Machine Vision Market Size, Share, Growth & Industry Analysis, By Product Type (Vision Systems, Cameras, Software, Frame Grabbers, Others) By Application (Inspection, Measurement, Identification, Guidance) By End-User (Automotive, Electronics & Semiconductor, Food & Beverage, Pharmaceuticals, Logistics, Others), and Regional Analysis, 2024-2031

Machine Vision Market: Global Share and Growth Trajectory

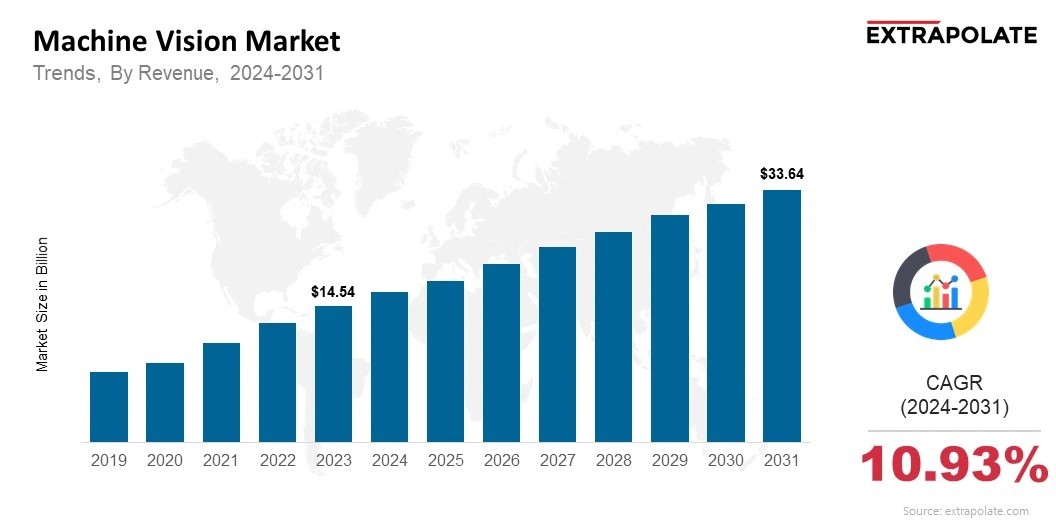

Global Machine Vision Market size was recorded at USD 14.54 billion in 2023, which is estimated to be valued at USD 16.27 billion in 2024 and reach USD 33.64 billion by 2031, growing at a CAGR of 10.93% during the forecast period.

The machine vision market is on fire. Manufacturers and industries are adopting machine vision systems to improve quality, productivity and operational efficiency. These systems do reliable, repeatable inspection, measurement and guidance tasks that reduce human error and increase throughput. Result is better product quality, lower costs and streamlined operations across industries.

The fuel for this growth is the convergence of advanced imaging technologies, artificial intelligence (AI) and automation in industrial environments. As industries want to be smarter, faster and more precise, machine vision is essential. Continuous innovation in cameras, sensors and processing algorithms is changing the way factories work. As these technologies evolve, the machine vision market will continue to grow strongly.

One of the biggest impact of machine vision is automated inspection. Machine vision systems can quickly detect defects, measure dimensions and verify assemblies with high accuracy. This eliminates inconsistencies and costly recalls while ensuring quality standards. Popular applications are electronics inspection, automotive component verification and packaging quality control. By replacing human subjective checks with data driven analysis, machine vision is redefining manufacturing excellence.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several key trends are fueling the adoption of machine vision systems:

Industry 4.0 and Smart Manufacturing: The move to Industry 4.0 is happening globally. Connected factories are integrating advanced sensors, AI and robotics to achieve higher automation. Machine vision is critical to this. They enable real-time quality monitoring, closed-loop process control and adaptive manufacturing. As manufacturers aim for lights-out production and zero-defect quality, demand for advanced machine vision systems is skyrocketing.

AI and Deep Learning: Recent breakthroughs in AI and deep learning are pushing the boundaries of what machine vision systems can do. Deep learning models can detect complex, variable defects and recognize patterns like humans. These systems get better with more data. As a result, machine vision applications are expanding into previously difficult areas such as unstructured object recognition, handwritten text reading and complex surface inspection.

3D Vision and Advanced Imaging: 3D machine vision is in high demand. 3D imaging allows accurate measurement of object shapes, volumes and positions which is critical for robotic guidance, bin picking and precision assembly. Technologies like structured light, stereo vision and laser triangulation are improving 3D imaging. Hyperspectral and multispectral imaging is opening up new applications in food inspection, pharmaceutical quality control and agriculture.

Rising Labor Costs and Skilled Worker Shortage: In many regions, rising wages and shortage of skilled labor is forcing manufacturers to automate more. Machine vision systems is a scalable and cost effective way to replace manual inspection and measurement. They give consistent results 24/7 without fatigue making them an attractive solution for manufacturers who want to maintain quality while reducing labor dependency.

Growing Use in Non-Industrial Applications: While factory automation remains the largest segment, machine vision is growing in non-industrial areas. These include logistics (parcel sorting and barcode reading), retail (checkout automation and shelf monitoring), medical imaging analysis and autonomous vehicles. This is expanding the total available market and attracting new investment.

Major Players and their Competitive Positioning

The machine vision market is competitive with many global players innovating to gain share. They offer complete cameras, software, vision systems and integration services to cover all application needs. Key players in this competitive landscape include: - Cognex Corporation, Basler AG, Keyence Corporation, Teledyne Technologies Incorporated, National Instruments Corporation, Omron Corporation, Allied Vision Technologies GmbH, ISRA Vision AG (part of Atlas Copco), Intel Corporation, Sony Corporation.

They compete on technology, performance, price and service. They are actively pursuing strategic partnerships, mergers and acquisitions to broaden their capabilities and market reach. For example Teledyne’s acquisition of FLIR Systems strengthens its thermal imaging and 3D sensing portfolio. ISRA Vision’s integration into Atlas Copco provides more scale and resources for global expansion.

In March 2025, IDS Imaging and Prophesee launched the uEye EVS camera series with event-based vision sensors. These compact industrial cameras use neuromorphic Metavision technology and Prophesee-Sony IMX636HD sensors to capture high-speed scenes with reduced data processing and power consumption, perfect for dynamic automation applications.

Consumer Behavior Analysis

Consumer behavior in the machine vision market is shaped by several key factors:

Quality Assurance: Manufacturers are making quality a competitive differentiator. Consumers want defect free products, so companies are adopting automated inspection systems. Machine vision delivers the precision and consistency to meet strict quality standards and reduce scrap and rework.

Cost-Benefit: While machine vision systems require significant upfront investment, manufacturers recognize the long term value. These systems reduce labor costs, prevent costly recalls and improve overall equipment effectiveness (OEE). ROI is realized quickly through reduced defects and higher throughput.

Ease of Integration: Customers want solutions that can be dropped into existing production lines. Vendors are responding with modular, plug-and-play systems, simple software interfaces and robust connectivity options for industrial protocols like OPC UA and Ethernet/IP. This reduces engineering costs and deployment time.

Adoption of AI-Powered Solutions: As customers get familiar with AI, they are asking for machine vision solutions with deep learning capabilities. These can handle variability and complexity that rule-based systems can’t, opening up new use cases and simplifying setup.

In June 2025, Cognex Corporation introduced OneVision, a cloud‑based platform for AI-powered machine vision. OneVision enables manufacturers to build, train, and deploy AI vision applications via a scalable cloud interface, simplifying integration and accelerating adoption across diverse industrial processes.

Reliability and Support: Manufacturers want vendors who provide reliable hardware, regular software updates and strong technical support. Downtime is expensive so service contracts and local support networks are key buying criteria.

Pricing Trends

The cost of machine vision systems varies greatly depending on system complexity, imaging technology, resolution and software capabilities. Basic 2D camera systems for simple inspections can be relatively cheap and accessible to small manufacturers. Advanced 3D or deep-learning enabled systems for complex inspections can be much more expensive.

Several pricing trends are emerging:

Declining Camera Costs: Improvements in sensor manufacturing have reduced the cost of high resolution cameras. As a result machine vision systems are becoming more accessible to small and medium sized enterprises (SMEs).

Software Licensing Models: Vendors are offering more flexible licensing models, including subscription based pricing and cloud based platforms. This reduces the upfront cost and aligns with production needs.

Total Cost of Ownership (TCO) Focus: Buyers are looking not just at the initial purchase price but also at maintenance, training and integration costs. Vendors are responding with bundled service contracts and training programs to make ownership simpler.

Leasing and Financing Options: Like other automation solutions vendors and integrators are offering leasing plans to help customers manage cash flow and make it financially feasible.

Growth Factors

Several factors are driving the growth of the machine vision market:

Technological Innovation: Rapid advances in imaging sensors, AI algorithms, 3D vision and embedded processing are expanding machine vision’s capabilities. Systems are getting faster, more flexible and easier to deploy opening up new markets and applications.

Industry 4.0: The push towards smart factories is driving demand for automated inspection, measurement and guidance solutions. Machine vision is essential for closed loop manufacturing and zero defect production.

Global Manufacturing Expansion: Developing regions in Asia-Pacific, Latin America and Africa are investing in manufacturing infrastructure. This is creating new demand for machine vision systems that can improve quality and productivity in local factories.

Quality and Regulatory Requirements: Industries such as automotive, electronics, food & beverage and pharmaceuticals are facing increasingly strict quality and traceability regulations. Machine vision helps manufacturers to comply with these standards by ensuring consistent inspection and documentation.

Labor Challenges: Rising labor costs and shortage of skilled inspectors are pushing companies to adopt automation. Machine vision is a scalable solution to reduce reliance on manual inspection.

Environmental and Sustainability Goals: Manufacturers are using machine vision to reduce waste by catching defects early and optimizing processes. This supports corporate sustainability initiatives and regulatory compliance.

Regulatory Landscape

While machine vision is less regulated than medical devices, some important standards and guidelines ensure safety, compatibility and quality:

- CE Marking in Europe: Machine vision systems sold in Europe must comply with safety and electromagnetic compatibility directives to get CE marking.

- Industrial Communication Standards: Compliance with industry standards such as GigE Vision, USB3 Vision and GenICam ensures interoperability between cameras, software and systems.

- ISO 9001 and Quality Management: Many machine vision component manufacturers have ISO 9001 certification to demonstrate their quality management practices.

- Sector Specific Standards: In industries such as automotive, food & beverage and pharmaceuticals machine vision systems often support traceability and inspection requirements aligned with sector specific regulations (e.g. FDA guidance for food production).

Recent Developments

Several recent developments are shaping the machine vision market:

- AI-Powered Vision Systems: Vendors are adding AI and deep learning to enable systems that can detect subtle or complex defects that were missed by rule-based approaches. These systems simplify setup, reduce false positives and improve yield.

- 3D Vision is Going Mainstream: 3D imaging is becoming common in robotic guidance, bin picking and quality control. Structured light and stereo vision are getting more accurate and cheaper.

- Cloud-Based Machine Vision: Some vendors are offering cloud-connected vision systems that allow remote monitoring, training of AI models and integration with factory analytics dashboards.

- Strategic Partnerships and Acquisitions: Big companies are acquiring specialist firms and partnering to strengthen their position. Examples include Cognex buying Sualab for deep learning and Teledyne acquiring companies to expand their imaging technologies.

- Logistics and Retail: Machine vision is powering automated checkout systems, barcode readers and parcel sorting in logistics hubs, showing growth beyond the factory floor.

Current and Potential Growth Implications

Demand-Supply Analysis: Strong demand for machine vision systems is driving manufacturers to produce more. Component shortages like image sensors and processors can cause temporary supply issues but investments in manufacturing capacity are addressing these.

Gap Analysis: While the market is growing fast, there are gaps in affordability and ease of use for smaller manufacturers. Vendors are prioritizing simpler interfaces and cost-effective solutions to get more SMEs on board.

Emerging Markets: There’s a lot of growth in developing regions where manufacturing infrastructure is being modernized. Localized solutions and support will be key to tapping these markets.

Top Companies in the Machine Vision Market

- Cognex Corporation

- Basler AG

- Keyence Corporation

- Teledyne Technologies Incorporated

- National Instruments Corporation

- Omron Corporation

- Allied Vision Technologies GmbH

- ISRA Vision AG (Atlas Copco)

- Intel Corporation

- Sony Corporation

Machine Vision Market: Report Snapshot

Segmentation | Details |

By Product Type | Vision Systems, Cameras, Software, Frame Grabbers, Others |

By Application | Inspection, Measurement, Identification, Guidance |

By End-User | Automotive, Electronics & Semiconductor, Food & Beverage, Pharmaceuticals, Logistics, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Machine Vision Market: High-Growth Segments

The following segments are expected to see significant growth in the machine vision market:

3D Vision Systems: Growing demand for precise robotic guidance and bin picking in manufacturing is driving 3D vision adoption.

AI-Powered Vision Systems: Deep learning vision systems can handle complex, variable inspections and open up new use cases across industries.

Embedded Vision: Vision integrated into machines and devices is the trend towards smaller, cheaper solutions.

Major Innovations

Innovation in the machine vision market includes:

AI Powered Inspection: Deep learning and AI means detection of complex defects and variability, reduced setup time and improved accuracy.

3D Imaging: Structured light, stereo vision and laser triangulation is pushing the boundaries of 3D inspection and guidance.

Cloud Connected Vision: Cloud integration means remote monitoring, AI model training and seamless integration with factory data systems.

Machine Vision Market: Potential Growth Opportunities

Opportunities for growth in the machine vision market include:

Emerging Markets: As manufacturing in emerging economies grows, demand for quality control and automation will drive machine vision adoption.

Robotics and AI: Machine vision plus AI and robotics brings smart automation. It helps in tasks like assembly, checks, and logistics.

Non-Industrial Applications: Retail, logistics, imaging, and self-driving cars are growing fast. This creates new markets for vision tech.

Extrapolate Research says:

The machine vision market will grow strongly over the forecast period. As factories get smarter and more connected, machine vision will be the essential enabler of quality, productivity and automation.

Technological innovation in AI, 3D imaging and cloud integration is expanding the possibilities and reducing the barriers to entry. With use cases growing across manufacturing and beyond, the opportunities are huge. Machine vision won’t just support industrial automation, it will transform it, delivering reliable, scalable solutions for a more precise and efficient future.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Machine Vision Market Size

- July-2025

- 140

- Global

- Information-Technology-Communication-IoT

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021