Smart Waste Collection Technology Market Size, Share, Growth & Industry Analysis, By Component (Smart Bins, Sensor Systems, Route Optimization Software, Fleet Management), By Deployment Mode (On-Premise, Cloud-Based), By Application (Residential, Commercial, Industrial, Municipal), and Regional Analysis, 2026-2033

Smart Waste Collection Technology Market: Global Share and Growth Trajectory

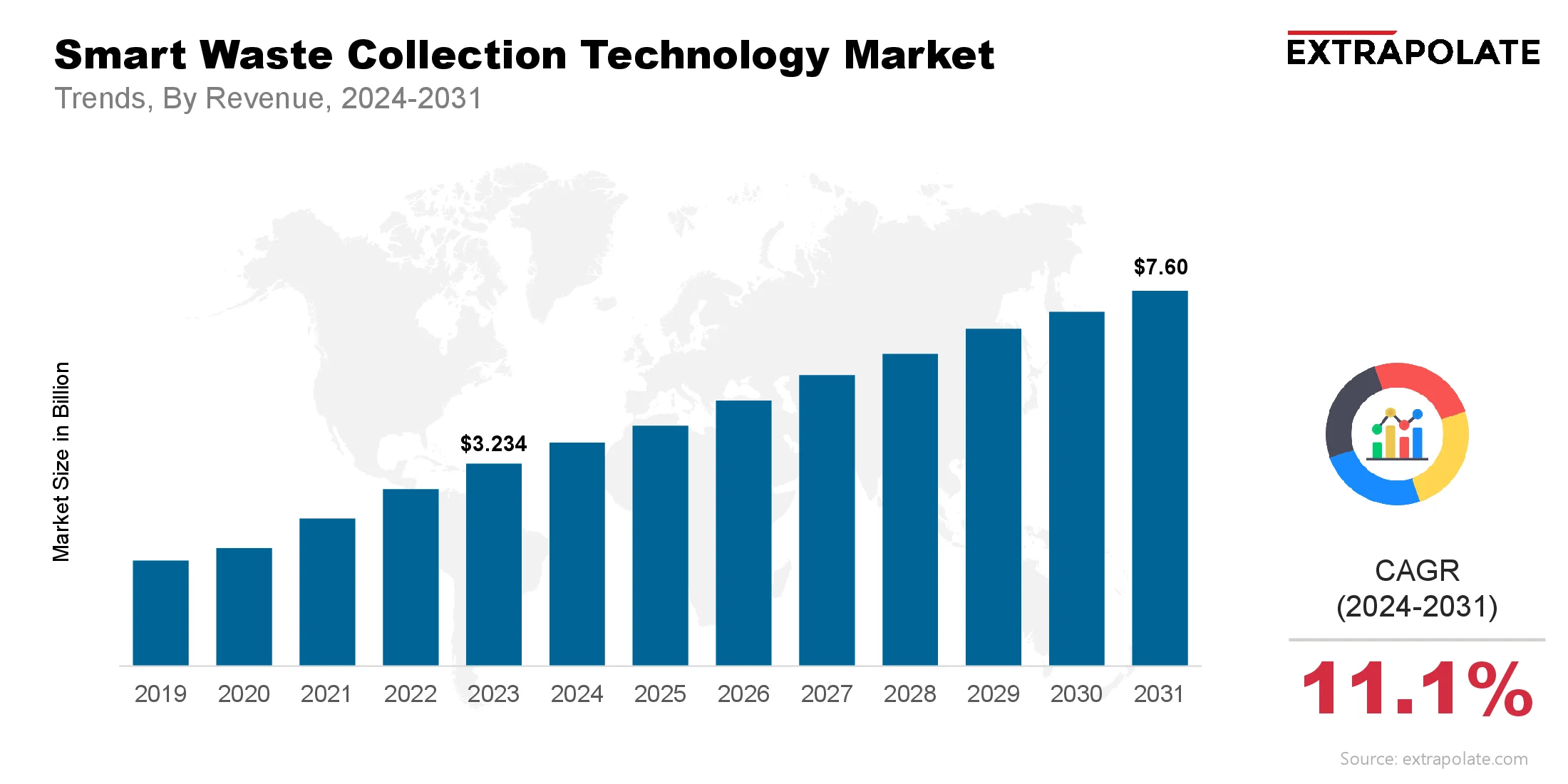

The global smart waste collection technology market size was valued at USD 3.23 billion in 2023 and is projected to grow from USD 3.62 billion in 2026 to USD 7.60 billion by 2033, exhibiting a CAGR of 11.1% during the forecast period.

The global market is witnessing a rapid surge as urbanization, technological advancement, and sustainability initiatives converge. Municipalities and private enterprises alike are adopting intelligent waste management solutions to improve collection efficiency, reduce operational costs, and minimize environmental impact.

This market integrates cutting-edge technologies—like IoT sensors, AI-powered route optimization, and real-time monitoring—into traditional waste collection systems, transforming the way cities manage solid waste.

The pressing need for sustainable urban living, growing waste volumes, and the emphasis on data-driven city infrastructure are propelling the smart waste collection technology sector. The market is evolving swiftly with automation, wireless communication, and sensor-based systems that allow for adaptive, responsive, and eco-friendly waste collection practices.

As environmental regulations tighten and the demand for cleaner cities intensifies, smart waste management is no longer a futuristic concept—it’s a present-day necessity.

From smart bins to fleet management platforms, these intelligent systems help stakeholders monitor fill levels, predict waste patterns, and deploy resources optimally. With smart waste collection contributing significantly to circular economy initiatives and smart city development, this market is set for an upward growth trajectory fueled by technological innovation and sustainability goals.

Key Market Trends Driving Product Adoption

IoT-Enabled Smart Bins Revolutionizing Waste Management

A prominent trend driving market adoption is the rise of IoT-enabled smart bins. These bins are equipped with sensors that measure fill levels and automatically notify collection crews when it’s time to empty them. T

his leads to fewer unnecessary pickups, less fuel consumption, and lower emissions. Cities like Seoul, Amsterdam, and San Francisco have already adopted these technologies, showcasing dramatic improvements in collection efficiency.

AI and Data Analytics for Route Optimization

Artificial intelligence and machine learning are now playing a central role in waste logistics. These technologies analyze historical and real-time data to determine optimal collection routes, forecast waste generation, and allocate resources dynamically.

Companies deploying these AI-driven systems report savings of up to 30% in operational costs. Additionally, route optimization reduces the environmental footprint of waste collection fleets by cutting down vehicle emissions and fuel consumption.

Rising Focus on Sustainable Urban Infrastructure

Smart waste collection is becoming integral to smart city initiatives worldwide. Governments and city planners are aligning waste collection strategies with broader sustainability objectives. By integrating waste collection systems with energy and water networks through digital platforms, cities aim to create cohesive, sustainable ecosystems. This trend is particularly noticeable in Europe and North America, where green infrastructure investment is gaining momentum.

Public-Private Partnerships (PPPs) Boosting Deployment

To address the capital-intensive nature of smart waste systems, several municipalities are entering into public-private partnerships. These collaborations enable cities to tap into technological expertise and financial resources of private firms while ensuring compliance with environmental goals. PPPs are increasingly being used to deploy smart bins, GPS tracking systems, and fleet management platforms across developing and developed regions alike.

Major Players and their Competitive Positioning

The smart waste collection technology market is intensely competitive and characterized by constant innovation. Leading companies are developing modular and scalable solutions to address the diverse needs of urban, industrial, and residential waste collection systems. Some of the key players dominating this landscape include are Enevo, Bigbelly Solar Inc., Compology, Waste Management Inc., SmartBin (Part of OnePlus Systems), Suez Environment S.A., Sensoneo, IBM Corporation, Rubicon Technologies, Urbiotica and others

These companies are leveraging strategic partnerships, acquisitions, and R&D investments to strengthen their market presence. For example, Enevo's smart waste sensor technology has been widely adopted across European cities, while Bigbelly has deployed solar-powered compacting bins in over 50 countries.

Consumer Behavior Analysis

- Growing Demand for Cleaner and Smarter Cities: Urban residents increasingly expect cleanliness and responsiveness in public services. This is pushing municipalities to modernize waste collection through smart technologies. Citizen engagement platforms that allow real-time reporting of overfilled bins and missed pickups are further encouraging adoption. The public’s preference for greener, more efficient urban services is a key force behind the shift to intelligent waste systems.

- In July 2025, Indore Municipal Corporation introduced “QuickSaaf” a mobile-based on-demand waste collection and cleaning service via its 311 app empowering citizens to request bulk or event-related waste pickup with transparent pricing and schedule flexibility.

- Economic Considerations Driving Adoption: Though smart waste collection solutions involve upfront investment in sensors, connectivity, and platforms, stakeholders recognize long-term benefits. These include reduced labor costs, lower fuel expenses, and increased asset lifespan. Consequently, cities and private waste contractors are more open to adopting smart solutions, particularly when ROI becomes evident within two to three years.

- Environmental Awareness Shaping Preferences: The global increase in climate awareness is influencing consumer and civic behavior. Citizens and governments alike are prioritizing initiatives that align with carbon neutrality and zero-waste goals. Smart waste systems help quantify and reduce landfill contributions, promote recycling, and enable data-driven policymaking—key factors that resonate with environmentally conscious users.

- Growing Familiarity and Ease of Use: User training and technical literacy among operators are improving rapidly. With mobile apps and web-based dashboards simplifying system interaction, even traditional waste management personnel are adapting to smart collection tools. The ease of integration with existing fleet and route planning systems is also making these technologies more acceptable at the operator level.

Pricing Trends

The cost of implementing smart waste collection technology varies by scale, solution type, and region. A basic sensor-equipped smart bin may cost between $200–$500, while full integration with AI-based route optimization software, fleet tracking, and analytics dashboards can push costs into the tens of thousands for city-wide deployment.

However, with economies of scale and advancements in low-cost sensors, prices are gradually decreasing. Moreover, subscription-based models and SaaS platforms are emerging, allowing users to pay for services rather than incur high capital expenditures. Financing models, including leasing and PPP arrangements, are also helping municipalities manage initial costs effectively.

Growth Factors

- Rising Urban Population and Waste Generation: Urban living is on the rise. Experts predict 6.7 billion city dwellers by 2050. Surging urban populations are generating more waste, pushing cities to adopt smarter collection technologies. Intelligent waste systems help mitigate the environmental impact of rapid urban growth.

- Regulatory Push for Smart and Green Infrastructure: Many governments have big goals for clean cities. They want urban growth to be green and waste-free. Laws demand smart tracking of waste. They also aim to boost collection speed and recycling levels. These rules are driving up demand. Cities now need digital systems to manage waste better.

- Technological Maturity and Integration: These tools enable smart systems to react quickly. They support better tracking, alerts, and control in real time. Tech is getting better and easier to use. It helps waste systems work faster and grow across cities.

- Circular Economy Models Driving Innovation: As the circular economy grows, design goals are changing. Focus is now on reuse, recycling, and waste reduction. These systems offer real-time data and traceability. That makes recycling efforts more focused and effective.

Regulatory Landscape

The smart waste market is shaped by many new rules. These include environmental, data privacy, and city laws:

- Environmental Compliance: Governments now demand lower emissions and less landfill use. This makes smart waste systems a must for compliance.

- Data Governance: Sensors and cloud systems collect user data. So, they must follow data laws like GDPR and CCPA).

- Municipal Smart City Mandates: Cities are planning smart waste along with other systems. Many get support through grants or policy programs.

Recent Developments

- Enevo Expands Operations in Asia-Pacific: Enevo has expanded into Southeast Asia. Its smart sensors are now in over 10 cities to boost waste efficiency.

- Rubicon Technologies Launches SmartCity Next-Gen Platform: With added tools for prediction and public input, the dashboard builds trust. It makes waste services more open and efficient.

- Bigbelly Introduces Solar-Powered Smart Compactors with 5G Connectivity: These bins hold waste and also support 5G tech. They show how one item can serve two smart city needs.

- Sensoneo and YIT Corporation Partnership in Smart Industrial Waste Management: The system uses smart sensors to watch hazardous waste. Alerts are sent instantly to prevent overflow or risk.

- These upgrades help firms run better. At the same time, they offer tools that match growing urban demands.

Current and Potential Growth Implications

a. Demand-Supply Analysis

As more people move to cities, waste volumes increase. This pushes the need for efficient, tech-driven collection. Scalable waste tech is still rare in these regions. High costs and weak digital infrastructure are major barriers.

b. Gap Analysis

Many urban areas are adopting smart waste tools. But lack of affordable options and unified systems remains a major barrier. Older systems create barriers to tech adoption. Cities find it hard to connect modern tools with outdated setups. Solving these issues needs clear tech guidelines. Cities also need models that can grow and adjust easily.

Top Companies in the Smart Waste Collection Technology Market

- Enevo

- Bigbelly Solar Inc.

- Compology

- Rubicon Technologies

- Sensoneo

- Suez Environment S.A.

- IBM Corporation

- SmartBin (OnePlus Systems)

- Waste Management Inc.

- Urbiotica

Smart Waste Collection Technology Market: Report Snapshot

Segmentation | Details |

By Component | Smart Bins, Sensor Systems, Route Optimization Software, Fleet Management |

By Deployment Mode | On-Premise, Cloud-Based |

By Application | Residential, Commercial, Industrial, Municipal |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

- Smart Bins: These bins are embedded with IoT sensors and compactors, and are expected to witness rapid adoption due to increasing urban waste volumes and the push for real-time monitoring.

Major Innovations

- AI-Powered Fill Level Sensors: Sensors track waste levels over time. This allows predictive planning for future collections.

- Solar-Compact Smart Bins: These systems use less energy during waste collection. They also reduce how often trucks need to operate.

- Integrated Citizen Feedback Portals: Public input boosts system performance. It also builds trust and encourages cleaner habits.

- Blockchain in Waste Tracking: Waste systems become easier to track. This builds trust and ensures everyone is held accountable.

Potential Growth Opportunities

- Expansion into Developing Economies: Urbanization in parts of Africa, Asia, and Latin America is speeding up. It opens the door to major market expansion.

- Integration with Renewable Energy Grids: Teaming up helps collect waste faster. It also uses real-time data to guide reverse logistics.

- Partnerships with E-Commerce and Retail Giants: Collaboration makes waste collection more efficient. It also enables reverse logistics based on real-time data.

Extrapolate Research says

Extrapolate Research believes that stakeholders who invest early in modular, AI-integrated, and sensor-based systems stand to gain significant competitive advantages—such as reduced operational costs, improved asset utilization, and better regulatory alignment. Municipalities and private operators should prioritize scalable cloud-based solutions and leverage public-private partnerships to overcome funding and infrastructure barriers. Additionally, markets in Asia-Pacific, Latin America, and Africa present untapped growth potential due to rising urbanization and increasing smart city initiatives. Ultimately, this report emphasizes that smart waste collection is no longer a peripheral technology—it is a foundational pillar of next-generation urban ecosystems and a strategic imperative for future-ready organizations.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Smart Waste Collection Technology Market Size

- July-2025

- 140

- Global

- Information-Technology-Communication-IoT

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021