In-Building in Wireless 5G Era Market Size, Share, Growth & Industry Analysis, By Component (Infrastructure (DAS, Small Cells, Repeaters), Services), By End-User (Commercial, Government, Residential, Industrial, Healthcare), By Building Size (Small, Medium, Large), and Regional Analysis, 2024-2031

In-Building in Wireless 5G Era Market : Global Share and Growth Trajectory

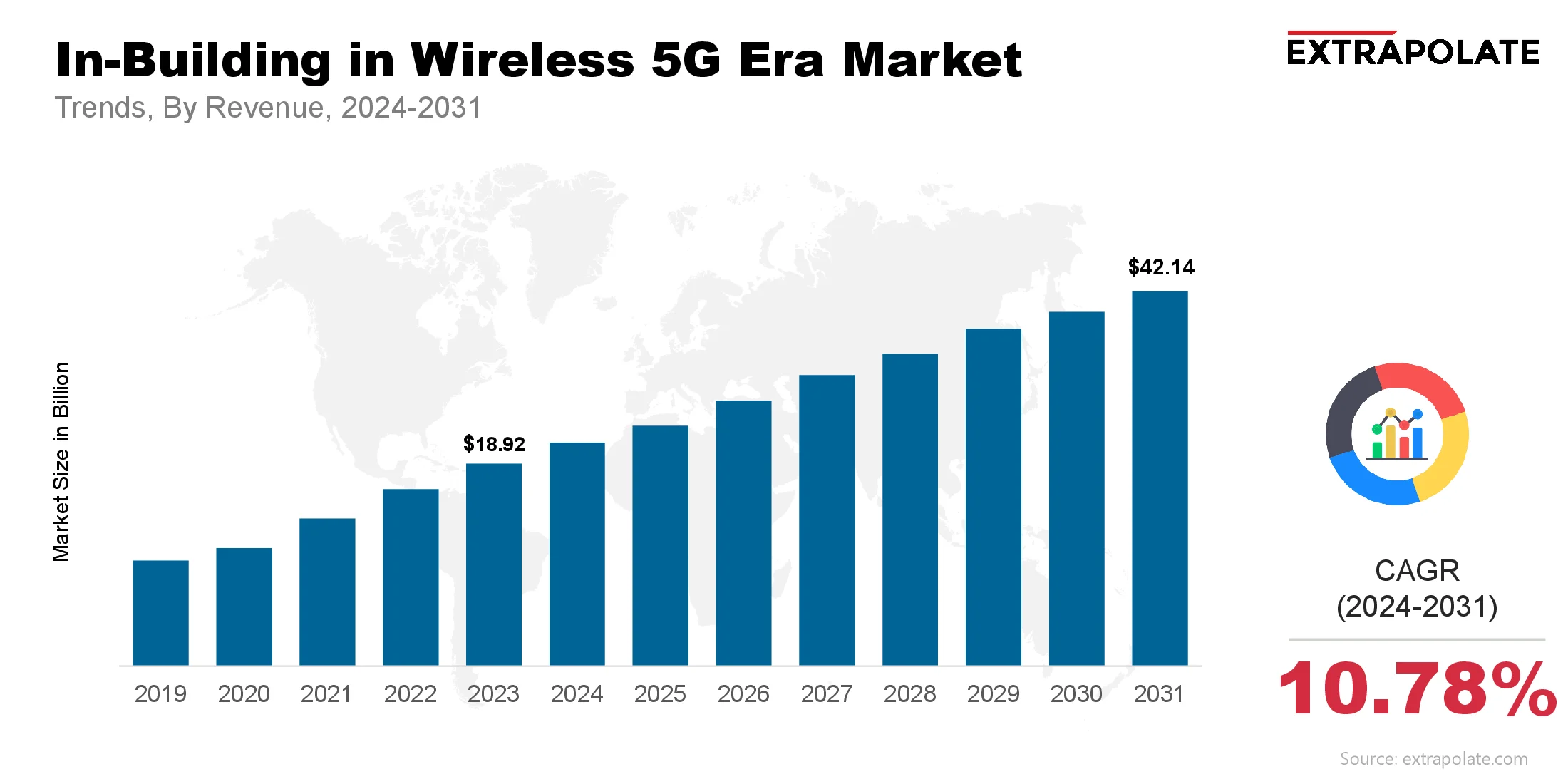

The global In-Building in Wireless 5G Era Market size was valued at USD 18.92 billion in 2023 and is projected to grow from USD 20.56 billion in 2024 to USD 42.14 billion by 2031, exhibiting a CAGR of 10.78% during the forecast period.

The global In-Building in Wireless 5G Era Market is undergoing significant transformation, especially in the era of 5G. With the demand for seamless connectivity, faster data speeds, and low-latency communication on the rise, in-building wireless systems are becoming essential infrastructure for modern buildings. These systems enhance mobile network coverage, improve user experience, and support advanced digital services, including IoT applications and smart building technologies.

Driving this surge is the rapid adoption of 5G technology, which requires high-frequency signals that struggle to penetrate building materials. As a result, businesses, property developers, and network providers are investing heavily in distributed antenna systems (DAS), small cells, repeaters, and other in-building wireless technologies to ensure uninterrupted connectivity. The market is expected to experience exponential growth as the global rollout of 5G accelerates and more commercial and residential facilities upgrade their internal communication infrastructure.

This market is evolving alongside key developments in network architecture and digital transformation strategies. As smart buildings and high-performance wireless applications proliferate, in-building wireless solutions are no longer a luxury—they are a necessity. Whether in hospitals, airports, corporate offices, or shopping malls, the demand for robust, secure, and ultra-fast wireless coverage continues to grow, underpinning the expansion of the global In-Building in Wireless 5G Era Market.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

Several important trends are fueling the growth and adoption of in-building wireless systems in the 5G era:

- 5G Network Deployment: The global rollout of 5G networks is a major catalyst for in-building wireless infrastructure. Unlike its predecessors, 5G uses higher-frequency bands that offer faster speeds but have limited ability to penetrate walls and other barriers. This has heightened the need for in-building solutions such as DAS and small cells to deliver consistent performance indoors.

- Rise of Smart Buildings and IoT: The convergence of IoT and building automation with wireless networks is reshaping expectations around connectivity. Smart HVAC systems, energy management platforms, connected security systems, and occupant experience technologies all require high-speed, low-latency connectivity. In-building wireless networks serve as the foundation for enabling these smart services.

- BYOD (Bring Your Own Device) Culture and Enterprise Mobility: Businesses increasingly rely on mobile devices and applications to support day-to-day operations. Employees expect high-performance wireless connectivity throughout the workplace, and organizations are responding by investing in in-building wireless infrastructure that ensures seamless performance across all levels of a facility.

- Public Safety Compliance: Regulatory mandates are driving demand for in-building wireless systems that support emergency responder communication. First responder network coverage (e.g., FirstNet in the U.S.) must be maintained indoors, especially in critical facilities such as hospitals, schools, and stadiums. This has made public safety DAS deployment a top priority for developers.

- Emergence of Neutral Host Models: Neutral host operators provide shared wireless infrastructure that multiple mobile network operators (MNOs) can use, reducing duplication and cost. This model is gaining popularity in large commercial buildings, transportation hubs, and campuses, further promoting the adoption of in-building wireless solutions.

Major Players and Their Competitive Positioning

The In-Building in Wireless 5G Era Market is marked by intense competition and strategic collaboration among major global players. Industry leaders continue to innovate with advanced hardware and software solutions that integrate with 5G networks while addressing growing demand across various verticals. Notable companies in this space included are CommScope Inc., Corning Incorporated, Ericsson, Huawei Technologies Co., Ltd., Nokia Corporation, ZTE Corporation, Comba Telecom Systems Holdings Ltd., Boingo Wireless, Inc., Samsung Electronics Co., Ltd., Dali Wireless Inc. and others. These companies are expanding their product portfolios through innovation, acquisitions, and strategic alliances. For instance, partnerships between equipment manufacturers and mobile network operators are becoming more common to accelerate deployment and extend in-building coverage.

Consumer Behavior Analysis

The decision to invest in in-building wireless technology is influenced by several key consumer and enterprise considerations:

- Quality of User Experience: Consumers increasingly demand consistent, high-quality wireless service inside buildings, especially in data-heavy environments like malls, airports, and conference centers. Dead zones and poor reception are unacceptable in an age where communication is mission-critical.

- Workplace Productivity: Organizations are aware that poor connectivity disrupts communication and collaboration. Companies are prioritizing infrastructure upgrades to ensure that employees can access cloud services, attend virtual meetings, and use mobile apps without disruption.

- Support for Next-Gen Applications: From augmented reality (AR) experiences in retail to telemedicine in healthcare, consumers and professionals alike expect low-latency wireless access indoors. The rise of such applications is reinforcing the importance of robust in-building networks.

- Energy Efficiency and Building Management: Building owners are realizing that reliable wireless connectivity supports better building automation and energy optimization. This contributes to cost savings and sustainability goals, aligning with growing consumer and regulatory focus on environmental performance.

Pricing Trends

Pricing in the In-Building in Wireless 5G Era Market varies depending on the scale, complexity, and technology used. Factors influencing pricing include building size, system type (e.g., DAS vs. small cells), signal source integration, number of network carriers supported, and desired data throughput.

While initial setup costs can be high—especially in large facilities—advancements in plug-and-play components and software-defined solutions are bringing down overall deployment costs. Furthermore, neutral host and managed service models are offering more flexible pricing and lower upfront investment, making these solutions more accessible to smaller and mid-sized enterprises.

In addition, government incentives and regulatory mandates for public safety coverage are contributing to increased affordability and wider adoption, particularly in developing countries and rural areas.

Growth Factors

Several powerful factors are driving the rapid expansion of the In-Building in Wireless 5G Era Market in the 5G era:

- Widespread 5G Commercialization: Switching to 5G fuels strong demand. This shift is boosting the wireless sector. As 5G expands, better indoor systems are needed. mmWave signals are weak over distance and blocked by walls.

- Urbanization and Infrastructure Development: Cities are growing fast with new buildings. Builders now add wireless systems early in the process. Old buildings are now getting network upgrades. This helps meet today’s high connectivity needs.

- Regulatory Push for Public Safety: Many nations now mandate radio coverage in new buildings. This ensures emergency teams stay connected. Laws create ongoing need for wireless safety systems. They ensure first responders stay connected indoors.

- Increased Bandwidth Requirements: Enterprises now rely on data-heavy tools. 4K video and edge computing lead the demand. The push for data drives new network needs. Scalable, future-proof systems are key indoors.

- Integration with Cloud and Edge Technologies: Cloud and edge tech power modern in-building wireless. They boost speed, fix issues fast, and improve appeal.

Regulatory Landscape

Rules from telecom and safety bodies apply here. Building codes also shape the market. These regulatory frameworks ensure performance reliability, spectrum integrity, and emergency communication readiness:

- FCC (Federal Communications Commission) Spectrum use is tightly managed in the U.S. It impacts how networks are planned and deployed.

- NFPA 72 (National Fire Alarm and Signaling Code) U.S. guidelines focus on DAS for safety use. They ensure radio access for first responders.

- ITU (International Telecommunication Union) Shared rules help avoid spectrum clashes. This makes cross-border 5G more reliable.

- CE and ISO Certifications Rules like these are required in most areas. They support safe use and standard checks.

Compliance is a must for smooth operation. It also avoids legal and safety risks.

Recent Developments

Several recent developments are shaping the trajectory of the In-Building in Wireless 5G Era Market:

- AI and Automation in Network Management: New tools use smart tech to manage networks. They handle checks, errors, and load better. These tools boost network performance. They also help cut running costs. In July 2025, AWS introduced a suite of agentic AI innovations at its New York Summit, aiming to move from experimental prototypes to enterprise-ready AI agents. Key launches included Amazon Bedrock AgentCore, S3 Vectors, an AI Agents & Tools catalog, and Kiro an AI-powered IDE to simplify agent development and deployment.

- Private 5G Networks: Firms are setting up private 5G networks. These are used only within their buildings and sites. Private networks bring high security and speed. They also allow custom setups.

- Partnerships Between MNOs and Infrastructure Providers: Strong ties between operators and vendors help fast-track rollouts. Sites like airports and smart campuses lead in the U.S., Europe, and East Asia.

- Green Building Initiatives: Energy use is now a key part of system design. It supports smart buildings and eco targets.

Current and Potential Growth Implications

a. Demand-Supply Analysis: 5G upgrades are driving change in firms. They need better indoor networks and expert help. Skilled labor is limited, and rules are tight. These issues slow 5G setup in some zones.

b. Gap Analysis: Old and far-off buildings often lack good signal. Low-income zones face ongoing signal issues. Cost-friendly, ready-to-use tools are gaining ground. These address the unmet demand in key areas.

Top Companies in the In-Building in Wireless 5G Era Market

- CommScope Inc.

- Ericsson

- Huawei Technologies Co., Ltd.

- Corning Incorporated

- Nokia Corporation

- ZTE Corporation

- Comba Telecom Systems Holdings Ltd.

- Boingo Wireless, Inc.

- Dali Wireless Inc.

- Samsung Electronics Co., Ltd.

In-Building in Wireless 5G Era Market: Report Snapshot

Segmentation | Details |

By Component | Infrastructure (DAS, Small Cells, Repeaters), Services |

By End-User | Commercial, Government, Residential, Industrial, Healthcare |

By Building Size | Small, Medium, Large |

By Region | North America, Europe, Asia-Pacific, Latin America, MEA |

High Growth Segments

- Small Cell Infrastructure: Urban zones need smart coverage. Small cells offer that at low cost.

- Healthcare Facilities: The use of mobile tools is growing in care. Reliable wireless keeps them connected.

- Industrial Campuses: As Industry 4.0 expands, factories rely on indoor wireless. It powers automation and tracking.

Major Innovations

- AI-Based Self-Optimizing Networks (SON): Smart systems learn and adapt. They change settings to fit demand.

- 5G-Ready Neutral Host Solutions: Shared systems lower spending. They help deploy networks faster.

- Cloud-Native Network Management: Central tools handle data and control. They link buildings across areas.

Potential Growth Opportunities

- Expansion into Smart Cities and Emerging Markets: As cities upgrade, demands grow. Indoor wireless becomes a core part of the network.

- Integration with Edge Computing and IoT: Faster decisions lead to smoother operations. This is vital for manufacturing and healthcare.

- Government Incentives for Public Safety and Smart Infrastructure: Such measures unlock investment options. They also drive faster execution.

Extrapolate Research Says:

High-speed indoor access and advanced applications are in demand. These factors are boosting the In-Building in Wireless 5G Era Market in the 5G era. As 5G expands, indoor coverage becomes vital. These systems enable full performance of next-gen networks. Key companies are pushing energy-smart, AI-ready tech. This supports diverse industry connectivity needs. Public safety rules are getting stronger. This, along with digital growth, is creating big gains for telecoms and investors.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

In-Building in Wireless G Era Market

- August-2025

- 140

- Global

- Information-Technology-Communication-IoT

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021