Physical Security Market Size, Share, Growth & Industry Analysis, By Component (Hardware (Surveillance Cameras, Sensors, Access Control Devices), Software, Services (Managed & Professional)), By Application (Government, Transportation, Retail, Banking & Finance, Residential, Healthcare, Education, Industrial), By System Type (Video Surveillance, Access Control, Intrusion Detection, Perimeter Security, Physical Barriers), and Regional Analysis, 2024-2031

Physical Security Market Global Share and Growth Trajectory

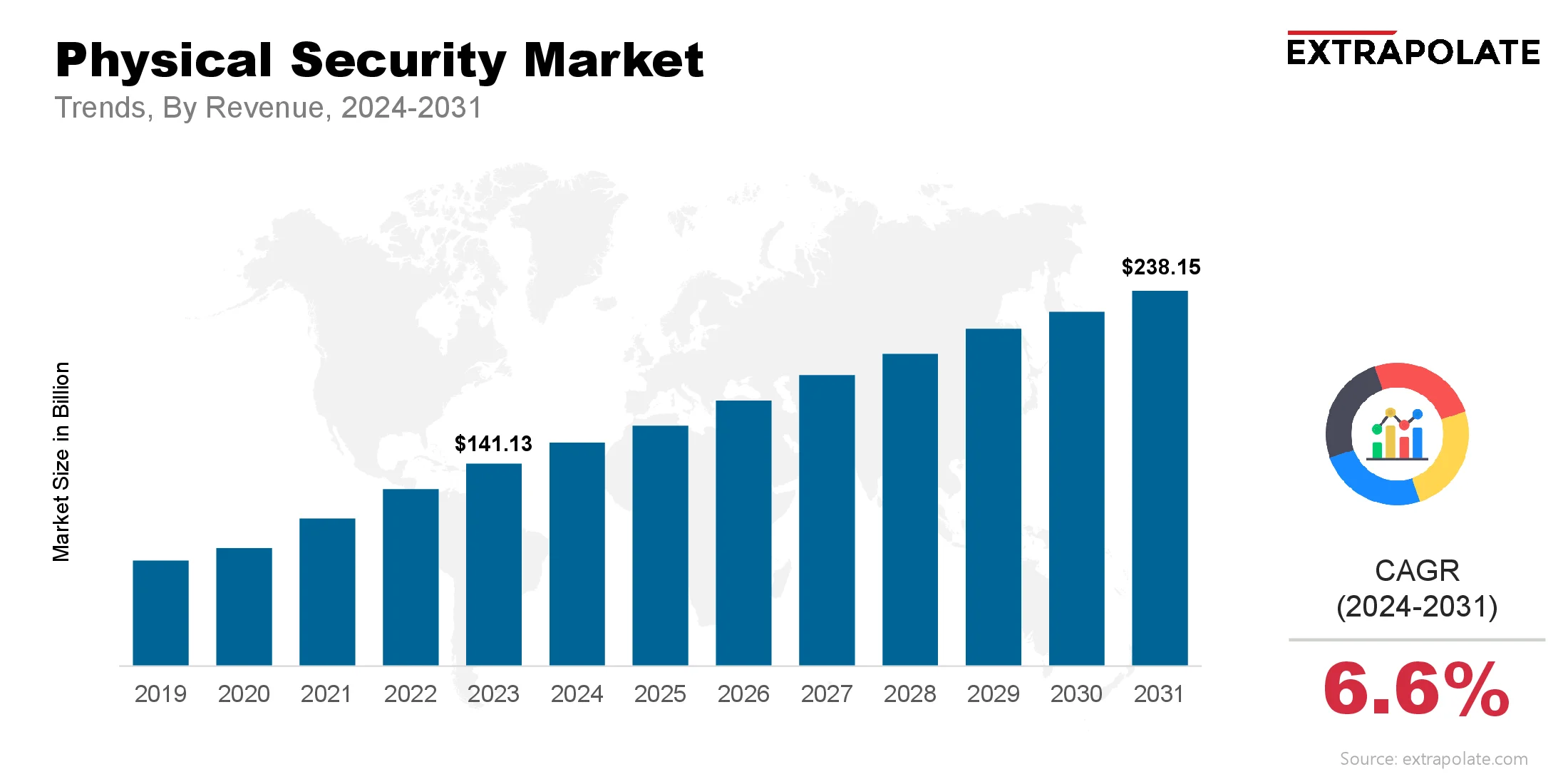

The global Physical Security Market size was valued at USD 141.13 billion in 2023 and is projected to grow from USD 151.78 billion in 2024 to USD 238.15 billion by 2031, exhibiting a CAGR of 6.6% during the forecast period.

The global market is experiencing rapid growth as organizations and governments increase their investments in safeguarding people, assets, and critical infrastructure. This market comprises a vast range of hardware and software solutions, which include video surveillance systems, access control mechanisms, perimeter intrusion detection, and physical barriers. The growing threat of terrorism, cyber-physical attacks, vandalism, and theft has intensified the need for advanced physical security infrastructure. Businesses are proactively deploying comprehensive security strategies that integrate physical systems with digital oversight to reduce vulnerabilities and maintain operational continuity.

In recent years, the convergence of physical and cybersecurity has driven growth, with smart technologies enabling real-time monitoring, predictive analytics, and faster response mechanisms. As urbanization accelerates and smart cities emerge, the demand for sophisticated physical security solutions continues to increase. These systems are being deployed not only in critical facilities such as airports, hospitals, and government buildings but also across commercial enterprises, educational institutions, and residential complexes.

Technological advancements, including AI-powered surveillance, facial recognition, biometric authentication, and cloud-based access control, are fueling the transformation of physical security systems. With a strong focus on proactive threat management, the market is poised for sustained growth over the next decade.

Key Market Trends Driving Product Adoption

Various trends are shaping the adoption and evolution of physical security solutions:

Rise in Smart Surveillance Systems

The deployment of high-definition (HD) and IP-based surveillance cameras has becoming popular due to their ability to provide superior imaging, remote accessibility, and analytics integration. These systems are being improved with AI and machine learning to support automated threat detection, behavior analysis, and license plate recognition.

Integration of Access Control and Identity Management

Access control systems are shifting beyond traditional card-based methods. There is a rise in the adoption of biometric authentication technologies like fingerprint, iris, and facial recognition systems to enhance identity verification. Enterprises are utilizng these systems to establish secure and efficient access to facilities, particularly in high-risk zones.

Proliferation of Cloud-Based Security Solutions

Cloud technology is reshaping physical security management by enabling centralized monitoring, scalability, and real-time data accessibility. Cloud-based video surveillance and access control systems enable enterprises to store and manage data offsite, reducing infrastructure costs and enhancing operational flexibility.

Growing Emphasis on Perimeter Security

Infrastructures such as airports, utilities, and defense installations are strengthening perimeter security through sensors, fencing systems, radar surveillance, and motion detectors. These technologies are necessary for early threat detection and play a critical role in multilayered security strategies.

Physical Security as a Service (PSaaS)

The emergence of subscription-based models has transformed how organizations deploy and manage physical security. PSaaS reduces capital expenditure and allows companies to access advanced security infrastructure with lower upfront investment, particularly benefiting SMEs.

Major Players and their Competitive Positioning

The physical security indurtry features a competitive landscape dominated by leading players offering end-to-end solutions. These firms continuously invest in research, partnerships, and strategic acquisitions to expand their portfolios and meet dynamic customer needs. Key companies include are Honeywell International Inc.,Johnson Controls International PLC,Bosch Security Systems,Axis Communications AB,Hikvision Digital Technology Co., Ltd.,Dahua Technology Co., Ltd.,Genetec Inc.,Hanwha Vision Co., Ltd.,Cisco Systems, Inc.,Allegion PLC and other.

These players are focused on incorporating advanced analytics, artificial intelligence, and Internet of Things (IoT) capabilities into their offerings. They are also improving interoperability across systems to provide smooth physical security ecosystems tailored to specific industry requirements.

Consumer Behavior Analysis

Consumer behavior in the physical security market is shaped by a combination of risk perception, regulatory compliance, and technological accessibility:

- Rising Demand for Proactive Security Solutions: Firms are shifting from reacting to incidents to preventing them. This proactive approach helps reduce risks before they happen. Organizations now prefer tools that can spot dangers early. These systems send alerts before small issues turn into big problems.

- Awareness and Regulatory Compliance: Regulations for keeping data safe and workplaces secure are getting stricter. As a result, security is now a major focus for company leaders. Finance, healthcare, and education must comply with national and global regulations. This pushes them to adopt advanced physical and digital security measures.

- Cost-Benefit Consideration: These systems can be expensive to install at first. But they help reduce insurance costs, prevent losses, and support smooth business operations. Flexible pricing options like leasing support smaller companies. These models reduce financial strain and encourage faster implementation.

- User Experience and Interface: Modern security tools are easier to use and work well on mobile devices. This makes staff more willing to use systems with simple controls and remote features.

Pricing Trends

The price of physical security tools changes with tech level and project size. It also depends on how well the system fits with others and what services are included. Security options vary from basic gear to high-tech setups. Advanced systems include AI, sensors, and biometric scans.

Top-tier security systems use tools like smart analytics and thermal cameras. They also send real-time alerts and cost more than basic setups. Mass production is making security gear cheaper. Local brands and monthly subscription plans add to the price drop.

Cloud-based tools and PSaaS have changed how firms spend on security. They now treat it as a running cost, which opens access to better systems. More rivals and rapid tech changes are reshaping the market. Prices will likely reflect service value rather than just product cost.

Growth Factors

Several critical drivers are driving the growth of the physical security market:

- Rising Global Security Threats: Threats like attacks, intrusions, and workplace violence are increasing. To stay safe, many groups are turning to high-tech physical protection.

- Urbanization and Smart Infrastructure: Urban areas are expanding with smart tech and infrastructure. To stay safe, they need reliable security frameworks. Urban areas now use smart tech like traffic systems and cameras. These tools make security a core part of city planning.

- Technological Advancements: Tech breakthroughs have made security smarter. Modern systems now use AI and sensors to spot and handle threats quickly.

- Regulatory Mandates and Compliance: New laws demand strong protection for data and personal safety. This forces businesses to update how they secure their physical spaces. Following legal rules is not optional for companies. This ongoing need drives steady growth in the market.

- Remote Monitoring and Mobility: As more people work from different locations, security needs have changed. Firms now want mobile-friendly systems with real-time tracking and one control point.

Regulatory Landscape

The physical security market operates under a complex set of global and regional rules that aim at ensuring safety, privacy, and ethical surveillance:

- GDPR (Europe): Laws set limits on collecting and storing security footage. They aim to ensure privacy and clear data practices.

- HIPAA (USA): In healthcare, patient zones must be closely guarded. Access control and monitoring systems help prevent unauthorized entry.

- ISO 27001 and ISO 22301: International rules cover data safety and business continuity. To meet them, companies must use proper physical security.

- Homeland Security Guidelines (USA): There are strict mandates to safeguard vital systems. They guide physical security in areas like energy, transit, and public health.

Firms must make sure their security tools meet legal standards. Failing to do so can lead to penalties and harm their reputation.

Recent Developments

Recent developments illustrate how the physical security market is undergoing significant transformation:

- AI and Machine Learning Integration: AI helps cameras recognize faces and notice strange activities. This makes it easier to react fast and stay ahead of risks.

- Smart Access Control Systems: TES built a smart system that sorts e-waste on its own. It uses deep learning and robotics to detect and split many device parts.

- Strategic Acquisitions: Big players are adding cloud and analytics talent through deals. Johnson Controls bought OpenBlue to boost smart building tech.

- Deployment of Drones and Robotics: Unmanned systems are gaining interest. Drones and patrol bots aid in large site monitoring.

- Cloud and Edge Technologies: Security setups are shifting to cloud and edge computing. This allows faster data handling on-site, boosting emergency response and system efficiency.

These updates mark a shift to advanced and linked security tools. They also help build flexible systems for future growth.

Current and Potential Growth Implications

- Demand-Supply Analysis: Rapid adoption of AI-driven security tech has created a supply-demand mismatch. Though chip shortages delayed system rollouts, manufacturers are ramping up efforts to restore balance.

- Gap Analysis: SMEs face real challenges in modernizing security. Limited funds and expertise delay tech use. More firms now offer low-cost, cloud security plans. This shift could bring smaller players into the market.

Top Companies in the Physical Security Market

- Honeywell International Inc.

- Johnson Controls International PLC

- Bosch Security Systems

- Axis Communications AB

- Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd.

- Genetec Inc.

- Cisco Systems, Inc.

- Hanwha Vision Co., Ltd.

- Allegion PLC

Leading players are shaping advanced security. Their tools link surveillance, entry control, and real-time insights.

In June 2025, Teledyne's FLIR division introduced the PT‑Series AI SR, a cutting-edge camera combining 4K visible and thermal imaging, real-time AI-powered object tracking, and pan/tilt control. It’s designed for high-risk commercial and industrial environments, providing multispectral threat detection and active response capabilities.

Physical Security Market: Report Snapshot

Segmentation | Details |

By Component | Hardware (Surveillance Cameras, Sensors, Access Control Devices), Software, Services (Managed & Professional) |

By Application | Government, Transportation, Retail, Banking & Finance, Residential, Healthcare, Education, Industrial |

By System Type | Video Surveillance, Access Control, Intrusion Detection, Perimeter Security, Physical Barriers |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

Several segments are anticipated to experience high growth in the coming years:

- Video Surveillance: Smart surveillance tech is in high demand. Both city zones and business sites seek sharper, AI-driven systems.

- Access Control Systems: Face ID, fingerprints, and mobile badges are reshaping access control. They combine strong security with simple access.

- Perimeter Security: More threats at key locations create pressure to improve protection. Companies are investing in radar, sensors, and barriers to respond.

Major Innovations

- AI-Enabled Analytics: Monitoring tools track live activity to catch threats instantly. This shortens response time and improves daily operations.

- Mobile Access Control: Encrypted smartphone credentials are replacing physical badges. They help streamline access and boost security.

- Integrated Platforms: Security tasks are easier with combined systems. Teams can track cameras, alerts, and entry points together.

Potential Growth Opportunities

Opportunities that could significantly boost market growth include:

- Expansion in Emerging Markets: Construction is growing fast in emerging markets. This creates new needs for physical security solutions. These need strong, modern security systems.

- Smart City Integration: Governments support smart city growth. This demands built-in security for traffic, monitoring, and rescue efforts.

- Partnership with Cybersecurity Providers: As digital and physical systems merge, new risks arise. Security firms are building joint tools to stop these threats.

Extrapolate says:

The physical security market is entering a strong growth phase. This is driven by new risks, smart systems, and legal demands. The physical security market is using AI and cloud to improve systems. This makes them smarter, more responsive, and more affordable. Physical security is no longer optional. Firms and governments now see it as vital for long-term strength. Digital intelligence is being added to physical systems. This will lead the next wave of global security upgrades.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Physical Security Market Size

- July-2025

- 140

- Global

- Information-Technology-Communication-IoT

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021