Environmental Monitoring Market Size, Share, Growth & Industry Analysis, By Product Type (Indoor Monitors, Outdoor Monitors, Portable Monitors, Smart Sensors), By Application (Air Quality Monitoring, Water Quality Monitoring, Soil Pollution, Noise Monitoring), By End-User (Industrial, Commercial, Government, Residential, Research & Academia), and Regional Analysis, 2024-2031

Environmental Monitoring Market: Global Share and Growth Trajectory

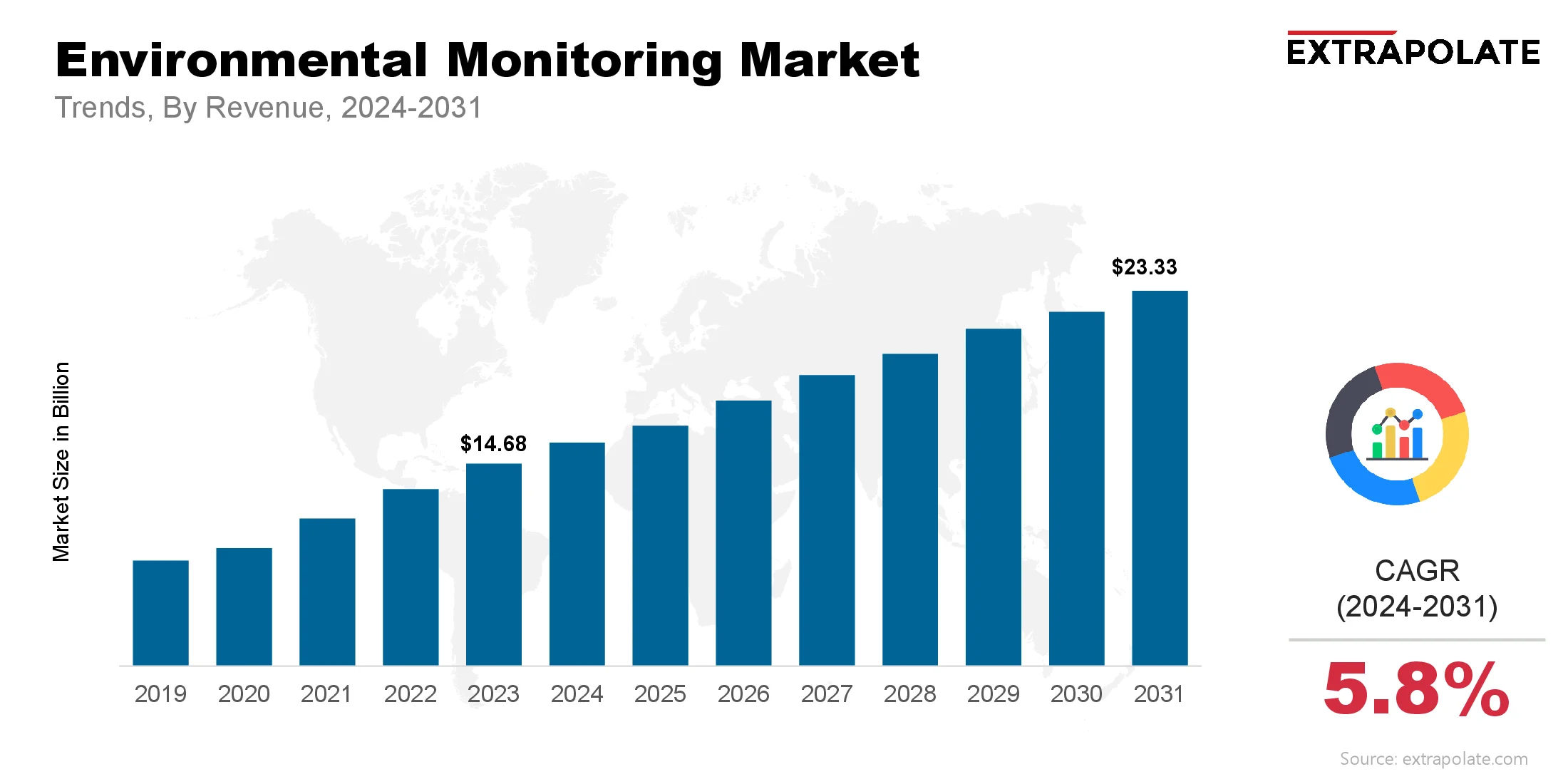

The global Environmental Monitoring Market size was valued at USD 14.68 billion in 2023 and is projected to grow from USD 15.67 billion in 2024 to USD 23.33 billion by 2031, exhibiting a CAGR of 5.8% during the forecast period.

The market is on the rise as pollution, climate change and environmental degradation become more pressing issues. Governments, industries and research institutions are relying more and more on environmental monitoring technologies to measure, analyse and manage environmental parameters. These tools are key to compliance, public health and sustainable development.

Technological advancements and global awareness of environmental challenges are the major drivers of this market. Environmental monitoring systems now offer high accuracy, real-time data and connectivity with smart technologies. They help detect pollutants, track climate change and measure air, water and soil quality. As data driven environmental stewardship becomes the norm, the market is poised for significant and sustained growth.

Air quality monitoring, water quality analysis and soil contamination tracking are the top applications driving this growth. Sensors, IoT, and AI now change how we track the environment. They help in factories, cities, and during disasters.

Key Market Trends Driving Product Adoption

Several key trends are driving the rapid adoption of environmental monitoring technologies:

Tightening Environmental Regulations:

Across the globe, governments and regulatory bodies are implementing stricter environmental regulations. Agencies like the US Environmental Protection Agency (EPA), European Environment Agency (EEA) and China’s Ministry of Ecology and Environment are setting high standards for air, water and soil quality. Industries are investing heavily in environmental monitoring systems to meet these requirements. Compliance monitoring is no longer optional – it’s part of business operations.

Rising Public Awareness and Health Concerns:

Growing public concern about air and water pollution and its impact on health is driving demand for real-time environmental data. Rising cases of respiratory and cardiovascular diseases caused by pollution have made communities demand transparency and proactive measures. Cities, schools, and homes now use air monitors. These tools help track local environment health.

Smart Technologies Integration:

Environmental monitoring is benefiting from smart technologies like IoT, AI and cloud computing. Wireless sensors, edge computing and mobile platforms enable real-time monitoring and faster decision making. These systems can now self-calibrate, detect anomalies and send alerts remotely. This has made environmental data more accessible, actionable and scalable.

Climate Change and Disaster Preparedness:

Extreme weather events, rising sea levels and changing climate patterns are making environmental monitoring systems essential for disaster preparedness and climate resilience. Governments are deploying sensors in high risk areas to detect early signs of floods, droughts and air quality deterioration. This shift towards predictive monitoring is redefining public safety and environmental management.

Key Players and their Positioning

The environmental monitoring industry is highly competitive and technology driven. Major players are offering a range of monitoring solutions for different environmental needs. Top players in the global environmental monitoring space are Thermo Fisher Scientific Inc., Siemens AG,General Electric Company (GE),Honeywell International Inc., Horiba Ltd., Teledyne Technologies Incorporated, Agilent Technologies Inc., Danaher Corporation, Aeroqual Ltd., Emerson Electric Co. and others.

These players are actively investing in research and development, forming strategic partnerships, and expanding their portfolios through mergers and acquisitions. Their focus is on creating comprehensive and scalable solutions that combine hardware, software, and cloud-based analytics to meet evolving client demands.

In April 2025, Axis Communications introduced its first environmental sensors: the AXIS D6210 and D6310 Air Quality Sensors, designed to detect indoor pollutants including particulate matter, volatile organic compounds (VOCs), nitrogen oxides, CO₂, temperature, and humidity. Integrating seamlessly with Axis IP devices or working standalone (D6310 by end of 2025), they support plug‑and‑play air‑quality monitoring and alerting within smart building systems.

In June 2025, Climit (formerly Floorcloud) launched the DataPuck, a long‑term environmental monitoring sensor engineered to log temperature and humidity conditions on construction jobsites for up to two years. It links with Climit’s Specification Database to compare real-time data against manufacturer thresholds, helping prevent post-installation failures and supporting warranty documentation.

Consumer Behavior Analysis

Consumer behavior in the market is influenced by a range of factors, from regulatory mandates to growing environmental consciousness:

- Regulatory Compliance and Risk Management: Firms see monitoring as key to avoid fines. It also helps cut risks and keeps sites safe. Companies prioritize systems that offer accuracy, automation, and compliance with regulatory frameworks such as ISO 14001, the Clean Air Act, and REACH regulations.

- Demand for Real-Time Monitoring: Users increasingly prefer real-time monitoring solutions that offer continuous and automated data collection. Manufacturing, mining, and farming need fast data. Quick insights help them work better and stay green.

- Increased Interest from Non-Industrial Consumers: Many buyers now include cities, schools, NGOs, and homes. Small, easy-to-use tools are popular for tracking air and water.

- Technology Literacy and Data Access: As environmental awareness spreads, more users seek intuitive platforms that offer accessible and interpretable data. Users now expect dashboards with maps and alerts. These tools help with easy use and smart choices.

Pricing Trends

The cost of environmental monitoring systems varies depending on their application, complexity, and data capabilities. Simple air sensors cost a few hundred dollars. Big stations for plants or cities can cost thousands more.

Ongoing costs include calibration, maintenance, software subscriptions, and data management. However, cloud-based platforms and SaaS models are helping lower the total cost of ownership by reducing infrastructure and labor needs. Firms now sell bundles with tools, apps, and reports. This helps small businesses get cheaper, flexible setups.

Growth Factors

Several powerful forces are propelling the growth of the market:

- Tech Advances: New sensors, wireless tech, and smart software are broadening environmental monitoring. Modern sensors are more sensitive, consume less power and are more accurate. Integrating with mobile apps and cloud platforms makes it easier to use and scale.

- Urbanization and Smart Cities: Smart cities are pushing need for environment checks. Cities now use sensors for air, noise, and heat data. These systems assist city planners and leaders in managing environmental health. They also help improve public policy.

- Industrial Emissions Monitoring: Industries are under pressure to control emissions and discharge. Real time monitoring is being adopted for stack emissions, wastewater and hazardous materials. It’s not just a regulatory requirement but also a way to improve efficiency and brand image.

- Climate Resilience and ESG Goals: Businesses and governments link environmental monitoring to ESG goals. Investors, stakeholders, and consumers are expecting transparency on environmental performance. Monitoring data supports sustainability reporting, carbon accounting, and resource optimization.

Regulatory Landscape

Environmental monitoring is shaped by a comprehensive and evolving regulatory framework. Key requirements include:

- United States (EPA): In the U.S., EPA rules cover air and water checks. Laws like the Clean Air Act set clear test steps.

- European Union (EEA and REACH): The EU uses laws like REACH to track air, water, and chemicals. Firms must test and report data to meet rules.

- International Standards (ISO): ISO 14001 (environmental management) and ISO 17025 (testing and calibration) govern quality assurance in monitoring.

As the global regulatory landscape continues to tighten, manufacturers and operators are adopting certified, automated monitoring solutions that ensure compliance and mitigate legal risks.

Recent Developments

Recent developments showcase the innovation and dynamism in the environmental monitoring industry:

- Low-Cost Sensors: Affordable sensors are rapidly advancing. This technology is especially useful for monitoring cities and communities. These systems support large-scale use and citizen science. They boost environmental transparency and engage the public.

- AI-Driven Predictive Analytics: Companies use AI models to predict pollution spikes. They also identify emission sources and simulate environmental trends. This turns reactive monitoring into proactive environmental management.

- Cross-Sector Collaborations: Governments, schools, and businesses are joining forces. They are building environmental sensor networks and creating open-data platforms. These collaborations support research, policy-making and community awareness.

- Satellite and Remote Monitoring: Satellite remote sensing works with ground sensors. This helps in assessing both macro and micro environments. This hybrid model is crucial for tracking deforestation, greenhouse gas emissions, and water pollution widely.

Current and Potential Growth Implications

Demand-Supply Analysis: Increasing demand is driving the production of modular and scalable monitoring systems. Developed regions have a mature demand base, emerging economies are investing in infrastructure and compliance tools. But there are challenges in supply chain logistics, calibration services and after-sales support especially in remote areas.

Gap Analysis: The biggest challenge is making it accessible and affordable in low-income areas and developing nations. There’s also a gap in data interoperability—systems don’t have standardized formats, making it hard to integrate data across platforms. Companies are working to overcome this by developing interoperable, plug-and-play systems with open APIs and cloud integration.

Top Companies in the Environmental Monitoring Market

- Thermo Fisher Scientific Inc.

- Siemens AG

- General Electric Company

- Honeywell International Inc.

- Horiba Ltd.

- Teledyne Technologies Incorporated

- Agilent Technologies Inc.

- Danaher Corporation

- Aeroqual Ltd.

- Emerson Electric Co.

Environmental Monitoring Market: Report Snapshot

Segmentation | Details |

By Product Type | Indoor Monitors, Outdoor Monitors, Portable Monitors, Smart Sensors |

By Application | Air Quality Monitoring, Water Quality Monitoring, Soil Pollution, Noise Monitoring |

By End-User | Industrial, Commercial, Government, Residential, Research & Academia |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

High growth is expected in the following segments:

- Air Quality Monitoring: Cities are growing, and health risks are rising. This boosts need for real-time air quality tools.

- Water Quality Monitoring: Freshwater is getting more polluted. Farms and utilities now need better water checks.

- Portable and Wearable Monitors: Small air monitors are now used in many places. Homes, schools, and offices like them for easy checks.

Major Innovations

Key innovations shaping the market include:

- Smart Monitoring Stations: Smart stations now track air, water, and weather. They use IoT, GPS, and live data links.

- AI and Machine Learning Integration: AI tools now spot patterns and predict risks. They also help automate rule checks and actions.

- Cloud-Based Dashboards: Cloud dashboards let users check data from anywhere. They link with maps and help in fast response.

Potential Growth Opportunities

The environmental monitoring market offers numerous opportunities:

- Emerging Markets: Asia, Latin America, and Africa are seeing more urban growth. These regions now care more about the environment.

- Climate Change Mitigation: Climate tools help track emissions and plan changes. Global deals like the Paris Accord back these efforts.

- Integration with Smart Infrastructure: Smart cities need strong environment tracking tools. These tools guide city plans, transport, and health steps.

Extrapolate says

The environmental monitoring market is on the upswing, driven by the global move to sustainability, stricter regulations and rapid tech advancement. Extrapolate sees this as the foundation of future environmental stewardship and industrial responsibility. As public health concerns grow and transparency becomes environmental, the demand for real time, smart monitoring will only increase. From air and water quality to climate resilience and smart city integration, environmental monitoring is changing how we see and interact with our world. For organisations and stakeholders looking to meet ESG goals, reduce environmental risk and gain competitive advantage, investing in monitoring infrastructure is no longer nice to have, it’s a must have.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Environmental Monitoring Market Size

- July-2025

- ���1���4���0

- Global

- Information-Technology-Communication-IoT

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021