Construction Equipment Market Size Share Growth & Industry Analysis, By Product Type (Excavators, Backhoes, Bulldozers, Loaders, Cranes, Forklifts, Pavers, Other Construction Equipment), By Application (Construction, Mining, Infrastructure, Oil & Gas, Agriculture, Others), By End User (Residential, Commercial, Industrial, Infrastructure Development, Others), and Regional Analysis 2024-2031

Construction Equipment Market: Global Share and Growth Trajectory

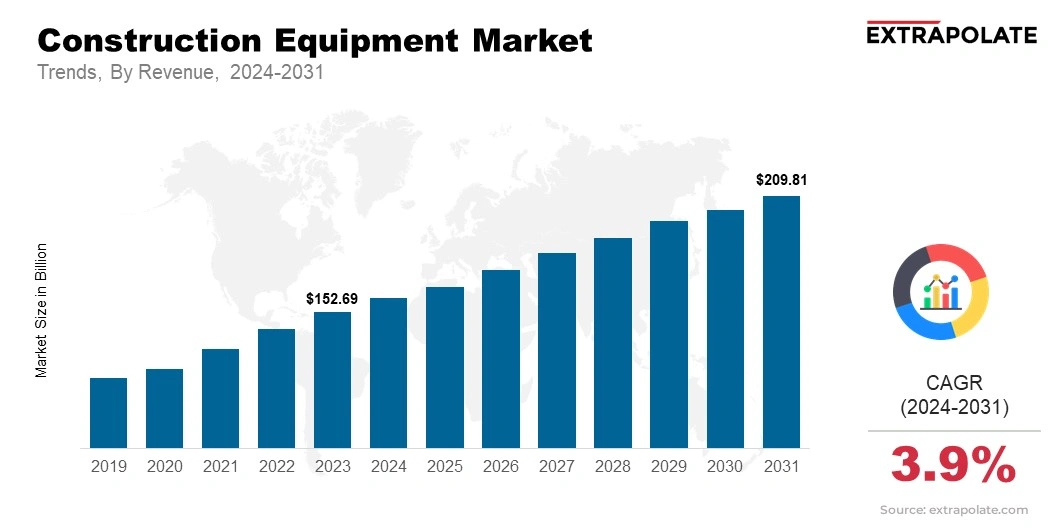

The global Construction Equipment Market size was valued at USD 152.69 billion in 2023 and is projected to grow from USD 160.05 billion in 2024 to USD 209.81 billion by 2031, exhibiting a CAGR of 3.9% during the forecast period.

The global market is experiencing substantial growth, driven by increasing infrastructure development, urbanization, and advancements in construction technologies. This market includes a wide range of heavy machinery used in construction, such as excavators, bulldozers, cranes, backhoes, and loaders.

As the demand for efficient, high-performing construction equipment rises, manufacturers are focusing on enhancing product features, including automation, connectivity, and sustainability, to meet evolving consumer needs.

Key Market Trends Driving Product Adoption

The construction equipment market is seeing rapid technological advancements. There are significant investments and growing consumer demand. Key trends driving market growth include:

- Automation and Digitalization: Autonomous construction equipment is being introduced. Digital technologies like telematics and IoT are improving efficiency and reducing human error.

- Sustainability Focus: Sustainability is becoming more important. This is increasing the demand for energy-efficient and low-emission construction machinery. Green technologies are gaining attention. Electric-powered equipment and hybrid models are becoming more popular.

- Safety Enhancements: As safety laws grow stricter, construction firms adopt machines with better protective features. These include sensors, cameras, and live monitoring systems.

- Telematics and Connectivity: IoT-powered machines permits instant data gathering and off-site diagnostics. This enhances equipment uptime while slashing repair expenses.

- Rental Services Growth: The growth of equipment rental services is allowing companies to use costly machinery. This reduces the need for large initial investments and broadens market access.

Major Players and their Competitive Positioning

The construction equipment market is dominated by key players, including Caterpillar, Komatsu, Volvo, and Liebherr. These companies constantly innovate to remain competitive. They focus on meeting demands for efficiency, sustainability, and technological integration. Smaller, niche companies are emerging in the market. They offer specialized machinery and solutions for specific construction needs.

Consumer Behavior Analysis

Construction companies and contractors are adopting equipment based on various factors, including:

- Efficiency and Productivity: Companies are investing in machinery that boosts efficiency. This helps reduce downtime and lowers overall operational costs.

- Cost and Financing Options: The high price of construction equipment increases the demand for rental options. Financing models also help businesses access advanced machinery more easily.

- Technological Features: Buyers are showing more interest in equipment with better automation and connectivity. They also prefer machines with improved safety features that meet current operational demands.

- Environmental Concerns: Companies are seeking machinery that aligns with sustainability objectives. They are focusing on energy-saving machines and environmentally friendly fuel choices.

Pricing Trends

Pricing trends in the construction equipment market depend on several factors. These include the brand, technology integration, machine type, and whether the equipment is purchased or rented. Premium machines with advanced features come at a higher price.

On the other hand, entry-level and smaller machines are more affordable for budget-conscious buyers. Rental services offer a cost-effective way to access high-end equipment. This option is growing in popularity for businesses looking to save on upfront costs.

Growth Factors

Several factors are fueling the growth of the construction equipment market:

- Infrastructure Development: Rising construction activities drives the demand for construction machinery. This includes residential, commercial, and infrastructure project.

- Urbanization: Massive urbanization in developing economies are generating the demand for construction equipment. This equipment is vital for sustaining urban planning and development projects.

- Technological Advancements: The shift to smart, automated, and telematics-enabled machinery are fuelling market growth. These technologies enhances efficiency and lower operational costs.

- Global Economic Growth: Economic growth in regions like Asia-Pacific and Latin America are boosting demand. This growth is driven by large-scale infrastructure projects that require construction equipment.

Regulatory Landscape

The regulatory landscape for construction equipment is changing. Governments are enforcing stricter safety standards, emissions regulations, and sustainability requirements. Manufacturers must comply with these regulations. This is essential for accessing key markets and maintaining consumer trust.

Recent Developments

The construction equipment market is always changing. New product innovations, technological advancements, and expanding services are shaping the industry. Key developments include:

- Electric and Hybrid Equipment: The push to reduce carbon emissions is driving the use of electric and hybrid machinery. Electric excavators and loaders are gaining popularity in construction.

- Telematics and Fleet Management Solutions: Advanced fleet management systems are optimizing equipment use. Real-time data analytics help reduce operational costs for construction companies.

- Automation and Autonomous Equipment: Self-driving construction equipment is improving efficiency. Autonomous machines are now handling tasks like excavation and material transport.

Current and Potential Growth Implications

Demand Supply Analysis

Demand for construction equipment is expected to stay high. This is due to the rise in construction activity worldwide. However, supply chain disruptions is a concern. Rising raw material costs and component shortages may impact both availability and pricing of certain machinery.

Gap Analysis

Despite significant growth in the market, there are areas for improvement:

- Sustainability: Many players are investing in eco-friendly equipment. However, there is still room for innovation to reduce the carbon footprint of construction machinery.

- Automation: The adoption of fully autonomous construction equipment is still in its early stages. More technological development is needed for widespread use.

- Affordability: High capital costs and financing challenges are barriers for small and medium-sized construction businesses. These issues limit their access to advanced machinery.

Top Companies in the Construction Equipment Market

Construction Equipment Market: Report Snapshot

Segmentation | Details |

By Product Type | Excavators, Backhoes, Bulldozers, Loaders, Cranes, Forklifts, Pavers, Other Construction Equipment |

By Application | Construction, Mining, Infrastructure, Oil & Gas, Agriculture, Others |

By End User | Residential, Commercial, Industrial, Infrastructure Development, Others |

By Region | North America, Europe, Asia-Pacific, Middle East & Africa, South America |

High Growth Segments

The following market segments are expected to experience significant growth:

- Excavators: This machinery is essential for earthmoving and construction projects. It helps with tasks like digging, grading, and lifting heavy materials.

- Cranes: Cranes are broadly used in construction. They are also essential for infrastructure and heavy lifting operations.

- Backhoe Loaders: Versatile equipment is used in many applications. These range from road construction to landscaping.

- Electric and Hybrid Machinery: A growing demand for sustainable equipment in response to environmental concerns.

Major Innovations

Innovation is key to staying competitive. It helps companies meet evolving demands and tackle industry challenges. Some of the latest innovations include:

- Autonomous Construction Equipment: Self-operating machinery boosts productivity. It also enhances safety on job sites.

- Hybrid and Electric Power Systems: Machinery with reduced emissions is becoming more common. It also lowers operating costs.

- Telematics and Fleet Management Systems: Real-time monitoring helps manage equipment better. It improves uptime and efficiency.

Potential Growth Opportunities

The construction equipment market has challenges. It also presents many opportunities:

- Supply Chain Challenges: Manufacturers are tackling supply chain issues. This helps them meet the increasing demand for construction equipment.

- Technological Advancements: Companies are focusing on technological innovations. This helps them stay competitive and meet the demand for advanced, energy-efficient machinery.

- Rental Market Growth: The global packaging materials market is growing quickly. This is driven by the demand for sustainable solutions, industrial growth, and the rise of ecommerce.

Extrapolate Research says:

The global construction equipment market is seeing immense growth. This is because of infrastructure projects, new technology, and sustainability efforts. The packaging materials market is always changing. It is propelled by innovation, environmental rules, and dynamic consumer expectations.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Construction Equipment Market Size Share Growth

- February-2025

- 148

- Global

- Machinery-Equipment

Related Research

0-Global Market Status and Trend Report 2015-2026

November-2020

2 Side Seal Machines-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020

3 Side Seal Machines-Global Market Status & Trend Report 2022-2030 Top 20 Countries Data

December-2020