Deep Learning Market Size, Share, Growth & Industry Analysis, By Component (Software, Hardware, Services), By Application (Image Recognition, Signal Recognition, Data Mining, Natural Language Processing (NLP), Speech Recognition), By End-User (Healthcare, BFSI, Automotive, Retail, Manufacturing, IT & Telecom, Media & Entertainment), and Regional Analysis, 2024-2031

Deep Learning Market: Global Share and Growth Trajectory

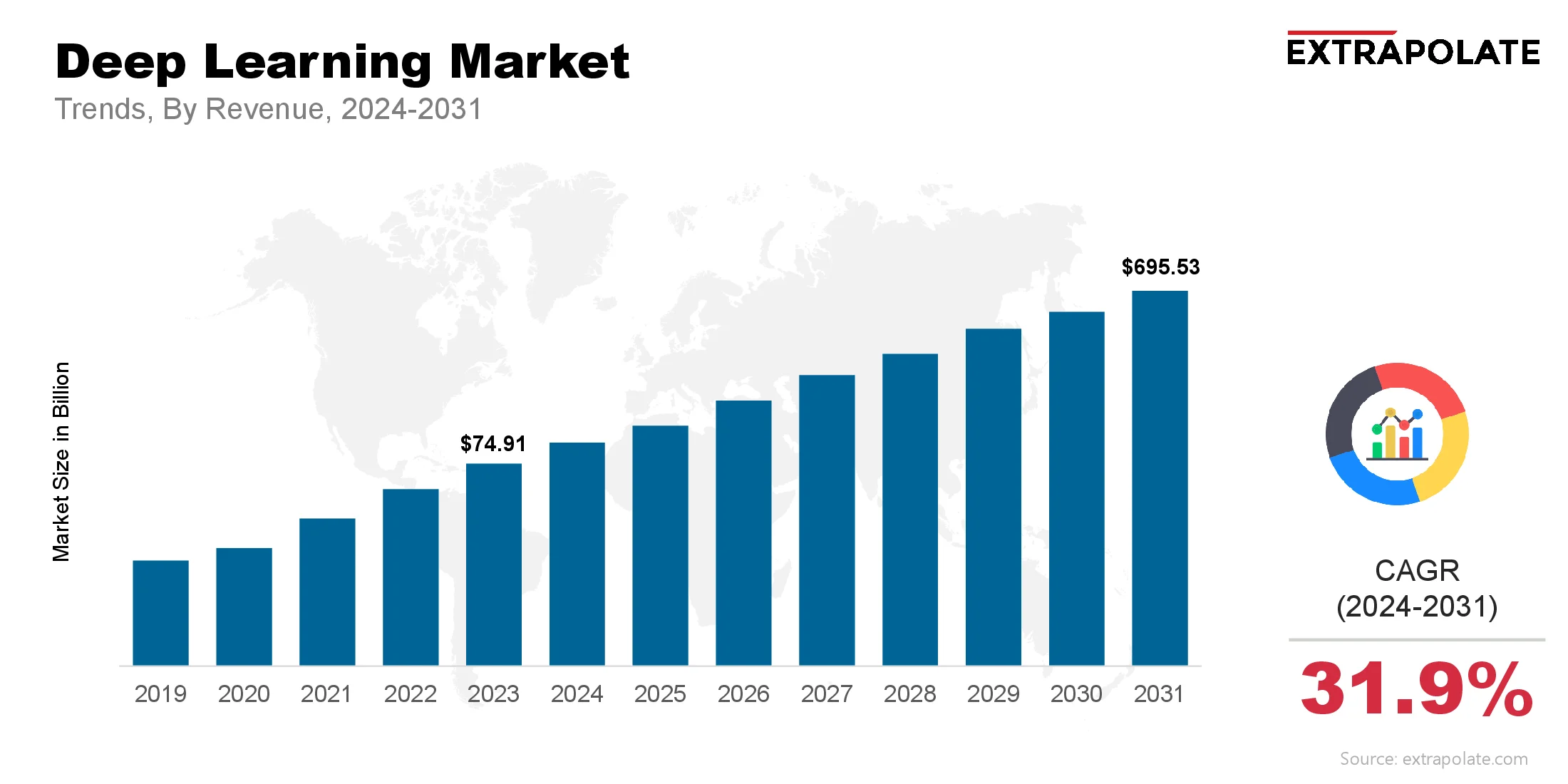

The global deep learning market size was valued at USD 74.91 billion in 2023 and is projected to grow from USD 99.70 billion in 2024 to USD 695.53 billion by 2031, exhibiting a CAGR of 31.9% during the forecast period.

The global market is advancing at an unprecedented rate, powered by rapid developments in artificial intelligence (AI), big data analytics, and computational capabilities. Deep learning, a subfield of machine learning, mimics the human brain in processing data and creating patterns for decision-making. Its deployment spans diverse sectors—from healthcare and automotive to finance and e-commerce—enhancing automation, insight generation, and real-time responsiveness.

This surge is driven by a blend of technological innovations, data explosion, and the demand for enhanced cognitive computing. As industries shift toward intelligent systems that learn and improve without explicit programming, deep learning stands at the forefront of this digital evolution. Breakthroughs in neural network architectures, such as convolutional neural networks (CNNs) and generative adversarial networks (GANs), are opening new frontiers for commercial and academic applications.

The transformative power of deep learning lies in its ability to analyze unstructured data—such as images, audio, and text—at scale. This has revolutionized applications such as autonomous driving, medical imaging, voice assistants, fraud detection, and predictive maintenance. As organizations harness deep learning for operational excellence and competitive advantage, the global market is poised for remarkable, sustained growth.

Key Market Trends Driving Product Adoption

Several pivotal trends are accelerating the adoption of deep learning technologies:

Explosion of Unstructured Data: Organizations are generating vast amounts of unstructured data, including video, audio, and sensor outputs. Deep learning algorithms excel in interpreting and extracting insights from this data, making them invaluable across industries. The proliferation of IoT devices and digital content further contributes to the data deluge, requiring scalable deep learning solutions to extract business value.

Advancements in Computational Power: The deep learning revolution is intricately tied to advances in graphics processing units (GPUs), tensor processing units (TPUs), and parallel computing infrastructures. These powerful hardware components facilitate faster training and deployment of complex neural networks, drastically improving model accuracy and reducing time-to-market.

Rise of Edge AI and Real-Time Processing: There is a growing demand for deploying deep learning models at the edge—closer to the data source—for faster decision-making and reduced latency. This is critical for autonomous vehicles, robotics, and industrial automation. The convergence of deep learning with edge computing is enabling devices to perform intelligent tasks without constant connectivity to cloud servers.

Wider Adoption of Transfer Learning and Pre-Trained Models: Deep learning is becoming more accessible due to the availability of pre-trained models and frameworks such as TensorFlow, PyTorch, and Hugging Face. Organizations can now fine-tune models with relatively smaller datasets, drastically cutting development time and resource requirements.

Major Players and their Competitive Positioning

The deep learning market is characterized by a dynamic and competitive landscape, with tech giants, startups, and research institutions pushing the boundaries of innovation. Key players include: NVIDIA Corporation, Google LLC, IBM Corporation, Microsoft Corporation, Amazon Web Services Inc., Intel Corporation, Baidu Inc., Meta Platforms Inc., Qualcomm Technologies Inc., and OpenAI.

These companies are leading the charge in developing AI platforms, chipsets, cloud services, and APIs to support the training and inference of deep neural networks. Strategic collaborations, mergers, and acquisitions are common as firms aim to expand their capabilities and global reach.

Consumer Behavior Analysis

Consumer behavior in the deep learning market reflects a growing appetite for intelligent, data-driven solutions that enhance efficiency and personalization.

- Demand for Automation and Predictive Insights: Businesses across sectors are investing in deep learning technologies to automate tasks, optimize operations, and make more accurate predictions. This includes applications such as chatbots, customer segmentation, fraud detection, and risk assessment.

- Rising Preference for Personalization: Consumers expect highly personalized experiences in entertainment, e-commerce, and digital services. Deep learning enables recommendation engines, sentiment analysis, and targeted marketing, driving consumer satisfaction and brand loyalty.

- Concerns Around Data Privacy and Ethics: As adoption increases, so do concerns about data usage, algorithmic bias, and transparency. Organizations are becoming more cautious and responsible in deploying deep learning solutions, with increased emphasis on explainability, fairness, and compliance with data protection regulations.

- Educational Institutions and Developers Embrace AI Training: Universities and online platforms are seeing rising enrollment in AI and deep learning courses. A new generation of developers is emerging, eager to innovate with neural networks and deploy scalable AI models across industries.

Pricing Trends

Pricing trends in the deep learning market are influenced by several factors, including the cost of infrastructure, software tools, skilled labor, and ongoing support.

High-performance GPUs and cloud-based machine learning platforms can be expensive, particularly for training large models. However, the cost of training and deploying deep learning models has declined due to open-source frameworks, model compression techniques, and competition among cloud providers such as AWS, Azure, and Google Cloud.

Subscription-based pricing, pay-as-you-go models, and freemium tiers are making deep learning tools more accessible to startups and SMBs. Additionally, enterprises are increasingly adopting managed AI services to reduce overhead costs and operational complexity.

Growth Drivers

Several big drivers are driving the deep learning market:

- AI Use Cases Across Industries: From detecting tumors in medical imaging to predictive maintenance in manufacturing, deep learning is being used everywhere. This broad applicability means continued demand across both private and public sectors.

- Cloud Based Deployment: Cloud offers scalability, flexible pricing and integrated tools for deep learning development and deployment. As more companies move to the cloud, deep learning services adoption is accelerating.

- Government Support and R&D Funding: Governments worldwide are launching national AI strategies, investing in R&D and providing incentives for AI startups. These initiatives are strengthening the deep learning ecosystem and encouraging innovation.

- More Labeled Datasets: Large datasets are required to train accurate deep learning models. With data annotation tools, open-source datasets and synthetic data generation, access to training data is improving big time.

- Better Model Efficiency: Research is focused on reducing model size and training time without compromising accuracy. EfficientNet, knowledge distillation and quantization are examples of techniques that are making deep learning more efficient and suitable for resource constrained environments.

Regulatory Landscape

As deep learning makes decisions, regulatory bodies are stepping in to ensure ethical, safe and transparent AI.

- AI Regulations and Frameworks: The EU’s AI Act and similar initiatives in the US, Canada and India are setting guidelines for responsible AI development and deployment. This includes risk classification, data governance, algorithmic transparency and human oversight.

- Data Privacy Laws: GDPR, CCPA and HIPAA dictate how deep learning models access and process personal data. Companies must comply by implementing data minimisation, anonymisation and user consent.

- Emerging Standards for Explainable AI (XAI): As deep learning models are black boxes, there is a push to develop methods for interpretability. XAI is becoming part of compliance requirements in healthcare, finance and other high risk domains.

Recent Developments

- OpenAI’s GPT and Multimodal Models: GPT-4 and multimodal models like GPT-4o have redefined what’s possible with deep learning - human-like conversation, image understanding, code generation.

- NVIDIA’s AI Hardware Ecosystem: NVIDIA is leading in terms of AI hardware with H100 GPUs and AI-focused platforms like DGX Cloud. Their work on transformer models and generative AI has big market implications.

In January 2025, NVIDIA announced their GeForce RTX 50 Series GPUs (RTX 5070, 5080, 5090) at CES with the new Blackwell architecture and GDDR7 memory and DLSS 4 AI frame generation. These GPUs are designed for deep learning workloads - inference and model training - for research and creative workflows on desktop AI PCs.

- Open-Source Foundation Models: Meta’s LLaMA, Mistral, and Stability AI’s models are making advanced AI capabilities available to more people. These open-source initiatives are leveling the playing field.

- Strategic Partnerships in AI: Microsoft is deepening their partnership with OpenAI and Google is investing in Gemini and DeepMind. Big tech is all in on AI infrastructure and services.

- Breakthroughs in Healthcare AI: Deep learning is enabling early detection of cancer, diabetic retinopathy, Alzheimer’s. Real-time image recognition and medical NLP is going mainstream.

Current and Future Growth

Demand-Supply Analysis: Deep learning expertise, infrastructure and tools are in demand but in short supply. Cloud and open-source frameworks help but the shortage of AI professionals is the bottleneck.

Gap Analysis: A big gap between deep learning innovation and practical deployment in small and medium enterprises (SMEs) mainly due to cost, complexity and lack of internal expertise. Bridging this gap requires affordable platforms, user-friendly tools and AI consulting services.

Emerging Markets and Localised Solutions: Asia-Pacific, Latin America and Africa are untapped markets. But success will depend on local language models, infrastructure and affordability.

Top Companies in the Deep Learning Market

Leading companies in the global deep learning market include:

- NVIDIA Corporation

- Google LLC

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services Inc.

- Intel Corporation

- Meta Platforms Inc.

- Baidu Inc.

- OpenAI

- Qualcomm Technologies Inc.

These players are leading through innovation, ecosystem expansion and strategic investments in AI and machine learning.

In March 2025, NVIDIA released the DGX Spark (formerly Project DIGITS), a desktop “AI supercomputer” with Blackwell GPUs and 128GB RAM that can train or fine tune models up to ~200B parameters. The DGX Spark is for AI researchers and developers who need high capacity model workstations but not full datacenter systems.

Deep Learning Market: Report Snapshot

Segmentation | Details |

By Component | Software, Hardware, Services |

By Application | Image Recognition, Signal Recognition, Data Mining, Natural Language Processing (NLP), Speech Recognition |

By End-User | Healthcare, BFSI, Automotive, Retail, Manufacturing, IT & Telecom, Media & Entertainment |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The following segments are projected to experience substantial growth:

- Natural Language Processing (NLP): NLP is growing fast with bots, voice tools, and big models. It helps in support, writing, and health tasks.

- Healthcare Sector: Deep learning is gaining traction in diagnostic imaging, genomics, and personalized medicine. It is enabling early detection and customized treatment pathways.

- Automotive Industry: ADAS and self-driving tech need smart vision tools. Deep learning helps spot objects, plan routes, and study driver actions.

Major Innovations

Recent innovations shaping the deep learning landscape include:

- Transformer Architectures: Models like BERT and GPT changed NLP. They understand context and can create text smartly.

- Federated Learning: This method trains AI on many devices without sharing raw data. It keeps user info safe while learning.

- Zero-shot and Few-shot Learning: These methods help AI learn new tasks with little data. This makes AI useful in more applications.

Growth Opportunities

Opportunities:

- AI-as-a-Service Platforms: As companies don’t want to invest heavily in AI, demand for pre-built APIs and customizable AI tools is growing.

- Industry Specific AI Solutions: Deep learning models for farming, shipping, schools, and cyber safety are growing fast. Each sector now needs smart, custom models.

- Collaborative AI and Human-in-the-Loop Models: Mixing human insight with AI boosts trust. It helps get better results in tricky tasks.

Extrapolate says:

The deep learning market is growing exponentially as demand for intelligent automation, better decision making and personalized experiences is soaring. From data rich industries like healthcare and finance to future forward industries like autonomous mobility and robotics, deep learning is changing how organizations operate and innovate.

Model efficiency, cloud infrastructure and global AI initiatives are removing barriers to adoption. As deep learning becomes more accessible and embedded in daily life, it will change not only technology stacks but also business models. Extrapolate expects deep learning to be a key part of the global AI landscape for years to come.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Deep Learning Market Size

- August-2025

- 148

- Global

- Information-Technology-Communication-IoT

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021