Software Defined Networking Market Size, Share, Growth & Industry Analysis, By Component (Software, Hardware, Services), By End-User (Enterprises, Telecom Service Providers, Cloud Service Providers, Others), By Deployment Model (On-Premise, Cloud-Based, Hybrid), and Regional Analysis, 2024-2031

Software Defined Networking Market: Global Share and Growth Trajectory

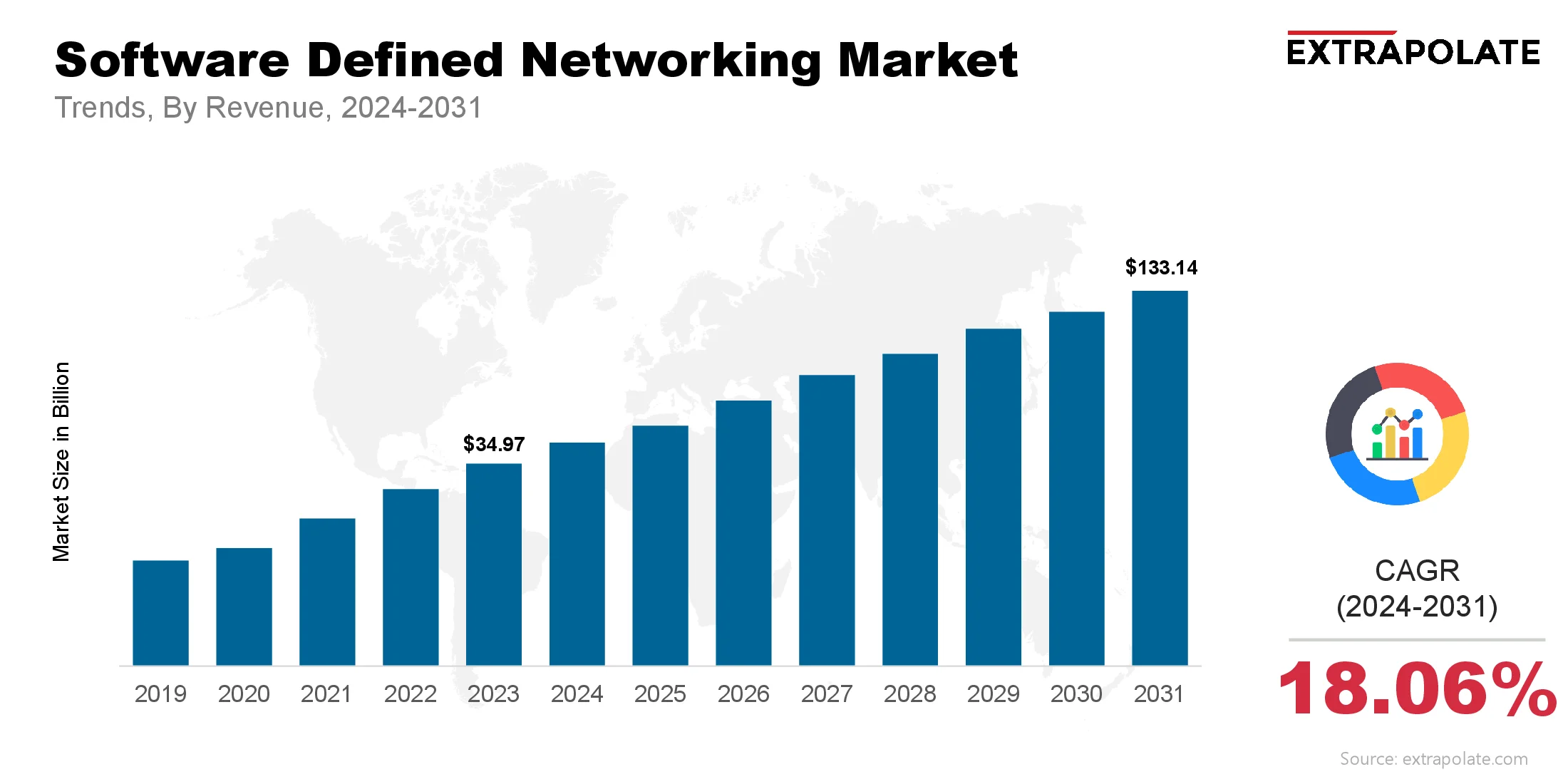

The global Software Defined Networking Market size was valued at USD 34.97 billion in 2023 and is projected to grow from USD 41.64 billion in 2024 to USD 133.14 billion by 2031, exhibiting a CAGR of 18.06% during the forecast period.

The global software defined networking (SDN) market is undergoing a significant evolution, transforming the landscape of traditional networking infrastructure. As enterprises across various sectors accelerate their digital transformation journeys, the demand for more flexible, programmable, and scalable network architectures has become paramount. SDN decouples the control plane from the data plane, enabling centralized network management, increased agility, and reduced operational costs.

The growing appetite for cloud computing, big data, IoT applications, and edge computing is catalyzing the shift towards SDN frameworks. Organizations seek to reduce the complexity of managing expansive networks while boosting security and performance. The SDN model not only enhances automation but also lays the groundwork for intelligent, policy-driven network control. As businesses strive for operational excellence and agility, SDN emerges as a key enabler of future-ready networking.

One of SDN’s most transformative impacts lies in its capacity to simplify and automate network configuration. With centralized control, enterprises can quickly adapt their networks to dynamic application requirements. This facilitates faster provisioning of services and reduces downtime, resulting in enhanced user experiences and better utilization of network resources.

Key Market Trends Driving Adoption

Key Market Trends Driving Adoption

Several trends are driving software defined networking:

- Cloud is Growing Fast: As businesses move to cloud models the limitations of traditional networking become more apparent. SDN allows for seamless integration with cloud environments, dynamic scaling and centralised control which fits perfectly with the distributed nature of cloud.

- Network Virtualisation is on the Rise: Network services are being virtualised (firewalls, load balancers, routers etc) and SDN provides the architecture to manage these virtualised resources, so organisations can move away from expensive proprietary hardware and switch to software based network functions.

- Network Agility and Automation is a Must: Enterprises are adopting SDN to meet the demand for agile IT environments. SDN platforms allow IT teams to automate network configurations, implement policy based routing and monitor traffic flow in real-time so they can accelerate digital transformation.

- 5G and IoT is Growing: As 5G and IoT expands SDN’s role becomes even more critical. These new technologies require ultra low latency, scalability and precise traffic management. SDN’s programmability gives the tools to handle multiple data streams and ensure device connectivity.

Major Players and their Positioning

The SDN market is highly competitive with continuous innovation and partnerships. Leading companies are investing in R&D to bring out new platforms and solutions to cater to different industry needs. Some of the major players are Cisco Systems Inc., VMware Inc., Juniper Networks Inc., Huawei Technologies Co. Ltd., Hewlett Packard Enterprise (HPE), Nokia Corporation, Ciena Corporation, Arista Networks Inc., Extreme Networks Inc., NEC Corporation and others.

These companies focus on cloud-native architectures, open-source contributions, and multi-vendor interoperability. Many are also forging partnerships with telecom operators and cloud service providers to enhance SDN deployment across hybrid and edge environments.

In June 2025, Cisco launched its Secure Network Architecture to accelerate workplace AI. The architecture integrates SDN by centralising network infrastructure management with AI driven automation, security and unified control across hybrid environments.

In February 2025, TP-Link showcased its Omada software defined networking solution at Tech Sabha 2025 in Hyderabad, India. The company highlighted how Omada SDN simplifies centralised network management with AI driven optimisation, scalability and security for e-governance, smart cities and digital classroom initiatives.

Consumer Behavior

Consumer behavior in the software defined networking market is influenced by:

- Cost Optimization: Enterprises are investing in SDN to reduce capital and operational expenses. By moving from proprietary hardware to software-based solutions, businesses get long term cost benefits and control over their network infrastructure.

- Scalability and Flexibility: Modern businesses need networking solutions that can scale with changing workloads. SDN allows organizations to configure their network according to real time demands without compromising performance.

- Security and Compliance: As cyber threats get more sophisticated, enterprises are prioritizing network security more than ever. SDN provides visibility and control over traffic flows, granular security policies and faster response to anomalies which aligns with evolving regulatory and compliance requirements.

- Simplified Network Management: IT teams are moving towards centralized, software driven management tools that reduce complexity. SDN provides a single pane of glass to manage and monitor the entire network infrastructure, hence improving operational efficiency and reducing the burden on network administrators.

Pricing Trends

Pricing of SDN solutions varies based on deployment model (on-premise, cloud based or hybrid), network size and integration complexity. While initial costs may be high due to architectural overhauls and training needs, SDN offers long term savings.

Open source SDN platforms like OpenDaylight and ONOS have made entry into the market more affordable. Also the trend towards Network-as-a-Service (NaaS) models allows enterprises to deploy SDN infrastructure on subscription basis, minimizing upfront investment.

Vendor competition is also driving down prices, especially in software segment. As more enterprises adopt SDN, economies of scale will further reduce deployment and maintenance costs.

Growth Drivers

Several factors are driving the growth of software defined networking market:

- Data Centers and Cloud Services: Proliferation of hyperscale data centers and multi-cloud strategies has increased the need for flexible and programmable networking solutions. SDN provides the agility and automation to support dynamic workloads across distributed environments.

- 5G Infrastructure: Telecom providers are deploying SDN to manage the complexity of 5G networks. SDN enables network slicing, traffic engineering and rapid provisioning – key requirements for delivering high speed, low latency services in 5G era.

- Edge Computing: With edge computing, enterprises need to manage traffic across decentralized nodes. SDN enables local decision making, reduces latency and ensures data routing between edge devices and central systems.

- Network Security and Compliance: SDN provides fine grained network segmentation, anomaly detection and dynamic policy enforcement – tools required to secure modern enterprise networks and achieve regulatory compliance in industries like finance, healthcare and government.

Regulatory Landscape

The SDN market operates in an evolving regulatory environment, particularly around cybersecurity, data privacy and network neutrality:

- Cybersecurity Standards: Governments and regulatory bodies are emphasizing robust security practices for SDN deployments. Compliance with standards like ISO/IEC 27001 and NIST Cybersecurity Framework is a must for enterprises using SDN.

- Telecom Regulations: SDN in telecom networks must comply with regional telecom regulations especially around network neutrality and interoperability. This ensures SDN architectures don’t compromise service quality or limit fair access to network services.

- Data Sovereignty Laws: With increasing concerns around cross-border data flows, enterprises deploying SDN must adhere to data localization and privacy laws like GDPR in EU and CCPA in California. SDN’s programmable nature helps in compliance through localized routing and data control policies.

Recent Developments

Recent developments in the SDN market are a reflection of its rapid innovation and growth:

- AI Integration: AI is being integrated with SDN controllers to enable predictive analytics, traffic forecasting and automated network troubleshooting. AI driven SDN platforms are making networks more efficient and reducing downtime.

- Multi-Cloud Expansion: Vendors are focusing on developing SDN solutions for multi-cloud and hybrid cloud architectures. This allows businesses to manage disparate environments under one policy framework.

- Strategic Alliances and Acquisitions: Key players are partnering with cloud service providers and startups to enhance their SDN capabilities. For example, Cisco’s acquisition of Viptela and HPE’s acquisition of Silver Peak have strengthened their SD-WAN and SDN offerings.

- Open-Source Momentum: Open-source SDN projects like Open Networking Foundation (ONF) and OpenDaylight are gaining traction. They are driving innovation and standardization, enabling broader adoption across industry verticals.

Current and Potential Growth Implications

a. Demand-Supply Analysis: Demand for SDN is outpacing traditional networks due to its flexibility and efficiency. But supply challenges arise in terms of skilled workforce availability and integration expertise, especially in small and medium enterprises.

b. Gap Analysis: While SDN adoption is strong in large enterprises and telecom sectors, small businesses are lagging behind due to limited budgets and technical know-how. Bridging this gap through managed SDN services and simple deployment models is a key focus for market players.

Top Companies in the Software Defined Networking Market

- Cisco Systems Inc.

- VMware Inc.

- Juniper Networks Inc.

- Huawei Technologies Co. Ltd.

- Hewlett Packard Enterprise (HPE)

- Nokia Corporation

- Ciena Corporation

- NEC Corporation

- Arista Networks Inc.

- Extreme Networks Inc.

Software Defined Networking Market: Report Snapshot

Segmentation | Details |

By Component | Software, Hardware, Services |

By End-User | Enterprises, Telecom Service Providers, Cloud Service Providers, Others |

By Deployment Model | On-Premise, Cloud-Based, Hybrid |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The following segments are expected to exhibit significant growth:

- Cloud-Based SDN Solutions: Cloud computing is now everywhere. Cloud-native SDN solutions are rising in use. They offer easy integration and strong scalability.

- SDN in Telecom Networks: Telecoms are using SDN more often. It helps manage traffic and enables network slicing. SDN also supports growing 5G needs.

- SD-WAN Solutions: SD-WAN is a fast-growing segment. It improves connectivity across sites. It also helps cut WAN costs for large enterprises.

Major Innovations

Innovation in the SDN market includes:

- Intent-Based Networking (IBN): Intent-Based Networking lets admins set network goals. The SDN controller auto-configures to meet those goals. This boosts automation and saves time.

- AI-Driven Network Management: AI in SDN boosts network management. Machine learning helps monitor performance and spot issues early. It also supports predictive maintenance.

Potential Growth Opportunities

Potential opportunities for market expansion include:

- Penetration in Emerging Markets: Emerging markets are going digital fast. Infrastructure is growing in these regions. SDN vendors offer low-cost, scalable tools to meet rising demand.

- Adoption by SMEs: SMEs are starting to adopt SDN. Easy setup and subscription pricing help. Managed services also make it more accessible.

- Integration with IoT and Edge Computing: SDN is merging with IoT and edge tech. This creates new use cases in smart cities and industry. It's also key for connected vehicles.

Extrapolate Research Says:

The software defined networking market is going to grow big as companies reimagine their IT infrastructure for agility, efficiency and security. With the rapid rise of cloud, 5G and edge, SDN is becoming the foundation of next gen networks.

As companies look to simplify and meet evolving connectivity requirements, SDN’s programmable, centralised approach is the future proof solution. Continuous innovation in AI, virtualisation and open standards will keep the market moving, for a new era of intelligent networking across industries.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Software Defined Networking Market Size

- August-2025

- 140

- Global

- Information-Technology-Communication-IoT

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021