Database security Market Size, Share, Growth & Industry Analysis, By Component (Software, Services) By Deployment Mode (On-Premise, Cloud) By Organization Size (SMEs, Large Enterprises) By Industry Vertical (BFSI, Healthcare, Retail, IT & Telecom, Government, Others), and Regional Analysis, 2024-2031

Database Security Market: Global Share and Growth Trajectory

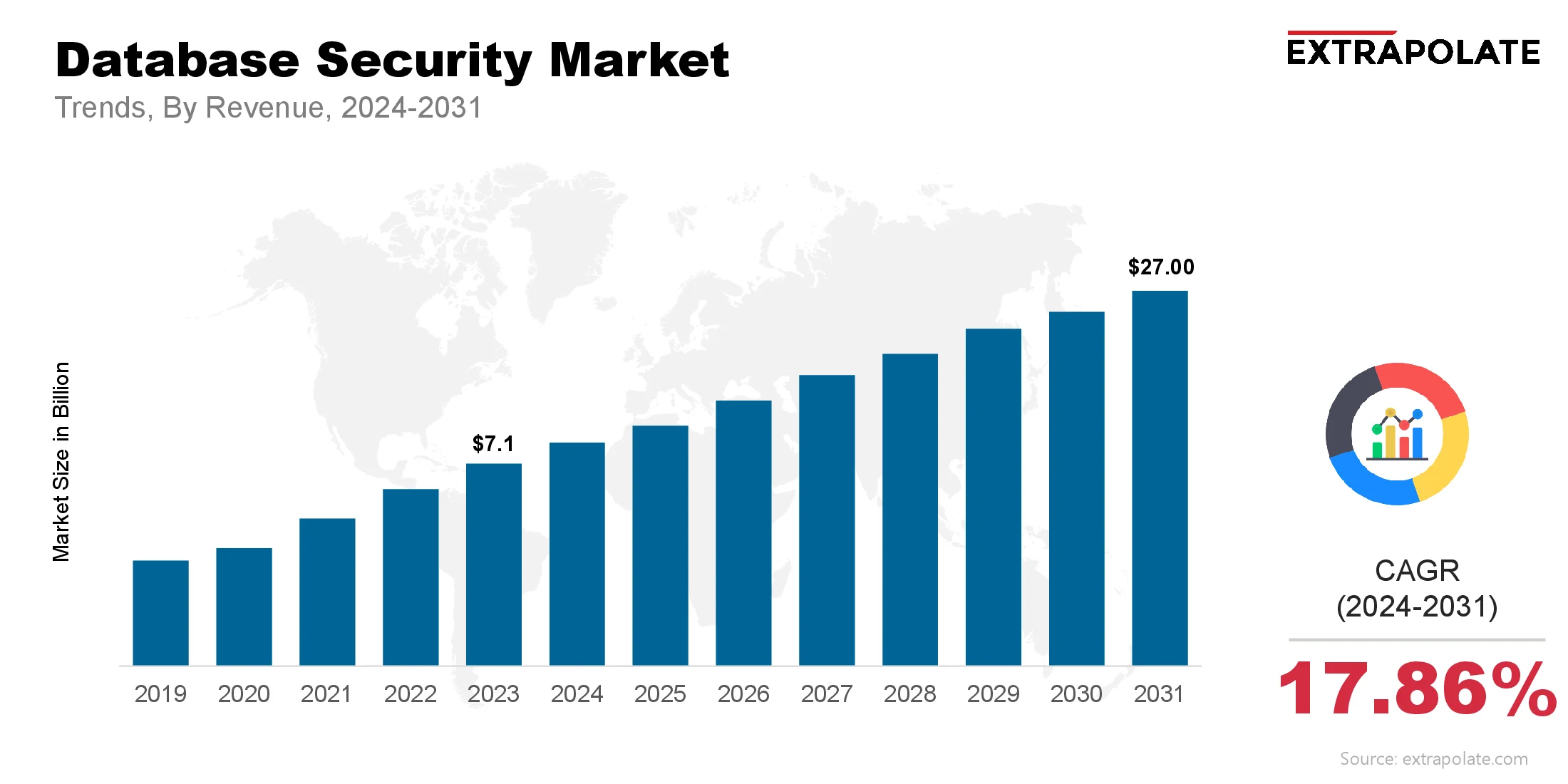

The global Database Security Market size was valued at USD 7.1 billion in 2023 and is projected to grow from USD 8.54 billion in 2024 to USD 27.00 billion by 2031, exhibiting a CAGR of 17.86% during the forecast period.

The market is growing fast, driven by digital transformation, data privacy regulations and increasing number of cyber attacks on databases. In today’s digital world, databases are the heart of storing and processing enterprise data, so they are the prime target for cybercriminals. As such, organisations across industries are investing heavily in robust security technologies to prevent data breaches, ransomware, unauthorized access and internal misuse.

With cloud computing, mobile access and big data analytics on the rise, the need for advanced and adaptive database security solutions is urgent. Modern database security is moving beyond traditional firewalls and antivirus to include encryption, tokenization, activity monitoring, identity and access management and real-time threat detection. As these technologies mature, the database security industry will grow exponentially.

The adoption of cloud databases and complexity of data architectures has further increased the demand for multi-layered security platforms. With regulatory frameworks like GDPR, CCPA and HIPAA mandating stricter data governance and breach notifications, database security is no longer a luxury – it’s a business necessity.

Key Market Trends Driving Product Adoption

Several powerful trends are fueling the demand for advanced database security solutions:

Cybersecurity Threats

Cyber attacks are growing in scale and sophistication, targeting databases with malware, phishing, SQL injection and ransomware. As enterprises hold sensitive data like financial records, intellectual property and personal information, securing these assets is top priority. Database security tools are being adopted to mitigate these risks and ensure data integrity and confidentiality.

Cloud Databases

Cloud is reshaping IT infrastructures. While cloud offers scalability and cost efficiency, it also introduces new security risks. Organisations are deploying cloud-native database security tools that offer visibility and control over data in public, private and hybrid clouds. These tools support real-time monitoring, data loss prevention (DLP) and compliance enforcement.

Regulatory Compliance and Data Privacy

Data protection regulations worldwide are forcing companies to secure customer and operational data tightly. Laws like GDPR in Europe, CCPA in California and others around the globe demand full transparency, consent management and breach accountability. As a result, database security solutions that support encryption, auditing and compliance reporting are being adopted more and more.The zero-trust security model has changed the game for database security. Organisations now operate under the principle of “never trust, always verify” and require strict access controls and continuous monitoring of all database activities. Database firewalls, identity management and behavioural analytics are becoming the key components of this model.

AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) is adding capabilities to database security solutions. These technologies help detect unusual access patterns, predict breaches and automate responses. AI driven tools are being used for anomaly detection, insider threat mitigation and behavioural analytics.

Major Players and Their Competitive Positioning

The database security market is highly competitive, with major technology companies and specialized vendors offering a wide range of solutions. Leading companies in this sector include: IBM Corporation, Oracle Corporation, Microsoft Corporation, McAfee LLC, Fortinet Inc., Cisco Systems, Inc., Imperva Inc., Thales Group, Trustwave Holdings, and CyberArk Software Ltd.

These players focus on innovation, mergers and acquisitions, partnerships, and cloud security integrations to gain a competitive edge. For example, Oracle and Microsoft are continuously enhancing their cloud database platforms with built-in security features, while firms like Imperva and Trustwave are specializing in database activity monitoring and vulnerability assessment.

In April 2025, Oracle introduced a significant enhancement to its Autonomous Database platform by reducing the cross-region Autonomous Data Guard standby RTO to under 10 minutes, improving recovery speed and resilience across multi-region deployments. This update strengthens Oracle’s zero‑trust and cloud-native security posture, ensuring faster failover and tighter data protection across environments.

In June 2025, IBM released the IBM Security QRadar Generative AI Content Extension 1.1.1, featuring five advanced dashboards that enable real-time monitoring of generative AI tool usage, user behavior, and IP-based threat patterns within database environments. This AI‑powered extension enhances visibility and proactive threat detection across database activity, marking a strategic advancement in behavioral analytics for database monitoring.

Consumer Behavior Analysis

Consumer demand for database security solutions is shaped by a blend of risk awareness, regulatory requirements, and technological readiness:

- Risk Awareness and Incident History: Companies that have been hit or narrowly missed by data breaches are more likely to invest in database security. Awareness of financial loss, reputation damage and legal repercussions drives IT leaders to take preventive measures proactively.

- Cost and ROI: While database security can be expensive upfront, many see it as an investment not a cost. The long term ROI is reduced breach risk, compliance benefits and customer trust. Vendors are also offering subscription based and SaaS models so smaller businesses can adopt.

- Cloud Compatibility: As businesses move databases to the cloud there is a clear preference for cloud native or cloud compatible solutions. Consumers want unified dashboards, automation and scalability in their security tools so minimal disruption to existing operations.

- Training and Expertise: Database administrators (DBAs) and IT professionals are now undergoing training in database security management, data privacy laws and incident response. This growing expertise within the organization accelerates the adoption and implementation of security protocols.

Pricing Trends

Pricing in the database security market varies greatly depending on the solution, deployment and scale. Here are the common pricing models:

- Subscription (SaaS): Monthly or annual subscriptions for cloud hosted security services.

- Perpetual Licensing: One time purchase with optional maintenance contracts.

- Tiered Pricing: Based on number of users, database instances or data volume.

- Modular Pricing: Users pay for individual features like encryption, monitoring or access control.

Vendors are offering more flexible pricing plans to cater to organizations of all sizes and sectors. Open source security tools are also available but often lack the support and features of commercial products.

Growth Factors

The database security market is being propelled by several growth enablers:

- Digital Transformation Across Industries: Businesses in banking, healthcare, retail and government are undergoing rapid digitization. With this digital transformation comes the need to protect large volumes of sensitive data which fuels the demand for database security tools.

- Data Centric Security: Organizations are adopting data centric security frameworks that focus on protecting the data itself rather than the network perimeter. This includes encryption, tokenization and secure access protocols all of which fall under database security.

- Threat Intelligence and Automation: Modern database security platforms are being equipped with real-time threat intelligence feeds and automated response capabilities. This automation reduces human error and speeds up incident response, improves overall system resilience.

Regulatory Landscape

Database security solutions must comply with a variety of legal and regulatory standards depending on the region and industry. These include:

- GDPR (EU): Enforces data privacy, breach notifications, and consent-based processing.

- CCPA (California): Grants consumers control over their data and mandates transparent data handling.

- HIPAA (USA): Requires healthcare data protection and audit trails.

- PCI-DSS (Global): Enforces secure handling of payment data for financial institutions and retailers.

Security solutions that support audit logging, role-based access, and encryption at rest and in transit are critical to compliance efforts. Regulatory bodies increasingly emphasize accountability, data localization, and privacy-by-design approaches.

Recent Developments

Recent activities in the database security landscape underscore its rapid evolution:

- Launch of AI-Driven Security Platforms: IBM, Microsoft, and Oracle have launched AI tools for database security. These tools spot issues fast and act in real time.

- Zero Trust Integration: Vendors are upgrading tools to support zero-trust rules. This adds micro-zones and checks users all the time.

- Rise of Cloud Database Security Services: Fortinet and Palo Alto now offer cloud database security. Their tools work with AWS, Azure, and Google Cloud.

- M&A Activity: Cybersecurity firms are buying database security startups. Imperva bought jSonar to grow its data security tools.

Current and Potential Growth Implications

a. Demand-Supply Analysis

Demand is outpacing supply in some areas, particularly in cloud-native and AI-powered tools. Vendors are scaling up and hiring to meet demand.

b. Gap Analysis

The biggest gap in the market is the lack of integrated end-to-end database security solutions. Many organizations are using a patchwork of tools that don’t talk to each other. SMEs can’t afford or don’t want to implement.

Top Companies in the Database Security Market

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- McAfee LLC

- Fortinet Inc.

- Imperva Inc.

- Thales Group

- Cisco Systems, Inc.

- CyberArk Software Ltd.

- Trustwave Holdings

Database Security Market: Report Snapshot

Segmentation | Details |

By Component | Software, Services |

By Deployment Mode | On-Premise, Cloud |

By Organization Size | SMEs, Large Enterprises |

By Industry Vertical | BFSI, Healthcare, Retail, IT & Telecom, Government, Others |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

High Growth Segments

The following segments are expected to witness strong growth:

- Cloud-Based Database Security: More firms are shifting to cloud databases. This drives quick growth in cloud-native security tools.

- Healthcare and BFSI Sectors: Healthcare and BFSI handle very private data. So, they are quick to use strong security tools.

- SME Adoption of SaaS Security Solutions: Small firms want low-cost and easy tools. That’s why they choose SaaS security options.

Major Innovations

The database security space is teeming with innovations, including:

- Autonomous Database Security: Some tools now fix themselves and spot odd behavior. They also change user access in real time.

- Homomorphic Encryption: Homomorphic encryption lets data stay locked while in use. This keeps it safe and makes work faster.

- Behavioral Analytics: AI tools now learn how users act. This helps find insider risks or compromised credentials.

Potential Growth Opportunities

Several strategic growth opportunities exist:

- Expansion in Emerging Economies: Digital use is rising in growing countries. This boosts the need for database security.

- Integration with DevSecOps Pipelines: Security is now built into DevSecOps steps. This helps more teams use secure tools early.

- Data Sovereignty and Localization: Some laws need data to stay in the country. This opens doors for local security tools.

Extrapolate says:

The database security market is about to get big fast as digitization accelerates and cyber threats mount. Organizations now realize that traditional perimeter based security is no longer enough to protect their data. The move to zero trust, cloud and AI driven threat detection is driving demand for modern intelligent database security solutions.

Regulators are tightening up compliance and businesses are trying to earn consumer trust so database security has gone from nice to have to must have. The market will continue to evolve as automation, AI and encryption push the boundaries of what’s possible with the world’s most valuable asset: data.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Database security Market Size

- July-2025

- 148

- Global

- Information-Technology-Communication-IoT

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021