Bitcoin Loan Market Size, Share, Growth & Industry Analysis, By Loan Type (Secured Loans, Unsecured Loans) By Platform (Centralized Finance (CeFi), Decentralized Finance (DeFi)) By Application (Trading, Business Funding, Personal Financing, Yield Farming), and Regional Analysis, 2024-2031

Bitcoin Loan Market: Global Share and Growth Trajectory

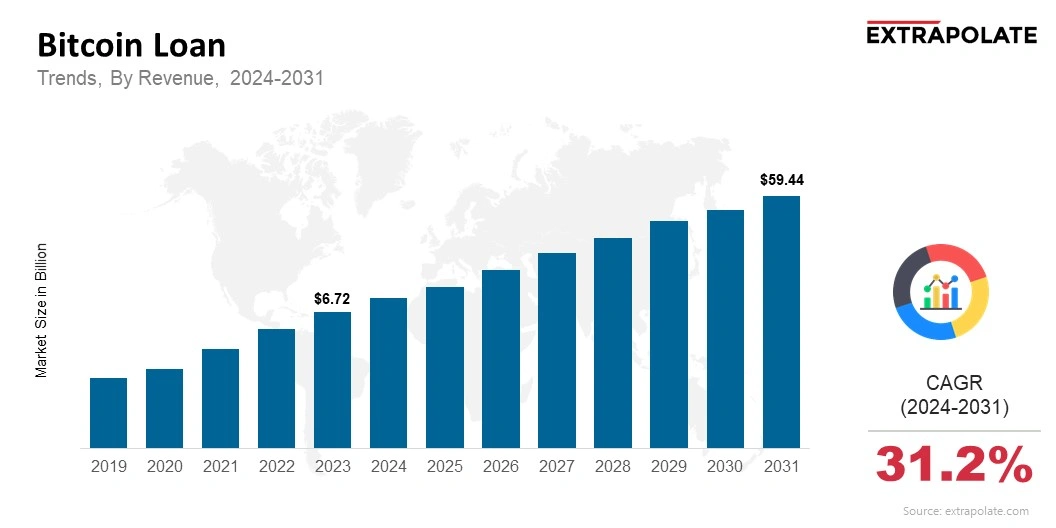

The global Bitcoin Loan Market size was valued at USD 6.72 billion in 2023 and is projected to grow from USD 8.89 billion in 2024 to USD 59.44 billion by 2031, exhibiting a CAGR of 31.2% during the forecast period.

The global market is gaining significant traction, driven by the growing adoption of cryptocurrencies, the expansion of decentralized finance (DeFi), and the increasing demand for alternative lending mechanisms. Bitcoin loans allow borrowers to use their digital assets as collateral in exchange for fiat currencies or stablecoins, offering a novel solution that combines liquidity access with the retention of long-term crypto holdings. As the financial ecosystem evolves toward digital transformation, Bitcoin-backed lending is becoming a vital part of the broader fintech and blockchain infrastructure.

The Bitcoin loan industry primarily consists of two models: centralized platforms, which involve traditional financial oversight and custody services, and decentralized platforms powered by smart contracts that operate without intermediaries. Both models serve individual investors and institutions looking to leverage crypto holdings without liquidating them. Borrowers benefit from immediate liquidity, while lenders gain attractive interest rates by lending their crypto or fiat capital. This dynamic is creating new economic opportunities across both retail and institutional segments.

One of the major factors fueling market growth is the increased trust in blockchain technology and the mainstream acceptance of Bitcoin as a legitimate asset class. This shift is supported by regulatory advancements in key regions and the entry of major financial institutions into the cryptocurrency space. Bitcoin loans offer unique advantages such as low barriers to entry, fast approval processes, global accessibility, and reduced dependency on credit scores, making them especially appealing in underbanked and developing regions.

Moreover, the integration of Bitcoin lending with DeFi protocols is reshaping how financial services are delivered. Decentralized lending platforms like Aave and Compound allow users to deposit Bitcoin-pegged assets (e.g., WBTC) to earn yields or take out loans, all governed by transparent and secure smart contracts. These platforms enhance market efficiency, transparency, and user control, setting a new standard for financial inclusion and digital wealth management.

Security and volatility remain notable challenges in the Bitcoin loan ecosystem. As the market matures, firms are boosting investments in risk controls. These include collateral models and layered authentication to secure user assets. Regulators in North America, Europe, and Asia-Pacific are creating clearer rules. These aim to support innovation and protect consumers.

North America leads the Bitcoin loan market. This is due to advanced crypto infrastructure, a large investor base, and favorable regulations. Asia-Pacific is growing fast in the Bitcoin loan market. This growth is driven by tech innovation, strong crypto adoption, and demand for alternative finance. Bitcoin lending is set to grow fast. Its rise is driven by blockchain, innovation, and changing user needs. It will help shape the future of decentralized finance.

Key Market Trends Driving Product Adoption

Key Market Trends Driving Product Adoption

The market is undergoing dynamic changes due to the surge in digital asset utilization and evolution in lending models. Key trends include:

• Rising Popularity of Crypto-Backed Lending: More users are using Bitcoin as collateral. This helps them get fiat or stablecoin loans without triggering taxes.

• Integration with DeFi Platforms: Decentralized lending protocols like Aave, Compound, and MakerDAO are growing fast. They are changing how crypto lending works.

• Institutional Participation: Aave, Compound, and MakerDAO are expanding quickly. They are redefining the structure of crypto lending.

• Regulatory Developments: Clearer regulations in the U.S. and Europe are emerging. They are helping create safer, more transparent lending spaces.

• Innovative Loan Products: New features are being introduced. Non-custodial lending, smart contract automation, and real-time collateral monitoring are part of this shift.

Major Players and their Competitive Positioning

The Bitcoin Loan market is competitive and evolving rapidly. Key players such as BlockFi, Nexo, Celsius Network, YouHodler, and SALT Lending are focusing on customer-centric features, low-interest rates, and robust security mechanisms. New entrants and DeFi protocols are also disrupting the traditional models with peer-to-peer lending ecosystems and staking-enabled lending options.

Consumer Behavior Analysis

• Liquidity Without Selling Assets: Preserving long-term holdings while accessing funds for business, investments, or personal use.

• Portfolio Diversification: Using borrowed funds to diversify into other cryptocurrencies, stocks, or real estate.

• Tax Efficiency: Avoiding capital gains taxes by borrowing instead of selling assets.

• Arbitrage and Yield Farming: Taking advantage of interest rate differentials and DeFi opportunities.

• Short-Term Financial Needs: Quick access to capital without credit checks or lengthy approvals.

Pricing Trends

Pricing in the Bitcoin Loan market is influenced by collateral value, loan-to-value (LTV) ratio, loan duration, and market volatility. Interest rates typically range between 4% and 13% annually, depending on platform reputation, collateral management, and currency type. DeFi platforms may offer more flexible rates, though they come with higher volatility and risk exposure.

Growth Factors

• Crypto Market Maturity: Increased trust in digital assets is making Bitcoin a credible collateral choice.

• Expansion of DeFi Ecosystems: Growth in decentralized lending and borrowing protocols.

• Global Financial Inclusion: Offering access to credit for the unbanked and underbanked populations.

• Blockchain Transparency and Security: Immutable records and smart contract-based automation.

• User Demand for Non-Traditional Finance: Rising dissatisfaction with conventional banking systems.

Regulatory Landscape

Regulatory bodies are closely examining the crypto lending space. Licensing requirements, anti-money laundering (AML) protocols, and consumer protection standards are becoming more defined, especially in markets like the U.S., U.K., Singapore, and Switzerland. Compliance with Know Your Customer (KYC) norms is also increasingly enforced by centralized platforms.

Recent Developments

Recent developments in the Bitcoin Loan market include:

• Institutional Loan Products: Entry of asset managers and fintech firms offering customized crypto loan solutions.

• Tokenization of Loan Agreements: Smart contracts representing loan terms as tradable digital assets.

• Growth in Bitcoin Yield Accounts: Users earn interest on Bitcoin deposits via loan issuance.

• Launch of Insured Loan Services: Coverage against borrower default or collateral volatility.

• Integration with Wallets and Exchanges: Seamless access to loan services from crypto platforms.

Current and Potential Growth Implications

Demand-Supply Analysis

There is strong demand from Bitcoin holders seeking liquidity without liquidation. Supply is growing through both centralized platforms and decentralized pools offering flexible terms and global reach.

Gap Analysis

• Volatility Risk Management: Ensuring safe loan operations during price swings.

• Limited Product Standardization: Diverse terms and risk practices across platforms.

• Regulatory Uncertainty: Varying frameworks affecting cross-border operations.

• Trust Issues in DeFi: Smart contract vulnerabilities and lack of human oversight.

• Inadequate Insurance Coverage: Few platforms offer protection against borrower or protocol failures.

Top Companies in the Bitcoin Loan Market

• BlockFi

• Celsius Network

• Nexo

• YouHodler

• SALT Lending

• Hodlnaut

• Aave

• Compound

• MakerDAO

• Unchained Capital

Report Snapshot

Segmentation | Details |

By Loan Type | Secured Loans, Unsecured Loans |

By Platform | Centralized Finance (CeFi), Decentralized Finance (DeFi) |

By Application | Trading, Business Funding, Personal Financing, Yield Farming |

By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Bitcoin Loan Market: High-Growth Segments

• DeFi Lending Platforms: Offering transparency and real-time automation.

• Business Funding Applications: Crypto loans used as working capital or expansion funding.

• Yield-Earning Loan Products: Dual benefit of borrowing and earning through staking.

• Asia-Pacific Region: Expanding fintech adoption and favorable crypto regulations.

• Personal Finance Solutions: Rapid crypto-to-fiat conversion for lifestyle expenses.

Major Innovations

• Smart Contract-Based Loans: Enabling trustless, instant lending.

• Multi-Collateral Options: Allowing users to back loans with multiple crypto assets.

• AI-Based Risk Assessment: Predictive analytics to evaluate borrower risk.

• Insurance-Backed Loan Pools: Minimizing losses from market volatility.

• Embedded Lending in Wallets: Instant credit access within digital wallets.

Bitcoin Loan Market: Potential Growth Opportunities

• Crypto-Fiat Integration Services: Real-time conversion and lending through embedded platforms.

• Institutional Lending Products: Structured crypto lending for hedge funds and corporates.

• Cross-Border Lending: Seamless global loan access without traditional barriers.

• Collateral Diversification: Accepting other digital assets like Ethereum or stablecoins.

• Sustainable Finance Models: Using blockchain lending to support ESG initiatives.

Extrapolate Research says:

The Bitcoin Loan market is revolutionizing how individuals and institutions access capital. By combining the liquidity of traditional finance with the autonomy of blockchain technology, the market is poised to redefine the future of global lending. Its growing relevance across DeFi, business finance, and personal wealth management highlights a transformative shift in financial ecosystems worldwide.

ARE YOU SEEKING COMPREHENSIVE INSIGHT ON VARIOUS

MARKETS?

CONTACT OUR EXPERTS TODAY

Bitcoin Loan Market Size

- May-2025

- 140

- Global

- Information-Technology-Communication-IoT

Related Research

2018-2023 Commercial Interior Design Market Size, Share & Trends Analysis Report By Application ( O

March-2021

2018-2023 Industrial Product Design Market Size, Share & Trends Analysis Report By Application ( Tr

March-2021

2D Animation Software Market Size, Share & Trends Analysis Report By Application (Construction Field

March-2021

2D Vision Measuring Systems Market Size, Share & Trends Analysis Report By Application ( Commercial

March-2021

360 Degree Feedback Software Market Size, Share & Trends Analysis Report By Application ( Corporatio

March-2021

3D and 4D Technology Market Size, Share & Trends Analysis Report By Application (Entertainment, Cons

March-2021

3D Animated Films Market Size, Share & Trends Analysis Report By Application ( Children, Adults, Oth

March-2021

3D CAD Design Software Market Size, Share & Trends Analysis Report By Application (Small Business, M

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application ( Manufacturing, Automo

March-2021

3D CAD Software Market Size, Share & Trends Analysis Report By Application (Manufacturing, Automotiv

March-2021