence

Related Research

Aerospace Robotics Market Size, Share, Growth & Industry Analysis, By Robot Type (Articulated Robots

June-2025

AESA Radar Market Size, Share, Growth & Industry Analysis, By Platform (Airborne, Naval, Ground-Base

July-2025

Aviation Refueling Hose Market Size, Share, Growth & Industry Analysis, By Material (Rubber, Thermop

June-2025

Dog Automatic Feeder-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

Drone Market Size, Share, Growth & Industry Analysis, By Type (Consumer Drones, Commercial Drones, M

March-2025

Electric Ships Market Size, Share, Growth & Industry Analysis, By Vessel Type (Passenger Ships, Carg

April-2025

Global Military Radar Market Size, Share, and COVID-19 Impact Analysis, By Component (Digital Signal

July-2022

Rockets and Missiles Market Size, Share, Growth & Industry Analysis, By Product (Rockets, Missiles),

June-2025

Satellite Propulsion Systems Market Size, Share, Growth & Industry Analysis, By Propulsion Type (Che

June-2025

Small Satellite Market Size, Share, Growth & Industry Analysis, By Satellite Type (CubeSat, MiniSat,

April-2025